Data Brokers Market Report Scope & Overview:

To Get More Information on Data Brokers Market - Request Sample Report

The Data Brokers Market Size was valued at USD 257.2 Billion in 2023. It is expected to grow to USD 441.4 Billion by 2032 and grow at a CAGR of 7.4% over the forecast period of 2024-2032.

The swift evolution of digitalization has reshaped the functioning of businesses and public services, and consequently, the enormous amount of data they produce and work with. The transition is being fueled by technologies such as cloud computing, IoT, artificial intelligence, and mobile apps that continuously create, acquire, and process data. The proliferation of data is further amplified by government efforts to digitize public services for instance, through e-governance platforms and smart city projects. Data brokers are a key piece to this puzzle, aggregating raw data blocks from outlets like social media, e-commerce, mobile apps, and public records, before refining them into digestible, actionable insights. Those insights are then sold to companies and industries to help them program their operations, target their customers better, and engineer new products.

The growth in the areas of marketing and advertising driven by the advent of more targeted and personalized advertising has led to an exponential increase in demand for more granular consumer insights. Marketers are looking for personalized marketing strategies to drive higher customer engagement and achieve maximum ROI.

In the U.S., consumer insights are also supported by regulatory measures aimed at ensuring data security and ethical usage. For example, compliance with rules like GDPR in Europe and equivalent frameworks in the U.S. mandates stringent data management, encouraging firms to refine their analytics capabilities.

The rapid proliferation of Internet of Things (IoT) devices is leading to an overwhelming increase of data from these connected devices systems constantly producing enormous volumes of real-time data. IoT devices offer valuable user behavioral, environmental, and operational data from smart home devices, wearable health trackers, industrial sensors, and smart city infrastructures. This data is subsequently aggregated by data brokers, and retooled into actionable insights which are sold to healthcare to monitor patients, smart cities to improve city design, and in industrial automation to optimize processes. This kind of demand generation for data brokerage services.

In 2024, Google Expanded its programmatic advertising suite to include advanced AI-driven targeting tools for enhanced campaign precision.

Data Brokers Market Dynamics

Drivers

-

There has been a noticeable rise in the need for effective data monetization and storage solutions.

-

Increasing demand for various data-based information regarding consumers and others drives the market growth.

One of the main drivers of the growth of the data brokers market is the increasing need for data-oriented insights, especially opted on consumer behavior, preferences, and market trends. With enterprises in verticals like retail, healthcare and finance looking to enhance their marketing campaigns, customer engagement and operational efficiency, this has led to the desire for accurate and actionable data. Data brokers are a third-party participant who aggregate, analyze, and offer access to enormous data sets captured from online transactions, social media, demographics, and other sources. By having this data, businesses can tailor extremely targeted and personalized campaigns that drive ROI, increase sales and professionalism, and foster loyalty. In addition, the growth of both digital platforms and programmatic advertising has made data brokers even more to go-to source for insights in the moment. Also, as regulation shifts around data privacy, organizations are relying on data brokers to comply with regulations without sacrificing opportunities to use consumer data. The coupled increasing demand for comprehensive and actionable data to make better business decisions continues to drive the market as an increasing number of organizations realize that making data-driven decisions gives them a competitive advantage.

According to the U.S. Bureau of Economic Analysis, businesses across industries are investing more in data-driven decision-making, acknowledging that data-driven strategies can boost productivity by up to 5%.

Restraint

Violation of privacy is a significant obstacle to market growth.

Data brokers acquire, process, and exchange data about individuals without their explicit consent or knowledge. This lack of awareness makes it challenging for consumers to fully understand the extent of their data-sharing agreements. Often, data-sharing consent is sneakily added, leaving users unaware of the implications. Unexpected data transfers can occur due to industry practices. For instance, a user may unknowingly consent to submit personal data to a company, only to find out years later that the data now belongs to a different company with entirely different practices. Data brokers often defend their actions by highlighting the anonymity of the data they collect and sell. However, numerous instances have proven that anonymous data can be easily de-anonymized by cross-referencing various data sets.

Opportunities

-

The increasing adoption of alternative data in the investment industry is expected to create significant opportunities for the data broker’s market.

-

The increasing adoption of the Internet of Things (IoT) in various industries and the rising number of interconnected devices worldwide are notable trends.

Data Brokers Market Segmentation Analysis

By Data Type

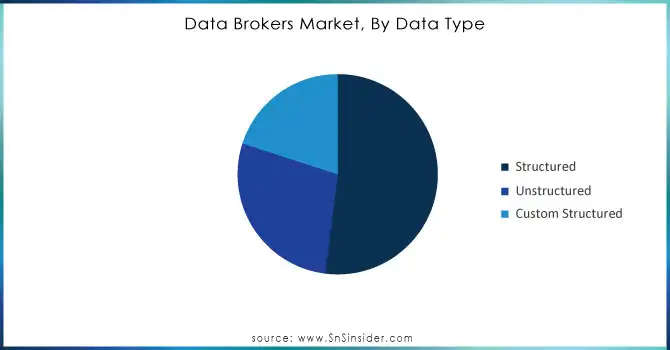

Structured data held the largest market share around 52% in 2023. It is due to its high efficiency in processing and analysis. It is organized in predefined formats, such as tables or spreadsheets, which makes it easy to manage, query, and analyze with traditional tools. This organization allows for quick retrieval of information, enhancing decision-making processes in industries like finance, retail, and healthcare. Structured data's widespread use across businesses, coupled with its compatibility with advanced data analytics tools, solidifies its position as the dominant form in the data market.

