Hydrofluoric Acid Market Report Scope & Overview:

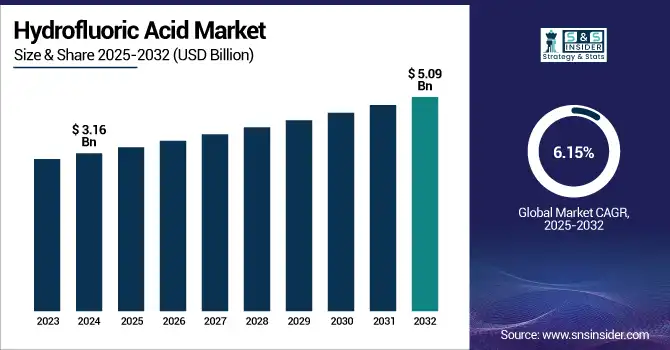

The Hydrofluoric Acid Market size was valued at USD 3.16 billion in 2024 and is expected to reach USD 5.09 billion by 2032, growing at a CAGR of 6.15% over the forecast period of 2025-2032.

To Get more information on Hydrofluoric Acid Market - Request Free Sample Report

The hydrofluoric acid market growth is booming on the back of expanding application of electronic grade hydrofluoric acid in semiconductor production and surging safety requirements for industrial grade HF acid. According to the CHIPS and Science Act, the U.S. Department of Commerce allocated USD 53 billion to increase domestic semiconductor manufacturing, generating demand for high-purity hydrofluoric acid.

According to the American Petroleum Institute (API), the U.S. alkylation industry is comprised of approximately 50% capacity that is dependent on hydrofluoric acid, and it provides employment to more than 447,000 workers and contributes USD 119 billion to GDP.

According to the U.S. Energy Information Administration, 42 out of 129 refineries (32%) run hydrofluoric alkylation units, which account for 42% of the nation's refining capacity.

The hydrofluoric acid market trends are also turning more towards safer catalyst technologies and applications in the burgeoning electronics and energy industries, as hydrofluoric acid companies are bracing themselves for the EPA’s proposed risk management rules.

Hydrofluoric Acid Market Dynamics:

Drivers:

-

Rapid Expansion of Semiconductor Fabrication Under the CHIPS Act Boosts Demand for High-purity Hydrofluoric Acid

The USD 52.7 billion in funding for domestic semiconductor manufacturing under the bipartisan CHIPS and Science Act has led to an unprecedented increase in the consumption of electronic-grade hydrofluoric acid as foundries continue to produce more advanced logic and memory chips. For cleaning and etching wafers, high-purity hydrofluoric acid is essential, and the Commerce Department shows semiconductor demand for the acid now is twice the current federal funding cap, underscoring the strong hydrofluoric acid industry demand in the electronics segment. This trend is driving the hydrofluoric acid market towards increasingly stringent reagent specifications, as chipmakers demand sub-10 ppt contamination levels to support sub-3 nm node processing.

-

Accelerated Refinery Alkylation Capacity Expansion Sustains Industrial-grade Hydrofluoric Acid Consumption

According to the American Petroleum Institute (API), approximately 50% of U.S. alkylation capacity is based on industrial grade hydrofluoric acid, and 42 of the 129 U.S. refineries have hydrofluoric units that contribute about 42% of total U.S. refining capacity. These alkylation units are not only essential to the production of clean, high-octane gasoline, but they also inject more than USD 119 billion into the U.S. economy each year and support more than 447,000 jobs nationally. With the increasing hydrofluoric acid market size in O&G, hydrofluoric acid companies are strengthening the supply chain and enhancing plant turnarounds. These undercurrents highlight hydrofluoric acid’s market share stability in traditional energy markets as regulatory scrutiny grows.

Restraints:

-

Heightened Workplace Safety and Liability Concerns Restrict Market Expansion for Hydrofluoric Acid

Process safety management data show an average of 98 EPA Risk Management Program-reportable accidents each year from 2016 to 2020 at facilities with high-hazard chemicals, including hydrofluoric acid. Public relations fiascos, such as petrochemical refineries releasing hydrogen fluoride uncontrollably highlight its extreme toxicity and heavy-gas properties, and increase the cost of insurance and the liability of companies. As a result, hydrofluoric acid makers are forced to spend money on extensive training, improved leak detection, and emergency neutralization equipment. This safety-motivated constraint attenuates the growth of the hydrofluoric acid market and helps to direct hydrofluoric acid market trends towards safer substitutes and inherently safer processes.

