Healthcare Claims Management Market Report Scope & Overview:

Get more information on Healthcare Claims Management Market - Request Sample Report

Healthcare Claims Management Market was valued at USD 15.01 billion in 2023 and is expected to reach USD 24.93 billion by 2032, growing at a CAGR of 5.85% from 2024-2032.

Increased complexity in the process of medical claims processing and volumes of patients will drive significant growth in the Healthcare Claims Management Market. Demand for automation and digital solutions to enhance billing and reimbursement procedures, leading to greater efficiency and accuracy, will also improve this market. Further growth, this year, is estimated at 1.3 billion for digital health technology; more pressing, therefore, is advanced claims management. Generative AI technologies are one example of how a 20-25% reduction in loss-adjusting costs and operational efficiency by cost savings across the industry can be achieved.

The movement towards value-based care and cost control necessitates intelligent healthcare claims management systems in the billing processes, which are highly complex and cannot be managed with mere manual processes. Claims automation on cloud-based or web-based platforms is adopted in the process to expedite fast, accurate claims handling against increasing healthcare costs. At this time, the deductible average for employer-based health coverage has risen to USD 3,811 annually for a family and hence requires cost management. Consistent with these efforts, the U.S. The administration has submitted a discretionary budget of USD 144.3 billion and a mandatory budget authority of USD 1.7 trillion for FY 2024. This spending demonstrates the government's thrust in improving healthcare delivery while trying to control growing health care costs.

The expansion of health insurance coverage is also accelerating the urgency of effective claims management systems. In 2023, 89.1% of adults aged between 18 and 64 years had health insurance at some point, which reflects the huge scale of claims to be managed. At the same time, the use of AI and RPA is also facilitating the process of claims processing, thereby ensuring that data accuracy increases and human error decreases. As the right platforms become institutionalized, insurers and healthcare service providers are now setting the groundwork to deal effectively with increasing claim volumes while at the same time supporting further digital transformation of the industry.

HEALTHCARE CLAIMS MANAGEMENT MARKET DYNAMICS

DRIVERS

- Rising Healthcare Costs and Employment-Based Insurance Drive the Need for Efficient Claims Management

In 2022, average expenditures per capita in the United States have averaged USD 12,555 per capita, above USD 4,000 over all other high-income countries. This huge amount places quite a burden on the health insurance sector to effectively cope with rising claim volumes. Worksite-based health insurance remains the most prevailing source of coverage for Americans, accounting for more than 54% of the country's population, meaning higher demand for sound claims management solutions. Rising costs are a future driver for healthcare; therefore, advanced technologies, that streamline claims processing and efficiency, are in demand. These systems enable faster reimbursement and relieve the administrative burden on healthcare providers.

- Stricter Government Regulations and the Shift to Value-Based Care Fuel Healthcare Claims Management Growth

Governments worldwide are strictly regulating the healthcare industry, including proper claims reporting and processing. Providers and payers respond to these high compliance mandates by adopting more advanced claims management solutions. Moving toward value-based care will continue demanding better tracking of data and faster claims resolution by new reimbursement models. Although still a common phenomenon in challenges for providers in the country, many have now begun to battle claims denials that have risen significantly: 42% of those from 2022 are now up to 77% of 2024; furthermore, 67% in 2024 compared with 51% in 2022 experience longer time-to-reimbursement for processing their claims. All of these place further emphasis on claims management automation, therefore accelerating payment optimally.

RESTRAINTS

- Data Privacy and Security Challenges in Healthcare Claims Management Market

Data privacy is one serious concern in the healthcare claims management market since it deals with such sensitive information about patients and their treatments. Maintaining compliance with strict regulations applicable in regions, like those in the U.S. involving HIPAA, or different regional laws, is particularly challenging for healthcare organizations managing enormous volumes of claim data. Healthcare data breach costs are quite high, and the average cost in 2023 was USD 4.45 million (USD 165 per record), with US-based breaches being the costliest at an average cost of USD 9.48 million. The financial risk added to reputational damage places it of paramount importance that healthcare providers and insurers emphasize data security. The market growth is therefore challenged by the slowing of the adoption of new claims management systems due to compliance as well as patient data protection.

