Education And Learning Analytics Market Key Insights:

Get More Information on Education And Learning Analytics Market - Request Sample Report

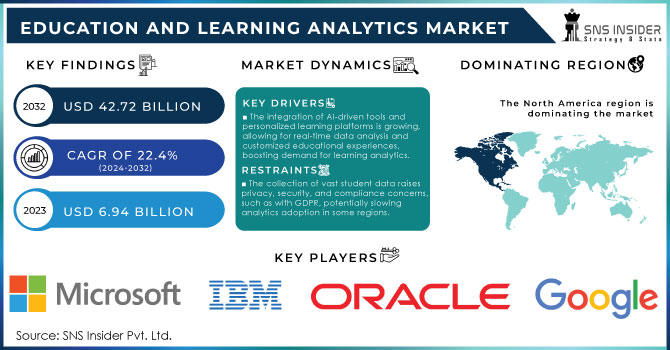

The Education And Learning Analytics Market Size was valued at USD 6.94 Billion in 2023 and is expected to reach USD 42.72 Billion by 2032, growing at a CAGR of 22.4% over the forecast period 2024-2032.

The growth of the education and learning analytics market is facilitated by the emerging need for data-driven approaches to decision-making within educational facilities across the globe. Various governments have shown significant interest in digital education organizations, investing in the promotion of policies that would support the use of learning analytics. For example, in the U.S. Department of Education 2023 report, it is stated that the federal government has invested over $130 billion in K-12 education to facilitate digital infrastructure use, including the adaptation of analytics tools. At the same time, in the European Union, a budget of €5.7 billion has been allocated in 2023 to finance the tasks of the Digital Education Action Plan. The latter focuses on the modernization of the learning environment, and a significant part of the funds will be spent on the acquisition of advanced analytics tools and performance monitoring systems. As a result, this has significantly increased the demand for those solutions among the teaching staff and educational administration. This is one of the quantitative factors contributing to the market growth as reliance on such tools simplifies the improvement of the teaching methodology and support of student engagement.

Big data is becoming increasingly available in the area of education, and the growing tendency towards personalized learning further increases the utility of analytics solutions. The data from UNESCO suggests that there has been a 30% growth in student enrollment in higher educational institutions from 2020 to 2023. In this case, the larger number of students requires more effective education management systems, and this is a powerful driver of the rapid spread of learning analytics tools across academic organizations. They are heavily relied on precise data and ease the right decisions in terms of student effectiveness, teacher reliability, and resource use. This aspect combined with firm governmental support is expected to drive market growth soon.

The growth of the market is driven by the growing global demand for personalized learning. This approach aims at creating individual educational pathways for students and heavily relies on analytics that would analyze the current week and strong sides of the learners, as well as predict problematic areas in the future. Many businesses also use analytics for setting strategic goals and performance analysis, which facilitates productivity increase. At the same time, most academic institutions suffer from an expert crisis, and the data produced by analytics tools can serve as a knowledge base and provide educators with a ready reference base. Thus, a growing tendency for learning management systems (LMS), as well as online educational platforms formation, combined with growing internet penetration in undeveloped regions, will intensify the market expansion in the future.

Market Dynamics

Drivers

-

The integration of AI-driven tools and personalized learning platforms is growing, allowing for real-time data analysis and customized educational experiences, boosting demand for learning analytics.

-

Many governments globally are investing in digital education and promoting policies for data-driven educational systems, driving the demand for learning analytics solutions.

-

Educational institutions are increasingly using data analytics to monitor student progress, identify potential dropouts, and improve retention rates, enhancing overall student success.

Increasing demand for adaptive learning technologies is one of the major factors fuelling the Education and Learning Analytics Market. The term “adaptive learning” refers to the application of technology and data to adapt educational experiences specifically to the needs of individual students. By examining real-time data in terms of student performance on specific topics, these systems can personalize the delivery of content, offer feedback, and create tailored learning pathways. In the higher education sector, for instance, as noted in a report from EdTech Magazine to be released in 2023, more than 77% of U.S.-based institutions are today using some type of adaptive technology, software, or system to boost the performance of their students. Such systems, such as ALEKS by McGraw-Hill and DreamBox Learning, are growing in prominence as they offer support for students in a variety of subjects, from math to science.

In Georgia State University, an increase in student retention rates by 25% was recorded after adaptive learning was introduced. This enables an analysis of the degree of student resonance, allowing the university to identify students at risk of dropping out and timely offer them the necessary assistance. Similarly, at Arizona State University, the use of adaptive learning tools was associated with a 23% improvement in student performance in mathematics courses.

