Edutainment Market Report Scope & Overview:

Get More Information on Edutainment Market - Request Sample Report

The Edutainment Market Size was valued at USD 2.06 billion in 2023 and is projected to reach USD 7.74 billion in 2032 with a growing CAGR of 16.8% Over the Forecast Period of 2024-2032.

The edutainment market has experienced significant growth recently, driven by the increasing demand for interactive and immersive learning experiences. Traditional educational methods, which focused on passive learning, have evolved due to technological innovations and changing expectations from educators and learners alike. The introduction of technologies such as gamification, virtual reality (VR), and augmented reality (AR) has accelerated the popularity of edutainment, blending education with entertainment to create engaging and dynamic learning environments. This shift is particularly evident across digital platforms like apps, games, and educational videos, which offer active participation and improved knowledge retention. For instance, VR allows learners to immerse themselves in historical events or conduct virtual science experiments, transforming education into an engaging experience. Additionally, gamification motivates learners by incorporating game-like elements such as points, rewards, and challenges, encouraging continuous progress.

This demand for edutainment has also impacted social media strategies, with brands increasingly adopting these methods to engage audiences. A remarkable 66% of social media users consider edutainment to be the most engaging form of brand content, surpassing skits, memes, or serialized content. Platforms like Instagram, YouTube, and TikTok provide ideal environments for these interactive educational experiences. 84% of social media users are on Instagram, the leading network, while 78% of social users have a YouTube profile, indicating a large audience for brands to target. 51% of YouTube users are more likely to engage with long-form videos from brands, and 31-60 second videos on the platform are the second most preferred content type. Furthermore, 54% of TikTok users engage with branded content at least once a day, underscoring the potential for brands to leverage these platforms. Additionally, 15% of survey respondents report having a Threads profile, suggesting a growing interest in emerging platforms for edutainment content. These statistics reflect the increasing integration of edutainment strategies across various social media channels, amplifying its relevance in today’s digital and learning landscapes.

Edutainment Market Dynamics

Drivers

-

Digital Learning Platforms as a Driving Force Behind Edutainment Market Expansion

The surge in the popularity of digital learning platforms has greatly contributed to the rise of interactive, gamified, and engaging educational tools, especially among young learners. This transformation has made learning more enjoyable and effective, utilizing technologies such as gamification, virtual reality (VR), and augmented reality (AR). These immersive methods not only captivate students but also improve knowledge retention, reshaping the traditional educational landscape. Online learning, which has seen a staggering 900% growth since its inception in 2000, is now the fastest-growing segment in the education sector. Research indicates that 49% of students have participated in online learning, and 70% of them believe it’s superior to traditional classroom learning., with businesses also increasingly adopting online training solutions-80% of companies now offer such programs. Furthermore, online learning can significantly enhance retention rates, boosting them by up to 50%, and reduce the time required to learn a subject by 40% to 60. China, the second-largest market, is expected to grow to USD 171 billion by the same year. This rapid growth, accelerated by the COVID-19 pandemic, is expected to continue, with online learning projected to expand by more than 200% from 2020 to 2025. The continued rise of online education platforms and tools indicates a strong shift toward digital, interactive learning environments.

Restraints

-

Overcoming Content Saturation and Navigating Challenges in the Edutainment Market

Content saturation is a significant restraint in the edutainment market, particularly as the number of digital learning platforms and educational content continues to grow exponentially. With more content creators and platforms emerging, distinguishing high-quality educational experiences from the sheer volume of offerings becomes increasingly difficult for both learners and educators. This oversaturation risks diluting the effectiveness of digital learning tools, as users may struggle to find engaging, credible, and valuable educational resources. 62% of consumers feel overwhelmed by the amount of content they encounter daily, which highlights the challenge of standing out in an overcrowded digital space. Furthermore, interactive content, which is central to edutainment, now represents a growing portion of digital marketing efforts, with 93% of marketers noting its effectiveness, as highlighted by Rock Content. This intensifies competition among platforms that use similar tools, making it harder for newcomers to capture attention and establish a solid user base. The need for personalized, high-quality educational material is pressing, but the constant influx of content may decrease overall engagement and learner retention. These factors contribute to the difficulty in maintaining market differentiation in the ever-expanding digital education landscape. As the industry grapples with content saturation, focusing on authenticity, interactivity, and delivering value is critical for success. With 73% of marketers acknowledging that creating standout content is their biggest challenge, the edutainment market must navigate these obstacles while continuing to innovate and offer engaging, unique learning experiences.