HEALTHCARE CLAIMS MANAGEMENT MARKET SEGMENT ANALYSIS

BY PRODUCT

In 2023, medical billing accounts for about 58% of the total revenues in the health claims management market. It is further motivated by its role of providing core support to the healthcare reimbursement processes that it supports by way of proper billing, hence ensuring smooth flows of payments from providers to the payers. However, claims processing is likely to increase at the highest CAGR of 6.65% during the period 2024-2032, due to growing demands for automation and high-end technology in streamlining the handling of claims. As insurers and providers focus on minimizing the claim denials, processing inefficiencies, and fraud, there is a growing demand for more sophisticated claims processing systems.

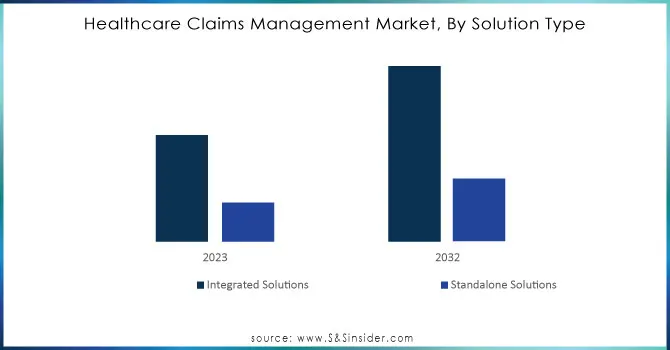

BY SOLUTION TYPE

In 2023, the market share was dominated by integrated solutions that accounted for approximately 74% of the revenue. Integrated solutions are complete capabilities that offer submission through reimbursement from the life cycle of health services and enable healthcare providers and insurers to operate efficiently in managing claims throughout this process. That is why they had a higher market share. It is expected that integrated solutions will grow at a CAGR of 6.13% between 2024 and 2032, led by the increasing demand for automation, improved claim accuracy, and better data analytics, which are all significant factors for meeting the growing complexity in the healthcare industry.

Need any customization research on Healthcare Claims Management Market - Enquiry Now

BY COMPONENT

In 2023, the revenues in the healthcare claims management market were 67%, which were accounted for by software solutions. They should be efficient, scalable and automated tools aimed at handling claims in real time with less error input and quicker processing. These types of solutions have high adoption ranges because they might enhance precision and cut off operational costs. More services are projected to grow at the highest CAGR of 6.93% from 2024 to 2032 since more and more healthcare providers require specialization for the betterment of the claim-handling process. The need for security, compliance with regulations, and personalized services also add to the rising need for services in the service market.

BY END USE

In 2023, healthcare providers dominated the healthcare claims management market with a revenue share of 68%. Their critical role in the process, from submission of claims to ensuring compliance and accuracy in payment, accounts for their dominance. With the continued growth of the healthcare sector, the need for efficient claims management tools is imperative in managing large volumes. Meanwhile, the healthcare payers would account for the highest CAGR of 7.08% from 2024 to 2032. The need for reducing operation costs while managing risk within a claims processing system boosts demand for payer-specific solutions among insurance companies, a main investment area in this market.

BY DEPLOYMENT MODE

Web-based solutions dominated the healthcare claims management market in 2023, accounting for 48% of the total revenue. The main reasons for this included that web-based solutions are easily accessible, scalable, and used by most health systems. Web-based solutions have a great deal of flexibility to integrate with existing infrastructures, which makes them extremely attractive to both small and large healthcare organizations. However, the cloud-based systems are most likely to exhibit the highest CAGR of 6.67% from 2024 to 2032. Rising demand for remote access, data security, and cost efficiency is driving healthcare providers towards cloud-based solutions that are more scalable and offer much more storage capacity than their traditional web-based models.

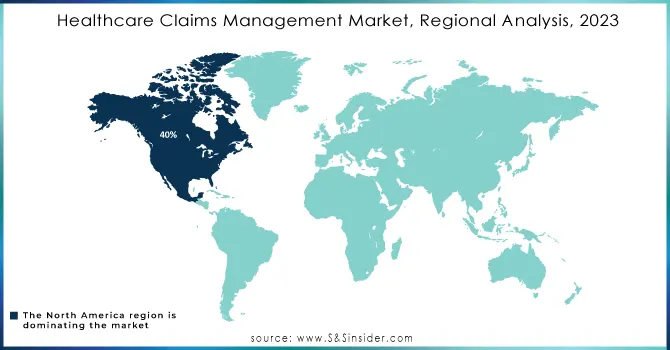

HEALTHCARE CLAIMS MANAGEMENT MARKET REGIONAL ANALYSIS

North America accounted for approximately 40% of the total market share in 2023, primarily due to the advanced healthcare infrastructure, high technology adoption, and a current trend towards digital healthcare solutions. The region also witnesses a high investment in healthcare innovations coupled with robust government regulations that support the growth of the market.

