Acromegaly Treatment Market Size & Growth:

The Acromegaly Treatment Market is estimated at USD 1.96 billion in 2025 and is expected to reach USD 3.06 billion by 2033, growing at a CAGR of 5.71% from 2026-2033.

This report specifically emphasizes major statistical facts of the acromegaly treatment market by providing a deep dive into incidence and prevalence data, offering a better picture of the disease burden by geography. It also examines drug prescribing trends by geography, offering actionable insights into physician behavior and treatment patterns. A thorough analysis of healthcare expenditure by payer category—government, commercial, private, and out-of-pocket—provides added value by highlighting funding patterns and access inequities. Also included is clinical trial activity and early-stage pipeline medications, which highlight patterns of innovation and provide a strategic view for investors tracking impending therapeutic developments.

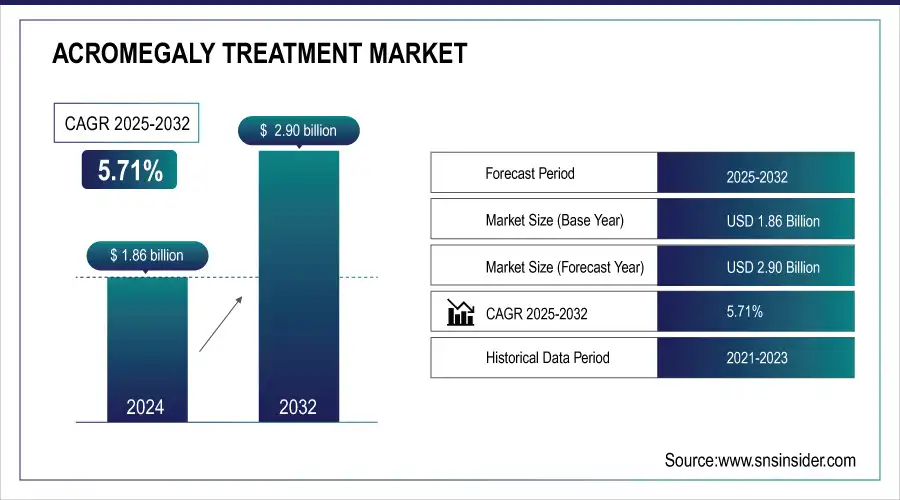

Acromegaly Treatment Market Size and Forecast

-

Market Size in 2024: USD 1.86 Billion

-

Market Size by 2032: USD 2.90 Billion

-

CAGR: 5.71% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

To Get more information on Acromegaly Treatment Market - Request Free Sample Report

Acromegaly Treatment Market Trends

-

Rising prevalence of acromegaly and increased disease awareness are driving market growth.

-

Advances in diagnostic techniques, including MRI and hormonal assays, are enabling early detection and treatment.

-

Adoption of pharmacological therapies, such as somatostatin analogs, GH receptor antagonists, and dopamine agonists, is boosting market demand.

-

Growing preference for minimally invasive surgeries and combination therapies is enhancing patient outcomes.

-

Expansion of specialty endocrinology centers and telemedicine services is improving treatment accessibility.

-

Increasing focus on personalized medicine and patient monitoring is shaping therapeutic strategies.

-

Collaborations between pharmaceutical companies, healthcare providers, and research institutions are accelerating drug development and innovation.

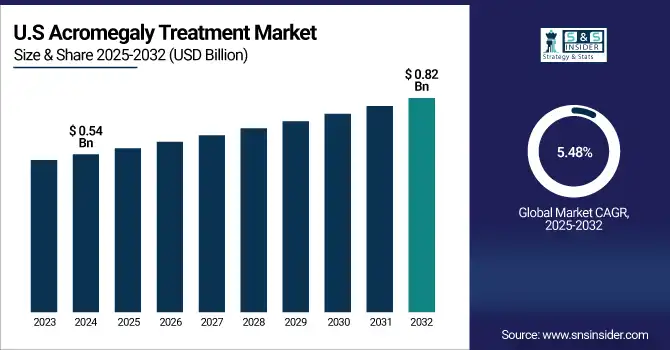

U.S. Acromegaly Treatment Market was valued at USD 0.54 billion in 2024 and is expected to reach USD 0.82 billion by 2032, growing at a CAGR of 5.48% from 2025-2032.

