Location of Things Market Report Scope & Overview:

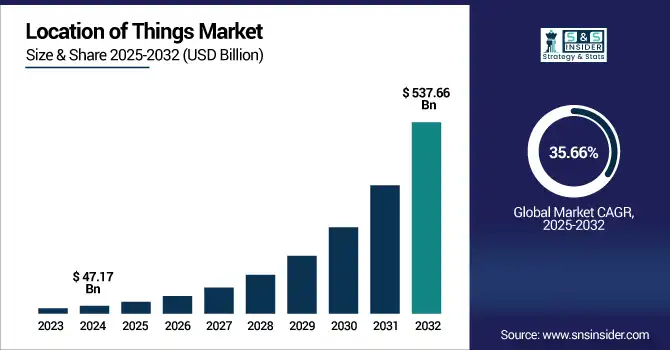

Location of Things Market was valued at USD 47.17 billion in 2024 and is expected to reach USD 537.66 billion by 2032, growing at a CAGR of 35.66% from 2025-2032.

To Get more information on Location of Things Market - Request Free Sample Report

The Location of Things market is growing rapidly due to increasing adoption of IoT-enabled devices, rising demand for real-time location data, advancements in GPS and connectivity technologies, and expanding applications across logistics, transportation, and smart cities. Enhanced decision-making and operational efficiency further drive market expansion globally.

Microsoft’s 2023 IoT Report reveals that over 80% of enterprises leverage location data to improve supply chain visibility and operational decision-making, with many reporting over a 20% reduction in logistics costs.

Additionally, the U.S. Department of Transportation has invested more than USD 1.3 billion in connected vehicle technology, focusing on real-time location and vehicle-to-everything (V2X) communication.

Leading logistics companies like UPS have deployed real-time tracking systems across over 50,000 GPS-enabled vehicles, optimizing route planning and delivery times through advanced location data analytics.

U.S. Location of Things Market was valued at USD 13.25 billion in 2024 and is expected to reach USD 148.90 billion by 2032, growing at a CAGR of 35.31% from 2025-2032.

The U.S. Location of Things market is expanding due to rising smart infrastructure projects, high IoT adoption, advanced connectivity, and growing demand for real-time tracking in transportation, retail, and logistics. Strong tech ecosystem and regulatory support further fuel growth.

The U.S. Smart Cities Initiative supports over 100 cities in deploying IoT and location-based technologies for better urban management, backed by over $160 million in federal grants.

In 2024, the U.S. Department of Transportation's Federal Highway Administration announced over $96 million in grants to 16 states for 20 projects under the Advanced Transportation Technology and Innovation (ATTAIN) program.

Market Dynamics

Drivers

-

Increased demand for advanced navigation and traffic management fuels precision mapping and spatial analytics capabilities.

The relentless surge in urbanization and city congestion creates a pressing need for intelligent navigation and traffic control. GPS-based route improvement and live traffic information is achievable through Location of Things technologies. This data helps smart city initiatives improve traffic flow, enhance emergency response, and aid urban planning activities. Accurate location data is crucial for autonomous vehicles and fleet management. The expansion of the location market worldwide is enabled through investments in connected infrastructure as well as real-time analytics.

The U.S. Department of Transportation's Strengthening Mobility and Revolutionizing Transportation (SMART) Grants program is set to provide up to USD 500 million over five years for smart community technologies and systems that improve transportation safety and efficiency.

The U.S. Department of Transportation has introduced the Rural Automated Vehicle (RAV) Research Program with a USD 25 million funding opportunity aimed at integrating automated vehicle technology into rural and Tribal communities to enhance safety.

Additionally, the Biden-Harris Administration announced over $96 million in grants to various states for deploying smart traffic technology, supporting projects such as integrating connected vehicle infrastructure and enhancing data collection systems to improve transportation safety and mobility.

Restraints

-

Data privacy concerns and regulatory uncertainties restrict the deployment of location-based services in consumer-focused applications.

The collection of location data is susceptible to privacy and control problems given that stricter data protection laws can lead to more stringent regulation. Users are getting aware that their data is tracked, and this makes them reluctant for location-based services. Regulatory requirements present compliance challenges and enhance liability risk for companies. Thus, many companies either take a conservative stance or refrain from some applications entirely, thereby impeding market development in privacy-conscious markets and the capabilities of location-based technologies in these contexts.

Opportunities

-

Integration of AI with geolocation data opens new frontiers in predictive analytics, automation, and customer personalization.