The Asia Pacific region would be growing at the fastest CAGR of 7.51% during 2024-2032, with rapid healthcare digitalization, increasing insurance penetration, and expansion of healthcare networks in emerging markets in India and China, apart from others. Furthermore, a rising focus on making better healthcare services and the care of patients is in turn boosting the demand for more efficient claims management systems in the region, causing the market to expand profoundly in the coming years.

KEY PLAYERS

- McKesson Corporation (McKesson Claims Management Solutions, McKesson Risk Management Solutions)

- The SSI Group, Inc. (SSI Claims Manager, SSI Clearinghouse)

- Quest Diagnostics (Quest Diagnostics Claims Management, Quest Diagnostics Revenue Cycle Management)

- Kareo (Kareo Billing, Kareo Claims Management)

- Optum, Inc. (a subsidiary of UnitedHealth Group) (Optum360 Claims Management, Optum Claims Analytics)

- Conifer Health Solutions (Conifer Revenue Cycle Management, Conifer Claims Management)

- CareCloud (CareCloud Claims Management, CareCloud Revenue Cycle Management)

- eClinicalWorks (eClinicalWorks Claims Management, eClinicalWorks RCM Solution)

- IBM (IBM Watson for Claims, IBM Revenue Cycle Management)

- Cerner Corporation (Cerner Claims Management, Cerner Revenue Cycle)

- Accenture Plc (Accenture Health Claims Solutions, Accenture Revenue Cycle Management)

- Allscripts Healthcare Solutions Inc. (Allscripts Revenue Cycle Management, Allscripts Claims Processing)

- athenahealth (AthenaCollector, AthenaIDX)

- Carecloud Inc. (CareCloud Claims Management, CareCloud Revenue Cycle Management)

- Oracle Corporation (Oracle Healthcare Claims, Oracle Healthcare Revenue Cycle)

- Plexis Healthcare Systems (Plexis Claims Management, Plexis Healthcare Solutions)

- Quest Diagnostics (Quest Diagnostics Revenue Cycle, Quest Diagnostics Claims Management)

- The SSI Group LLC (SSI Clearinghouse, SSI Claims Management)

LATEST NEWS

- Oracle Health has been successful with the launch of its 2024 introduction called the Oracle Health Clinical Data Exchange. A cloud-based program designed to automate the health care process of medical claims to streamline all the medical record submissions while keeping administrative costs relatively low compared to traditional methods, processing claims, as well as settlement payment, is faster.

- In 2024, Conifer Health Solutions extended its exclusive contract with Dartmouth Health to deliver complete revenue cycle management (RCM) services, aiming to enhance healthcare claims processing and patient involvement.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 15.01 Billion |

| Market Size by 2032 | USD 24.93 Billion |

| CAGR | CAGR of 5.85% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Medical Billing, Claims Processing) • By Component (Software, Services) • By Solution Type (Integrated Solutions, Standalone Solutions) • By Deployment Mode (Cloud-based, On-premise, Web-based) • By End-use (Healthcare Providers, Healthcare Payers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | McKesson Corporation, The SSI Group, Inc., Quest Diagnostics, Kareo, Optum, Inc., Conifer Health Solutions, CareCloud, eClinicalWorks, IBM, Cerner Corporation, Accenture Plc, Allscripts Healthcare Solutions Inc., athenahealth, Carecloud Inc., Oracle Corporation, Plexis Healthcare Systems. |

| Key Drivers | • Rising Healthcare Costs and Employment-Based Insurance Drive the Need for Efficient Claims Management. • Stricter Government Regulations and the Shift to Value-Based Care Fuel Healthcare Claims Management Growth |

| Restraints | • Data Privacy and Security Challenges in Healthcare Claims Management Market |