AI-driven adaptive learning tools are increasingly being incorporated across K-12 schools and institutions of higher learning. Moreover, as in the case of the use of learning analytics in schools, this move is transforming the educational experience. The frequent implementation difference makes the learning experience more engaging but also ensures that the learning results are more effective due to, for instance, the greater reliance on modifiable student data.

Restraints:

-

The collection of vast amounts of student data raises concerns around privacy, data breaches, and compliance with regulations like GDPR, which may slow down the adoption of analytics in some regions.

-

The initial costs of setting up learning analytics platforms, along with the need for advanced IT infrastructure and trained personnel, can be prohibitive for smaller institutions.

-

Variability in how different institutions collect and manage data creates challenges in integrating analytics platforms, hindering the consistent application of learning analytics across diverse educational settings.

One of the primary restraints in the education and learning analytics market is data privacy and security. With educational institutions relying more and more on the capture, transmission, and analysis of enormous volumes of data on students, this data grows more susceptible to potential breaches or unauthorized access. Educational data often contains personal information provided in registration forms, as well as students’ performance results, learning patterns, and other statistics that some might want to keep private or access for malicious purposes. In Europe, the General Data Protection Regulation and the Family Educational Rights and Privacy Act in the U.S. introduce heavy restrictions on how educational data can be used, stored, and transmitted, which can force educational institutions to handle vast amounts of data manually. This process is further complicated by cyber threats such as hacking, DDoS attacks, data breaches, and other types of tampering and unauthorized access to data, which is a common problem for many educational institutions that might lack complex security systems.

Market Segmentation Analysis

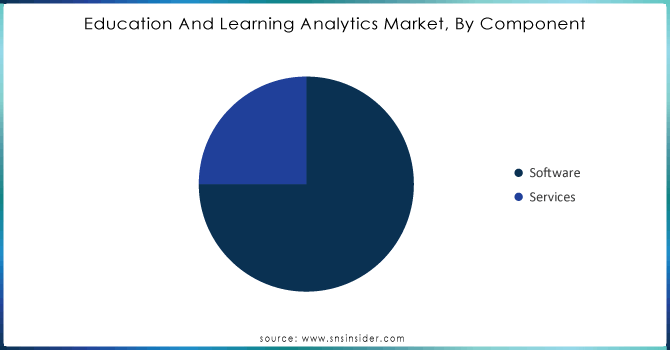

By Component

In 2023, the software component dominated the market with a revenue share of 75%. This outcome is associated with the rising popularity of cloud solutions, along with growing numbers of artificial intelligence integration with learning management systems and student information systems. Governments worldwide invest in digital education technologies, where software platforms are central in managing and analyzing student data. As reported by the U.S. National Center for Education Statistics, over 85% of public schools in America had cloud-based learning management systems in 2023. Software is favored by educational institutions because of offers scalability, flexibility, and ease of integration, and these factors define its high market share. The increasing attention to data security and AI-driven analytics platforms also promotes the widespread market presence of the software segment. Moreover, governments stimulate the development of secure, smart software systems to enhance learning outcomes, thereby reinforcing the sector’s dominance in the overall market.

Need Any Customization Research On Education And Learning Analytics Market - Inquiry Now

By End Use

The academic sector contributed a substantial revenue share in 2023 in the education and learning analytics market. The main drivers are the extensive deployment of analytics tools at schools, colleges, and universities across the globe. As per the 2023 report by UNESCO, global enrollment at higher educational institutions surged by 20% from 2021 to 2023. The surging enrollment in higher education is positively impacting the demand for analytics solutions for learning, thereby boosting the growth of the sector. Educational institutions across the globe are deploying advanced tools and solutions to ensure the continuous monitoring of students’ performance and recognize the learning gaps to improve learning deliveries. The Department of Education in the U.S. stated through the 2023 data that nearly 70% of higher educational institutions have adopted analytics tools to track the performance of students and improve the retention rate. Furthermore, the adoption of learning analytics at higher education institutions in European countries, especially in Germany and the U.K. is at a massive surge given the government programs being implemented to improve the quality of education. These institutions are relying on analytics solutions for offering personalized learning paths and improving students’ outcomes. Hence, the academic sector will still play a key role in the revenue generated in the market.

By Application

Performance management accounted for the leading share of the education and learning analytics market in 2023, as it facilitates the monitoring of student development and the evaluation of teaching performance. Approximately 60% of the educational establishments used management analytics to observe students’ grades, attendance, and other engagement aspects according to the report of the U.S. Department of Education. Such analytics application facilitates the control of data influencing the force of schools or universities to track the metrics of students and staff alike. Different levels of applications in learning analytics within North American and European universities implicate the persistence of performance management in the education market. The establishment of these technology theories encourages the application of performance management tools as the priority tool of the market thus causing the leading position of the application on the market.