Hydrofluoric Acid Market Segmentation Analysis:

By Grade

The anhydrous segment dominated and held the largest share in the hydrofluoric acid market in 2024, in terms of value, with a market share of 58.3%, owing to rising demand for high-purity hydrofluoric acid used in the semiconductor manufacturing process. A subsegment, electronic grade hydrofluoric acid, dominated this market, with advanced chip manufacturing process, wafer etching, and cleaning as applications. Billions worth of funding under the U.S. CHIPS Act has been set aside to support domestic semiconductor development, increasing demand for ultrapure acid. Hydrofluoric acid manufacturers are innovating purification processes to adhere to stringent purity regulations.

The diluted grade emerged as the fastest growing segment, recording a CAGR of 6.41% during 2025-2032. It is widely employed for alkylation in refinery processes. About 42 of the 129 U.S. refineries use hydrofluoric acid alkylation units, representing 42% of the national capacity, according to the American Petroleum Institute. As refineries have modernized and concentrated on cleaner fuel, the use of diluted hydrofluoric acid has increased, in particular for high-octane gasoline and environmentally mandated blends.

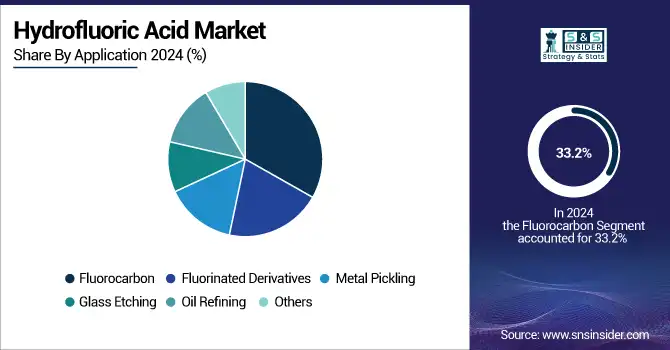

By Application

Fluorocarbon application dominated the hydrofluoric acid market in 2024 with a market share of 33.2%, which can be attributed to its use as a raw material in the production of refrigerants and fluoropolymers. A top subsegment is HFC and HFO for refrigeration, which is holding up as countries phase down ozone-depleting substances under the Kigali Amendment. U.S. EPA’s SNAP encourages low-GWP refrigerants, which will increase fluorocarbon production and hence hydrofluoric acid consumption in this end-use sector.

The fluorinated derivatives application emerged as the fastest growing segment in the hydrofluoric acid market, with a CAGR of 6.8% during the forecast period of 2025-2032. Such a compound is indispensable for use in lithium-ion battery electrolyte. Electric vehicle sales increased to 18% of total car sales in 2023, according to the International Energy Agency, further increasing the demand for battery-grade materials. With EV battery recycling and secondary use cases growing, hydrofluoric acid remains important for recovering and purifying fluorinated lithium salts.

By End-user Industry

The chemical processing industry dominated in 2024, accounting for a market share of 31.2%, owing to hydrofluoric acid's application in the production of fluorine-based intermediates and aluminum fluoride. These intermediates serve a variety of end markets, including agrochemicals, refrigerants, and specialty materials. According to the U.S. Geological Survey, chemical producers' demand for aluminum fluoride is also increasing with the growth of the aluminum industry. This is a factor that fuels the demand for the hydrofluoric acid market in chemical processing applications.

The electrical and electronics industry registers the fastest growth end-user industry, with a CAGR of 6.87% over 2025-2032, on account of the expansion of semiconductor manufacturing and solar PV panel production. High-purity hydrofluoric acid is an important etchant and cleaning solvent for silicon wafers. Upon this trend is the flow of private investment to establish chip fabrication facilities above USD 200 billion, supported by the CHIPS Act and Science. Hydrofluoric acid manufacturers are adjusting capacities to meet this surging end-use demand.