Integration of AI with geolocation data has transformed the spatial analysis and movement prediction domain. This allows for process delivery with real time insights, predictive modeling and automation. Retailers have hyper-personalized deals that are based on movement and logistics firms predict whether delivery will be delayed by examining real-time data and using AI-driven routing. By doing so, it extends Location of Things into strategic planning, marketing, and autonomous systems. The adoption of AI at an increasing rate is enabling new path-breaking data-driven services and therefore result in a major new opportunity by boosting the market for organizations that can utilize these technologies.

Tesla plans to launch its robotaxi service in Austin in June 2025, starting with a limited pilot rollout of about 10 autonomous Model Y vehicles. The company aims to scale the program to 1,000 robotaxis within a few months, utilizing a fleet of self-driving Teslas nationwide. T

he U.S. Department of Defense (DoD) and the U.S. Air Force (USAF) have issued a Small Business Innovation Research (SBIR) topic for 2025, focusing on the development of secure geolocation relay and analytics services.

Meanwhile, the General Services Administration (GSA) has developed the AI Guide for Government to assist federal agencies in understanding and implementing AI technologies. This guide provides insights into AI applications, including predictive analytics and geolocation data integration.

Challenges

-

Inconsistent location accuracy in dense urban and indoor environments affects reliability of real-time decision-making systems.

GPS signals are blocked inside buildings and dense urban settings, making locating people in an emergency, navigating indoors or tracking assets very challenging. There are alternatives, including Wi-Fi triangulation and BLE beacons, but these are costly and complicated for deployment. In critical sectors, inconsistent accuracy undermines user trust and reliability. These technical limitations need to be overcome for the full potential of the Location of Things market to be realized and for these applications to scale properly.

Segment Analysis

By Location Type

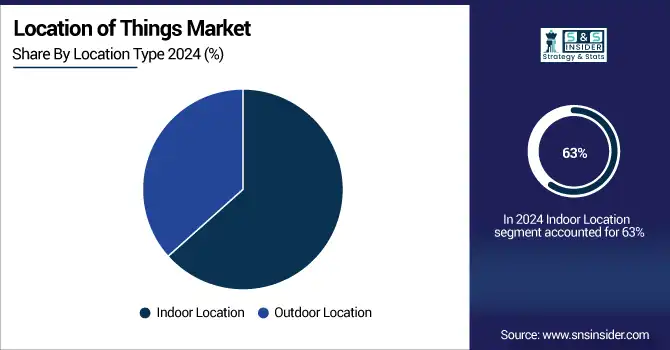

Indoor Location segment dominated the Location of Things Market with the highest revenue share of about 63% in 2024 as it is extensively used in commercial buildings, airports, shopping malls and healthcare facilities. Companies utilize indoor location services for tracking assets, crowd analytics, navigation, and personal services. With the highest demand due to the need for real-time indoor positioning & operational efficiency, which is increasing in various domains.

Outdoor Location segment is expected to grow at the fastest CAGR of about 36.99% from 2025–2032 due to rising usage & benefits of location-based services in agriculture, autonomous vehicles, environmental monitoring, and logistics. More precise location and better coverage Satellite technologies are getting more precise and the emergence of the 5G network is improving location accuracy and coverage. This segment is quickly growing at the highest growth rate due to the rapid expansion of smart cities and outdoor safety applications additionally the high demand for location-aware mobility services.

By Location Type

Government, Defence, and Public Utilities segment dominated the Location of Things Market with the highest revenue share of about 25.30% in 2024 as governments and enterprises alike invested heavily in infrastructure modernization, public security, and emergency response systems. In these sectors, geolocation is employed for monitoring, disaster management and resource distribution. Proper mission-critical real-time data has made Government and defense entities, the largest early adopter of secure and scalable location intelligence platforms.

Transportation and Logistics segment is expected to grow at the fastest CAGR of about 37.49% from 2025–2032 due to the rapid adoption of applications such as Fleet Management, Route Optimization, and Supply Chain Visibility. Delivery, fuel cost, and autonomous mobility operations all benefit from location data. A further driver for the adoption of real time tracking solutions across urban and long-haul transportation networks is the growth of e-commerce and cross-border trade.

By Application

Mapping and Navigation segment dominated the Location of Things Market with the highest revenue share of about 28% in 2024 due to its role as a fundamental aspect of the location-based application. It backs everything from consumer apps to enterprise logistics and autonomous systems. This segment has taken the lead in making location intelligence and spatial decision-making possible, thanks to high dependence on GPS data, mapping platforms, and real-time route guidance over various industries.