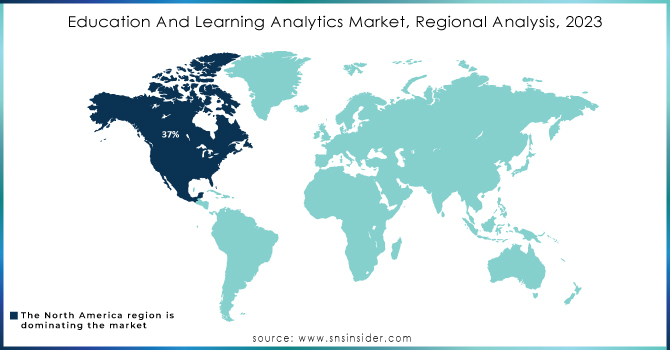

Regional Analysis

In 2023, North America held a leading position in the education and learning analytics market, with more than 37% of the total market size. The region’s dominance can be attributed to the constant and significant investment in educational technologies by the government and the widespread use of digital learning. For example, the U.S. Department of Education spent more than $5.2 billion annually on technology in education, which largely facilitated a wide range of analytics in the country. In Canada, provincial governments also showed significant interest and willingness to invest in the digitalization of all educational establishments.

The Asia-Pacific region will grow at the highest CAGR as compared to other countries. The apparent reason for such an outstanding index is several government-led initiatives aimed at improving the quality of education with the help of advanced technologies. In 2023, the Ministry of Education in India invested $3.1 billion in the digitalization of the learning process. It puts a special emphasis on learning analytics and its role in students’ performance. In China, the Ministry of Education also showed a tendency to increase investments in AI-driven tools to renovate and upgrade the country’s vast educational system. In addition, the factors that will also contribute to Facilitating Asia-Pacific’s market growth in the future is the rapidly growing student population and their increase in digital literacy.

Recent Developments

-

In 2024, the US Department of Education announced cooperation with the leading cloud services providers, such as Amazon Web Services, Google Cloud, and Oracle, to expand the application of learning analytic platforms in public schools, which would improve tracking of student performance and educational decision-making at the school and district levels.

-

In 2024, Instructure Holdings Inc. acquired Scribbles, which is a K-12 record and credentialing management provider, to broaden its credentialing network and enhance student mobility and district transfers.

-

In March 2024, Jenzabar, Inc. and Google Cloud established a collaboration to incorporate Google’s security, AI, and infrastructure in Jenzabar’s student information systems for higher education institutions, enabling more secure and personalized SIS.

Key Players

Key Service Providers/Manufacturers:

-

IBM Corporation (Watson Education, IBM Cognos Analytics)

-

Microsoft Corporation (Azure Machine Learning, Microsoft Power BI)

-

SAP SE (SAP Analytics Cloud, SAP SuccessFactors)

-

Oracle Corporation (Oracle Learning Management, Oracle BI)

-

Google LLC (Google Classroom, Google Analytics for Education)

-

SAS Institute Inc. (SAS Visual Analytics, SAS Enterprise Guide)

-

Tableau Software (Tableau Desktop, Tableau Prep)

-

Blackboard Inc. (Blackboard Analytics for Learn, Blackboard Predict)

-

D2L Corporation (Brightspace Insights, Brightspace Performance+)

-

Cornerstone OnDemand, Inc. (Cornerstone Learning, Cornerstone Analytics)

Key Users (Educational Institutions and Organizations):

-

Harvard University

-

Stanford University

-

University of Cambridge

-

University of Oxford

-

The Open University (UK)

-

University of Melbourne

-

Massachusetts Institute of Technology (MIT)

-

National University of Singapore

-

University of California, Berkeley

-

University of Toronto

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.94 Billion |

| Market Size by 2032 | USD 42.72 Billion |

| CAGR | CAGR of 22.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Deployment (On-premises, Cloud) • By End Use (Academics {K-12, Higher Education}, Enterprises) • By Type (Descriptive, Predictive, Prescriptive) • By Application (Curriculum Development & Intervention Management, Performance Management, Student Engagement, Budget & Finance Management, Operations Management, People Acquisition & Retention, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation, Microsoft Corporation, SAP SE, Oracle Corporation, Google LLC, SAS Institute Inc., Tableau Software, Blackboard Inc., D2L Corporation, Cornerstone OnDemand, Inc. |

| Key Drivers | • The integration of AI-driven tools and personalized learning platforms is growing, allowing for real-time data analysis and customized educational experiences, boosting demand for learning analytics. |

| Restraints | • The collection of vast amounts of student data raises concerns around privacy, data breaches, and compliance with regulations like GDPR, which may slow down the adoption of analytics in some regions. |