Location Analytics Market Report Scope & Overview:

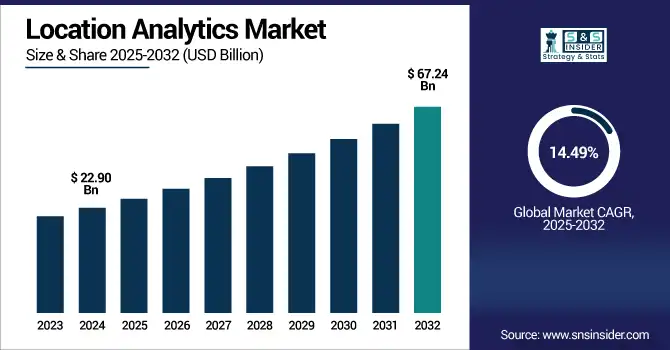

Location Analytics Market was valued at USD 22.90 billion in 2024 and is expected to reach USD 67.24 billion by 2032, growing at a CAGR of 14.49% from 2025-2032.

To Get more information on Location Analytics Market - Request Free Sample Report

The growth of the Location Analytics Market is driven by the rising demand for real-time location-based insights to enhance decision-making across industries. Increasing use of GPS-enabled devices, IoT sensors, and mobile applications fuels data generation, enabling businesses to optimize operations, customer engagement, and logistics.

-

According to a U.S. Census Bureau–affiliated study, GPS-based location from smartphones can pinpoint users within 3 meters of accuracy under optimal conditions, enhancing the reliability of location intelligence.

-

Per a 2023 advisory by the U.S. Department of Commerce’s IoT board, IoT sensors with GPS enable real-time tracking of goods and assets, significantly improving supply chain visibility, reducing delays, and streamlining operations.

The integration of AI and big data analytics further enhances the precision and utility of location intelligence.

-

Additionally, NIST’s April 2023 IoT advisory highlights applications such as real-time monitoring of goods, predictive maintenance, enhanced transparency, and data-driven decision-making across public safety and infrastructure.

Growing adoption in sectors like retail, transportation, healthcare, and public safety coupled with smart city initiatives and digital transformation is accelerating market expansion over the forecast period.

U.S. Location Analytics Market was valued at USD 6.43 billion in 2024 and is expected to reach USD 18.69 billion by 2032, growing at a CAGR of 14.26% from 2025-2032.

The U.S. Location Analytics Market is growing due to rising demand for real-time geospatial data, increasing adoption of smart technologies across sectors, expansion of IoT ecosystems, and strong investments in advanced analytics for business intelligence, urban planning, and logistics optimization.

Location Analytics Market Dynamics

Drivers

-

Rising Demand For Real-Time Data Visualization Is Accelerating Enterprise-Wide Use Of Location Analytics Across Multiple Industry Verticals Globally.

Real-time data visualization increasingly is key for businesses attempting to make faster and more informed decisions in fast-changing business environments. Geography analytics allows companies to see trends in data and stay in synch with rapidly changing conditions. This feature improves operations efficiency, customer targeting and resources allocation. By Fatima Toor Industries including retail, transportation, logistics and city planning are becoming more dependent on location data for making decisions today. The potential to map and analyze real-time spatial data is spurring widespread adoption of location analytics tools, leading to enhanced customer service and business performance.

-

Supporting this trend, the U.S. Census Bureau’s "OnTheMap for Emergency Management" tool provides real-time mapping of population and workforce data during disasters, enabling rapid decision-making in high-stakes environments.

-

Similarly, the CDC’s Enterprise Data, Analytics, and Visualization (EDAV) platform accelerates data workflows “from collection to visualization and action,” underscoring the value of live geospatial intelligence in public health response.

-

Furthermore, the Colorado Department of Transportation (CDOT) has developed a Real Time Data Hub that integrates geospatial data streams into Esri-based GIS dashboards to support real-time infrastructure and safety operations.

Restraints

-

Concerns Related To Data Privacy And User Surveillance Are Limiting The Adoption Of Location Analytics Across Several Sensitive Sectors.

The growing adoption of location-based data is causing severe privacy concerns for users and regulators, particularly in terms of surveillance and unauthorized tracking. This, coupled with the increasing trend among the governments across the globe to implement stringent data protection laws viz. GDPR, CCPA etc., have made it difficult for companies to collect, store and utilize the geolocation data. This environment of regulation requires organizations to build expensive compliance functions and in many cases limits adoption of location analytics. In verticals such as health and finance, $in which sensitivity to data is high, fear over breach and brand damage serve as a strong inhibitor to the adoption and scale of location-based solutions.

-

In 2025, California Attorney General Rob Bonta launched a major investigative sweep targeting ad networks, app providers, and data brokers over potential violations of CCPA’s geolocation regulations.

-

Under the CCPA/CPRA, precise geolocation data is classified as "sensitive personal information," requiring "limit use/disclosure" rights and opt-out compliance.

Opportunities

-

Growing Adoption Of Smart Cities Initiatives Is Creating Immense Demand For Advanced Location Analytics Tools And Infrastructure.