The United States occupies a leading position in the North American market for acromegaly treatment because of its high-tech healthcare infrastructure, high awareness regarding rare endocrine disorders, and quick uptake of new therapies. Furthermore, the fact that there are top pharma players and ongoing clinical research activities serves to reinforce the leadership of the country in the region.

Acromegaly Treatment Market Growth Drivers:

-

The growing incidence of acromegaly, along with the advancement in diagnostic technology, is significantly fueling the need for proper treatment.

Acromegaly continues to be underdiagnosed because of its insidious nature and infrequent occurrence, yet increased awareness among physicians and patients is reversing this trend. An estimated 60 to 70 individuals per million are affected worldwide, with 3 to 4 new cases per million diagnosed each year. The use of advanced imaging modalities and biochemical markers such as IGF-1 and GH suppression tests has enhanced early diagnosis rates, especially in North America and Europe. Also, efforts by organizations like the Pituitary Network Association to create awareness and fund research have increased patient identification at a faster rate. Early diagnosis has a direct influence on treatment outcomes, and hence, it is increasing the demand for early medical intervention, thus fueling overall market growth.

-

Expanding Therapeutic Pipeline and Regulatory Approvals are driving the market growth.

Pipeline growth and regulatory pick-up are driving innovation and choice of treatment opportunity for acromegaly. Some biopharma players are investing in new somatostatin receptor ligands, GH receptor antagonists, and oral therapies to enhance compliance and effectiveness. In March 2025, Crinetics Pharmaceuticals revealed that the Marketing Authorization Application (MAA) for paltusotine, the first once-daily, oral nonpeptide somatostatin analog, had been validated by the European Medicines Agency. Teva introduced octreotide acetate injectable suspension in October 2024 as the first generic equivalent of Sandostatin LAR in the United States, increasing access to treatment. These launches, underpinned by fast-track designations and orphan drug status in primary markets, demonstrate the sector's dedication to treating this rare endocrine disorder. As innovation continues to speed up, players in the market enjoy a competitive advantage, and patients have a wider range of treatment options.

Acromegaly Treatment Market Restraints:

-

One of the major constraints preventing the acromegaly treatment market from growing is the cost of long-term therapy, most importantly with branded drugs and biologics.

Somatostatin analogues and growth hormone receptor antagonists are among the drugs that need to be administered continuously, and as a result, patients and health systems may incur considerable cumulative costs. For instance, treatments such as pegvisomant or lanreotide may be in the range of thousands of dollars monthly, which reduces affordability for the uninsured population and those living in the developing world. In addition, reimbursement issues and varying insurance availability throughout regions further limit access. In low-income and middle-income countries, where infrastructure and finances for healthcare can be lacking, patients are hindered by delayed diagnoses and inaccessibility to specialist treatment. These systemic and financial obstacles impede broad adoption and fair access, thus slowing overall market growth.

Acromegaly Treatment Market Opportunities:

-

The advent of oral drug products and patient-friendly therapy is a great opportunity in the acromegaly treatment market.

Conventional treatment is normally through frequent injections of somatostatin analogues, which can be painful and decrease compliance. But new oral therapies like Chiasma's Mycapssa—the first FDA-approved oral octreotide capsule—have demonstrated encouraging efficacy for maintenance therapy in patients with a response to injectable products. These options enhance patient compliance, minimize the weight of recurrent clinical visits, and pave the way for home-based treatment. With more investment in R&D by pharmaceutical firms for non-invasive drug delivery systems and formulations, the horizon for acromegaly treatment is likely to become more penetrative, particularly in outpatient clinics. This also facilitates wider penetration into emerging markets where medical facilities for frequent injectables might be inadequate.

Acromegaly Treatment Market Challenges:

-

Diagnostic Delays and Low Awareness Levels are challenging the market growth.

The key challenge in the market of acromegaly treatment is the ongoing delay in diagnosis and the generally low level of disease awareness among the public and healthcare professionals. Acromegaly develops slowly, and its symptoms, e.g., enlarged hands or facial deformity, are commonly confused with other conditions or with normal aging. This results in an overall diagnostic delay of 7–10 years, during which the disease can advance, raising the risk of serious complications such as diabetes, cardiovascular disease, and joint disease. The paucity of acromegaly also results in limited clinical experience for general practitioners and delayed referrals to endocrinologists. This is detrimental to treatment outcomes and patient quality of life. Furthermore, underdiagnosis in rural and developing areas worsens the problem. Enhancing early detection by education and screening initiatives continues to be an important challenge for healthcare systems globally.