Media and Marketing Engagement segment is expected to grow at the fastest CAGR of about 37.36% from 2025–2032 due to rising demand for hyper-personalized, location-targeted campaigns. Contextual content delivery, ad placement optimization and consumer engagement all get a real-time boost from geolocation, as businesses are taking advantage of this. The segment is set to explode with adoption, as the business of those business is increasingly data-driven, the mainstream embrace of location-driven analytics in retail, events, and digital media.

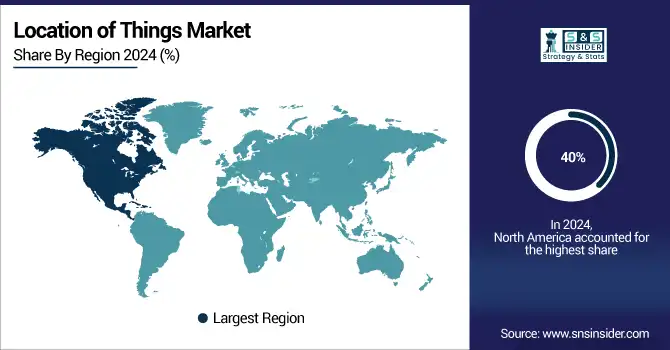

Regional Analysis

North America dominated the Location of Things Market with the highest revenue share of about 40% in 2024 due to higher productivity of IoT technology implementation, more lucrative digital infrastructure and a wide variety of leading companies. That encourages constant demand backed by its widespread deployment in smart cities, defense, logistics, and retail sectors. The region has been strengthened by supportive regulatory frameworks and high investment in R&D, which led to early and widespread adoption of location-based technologies.

The U.S. dominated the Location of Things Market due to robust IoT infrastructure, strong tech ecosystem, and widespread adoption across transportation, defense, and retail sectors.

Asia Pacific is expected to grow at the fastest CAGR of about 38.07% from 2025–2032 driven by rapid urbanization, growing smart city projects, and higher mobile phone adoption. Connected infrastructure and real-time mobility solutions are a key focus area for governments in China, India, and Southeast Asia, who are investing heavily to catalyze the transformation in cities. With rapid regional growth in e-commerce, transportation, and manufacturing, the demand for location intelligence to optimize operational efficiency and customer experience is gaining traction.

China is dominating the Location of Things Market in Asia Pacific due to massive smart city initiatives, advanced manufacturing, and rapid expansion of connected infrastructure.

Europe is a significant player in the Location of Things Market due to strong government support for smart city projects, advanced transportation networks, and growing adoption of IoT technologies across logistics, public safety, and industrial automation sectors.

Germany is dominating the Location of Things Market in Europe due to strong industrial automation, advanced manufacturing, and high investment in smart infrastructure technologies.

Middle East & Africa are emerging in the Location of Things Market driven by smart city developments, infrastructure modernization, and increased investment in security and utilities. Latin America is growing due to rising urbanization, digital transformation, and expanding logistics networks.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

ESRI, Wireless Logic, HERE, TruePosition, Inc., Navizon, Inc., Bosch Software Innovations GMBH, Pitney Bowes, Inc., TIBCO Software, Trimble, Inc., Qualcomm Technologies, Inc., Ubisense Group PLC, Google, Inc., IBM Corporation, Microsoft Corporation, Telogis

Recent Developments:

-

In 2024, the release of ibi WebFOCUS Reporting Server 9.3.4 introduced enhancements to data management, visual discovery, and predictive analytics, empowering users to leverage data more effectively.

-

In June 2024, Esri rebranded its ArcGIS Platform to the ArcGIS Location Platform, introducing a dedicated site and dashboard. This update streamlines developer access to tools and services, enhancing user experience

-

In November 2024, Wireless Logic's Conexa eSIM was integrated into u-blox's LTE CAT 1 BIS modules, enhancing global IoT connectivity with multi-IMSI support and eUICC technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 47.17 Billion |

| Market Size by 2032 | USD 537.66 Billion |

| CAGR | CAGR of 35.66% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Location Type(Indoor Location, Outdoor Location) •By Application(Mapping and Navigation, Asset Management, Location Intelligence, Media and Marketing Engagement) •By Vertical(Government, Defence, and Public Utilities, Transportation and Logistics, Retail and Consumer Goods, Manufacturing and Industrial, Healthcare & Life Sciences, BFSI, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ESRI, Wireless Logic, HERE, TruePosition, Inc., Navizon, Inc., Bosch Software Innovations GMBH, Pitney Bowes, Inc., TIBCO Software, Trimble, Inc., Qualcomm Technologies, Inc., Ubisense Group PLC, Google, Inc., IBM Corporation, Microsoft Corporation, Telogis |