Hydrofluoric Acid Market Regional Outlook:

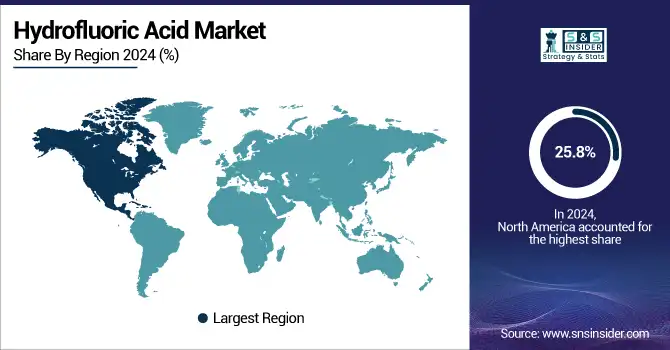

North America accounted for about 25.8% of the hydrofluoric acid market in 2024 due to huge demand for electronic-grade hydrofluoric acid in semiconductors and chemicals. As the dominant country, the U.S. benefits from public sector programmes, including the CHIPS Act investment in domestic semiconductor production and high-purity hydrofluoric acid use. The U.S led the market in North America with USD 466.53 million in 2024 and accounted for a market share of 57%. On the other hand, an expanding chemical industry in Canada is creating demand for industrial HF acid. Key players operating in the demand for hydrofluoric acid market in the region are increasing their production capacity to cater to the rise in the electronics and refining industry.

Europe is the second largest market with a market share of 20.6% due to advanced chemical manufacturing and the automotive industry, especially Germany and France, which rely heavily on fluorochemical production and metal pickling for hydrofluoric acid. The environmental directives of the EU recommending the move to eco-friendly refrigerants as per the F-Gas Regulation have also aided the hydrofluoric acid industry growth by promoting high-purity acid for the fluorocarbon production. Europe is kept in place thanks to the existence of several key hydrofluoric acid producers and continuing investment in chemical processing plants.

Asia Pacific dominated the hydrofluoric acid market with the largest share of 39.7% and is also the fastest-growing region with the highest CAGR of 6.49%, owing to rapid industrialization in countries including China, Japan, and South Korea. Wafer fabrication drives demand for electronic-grade hydrofluoric acid in the region, which is home to a large electronics-manufacturing base. Industrialized HF acid by China, the world number one, is flowing into semiconductor fabs and battery production, utilizing HF acid in lithium battery electrolytes. The market is trending with the government’s support for green technology and the growing automotive industry.

Latin America has potential as a developing market owing to the rising oil refining and chemical production in Brazil and Mexico, which are big users of industrial hydrofluoric acid for metal treatments. In the meantime, investments in strategic infrastructure and regulatory support are helping to grow the market.

The Middle East & Africa is witnessing a steady rise and has a significant CAGR, due to early adoption by the hydrofluoric acid companies to serve the surging petrochemical and refining sector in Saudi Arabia and the UAE. By investing in refinery modernization and fluorochemical facilities, which are also in line with the various regional economy’s diversification plans, these regions form the cornerstone for HF demand in the respective regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major hydrofluoric acid market competitors include Honeywell International Inc., Daikin Industries, Ltd., Solvay S.A., Dongyue Group, Sinochem Group Co., Ltd., Stella Chemifa Corporation, Lanxess AG, Orbia (Mexichem Fluor S.A. de C.V.), Morita Chemical Industries Co., Ltd., and Yingpeng Chemical Co., Ltd.

Recent Developments:

-

In April 2025, China’s hydrofluoric acid prices rose 1.63% in mid-April 2025, supported by stable costs and peak-season refrigerant demand, with average prices reaching 12,450 RMB/ton.

-

In October 2024, Tanfac Industries commissioned an expanded hydrofluoric acid plant, doubling capacity to 29,700 MT with a ₹100 crore investment, aiming to boost specialty fluoride production in India.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.16 billion |

| Market Size by 2032 | USD 5.09 billion |

| CAGR | CAGR of 6.15% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Grade (Anhydrous, Diluted) •By Application (Fluorocarbon, Fluorinated Derivatives, Metal Pickling, Glass Etching, Oil Refining, Others) •By End-user Industry (Oil & Gas, Chemical Processing, Pharmaceuticals, Electrical & Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Honeywell International Inc., Daikin Industries, Ltd., Solvay S.A., Dongyue Group, Sinochem Group Co., Ltd., Stella Chemifa Corporation, Lanxess AG, Orbia (Mexichem Fluor S.A. de C.V.), Morita Chemical Industries Co., Ltd., and Yingpeng Chemical Co., Ltd. |