Acromegaly Treatment Market Segment Analysis

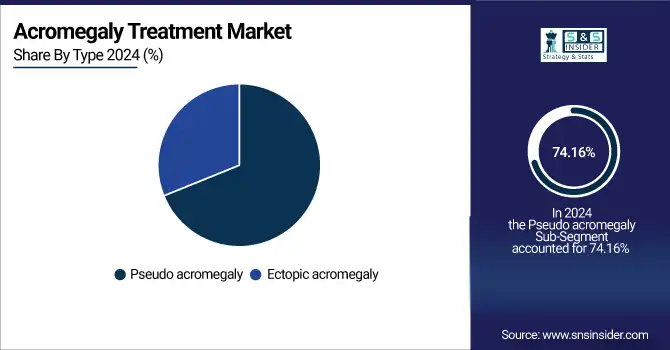

By Type, Pseudoacromegaly segment dominates the Acromegaly Treatment Market

In 2024, the pseudoacromegaly segment dominated the acromegaly treatment market with a 74.16% market share as a result of its growing clinical awareness and diagnostic complexity. Pseudoacromegaly features phenotypic manifestations indistinguishable from those of typical acromegaly, such as enlarged facial structures and extremities, but without hypersecretion of growth hormone (GH) or insulin-like growth factor 1 (IGF-1). This diagnostic overlap has created increased clinical interest, fueling demand for differential diagnostics and focused therapeutic approaches. Moreover, the dominance of the segment is also due to enhanced genetic and molecular testing capabilities that assist in distinguishing pseudoacromegaly from actual GH-secreting pituitary adenomas. With growing clinical research and recognition of rare disorders that can mimic acromegaly, healthcare systems are putting more money into diagnostic algorithms and personalized treatment strategies, increasing the significance and demand for this segment in developed and emerging economies.

By Drug, Somatostatin Analogues (SSAs) segment dominates the market

The Somatostatin Analogues (SSAs) segment dominated the acromegaly treatment market with a 64.18% market share as the first-line medical treatment for the management of growth hormone-secreting pituitary tumors. SSAs like octreotide, lanreotide, and pasireotide are most effective in lowering GH and IGF-1 levels, allowing for normalization of hormonal activity and tumor growth control in inoperable or residual disease patients following surgery. These agents have demonstrated persistent clinical effectiveness, long-acting products (e.g., monthly depot injections), and tolerable side-effect profiles, further securing their popularity with endocrinologists. The approval of oral products such as Mycapssa (octreotide capsules) has increased patient access and compliance, particularly among those who dislike injections. Ongoing investment by drug companies in optimizing SSA delivery systems and increasing indications has also strengthened the leadership of this segment in 2024.

By Age Group, 41-60 age group dominates the Acromegaly Treatment Market

The 41-60 segment dominated the acromegaly treatment market with a 48.26% market share in 2024 because more cases of acromegaly occur in people in this adult mid-life category. Acromegaly progresses slowly for years, and gradually its symptoms grow more apparent. This group is more likely to be diagnosed because patients could have lived with undiagnosed symptoms, for instance, large hands, feet, and facial structures that become more evident and alarming in their advancing years. By the age of their 40s or 50s, the development of acromegaly frequently leads to more medical intervention and diagnosis, resulting in more treatment being started among this group. Moreover, patients in this age group are more likely to come in for treatment of symptoms affecting their quality of life, like joint pain and sleep apnea. Healthcare providers are also more alert to the diagnosis of acromegaly in this group, which results in more cases being treated with newer therapeutic strategies. This helps to dominate the 41-60 segment in the market.

By Distribution Channel, Hospital Pharmacies segment dominates the market

The Hospital Pharmacies segment dominated the acromegaly treatment market with a 52.13% market share in 2024 because of the vital role that hospitals have in treating and diagnosing acromegaly, which is a rare and complicated disorder. Hospital pharmacies tend to be the first port of entry for patients who need complex treatments like somatostatin analogs (SSAs), growth hormone receptor antagonists (GHRAs), and dopamine agonists, which are usually given through injections or infusions that must be monitored by clinicians. These drugs are usually employed in acromegaly management for regulation of growth hormone, and their use requires close patient monitoring and care, which is best provided in hospital facilities. Acromegaly patients often need a multidisciplinary team, such as endocrinologists, surgeons, and oncologists, which makes hospital-based pharmacies the most desirable channel of distribution for drugs employed in the treatment of this disease. Hospitals have the facilities to offer the required support for intricate therapeutic regimens, such as drug administration and monitoring for possible side effects. Centralized care and availability of specialized treatments make hospital pharmacies the leader in the Acromegaly Treatment Market.

