Antimicrobial Textile Market Report Scope & Overview:

The Antimicrobial Textile Market Size was valued at USD 12.28 billion in 2023. It is expected to reach USD 21.27 billion by 2032 and grow at a CAGR of 6.3% over the forecast period 2024-2032.

Get more information on the Antimicrobial Textile Market - Request Sample Report

The antimicrobial textile market is experiencing robust growth, driven by the rising demand for enhanced hygiene and microbial resistance across healthcare, apparel, and home textiles. Increasing consumer awareness about health, coupled with advancements in antimicrobial technology, is propelling the market forward. Companies are investing in innovative solutions to meet these needs. For example, researchers in Europe introduced a chitosan nanocapsule-based antibacterial coating in October 2023, representing a shift toward eco-friendly, natural agents that are both effective and sustainable. In November 2023, an innovative antimicrobial textile coating was developed specifically for hospital curtains, designed to prevent bacterial spread in healthcare settings, emphasizing the importance of targeted applications within critical environments. This focus on sustainable and application-specific technologies aligns with broader industry trends, where antimicrobial textiles are sought for microbial resistance and compatibility with environmental standards.

Several companies are actively redefining industry standards with cutting-edge antimicrobial technologies. In October 2024, 1888 Mills launched a new antimicrobial technology to set industry benchmarks by enhancing the durability and efficacy of antimicrobial properties in consumer textiles. In January 2023, Brookhaven National Laboratory announced its involvement in developing antimicrobial solutions adaptable across various textiles, underscoring the role of research institutions in advancing this field. In February 2022, researchers explored natural silver-based antimicrobials derived from substances such as wine and chocolate, highlighting the industry’s commitment to sustainable practices. Introducing a new ISO standard for antibacterial textiles in November 2021 further establishes quality benchmarks, supporting innovation and adoption in a competitive market. This trend of using natural, biodegradable agents gains traction as manufacturers seek to meet regulatory standards and consumer demand for eco-friendly products.

Antimicrobial Textile Market Dynamics:

Drivers:

-

Rising Health and Hygiene Awareness among Consumers Increases Demand for Antimicrobial Textiles in Various Applications

-

Growing Demand for Antimicrobial Textiles in Healthcare Sector to Improve Hygiene and Reduce Infection Rates

-

Increasing Adoption of Antimicrobial Textiles in Sportswear and Activewear for Improved Comfort and Odor Control

-

Advances in Antimicrobial Technology for Textiles Enhance Durability and Efficacy in Microbial Protection

-

Growing Trend of Sustainable and Bio-Based Antimicrobial Agents in Textile Manufacturing

In response to environmental concerns, manufacturers are increasingly adopting bio-based antimicrobial agents derived from natural sources, such as chitosan and plant extracts, as alternatives to synthetic chemicals. This shift toward sustainable solutions aligns with rising consumer demand for eco-friendly products that do not harm the environment or human health. Bio-based antimicrobials offer effective microbial protection and are biodegradable, making them ideal for applications in sectors like healthcare and apparel. Additionally, these natural agents are less likely to cause skin irritation, a common concern associated with synthetic treatments. As more companies embrace sustainable practices in manufacturing, the adoption of bio-based antimicrobial agents is expected to play a key role in expanding the antimicrobial textile market.

Restraint:

-

High Cost of Antimicrobial Textiles May Limit Adoption in Price-Sensitive Markets

Despite the benefits, the high cost of antimicrobial textiles poses a significant challenge to market growth, particularly in price-sensitive regions. The advanced technologies and specialized treatment processes used in antimicrobial textiles contribute to higher production costs, which can be a barrier for small and medium-sized manufacturers. Additionally, bio-based and eco-friendly antimicrobial agents, though beneficial, tend to be more expensive than synthetic options, further driving up costs. This can make antimicrobial textiles less accessible to cost-conscious consumers, especially in developing countries where price often takes precedence over added features. Without cost-effective solutions, the market may struggle to achieve widespread adoption in budget-conscious markets, potentially slowing growth in these areas.

Opportunity:

-

Growing Demand for Antimicrobial Home Textiles Provides Expansion Opportunities in Residential Applications

-

Increasing Investments in Research and Development to Innovate and Expand Product Offerings

-

Expansion of Antimicrobial Textile Applications into Industrial and Commercial Sectors

Challenge:

-

Balancing Antimicrobial Efficacy and Environmental Sustainability Presents Ongoing Challenges in Product Development

| Trend | Description |

|---|---|

| Increased Demand for Hygiene-Enhanced Products | Consumers are increasingly prioritizing hygiene in their purchasing decisions, especially in sectors like healthcare, home textiles, and activewear. Antimicrobial textiles are becoming a preferred choice due to their ability to reduce bacterial growth. |

| Preference for Sustainable and Eco-friendly Solutions | Consumers are becoming more environmentally conscious and are seeking antimicrobial textiles made from sustainable or bio-based materials, aligning with the broader trend of eco-friendly consumption. |

| Rising Awareness of Health and Wellness | With growing awareness around health and wellness, especially post-pandemic, consumers are more inclined to purchase textiles that promote better hygiene and minimize exposure to harmful bacteria. |

| Adoption of Antimicrobial Textiles in Everyday Apparel | There is a rising trend of antimicrobial textiles being incorporated into everyday wear, such as clothing, socks, and sportswear, due to their odor-resistant and hygienic properties. |

| Growth in Online Shopping for Functional Textiles | E-commerce platforms are increasingly becoming the go-to option for purchasing antimicrobial textiles, as consumers seek out specialized products with functional benefits, such as odor control and protection against infections. |

Antimicrobial Textile Market Segmentation Overview

By Type

In 2023, the Quaternary Ammonium segment dominated the antimicrobial textiles market, holding a market share of 35%. Quaternary ammonium compounds, known for their broad-spectrum antimicrobial properties, are widely used in textiles across various sectors, including healthcare and hospitality, due to their effectiveness in preventing bacterial and fungal growth. These compounds are incorporated into fabrics such as medical uniforms and bedding, where hygiene is crucial. For example, many hospitals use antimicrobial textiles treated with quaternary ammonium to prevent hospital-acquired infections (HAIs), contributing to its dominance in the market.

By Fabric Type

Cotton fabric dominated and held the highest revenue share of more than 40% in 2023 due to its natural origin, breathability, and comfort properties. Cotton's widespread availability and familiarity in textile manufacturing also contribute to its leading position. Additionally, the increasing consumer preference for sustainable and eco-friendly materials further drives the demand for cotton-based antimicrobial textiles, solidifying its significant market share.

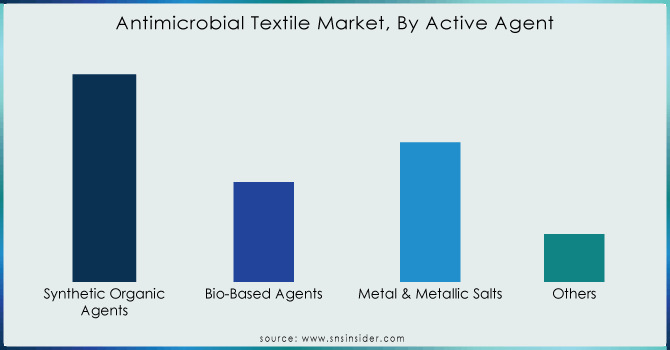

By Active Agent

In 2023, the Synthetic Organic Agents segment dominated the antimicrobial textiles market with a market share of 50%. Synthetic organic agents, such as triclosan and quaternary ammonium compounds, are commonly used in antimicrobial textiles due to their strong and long-lasting antimicrobial properties. These agents are effective in preventing the growth of bacteria and fungi on fabrics and are widely utilized in healthcare, apparel, and home textiles. For instance, synthetic organic agents are found in medical uniforms and bedding in hospitals, where the need for infection control is paramount, leading to their widespread use and dominance in the market.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

In 2023, the Medical Textiles segment dominated the antimicrobial textiles market with a market share of 30%. Medical textiles are designed for critical applications in hospitals and healthcare settings, such as surgical gowns, drapes, and wound dressings, where hygiene and infection control are essential. The use of antimicrobial agents in these textiles helps prevent the spread of harmful microorganisms, making them vital in medical environments. With the increasing emphasis on patient safety and the prevention of hospital-acquired infections (HAIs), the medical textiles sector continues to drive the demand for antimicrobial textiles, solidifying its dominance in the market.

Antimicrobial Textile Market Regional Analysis

In 2023, North America dominated the antimicrobial textiles market, holding a market share of 40%. This dominance is primarily driven by the strong demand for antimicrobial textiles in sectors such as healthcare, apparel, and home textiles, where hygiene and safety are paramount. The United States, in particular, leads the market in this region, owing to its robust healthcare infrastructure and stringent infection control standards. For instance, the use of antimicrobial fabrics in medical textiles like hospital gowns, bed linens, and surgical drapes has become increasingly widespread due to the growing awareness of hospital-acquired infections (HAIs). Additionally, the rising adoption of antimicrobial finishes in activewear and sports apparel further drives market growth in North America. Companies like DuPont and Microban, which are headquartered in the U.S., have significantly contributed to the development and commercialization of antimicrobial textiles, reinforcing the region's dominance. The U.S. market is also characterized by high consumer demand for products that offer enhanced hygiene, which is evident in the increasing prevalence of antimicrobial-treated clothing and textiles in everyday life.