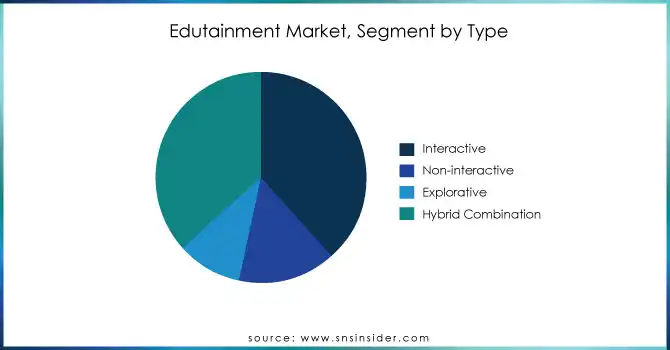

Edutainment Market Segment Analysis

By Gaming Type

The interactive gaming segment of the edutainment market is the largest, capturing around 39% of revenue in 2023. This dominance reflects the growing appeal of immersive learning experiences that blend education with entertainment. Interactive games, driven by gamification, augmented reality (AR), and virtual reality (VR), engage learners in a hands-on, enjoyable way, promoting deeper knowledge retention and skill development. These games offer personalized learning paths, allowing users to explore subjects actively and at their own pace. As a result, the interactive gaming segment is particularly popular among younger audiences, schools, and educational institutions, fostering both engagement and cognitive development in an increasingly digital learning environment.

By Facility Size

In 2023, the facility size segment of 5,001 to 10,000 square feet dominated the edutainment market, accounting for approximately 40% of the revenue share. This range is ideal for balancing space efficiency with the ability to accommodate interactive learning experiences and engaging activities, making it particularly suitable for edutainment centers, gaming zones, and educational venues. Such spaces provide enough room for diverse activities, including VR/AR simulations, interactive exhibits, and games, all while maintaining an optimal customer experience. The popularity of mid-sized facilities reflects the increasing demand for versatile environments that can support both educational and entertainment content in a dynamic and engaging way.

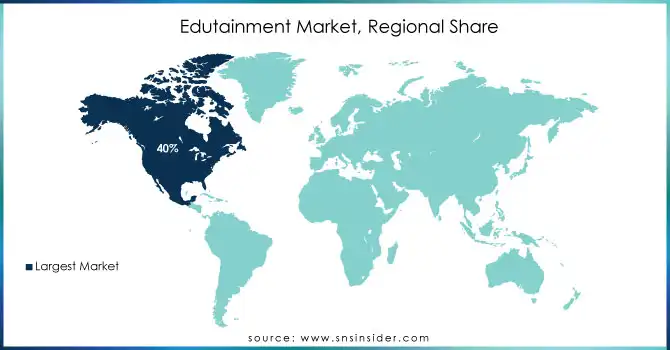

Edutainment Market Regional Overview

North America holds a dominant share of around 40% of the global edutainment market in 2023 due to a combination of factors such as technological advancements, high digital penetration, and innovation in educational content delivery. The United States, in particular, is a leader in integrating technologies like gamification, augmented reality (AR), and virtual reality (VR) into learning platforms, making education more interactive and engaging. The region benefits from substantial investments in edutainment startups, a favorable regulatory environment, and extensive infrastructure for digital education. Additionally, the rise of online learning platforms, such as Coursera, Duolingo, and Khan Academy, further propels this market growth. These platforms offer not just educational content but immersive and gamified experiences, which appeal to both young learners and adults. The widespread use of mobile devices and access to high-speed internet also ensures that interactive learning experiences are easily accessible, making North America a key region for the edutainment market’s success.

Asia-Pacific emerged as the fastest-growing region in the edutainment market in 2023, driven by rising technological adoption, increasing disposable incomes, and a growing focus on digital education. Countries like China, India, and Japan are spearheading this growth due to significant investments in digital infrastructure and educational reforms. China is leading with advancements in AR/VR-based learning and government-backed online education initiatives. India is witnessing a surge in edtech startups offering gamified learning experiences to its massive student population. Japan emphasizes robotics and AI integration in educational systems, promoting interactive and immersive learning environments. This rapid development is fueled by increasing internet penetration, the widespread use of smartphones, and government initiatives aimed at enhancing digital literacy and education access. Combined, these factors position Asia-Pacific as a dynamic and evolving market for edutainment, with immense potential for further growth.

Do You Need any Customization Research on Edutainment Market - Enquire Now

Key Players in Edutainment Market

Some of the major key players in Edutainment Market with their product:

-

LeapFrog Enterprises, Inc. (LeapPad Academy, LeapStart)

-

Disney Interactive (Disney Infinity, Club Penguin)

-

Nickelodeon (ViacomCBS) (Nick Jr. App, Moose A. Moose)

-

VTech Communications, Inc. (VTech Learning Tablet, VTech Kidizoom Camera)

-

Osmo (By Tangible Play, Inc.) (Osmo Genius Kit, Osmo Monster)

-

Samsung Electronics (Samsung Smart School, Samsung Gear VR)

-

Mattel, Inc. (Fisher-Price Smart Toy, Barbie Learn & Play)

-

Kahoot! (Kahoot! Game-based Learning Platform, Kahoot! Academy)

-

Pixar Animation Studios (Pixar in a Box)

-

Razor USA LLC (Razor A Kick Scooter)

-

CuriosityStream (CuriosityStream Subscription Service)

-

Duolingo (Duolingo Language Learning App)

-

Code.org (Hour of Code, CS Fundamentals)

