Low Noise Amplifier Market Size & Growth Analysis:

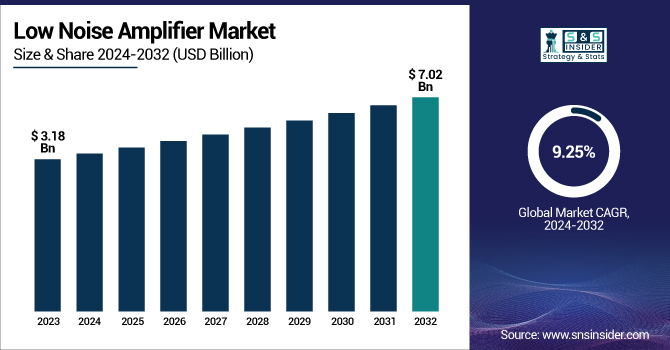

The Low Noise Amplifier Market was valued at USD 3.18 billion in 2023 and is expected to reach USD 7.02 billion by 2032, growing at a CAGR of 9.25% over the forecast period 2024-2032.

To Get more information on Low Noise Amplifier Market - Request Free Sample Report

Demand for low noise amplifiers (LNA) is expected to remain strong, as extensive production volumes are required to satisfy demand from emerging applications in 5G, satellite kilowatt, automotive radar, and defense applications. Frequency band trends towards mmWave and high-frequency LNAs (over 60 GHz) for enhanced communication. LNA fab capacity utilization continues to be high, particularly for SiGe and GaAs-based LNAs. Adoption through the development of 5G, Wi-Fi 6/7, V2X, and satellite communication protocols continues to catch on, supporting next-generation connectivity and rapid data transmission too.

The LNA market in the U.S. is poised to see major growth due to the speedy rollout of 5G, as well as the more sophisticated satellite communications. Telecom operators are upgrading the infrastructure to offer improved data rates with high signal quality catering to the independently growing demand for high-frequency LNA (6-60 GHz). Moreover, the growing demand for wireless applications, as well as the rapid growth of IoT devices and consumer electronics, continues to drive demand for LNAs to operate efficiently in various applications.

The U.S. Low Noise Amplifier Market is estimated to be USD 0.85 Billion in 2023 and is projected to grow at a CAGR of 9.06%. The U.S Low Noise Amplifier market is driven by the growing spending by military and aerospace sectors which are focused on radar, electronic warfare, and space communication systems. The increasing penetration of autonomous and assisted driving technologies is further propelling the LNA market.

Low Noise Amplifier Market Dynamics

Key Drivers:

-

Rising Demand for Low Noise Amplifiers Driven by 5G Satellite Communication Radar and Advanced Technologies

Evolving deployment of 5G, satellite communication, as well as radar systems, are the major reasons behind the speedily changing demand for low noise amplifiers (LNA). High-speed internet is on the rise along with IoT devices requiring advanced wireless communication technologies, which has increased the need for low noise amplifiers (LNAs) offering improved performance with low power. Moreover, the increased market growth of autonomous vehicles, military defense systems, and medical imaging applications is also expanding its global market. The transition to higher frequency (mmWave) bands for many telecom and aerospace applications is driving the need for high-performance GaAs and SiGe-based LNAs.

Restrain:

-

Overcoming High Frequency Challenges in Low Noise Amplifiers for 5G Satellite Communications and Radar Systems

The high-frequency technology difficulties facing LNA are one of its major challenges. Engineers are challenged with optimizing noise figure, linearity, and power efficiency of wide-band signal chains while maintaining signal fidelity, as demand for 5G mmwave, satellite communications, and advanced radar systems continue to increase. In the high-frequency region (≥60 GHz), the transition requires more advanced materials such as GaAs and SiGe, resulting in design and rapid production hurdles. Moreover, shrinking the size of low noise amplifiers (LNAs) tends to larger, multi-function RF modules suitable for the fast-growing Internet of Things (IoT) and telecom applications, which require more stringent integration, packaging, and engineering, both for technological challenges.

Opportunity:

-

Emerging Opportunities for Low Noise Amplifiers in IoT Smart Cities Satellite Services and 6G

AI-enabled RF designs, integration of LNAs in next-gen IoT sensors, and smart city rollout are some of the identified opportunities. With more investments in space exploration and satellite broadband services among new entrants such as SpaceX, OneWeb and Amazon’s Kuiper, an attractive market is opening up for high-frequency LNAs. Additionally, as RF components continue to shrink into smaller geometries and 6G becomes a reality, new revenue doors are sure to open. The increased adoption of consumer electronics, telecom, and automotive radar applications will positively impact the implementation of high-efficiency, ultra-low-noise amplifiers, benefitting the companies investing in these technologies over the forecast timeframe.

