Privacy Enhancing Technology Market Report Scope & Overview:

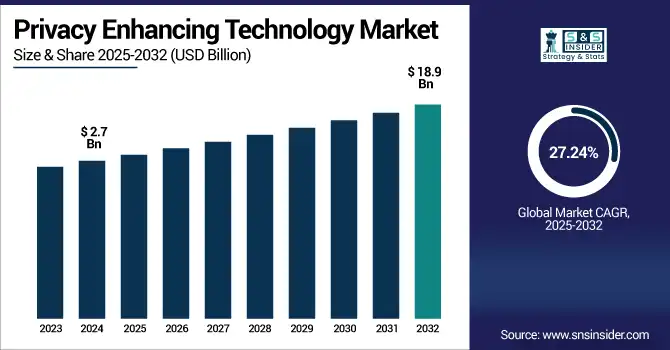

The Privacy Enhancing Technology Market size was valued at USD 2.7 billion in 2024 and is expected to reach USD 18.9 billion by 2032, growing at a CAGR of 27.24% during 2025-2032.

To Get more information on Privacy Enhancing Technology Market - Request Free Sample Report

Privacy Enhancing Technology Market growth is driven by a surge in data privacy concerns, a rise in stringent regulatory requirements, and an increase in adoption of digital transformation forms across sectors. Organizations have huge spends on devices that protect critical data but allow for data to be used for analysis and business intelligence. BEC and growing cyber threats, expanding use of cloud computing, and a higher need for compliance with data protection regulations such as GDPR, CCPA, and HIPAA are key growth factors. The increasing number of connected devices and the emergence of data-centric business approaches are also contributing to the growth of the market. In the future, with the development of cryptographic methods and data anonymization, and secure multi-party computation, the market could experience strong growth.

The US Privacy Enhancing Technology Market growth factors as increased data privacy regulations, increasing cyber threats, and widespread cloud adoption. Valued at approximately USD 0.8 billion in 2024, the market is projected to reach USD 5.4 billion by 2032, growing at a CAGR of around 26.9%. The privacy enhancing technology market trend focuses on advanced cryptographic solutions and growing demand across BFSI, healthcare, and IT sectors.

Market Dynamics:

Drivers:

-

Stringent Data Privacy Regulations Cause Increased Adoption of Privacy Enhancing Technologies

The high proliferation of stringent data privacy regulations across the globe, like the GDPR in Europe, CCPA in the US, and HIPAA in Healthcare, is a key driving factor for the growth of the Privacy Enhancing Technology Market. Organizations need to use technologies that protect sensitive data and comply with regulations to avoid heavy fines and loss of reputation. To protect user data, privacy-enhancing technologies such as anonymization, encryption, and secure multiparty computation allow companies to share and analyze individual data without requiring the exposure of personally identifiable information. As the impact of regulatory pressure falls on all industries, such as BFSI, healthcare, and IT, their investment in PET solutions is devoted to the considerable expansion of the market.

For instance, according to a 2024 report, 85% of organizations in North America and Europe have intensified their investments in privacy-enhancing technologies to comply with evolving data privacy laws such as GDPR and CCPA.

Restraints:

-

High Implementation Costs and Technical Complexity Cause Slow Adoption Among SMEs

While Privacy Enhancing Technologies have a lot to offer in terms of market growth, their implementation processes and worth can be complicated and expensive, restricting the market capacity. PET solutions tend to be on the higher end, and smaller enterprises (or startups) often find themselves with a tighter budget. Furthermore, incorporating these technologies with the current IT infrastructure requires unique knowledge that the organization does not possess. This makes adoption difficult as deploying cryptography is complex, and maintaining the performance of the system without sacrificing usability further creates challenges. Such economic and technical hurdles may delay mass adoption, especially in lower-capital-level or IT-immature places or industries.

Opportunities:

-

Rising Cloud Computing and Big Data Use Cause Greater Demand for Advanced Privacy Solutions

With the rise of cloud computing and big data analytics, the cloud computing market is an ultra-giant opportunity platform for the Privacy Enhancing Technology Market. Organizations today are required to not just collect but analyze their sensitive data in large volumes and read analytically in cloud environments demand mitigation for problems that counter these needs, i.e. PETs are designed for privacy and solidarity, allowing for secure data processing and data sharing in decentralized and multi-party settings, enabling companies to utilize enterprise data-driven insights without breaching privacy legislations across fractions of the world. Warmer climate, and as more AI and ML models are trained, this creates overhead and demand for PETs to protect training data and IP. Such a growing ecosystem will provide significant room for the growth of new innovative privacy-enhancing solutions.