Do You Need any Customization Research on Data Brokers Market - Enquire Now

By Pricing Model

The Subscription Paid model held the largest market share around 48% in 2023. This is due to its predictability and long-term revenue generation. This model offers businesses a consistent income stream, making it attractive for service providers in industries such as software, media, and entertainment. With customers paying a fixed fee regularly, companies can forecast revenue and plan expansions. The success of popular platforms like Netflix and Spotify, which thrive on subscription models, further validates its dominance, especially as consumers increasingly prefer predictable and ongoing access to services.

By End-User

BFSI (Banking, Financial Services, and Insurance) sector accounted for the largest market share around 32% in 2023. This is owing to its huge data utilization for customer segmentation, risk analysis, and fraud detection. The ongoing trend of moving towards online banking and customized financial products has, thus driven the demand for advanced data services within this industry. Increasing emphasis on data-based decisions to enhance customer experience and operational efficiency implies this dominance. BFSI companies largely rely on data brokers for actionable intelligence with the help of digital transformation demand for financial technologies and customer insights.

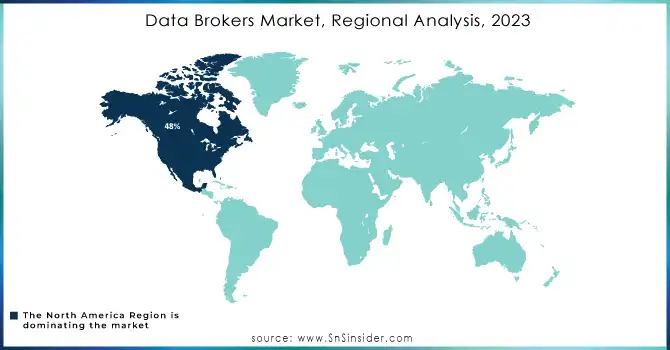

Data Brokers Market Regional Overview

North America region held the largest market share around 48% in 2023. This is owing to the wing to various reasons such as high industrial activity, the presence of advanced technology and strong regulations. Fluoropolymer tubing is widely used in various industries like pharmaceutical, aerospace and chemical since they require high-performance materials, which makes the U.S., being home to such industries, a major market for fluoropolymer tubing. In 2023, the U.S. Bureau of Economic Analysis showed the manufacturing sector of the GDP valued at USD 2.4 trillion and is expected to drive the demand for advanced materials in industrial processes. Further, tight safety and quality regulations in North America increase the consumption of fluoropolymer tubing, which is durable in harsh environments and resistant to various chemicals, for critical applications. The increasing trend of innovation through industries like healthcare and automotive can equally drive the region towards market dominance.

Key Players in Data Brokers Market

-

Oracle (Oracle Data Cloud, Oracle Big Data Appliance)

-

Thomson Reuters (Eikon, DataScope)

-

Equifax, Inc. (Equifax Workforce Solutions, Credit Report Services)

-

CoreLogic (Property Data, Flood Risk Services)

-

TransUnion LLC (CreditVision, TrueRisk)

-

ID Analytics, LLC (ID Network, ID Score)

-

Acxiom LLC (Acxiom Data Solutions, Audience Solutions)

-

IBM (IBM Watson, IBM Cloud Pak for Data)

-

Ignite Technologies (Ignite CRM, Ignite ERP)

-

Epsilon Data Management, LLC (Epsilon Email, Epsilon Data Solutions)

-

Alibaba (Alibaba Cloud, Alipay)

-

TowerData Inc. (Email Validation, Data Enrichment)

-

Intelius, Inc. (People Search, Background Check)

-

Experian (Experian Credit Report, Business Credit Services)

-

LexisNexis (LexisNexis Risk Solutions, LexisNexis Data Exchange)

-

SAP (SAP Analytics Cloud, SAP Data Hub)

-

Nielsen (Nielsen Media Impact, Nielsen Digital Ad Ratings)

-

Fair Isaac Corporation (FICO) (FICO Score, FICO Analytics)

-

Microsoft (Azure Data Services, Power BI)

Recent Development:

-

In 2024, TransUnion LLC Launched a new AI-powered platform, TruValidate, to enhance fraud prevention and identity verification, providing businesses with advanced data insights for more accurate risk assessment.

-

In 2023, IBM launched “IBM Watson Marketing Insights,” a platform that leverages AI to analyze consumer data and provide actionable insights, enhancing targeted marketing strategies for clients.

-

In 2023, Oracle integrated advanced machine learning algorithms into its Oracle Data Cloud to offer businesses deeper consumer insights and improve data-driven decision-making processes.

| Report Attributes | Details |

| Market Size in 2023 | US$ 257.2 Billion |

| Market Size by 2032 | US$ 441.4 Billion |

| CAGR | CAGR of 7.4% From 2023 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Data Type (Structured, Unstructured, Custom Structured) • By Pricing Model (Subscription Paid, Pay Per Use Paid, Hybrid Paid Models) • By Customer Category (Consumers, Businesses) • By End-User (Government, Manufacturing, BFSI, Healthcare, FMCG) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Oracle, Thomson Reuters, Equifax, Inc., CoreLogic, TransUnion LLC, ID Analytics, LLC, Acxiom LLC, IBM, Ignite Technologies, Epsilon Data Management, LLC, Alibaba, TowerData Inc., Intelius, Inc. |

| Key Drivers | • There has been a noticeable rise in the need for effective data monetization and storage solutions. • Increasing demand for various data-based information regarding consumers and others. • New technologies and business models, such as social media and mobile applications, have revolutionized the accessibility, variety, and sheer volume of information available to us. |

| Market Restraints | • Violation of privacy is a significant obstacle to market growth. |