-

Wondershare Technology (FamiSafe)

-

Houghton Mifflin Harcourt (EdTech Solutions, K-12 Learning Platforms)

-

National Geographic Kids (National Geographic Kids App)

-

TinkerPlay (by TinkRworks) (TinkerPlay App)

-

Minecraft (by Mojang Studios) (Minecraft Education Edition)

-

Funbrain (Funbrain Interactive Games)

-

Skillshare (Skillshare Online Learning Platform)

-

Kidzania (Kidzania Interactive Learning Centers)

-

Legoland Discovery Center (LEGO-based Interactive Learning Centers)

-

Kindercity (Kindercity Play and Learn Centers)

-

Plabo (Plabo Interactive Learning Playgrounds)

-

Pororo Park (Pororo Park Interactive Entertainment Centers)

-

Curiocity (Curiocity Interactive Science Centers)

-

Totter’s Otterville (Totter’s Otterville Interactive Play Zones)

-

Mattel Play Town (Mattel Play Town Interactive Learning Centers)

-

Little Explorers (Little Explorers Play Zones)

-

Kidz Holding S.A.L (Kidz Holding Interactive Learning Experiences)

List of potential customer companies for the edutainment market, including organizations that could use edutainment products or services in various sectors such as education, technology, entertainment:

Schools and Educational Institutions

-

K-12 Schools

-

Universities and Colleges

-

International Schools

-

Online Education Platforms

Children’s Museums

-

The Children's Museum of Indianapolis

-

Boston Children's Museum

-

The National Children's Museum (Washington D.C.)

Entertainment and Leisure Companies

-

The Walt Disney Company

-

Universal Studios

-

SeaWorld Entertainment

-

Merlin Entertainments Group (Operators of LEGOLAND)

Technology Companies

-

Apple Inc.

-

Google (especially for educational platforms like Google Classroom)

-

Microsoft (Minecraft Education Edition)

-

Samsung Electronics

-

Sony Interactive Entertainment

Gaming Companies

-

Nintendo

-

Activision Blizzard

-

Epic Games

-

Ubisoft

Learning and Development Providers

-

Pearson Education

-

Kaplan, Inc.

-

Scholastic Corporation

-

Houghton Mifflin Harcourt

EdTech Startups

-

Duolingo

-

Kahoot!

-

Quizlet

-

Tinkercad (by Autodesk)

-

Codeacademy

Non-profit Organizations and Foundations

-

Bill & Melinda Gates Foundation (funding educational initiatives)

-

Khan Academy

-

UNESCO (United Nations Educational, Scientific and Cultural Organization)

Government Agencies

-

U.S. Department of Education

-

Department of Culture, Media and Sport (UK)

-

Ministry of Education (Various countries)

Healthcare and Medical Institutions

-

Children's hospitals using therapeutic games for recovery

-

Health-focused educational programs for children

Recent Development

-

June 5, 2024 Samsung Electronics America has expanded its MICRO LED portfolio with the introduction of the MS1B (89” and 101” class) and MS1C (114” class) display options. These new screens offer cutting-edge display technology with enhanced depth, color, and brightness, providing a luxury home theater experience.

-

April 2, 2024 Disney continues to lead in edutainment with its integration of valuable life lessons in animated films, such as "The Lion King" and "Moana." The company seamlessly blends education and entertainment, offering both entertaining content and meaningful moral teachings for audiences of all ages.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD2.06 Billion |

| Market Size by 2032 | USD 7.74 Billion |

| CAGR | CAGR of 16.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Gaming Type(Interactive, Non-interactive, Explorative, Hybrid Combination) • By Facility Size(5,001 to 10,000 Sq. Ft., 10,001 to 20,000 Sq. Ft., 20,001 to 40,000 Sq. Ft., >40,000 Sq. Ft.) • By Revenue Source(Entry fees & tickets, Food & Beverages, Merchandising, Advertising, Others) • By Visitor Demographics( Children (0 to 12), Teenager (13 to 18), Young Adult (19 to 25), Adult (25+)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | LeapFrog Enterprises, Inc., Disney Interactive, Nickelodeon (ViacomCBS), VTech Communications, Inc., Osmo (By Tangible Play, Inc.), Samsung Electronics, Mattel, Inc., Kahoot!, Pixar Animation Studios, Razor USA LLC, CuriosityStream, Duolingo, Code.org, Wondershare Technology, Houghton Mifflin Harcourt, National Geographic Kids, TinkerPlay (by TinkRworks), Minecraft (by Mojang Studios), Funbrain, Skillshare, Kidzania, Legoland Discovery Center, Kindercity, Plabo, Pororo Park, Curiocity, Totter’s Otterville, Mattel Play Town, Little Explorers, and Kidz Holding S.A.L. are key players in the edutainment market. |

| Key Drivers | • Digital Learning Platforms as a Driving Force Behind Edutainment Market Expansion |

| Restraints | • Overcoming Content Saturation and Navigating Challenges in the Edutainment Market |