Challenges:

-

Challenges in Low Noise Amplifiers Due to Regulatory Tensions Thermal Management and Interference Issues

A key restraint is the increasing regulatory and standardization tension amid RF components. Wireless communication protocols are constantly evolving, leading to new compliance specifications that can change over regional markets. Such dense frequency bands make interference management a complex process, and this can be especially tricky for urban 5G deployment as well as military applications. Additionally, thermal management problems often arise in high-power RF amplifiers which can affect performance and stability, and/or lead to power reliable solutions, making the need for innovative cooling solutions. To help resolve these issues, continued investments in R&D, access to engineers and scientists, partnerships with semiconductor foundries, and telecom infrastructure providers focused on LNA solutions that need to be developed for next-generation systems will be needed.

Low Noise Amplifier Industry Segment Analysis

By Frequency

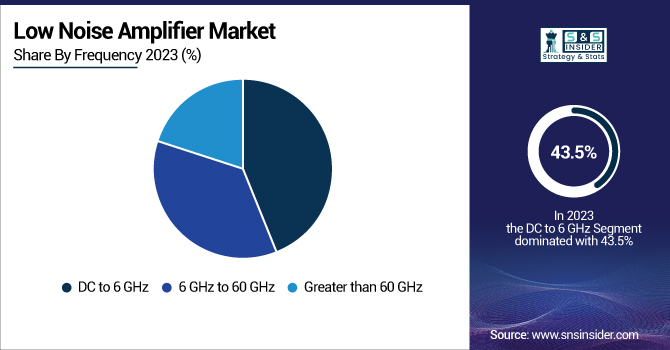

The segment of DC to 6 GHz held the largest share in 2023, capturing 43.5% of the overall Low Noise Amplifier (LNA) market. The dominance was ultimately influenced by the overuse of its application in consumer electronics, wireless communication, industrial automation, and medicine. The dominance of the segment is mainly due to the cost competitiveness, high integration capability, and ease of interface with diverse RF systems, thus having major adoption in Wi-Fi, Bluetooth, and sub-6 GHz 5G networks.

The Greater than 60 GHz segment is expected to witness the fastest CAGR from 2024-2032, owing to increased utilization of mmWave technology for communication in 5G, satellite communications, automotive radar, and military applications. High-frequency bands particularly over high-speed data transmission and advanced signal processing have driven requirements for GaAs- and GaN-based LNAs. This segment is poised for major growth due to 6G, space exploration, and next-gen wireless tech.

By Material

Silicon (Si) held the highest share of the low noise amplifier (LNA) market at 38.8% in 2023. This prevalence is mainly attributed to low-cost production, high scalability, and high compatibility with CMOS technology which makes it a favorable choice for consumer electronics, telecom, and industrial applications. Because of energy efficiency and mass production, silicon-based LNAs are favored for sub-6 GHz wireless communication, IoT devices, and RF front-end modules.

Silicon Germanium (SiGe) is expected to grow at the fastest CAGR from 2024-2032. The demand for SiGe is anticipated to increase with the rise of high-frequency applications such as 5G mmWave, autonomous automotive radar, and satellite communications. Compared to standard silicon, SiGe LNAs provide superior noise performance, greater speed, and enhanced thermal stability. SiGe based LNAs will continue to grow well into 6G research and beyond, especially as the industry shifts toward high-frequency bands and new wireless technologies, such as the multi-antenna architectures, high-order modulation types, and larger carriers that the new radio access technologies will demand in overhead measurement and equalization.

By Vertical

The LNA market was dominated by Consumer Electronics in 2023 accounting for about 37.4% of the whole market share. The widespread usage of smartphones, tablets, smart TVs, and wearables where LNA plays an important role in improving wireless connectivity and reception, drives this domination. This demand in consumer devices is further driven by the rising penetration of Wi-Fi 6, Bluetooth, and sub-6 GHz 5G networks, all of which are preferred to be silicon-based due to low cost and integration potential.

Between 2024-2032, the Telecom & Datacom segment is projected to achieve the highest CAGR, fueled by the rapid deployment of 5G infrastructure, fiber-optic telecommunications, and satellite internet. Factors such as increasing deployment of mmWave 5G and small cells along with the exploding need for next-gen telecom infrastructure with high linearity and low noise figures per transistor resulting in high-performance LNAs (Low Noise Amplifiers) are expected to further promote market expansion at the global level. Besides that, the segment will also get a boost from increasing investments in 6G research and cloud data centers.