Moreover, Asia Pacific emerged as the fastest-growing region in the antimicrobial textiles market in 2023, with an estimated CAGR of 8.5%. This growth is fueled by increasing awareness about hygiene and the rising demand for antimicrobial-treated fabrics in the healthcare, apparel, and industrial sectors. China and India are at the forefront of this surge, driven by rapid industrialization, growing populations, and rising disposable incomes. In China, the healthcare sector's focus on preventing hospital-acquired infections has led to the adoption of antimicrobial textiles in medical uniforms and hospital bedding. India is witnessing significant growth in the demand for antimicrobial textiles in activewear, driven by the expanding fitness and sports industries. The growing trend of antimicrobial home textiles in countries like Japan and South Korea is also contributing to the region's rapid market expansion. Furthermore, the presence of leading textile manufacturers in the region, coupled with the increasing shift toward sustainable and hygienic textile solutions, further fuels the market growth in Asia Pacific. Companies like HeiQ Materials and Archroma are tapping into the region's growing demand for antimicrobial textiles, further propelling the region's position as the fastest-growing market in 2023.

Recent Developments

October 2024: 1888 Mills launched a new antimicrobial technology, aiming to set a new industry standard by enhancing fabric durability and infection prevention, particularly in healthcare and home textiles.

November 2023: A new antimicrobial coating for hospital curtains was developed, effectively preventing bacterial and fungal growth, addressing hospital-acquired infections, and improving hygiene standards in healthcare settings.

Key Players

-

Aditya Birla Group (Smartcel Sensitive, Amicor)

-

Archroma (Puractive, Sanitized T 99-19, Sanitized TH 27-24)

-

Biocote Limited (BioCote Silver Ions, BioCote Antimicrobial Additives)

-

DuPont (Silvadur, Intellifresh)

-

Fuji Chemical Industries, Ltd. (Astivita, SMC Antimicrobial Masterbatch)

-

Herculite, Inc. (Sure-Chek Healthcare, Sure-Chek Linen)

-

HeiQ Materials AG (HeiQ Viroblock, HeiQ Pure)

-

Indorama Ventures Public Company Limited (PurThread, IVL Antimicrobial Polyester)

-

Kolon Industries, Inc. (Kolon Antibacterial Fabric, Kolon Silver Line)

-

LifeThreads LLC (Element Collection, Advanced Antimicrobial Scrubs)

-

Lonza Group AG (Reputex, Hygienilac)

-

Microban International, Ltd. (Microban SilverShield, Microban ZPTech)

-

Milliken & Company (BioSmart, AlphaSan)

-

Response Fabrics (India) Pvt. Ltd (Safe-T-Fresh, GermFree Fabric)

-

SANITIZED AG (Sanitized Silver, Sanitized T 11-15)

-

Sciessent LLC (Agion, Lava)

-

Sinterama S.p.A (Biofresh, Silver Pro)

-

The Dow Chemical Company (Dow Silvadur, Dow Antimicrobial 8500)

-

TOYOBO CO., LTD. (BREATHAIR, COSMENYL Antimicrobial)

-

Vardhman Holdings Limited (Vardhman Antibacterial Yarn, Vardhman Silver Fiber)

Raw Material Suppliers

-

Huntsman Corporation

-

BASF SE

-

Dow Chemical Company

-

Fujifilm Corporation

-

Royal DSM

Textile Manufacturers

-

Aditya Birla Group

-

Vardhman Textiles Limited

-

Kolon Industries, Inc.

-

Indorama Ventures Public Company Limited

-

Toray Industries, Inc.

Technology Providers

-

Microban International, Ltd.

-

HeiQ Materials AG

-

Sciessent LLC

-

Biocote Limited

-

Sanitized AG

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 12.28 Billion |

| Market Size by 2032 | US$ 21.27 Billion |

| CAGR | CAGR of 6.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Active Agent (Synthetic Organic Agents, Bio-Based Agents, Metal & Metallic Salts, and Others) • By Fibers (Cotton, Polyamide, Polyester, and Others) • By Application (Medical Textiles, Home Textiles, Apparel, Commercial Textiles, Industrial Textiles, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | TOYOBO CO., LTD., Aditya Birla Group, Herculite, Inc., Vardhman Holdings Limited, Fuji Chemical Industries, Ltd., Indorama Ventures Public Company Limited., Response Fabrics (India) Pvt. Ltd, Kolon Industries, Inc., SANITIZED AG, Microban International, Ltd., Biocote Limited, and other players. |

| DRIVERS | • Increasing awareness about hygiene and healthcare-associated infections. • Rising concern over antibiotic resistance, driving the search for alternative solutions like antimicrobial textiles. • Growing demand for functional textiles in healthcare, apparel, and home furnishing sectors.. |

| Restraints | • High initial investment required for research and development of advanced antimicrobial treatments. • Limited availability of raw materials suitable for antimicrobial treatment. • Concerns about the potential environmental impact of antimicrobial agents in textiles. |