The surge in demand for real-time, location-based intelligence arrives as governments and urban planners increasingly speed up the development of smart cities worldwide. These efforts seek better traffic control, waste distribution, energy allocation and urban security using data-based organization. Location intelligence is core, empowering officials to map city resources, track population movement, and identify outliers. As a consequence of adding geospatial tools to the IoT/AI mix, it is a case of the whole being greater than the sum of the parts for urban decision support. This large-scale conversion of cities to intelligent environments offers substantial prospects for location analytics suppliers delivering solutions specifically designed for the sustainable and smart management of the city.

-

Supporting this shift, Singapore’s GovTech manages over 110,000 sensor-equipped lampposts, which collect live urban data on foot traffic, lighting, and incident detection to enable responsive city operations.

-

Similarly, Dallas has invested USD 3.8 million in a smart city neighborhood pilot integrating AI cameras and Wi-Fi-enabled lighting poles. Early results from this initiative show reduced crime, improved environmental conditions, and upcoming features like gunshot detection and automated license plate recognition, reflecting the real-world benefits of location-enabled urban intelligence.

Challenges

-

Inconsistent Data Quality And Lack Of Standardized Geospatial Formats Pose Major Challenges To Effective Location Analytics Deployment.

The quality of location analytics is highly influenced by the correctness, uniformity and interconnection of location data. Organizations however are all too frequently faced with siloed, outdated, and/or incomplete data that restrict the confidence of such analyses. Vendors and platforms may also have different formats, coordinate systems and data models, which introduces interoperability problems during integration. Such discrepancies may lead to errors in mapping, false predictions, and inefficiencies in operation. Data fidelity between sources continues to be a fundamental challenge for companies looking to deploy location analytics at scale. This problem demands cross-industry standards and strict data governance regulations.

-

In North Carolina public health datasets, over 40% of records had errors in geographic fields like city, county, or ZIP code. These were only detected and corrected through GIS-based verification.

Location Analytics Market Segmentation Analysis

By Component

The solution segment dominated the Location Analytics Market in 2024, as solutions are widely used across different verticals to make better decisions in real-time, visualize the spatial data, and improve operational efficiency. Standalone and integrated location analytics software spending will increase as enterprises look to gain insights from their geospatial data statistics. This puts its dominance into sectors like retail, logistics, and urban planning, reinforced by its extensibility and ease of integration into key existing systems.

The services segment is expected to grow at the fastest CAGR from 2025 to 2032 due to rising demand for consulting, implementation, and support services in all verticals. Enterprises are turning to industry leaders for advice on the successful implementation of location analytics platforms that will seamlessly connect with their IT. The growing complexity of analytics solutions and increasing demand for customization and maintenance are contributing to the explosive growth of professional and managed services worldwide.

By Location Type

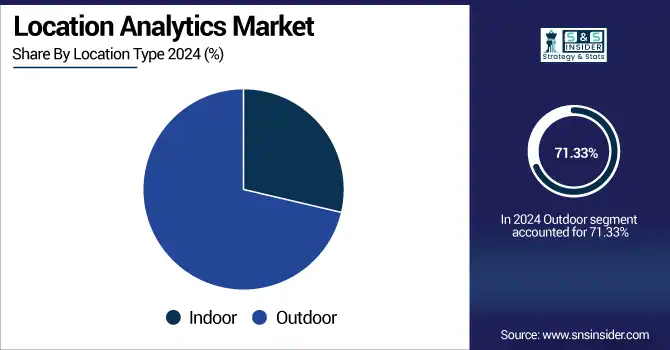

The outdoor segment dominated the Location Analytics Market in 2024 as organizations focused on location tracking and geofencing-based and mobility services for outdoor assets and customers. Real-time outdoor location data is essential for navigation, planning, and targeted communication for a great number of industries, including, but not limited to, transportation, logistics, agriculture, and advertising. The widespread adoption of GPS-enabled hardware along with greater spend on smart infrastructure has further solidified the position of outdoor analytics use cases.

The indoor segment is expected to grow at the fastest CAGR from 2025 to 2032, owing to the penetration of smart buildings, indoor navigation and real-time asset tracking. Indoor location analytics are being used by retailers, hospitals, airports, and warehouses to improve customer satisfaction, understand space utilization, and increase operational visibility. Although, with the increased use of beacons, Wi-Fi monitoring as well as furthermore RFID systems, the development of interior analytics solutions is getting speed.

By Vertical

The retail segment dominated the Location Analytics Market in 2024 owing to the sector’s aggressive adoption of geospatial tools for customer behavior analysis, site selection, and inventory planning. Retailers are leveraging location data to optimize store performance, deliver personalized promotions, and improve supply chain logistics. The competitive landscape of retail and the growing focus on omni-channel strategies further drive location intelligence integration across retail operations.

The healthcare segment is expected to grow at the fastest CAGR from 2025 to 2032 due to rising use of geospatial tools for disease surveillance, patient flow optimization, and emergency service coordination. Healthcare providers and public health agencies are increasingly relying on location analytics to map health outcomes, track outbreaks, and improve accessibility. Demand for data-driven health infrastructure planning is accelerating adoption in both public and private healthcare systems.