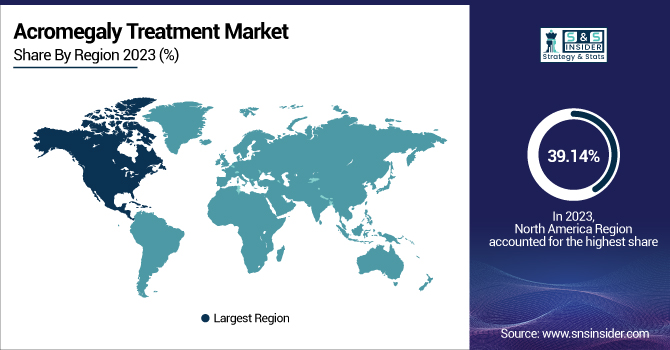

Acromegaly Treatment Market Regional Analysis

North America Acromegaly Treatment Market Insights

North America dominated the acromegaly treatment market with a 39.14% market share in 2024, owing to a mix of sound healthcare infrastructure, high levels of awareness, and early diagnosis. The region has enough insurance coverage and access to sophisticated diagnostic equipment and therapeutic agents, such as long-acting somatostatin analogs and growth hormone receptor antagonists. In addition, the availability of major pharmaceutical companies like Pfizer, Novartis, and Ipsen, and a supportive regulatory environment, encourages innovation and the timely approval of new therapies. Academic and clinical research centers in the U.S. and Canada also contribute significantly to the support of ongoing trials and the creation of next-generation therapies. Moreover, regular screening programs and the availability of specialist endocrinologists also enhance treatment outcomes. North America's high clinical trial enrollment also speeds up the development and verification of new treatments.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Acromegaly Treatment Market Insights

The Asia Pacific is the fastest-growing region in the acromegaly treatment market with 9.16% CAGR over the forecast period due to rising awareness of rare endocrine disorders, growing healthcare spending, and upgrades in diagnostic centers in developing economies like China, India, and South Korea. Governments and private healthcare providers are heavily investing in rare disease management and hormone-related treatments, and this is propelling market growth. Moreover, increasing partnerships among local biotech companies and multinational pharmaceutical companies are improving access to innovative treatment solutions, which were previously restricted in these markets. The growing patient pool and increased disposable income further drive the rapid market growth in the region. In addition, efforts by health ministries to add rare disease treatments to public health programs are propelling access. Telemedicine penetration and e-pharmacy penetration also aid wider treatment outreach in rural areas.

Europe Acromegaly Treatment Market Insights

Europe holds a significant share in the Acromegaly Treatment Market, driven by well-established healthcare infrastructure, high awareness of rare endocrine disorders, and widespread access to advanced diagnostic and therapeutic options. Strong adoption of somatostatin analogues, growth hormone receptor antagonists, and surgical interventions supports market growth. Government initiatives, reimbursement policies, and active research in rare disease management further enhance treatment accessibility, making Europe a key regional contributor to the global acromegaly treatment market.

Middle East & Africa and Latin America Acromegaly Treatment Market Insights

The Middle East & Africa and Latin America regions are witnessing steady growth in the Acromegaly Treatment Market, fueled by increasing healthcare investments, rising awareness of rare endocrine disorders, and improving access to specialized treatments. Expansion of hospital networks, availability of advanced diagnostic tools, and gradual adoption of somatostatin analogues and other therapeutic options are driving market development. Growing initiatives to enhance rare disease management are further supporting regional market growth.

Acromegaly Treatment Market Competitive Landscape:

Crinetics Pharmaceuticals, Inc.

Crinetics Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company focused on developing novel therapeutics for rare endocrine diseases. The company leverages advanced molecular design and precision medicine approaches to create first-in-class treatments targeting somatostatin and other hormone-related pathways. Crinetics aims to address unmet medical needs in conditions like acromegaly, Cushing’s disease, and congenital hyperinsulinism, advancing both oral and injectable therapies through rigorous clinical trials to provide innovative, safe, and effective options for patients with complex endocrine disorders.

-

In March 2025, Crinetics Pharmaceuticals, Inc. reported that the European Medicines Agency (EMA) formally validated the Marketing Authorization Application (MAA) for paltusotine, a first-in-class, once-daily oral nonpeptide agonist selectively engaging somatostatin receptor type 2 (SST2), under development for the treatment and long-term control of acromegaly, a rare, progressive endocrine disease with chronically elevated growth hormone levels.