Low Noise Amplifier Market Regional Insights

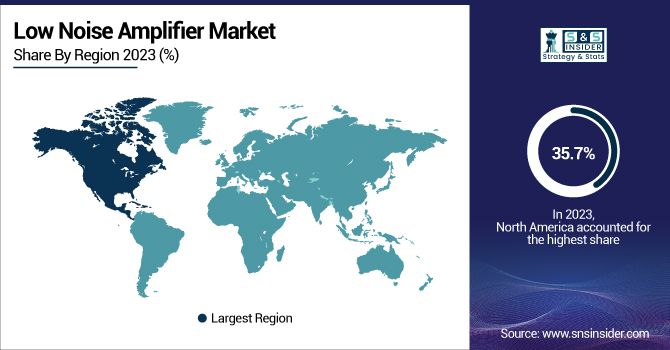

North America accounted for the highest 35.7% share of the Low Noise Amplifier (LNA) market in 2023, mainly due to the development of 5G infrastructure, aerospace, defense, and satellite communication. Moreover, strong innovation in high-performance LNA particularly by Qorvo, Skyworks Solutions, and Analog Devices is driving military radar, space exploration, and telecom applications. The steady growth of low-noise, high-frequency amplifiers thanks to the U.S. Department of Defense (DoD) and its continued investments in advanced radar systems and satellite-based communication. Furthermore, the rise in launching satellite broadband services by companies such as SpaceX, Project Kuiper of Amazon, etc., is expected to boost the demand for LNAs in satellite communication networks.

From 2024-2032, the fastest-growing region is the Asia Pacific, primarily due to the extensive rollout of 5G, expanding IoT, and new semiconductor manufacturing. Heavy investment in telecom infrastructure, automotive radar, and industrial automation in countries such as China, Japan, South Korea, and India is driving the demand for high-performance low-noise amplifiers (LNAs). Huawei of China and NTT Docomo of Japan are accelerating mmWave in 5G, while Samsung of South Korea is advancing 6G research. Besides this, the greater LNA production for consumer electronics and telecom applications at TSMC and other semiconductor foundries in Taiwan made Asia Pacific the highest-adopting local market for LNA.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in Low Noise Amplifier Market are:

-

NXP Semiconductors N.V. (BGA2869 LNA)

-

Analog Devices, Inc. (HMC519LC4 LNA)

-

Infineon Technologies AG (BFP640ESD LNA)

-

L3 Narda-Miteq (AMF-5B-08001200-15-10P LNA)

-

Qorvo, Inc. (QPL9057 LNA)

-

Skyworks Solutions, Inc. (SKY67151-396LF LNA)

-

ON Semiconductor Corp. (NCS199A1 LNA)

-

Panasonic Corp. (AN32100A LNA)

-

Texas Instruments Inc. (OPA657 LNA)

-

Teledyne Microwave Solutions (TMS-LNA-1000-2000-30-10P)

-

API Technologies Corp. (L1000-01 LNA)

-

AmpliTech Inc. (AMT-18302640-35-16P LNA)

-

B&Z Technologies LLC (BZ-LNA-1800-2500-25-10P)

-

Broadcom Ltd. (AFEM-S257 LNA)

-

Cree, Inc. (CG2H40010 LNA)

Recent Trends

-

In June 2024, Teledyne e2v HiRel launched the TDLNA0840SEP, an ultra-low power LNA (0.3 GHz to 4 GHz) for new space applications, featuring 27 mW power consumption and radiation tolerance up to 100 krad (Si).

-

In December 2024, AmpliTech Group introduced low-noise cryogenic HEMT amplifiers to enhance quantum computing performance at 4K temperatures, minimizing signal noise for improved accuracy.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.18 Billion |

| Market Size by 2032 | USD 7.02 Billion |

| CAGR | CAGR of 9.25% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Frequency (DC to 6 GHz, 6 GHz to 60 GHz, Greater than 60 GHz) • By Material (Silicon, Silicon Germanium, Gallium Arsenide, Others) • By Vertical (Consumer Electronics, Telecom & Datacom, Medical, Military & Space, Industrial, Automotive) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NXP Semiconductors, Analog Devices, Infineon Technologies, L3 Narda-Miteq, Qorvo, Skyworks Solutions, ON Semiconductor, Panasonic, Texas Instruments, Teledyne Microwave Solutions, API Technologies, AmpliTech, B&Z Technologies, Broadcom, Cree. |