By Application

The sales and marketing optimization segment dominated the Location Analytics Market in 2024 as organizations prioritized location-driven strategies to enhance customer engagement and revenue generation. By analyzing geospatial data, businesses tailor campaigns, choose optimal store locations, and predict consumer demand patterns. Location analytics empowers marketers to deliver hyper-local, targeted offers, making it an essential component for customer acquisition, retention, and competitive differentiation in retail, telecom, and FMCG sectors.

The disaster and emergency response management segment is expected to grow at the fastest CAGR from 2025 to 2032 due to increasing climate-related disasters and public safety concerns. Governments and humanitarian organizations are deploying location analytics for early warning systems, risk assessment, and resource allocation. Real-time geospatial insights enhance situational awareness, enabling faster and more effective disaster response. Integration with drones, sensors, and mobile networks is also expanding this segment’s use cases.

Location Analytics Market Regional Outlook

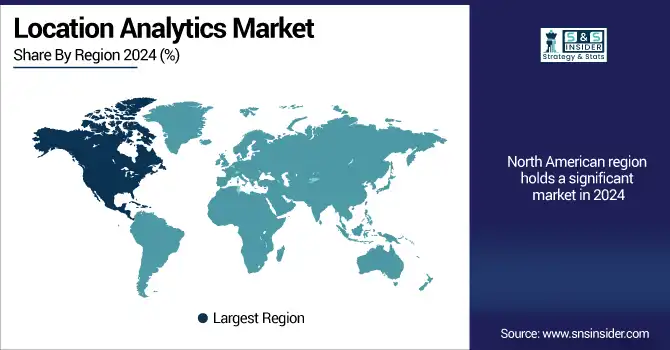

North America dominated the Location Analytics Market in 2024 due to widespread digital infrastructure, early technology adoption, and high investment in advanced analytics. Enterprises across sectors such as retail, logistics, and public safety extensively use location-based tools for strategic decision-making. The presence of major players, coupled with strong regulatory frameworks and demand for real-time spatial intelligence, has solidified North America's leadership in the global location analytics ecosystem.

The United States is dominating the Location Analytics Market due to advanced infrastructure, high technology adoption, and widespread enterprise use across major industries.

Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, expanding smartphone penetration, and government-led smart city initiatives. Countries like China, India, and Southeast Asian nations are increasingly adopting location analytics in transportation, e-commerce, public health, and infrastructure planning. Growing digital transformation, rising demand for real-time services, and increased investments in geospatial technologies are fueling strong regional growth throughout the forecast period.

China is dominating the Location Analytics Market in Asia Pacific due to large-scale smart city initiatives, massive IoT adoption, and strong government-backed digital infrastructure growth.

Europe is experiencing steady growth in the Location Analytics Market driven by smart mobility initiatives, urban sustainability projects, and regulatory compliance requirements. Countries are increasingly investing in geospatial tools to optimize public services, transportation networks, and environmental monitoring systems.

Germany is dominating the Location Analytics Market in Europe owing to strong industrial digitization, smart city projects, and robust demand across logistics and manufacturing sectors.

Middle East & Africa and Latin America are witnessing rising adoption of location analytics due to expanding urbanization, digital transformation efforts, and demand for real-time insights in retail, public safety, and logistics, supported by growing investments in smart city and infrastructure projects.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Spatial.ai, Placense, Locale.ai, Quadrant, Orbica, Geoblink, MOCA, Mapidea, GapMaps, Hardcastle GIS, MapLarge, FourSquare, Ascent Cloud, PlaceIQ, SparkGeo, Tibco Software, CARTO, Quuppa, Lepton Software, IndoorAtlas, CleverMaps.

Recent Developments:

-

In 2025, Spatial.ai released FollowGraph, a geosocial AI-powered dataset quantifying consumer interest in 2000+ social media accounts by geography, aiding precise audience mapping for CRE, retail, urban planning.

-

In 2024, CoreLogic introduced Araya, an AI-enabled property and location intelligence platform integrating property-level data with market and risk analytics, streamlining real estate decision support.

-

In 2023, EON Reality unveiled new Spatial AI–powered capabilities via their AI Assistant at the “Experience Fest”, enabling XR avatars to see, interact and co-create content in real space .

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 22.90 Billion |

| Market Size by 2032 | USD 67.24 Billion |

| CAGR | CAGR of 14.49% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Location Type (Indoor, Outdoor) • By Application (Disaster and Emergency Response Management, Sales and Marketing Optimization, Supply Chain Management, Customer Experience Management, Risk Assessment and Mitigation, Others) • By Vertical (BFSI, Transportation and Logistics, Government and Defense, Tourism and Hospitality, Manufacturing, Healthcare, Retail, IT and Telecommunications, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Spatial.ai, Placense, Locale.ai, Quadrant, Orbica, Geoblink, MOCA, Mapidea, GapMaps, Hardcastle GIS, MapLarge, FourSquare, Ascent Cloud, PlaceIQ, SparkGeo, Tibco Software, CARTO, Quuppa, Lepton Software, IndoorAtlas, CleverMaps |