Teva Pharmaceutical Industries Ltd.

Teva Pharmaceutical Industries Ltd. is a global pharmaceutical company specializing in generic and specialty medicines across multiple therapeutic areas. Teva develops, manufactures, and markets high-quality, cost-effective medications, including oral, injectable, and biologic therapies, serving patients worldwide. The company emphasizes innovation in generics, specialty drugs, and biopharmaceutical solutions, while maintaining a strong pipeline for rare diseases, neurological conditions, and chronic disorders. Teva focuses on accessibility, affordability, and expanding treatment options globally.

-

In October 2024, Teva Pharmaceuticals launched the U.S. market introduction of octreotide acetate for injectable suspension, the first generic equivalent of Sandostatin LAR Depot, indicated for treating acromegaly and managing severe carcinoid syndrome diarrhea, now available to patients throughout the United States.

Acromegaly Treatment Companies are:

-

Pfizer Inc. (SOMAVERT, Genotropin)

-

Novartis AG (Sandostatin LAR, Signifor LAR)

-

Ipsen Biopharmaceuticals, Inc. (Somatuline Depot, Dysport)

-

Chiasma, Inc. (Mycapssa, Octreotide Capsules)

-

Crinetics Pharmaceuticals, Inc. (Paltusotine, CRN01941)

-

Recordati S.p.A. (Isturisa, Signifor)

-

Sun Pharmaceutical Industries Ltd. (Octride Depot, Somatropin)

-

Teva Pharmaceutical Industries Ltd. (Octreotide Acetate, Somatropin Injection)

-

Ferring Pharmaceuticals (Zomacton, OctreoScan)

-

Antares Pharma, Inc. (Xyosted, TLANDO)

-

Novo Nordisk A/S (Norditropin, Somapacitan)

-

Amphastar Pharmaceuticals, Inc. (Octreotide Injection, Somatropin Injection)

-

Wockhardt Ltd. (Wosulin, Wosoptide)

-

Daewoong Pharmaceutical Co., Ltd. (Somatropin DW EHD, DWP14012)

-

BioPartners GmbH (Biopart-Somatropin, Biopart-Depot Octreotide)

-

Intas Pharmaceuticals Ltd. (Octride Depot, Somatropin Intas)

-

Cipla Ltd. (Somatropin Cipla, Octreotide Acetate)

-

Zydus Lifesciences Ltd. (Somazina, Octride Depot)

-

Eli Lilly and Company (Humatrope, Forteo)

-

LG Chem (Euportin, Somatropin LG)

Suppliers (These suppliers commonly provide biopharmaceutical manufacturing services, including active pharmaceutical ingredients (APIs), formulation development, and fill-finish capabilities. They are crucial for ensuring high-quality biologics and peptide-based drugs, which are widely used in acromegaly treatment.) in Acromegaly Treatment Market

-

Lonza Group AG

-

Thermo Fisher Scientific Inc.

-

Sartorius AG

-

WuXi AppTec

-

Catalent, Inc.

-

Samsung Biologics

-

Boehringer Ingelheim BioXcellence™

-

Evonik Industries AG

-

Ajinomoto Bio-Pharma Services

-

Patheon (by Thermo Fisher Scientific)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.86 Billion |

| Market Size by 2032 | USD 2.90 Billion |

| CAGR | CAGR of 5.71 % From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Ectopic Acromegaly, Pseudo Acromegaly) |

| • By Drug (Somatostatin Analogues (SSAs), Growth Hormone Receptor Antagonists (GHRAs), Dopamine Agonists, Others) | |

| • By Age Group (Less than 40, 41–60, 61 Above) | |

| • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Others) | |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Pfizer Inc., Novartis AG, Ipsen Biopharmaceuticals, Inc., Chiasma, Inc., Crinetics Pharmaceuticals, Inc., Recordati S.p.A., Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Ferring Pharmaceuticals, Antares Pharma, Inc., Novo Nordisk A/S, Amphastar Pharmaceuticals, Inc., Wockhardt Ltd., Daewoong Pharmaceutical Co., Ltd., BioPartners GmbH, Intas Pharmaceuticals Ltd., Cipla Ltd., Zydus Lifesciences Ltd., Eli Lilly and Company, LG Chem, and other players. |