In 2024, global spending on cloud security is projected to reach $32.03 million, indicating a significant investment in securing cloud environments.

Challenges:

Lack Of Standardization and Awareness Causes Hesitation in Widespread Deployment of PETs

The absence of any universal standards and rise of end users and businesses with low knowledge about privacy enhancing technology acts as one of the key hurdles for the privacy-enhancing technology Market. That makes it difficult for organisations to assess, adopt, and implement PETs with confidence when there are no widely accepted frameworks or benchmarks in place. Also, a lack of familiarity with the full potential of what these technologies can bring to organisations leaves many enterprises enamoured by the prospect of new horizons, but hesitant to fully approach their shores — or worse, entirely unwilling to depart from the established course. This knowledge gap makes decision-making hard and slows down adoption, especially as privacy needs and technologies evolve rapidly. This obstacle can be mitigated through a combination of increased education, awareness campaigns, and standardization efforts, all of which will be necessary for market growth.

Segmentation Analysis:

By Component:

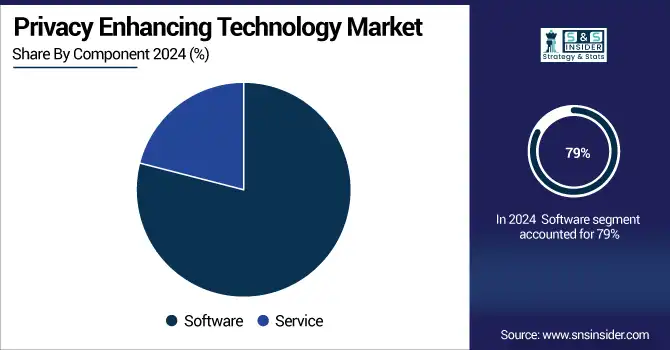

The Software segment dominated the market in 2024 and accounted for 79% of privacy-enhancing technology market share, owing to growing demand for integrated advanced cryptographic tools, data anonymization, and secure multiparty computation directly within an application. Factors such as rising digital transformation, regulatory compliance requirements, and companies seeking scalable, automated privacy solutions are behind the growth. We expect this segment to continue in the lead with solutions that will improve data security and privacy in different industrial sectors. The software market will grow steadily, propelled by BFSI, the health sector, and the IT market.

The Service segment is projected to register the fastest CAGR, due to increasing consulting, integration, and managed privacy services. Organizations are beginning to need a greater extension of expertise due to the complexities of deploying PETs, the necessity of compliance audits, and the need for ongoing management of data protection expertise. Growing cloud adoption coupled with increasing changes in privacy legislation necessitate professional services. The growth of this segment is driven by SMEs and enterprises seeking bespoke and affordable privacy solutions, coupled with expert guidance.

By Type:

The Cryptographic Technique segment dominated the privacy-enhancing technology market in 2024 and accounted for 46% of revenue share due to the vital necessity of wanting to use the privacy-enhancing technology market for encrypting data, computational multiparty secure, and zero-knowledge puzzles. Rising cyber threats and stringent regulatory mandates are compelling enterprises to implement robust cryptographic solutions to secure their sensitive data. The BFSI, healthcare, and IT sectors, where data confidentiality and secure transactions are the norms, will continue to grow steadily.

The Anonymization Technique segment is projected to register the fastest CAGR, due to the growing need to share and analyze data while remaining anonymous when it comes to personal information. Anonymization is driven by regulatory requirements (e.g., GDPR, CCPA) that balance privacy against data utility. The increased dependence and use of big data and AI in nearly every enterprise, especially in healthcare and marketing, drives the need for robust anonymization solutions.

By Application:

The Compliance Management segment dominated the privacy-enhancing technology market in 2024 and accounted for a significant revenue share, driving regulatory requirements such as GDPR, CCPA, and HIPAA, driving organizations to find and implement PETs that will allow automation of data privacy and compliance tracking. Tools that streamline compliance workflows while lowering legal risks have become a priority for enterprises. Businesses in sectors with changing regulations must treat compliance as a continuous investment and not a one-time cost, hence, the segment will remain growing with emphasis on BFSI, healthcare, and IT sectors, to comply with the regulations set out to avert penalties.

The Reporting and Analytics segment is expected to register the fastest CAGR, as demand grows for actionable insights with sensitive data without compromising privacy. These technologies allow data analysis and visualization while keeping personal data hidden. The increasing adoption of AI, big data, and real-time analytics in industries such as marketing, healthcare, and finance drives the rapid growth of privacy-preserving analysis solutions.

By End-User:

The BFSI segment dominated the privacy-enhancing technology market in 2024 and accounted for a significant revenue share, as data in this sector is highly sensitive in nature and the sector requires a higher level against the increasing level of cyber threats, along with stringent regulatory compliance like PCI DSS and GDPR. Banking, insurance, and financial institutions make high purchases of PETs to safeguard transaction and customer data. Continued market driving growth will be delivered through the expansion of digital banking and related banking fraud prevention needs, making this segment the largest.

The Healthcare segment is expected to register the fastest CAGR, owing to the increased need to secure patient records according to regulations such as HIPAA and GDPR. With the increasing adoption of electronic health records, telemedicine, and AI-driven diagnostics, healthcare data privacy is becoming more significant and consumer demand for privacy-enhancing technologies is driving this segment. The rapid growth of this segment can be attributed to the growing emphasis on data security and confidentiality in healthcare research and patient care.

Regional Analysis:

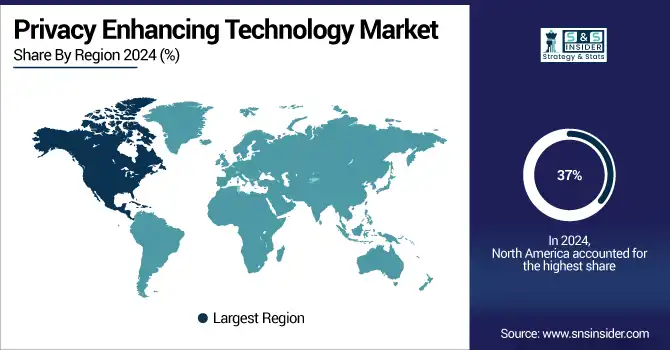

North America dominated the privacy enhancing technology market in 2024 and accounted for 37% of revenue share, aided by location of leading PET solution providers and considerable R&D investments. The region will maintain growth, as evermore regularity updates and the rising attention of enterprises towards data protection and privacy.

According to a privacy enhancing technology market analysis, Asia-Pacific is expected to register the fastest CAGR, owing to rapid digital transformation across enterprises, rising cloud adoption, and growing data privacy regulations in India, Japan, Australia, and other developing countries. The increasing awareness towards data protection, in addition to the rising IT infrastructure, also triggers the demand for PET. As governments and businesses become more focused on protecting sensitive information, the market in the region will grow rapidly for privacy-enhancing technologies.

Europe’s growth is driven by regulations such as GDPR, increasing cyber threats, and growing adoption of privacy enhancing technologies in BFSI, healthcare and government sectors. As companies focus on protecting data, the market is expected to continue growing steadily with many enterprises keen on compliance parts for data privacy and extended security solution sets.

Germany leads Europe due Strong data protection legislation, a high level of digitalization, and massive investments in cybersecurity infrastructure. With Industry 4.0 and privacy regulations as the current trends, PET is proliferating in the counter and the market has enough capacity to expand continuously with rising demand in manufacturing and BFSI and health care industries.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major privacy enhancing technology market companies are Duality Technologies, Enveil, Cape Privacy, IBM Corporation, Microsoft Corporation, Google LLC, Amazon Web Services (AWS), Apple Inc., Privitar, Anonos, Inpher, Thales Group, Broadcom Inc. (Symantec), Palantir Technologies, TripleBlind, CryptoExperts, Cosmian, Decentriq, Zama, OpenMined and others.

Recent Developments:

-

In May 2025, Cape introduced a context-aware prompt perturbation mechanism with differential privacy to enhance privacy-utility trade-offs in large language models.

-

In April 2025, Apple began using synthetic data and differential privacy techniques to train AI models without compromising user privacy.

|

Report Attributes |

Details |

|

Market Size in 2024 |

US$ 2.7 Billion |

|

Market Size by 2032 |

US$ 18.9 Billion |

|

CAGR |

CAGR of 27.24% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Software, Service) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, ASEAN Countries, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar,Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America) |

|

Company Profiles |

Duality Technologies, Enveil, Cape Privacy, IBM Corporation, Microsoft Corporation, Google LLC, Amazon Web Services (AWS), Apple Inc., Privitar, Anonos, Inpher, Thales Group, Broadcom Inc. (Symantec), Palantir Technologies, TripleBlind, CryptoExperts, Cosmian, Decentriq, Zama, OpenMined and others in the report |