Ceramic Tiles Market Report Scope & Overview:

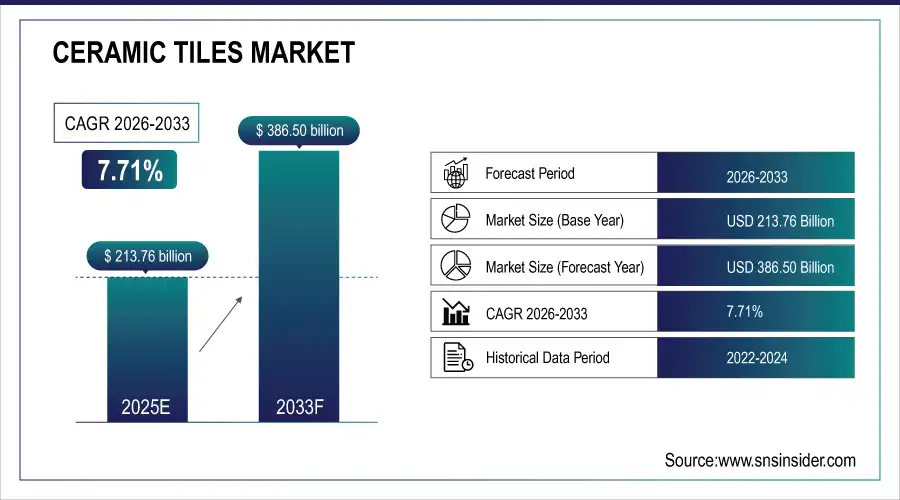

The Ceramic Tiles Market Size was valued at USD 213.76 Billion in 2025E and is projected to reach USD 386.50 Billion by 2033, growing at a CAGR of 7.71% during the forecast period 2026–2033.

The Ceramic Tiles Market analysis details performance trends and developments in the category, as and market value and growth. The market is divided by product type, end user (residential, commercial, industrial, hospitality and infrastructure), renovation type and application as and distribution channel including specialty stores, home improvement retailers, online retailing and direct sales. Growth is fueled by urbanization, growth in new construction and renovation expenditures, and greater interest in tiles that are aesthetically pleasing, durable, and eco-friendly.

Porcelain and glazed tiles accounted for 42% of the Ceramic Tiles Market in 2025, driven by strong demand from residential and commercial construction.

Market Size and Forecast:

-

Market Size in 2025: USD 213.76 Billion

-

Market Size by 2033: USD 386.50 Billion

-

CAGR: 7.71% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Ceramic Tiles Market - Request Free Sample Report

Ceramic Tiles Market Trends:

-

Increasing urbanization and commercialization has led to a rise in the demand for luxury and designer ceramic tiles.

-

Smart manufacturing, digital printing and sustainable manufacture are creating tiles that are significantly longer-lasting, more bespoke and friendlier to the environment.

-

High-end consumers are wooed by technological and luxury-enhanced technology-included tiles, i.e. anti-slip, antibacterial & self-cleaning versions.

-

Online marketplaces and home improvement retailers are increasing access to tiles, streamlining the selection process and providing inspiration for renovation projects.

-

Unprecedented construction activities and increasing disposable income, new residential as and remodeling of old homes across emerging markets are also supporting the demand for decorative and functional ceramic tiles.

U.S. Ceramic Tiles Market Insights:

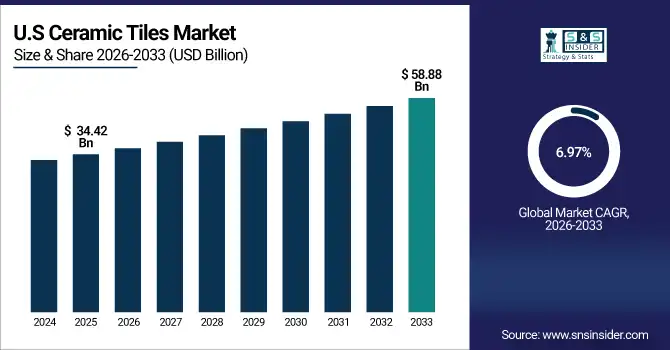

The U.S. Ceramic Tiles Market will expand from USD 34.42 Billion in 2025E to USD 58.88 Billion by 2033, growing at a CAGR of 6.97%. Growth is driven by rising residential renovations, commercial construction, and demand for durable, aesthetically appealing, and eco-friendly tiles, supported by specialty stores and online retail channels.

Ceramic Tiles Market Growth Drivers:

-

Surging residential and commercial construction, coupled with renovation trends, is driving global demand for premium ceramic tiles.

The Ceramic Tiles Market growth is due to growing residential and commercial construction, new structure and renovation activities in developing as and developed regions. Ceramic tile volumes are projected to exceed 12 billion square meters by 2033 from 7.5 billion square meters in 2025, on the back of urbanization, increasing disposable income, and sustained demand for robust, aesthetic and environmentally friendly flooring options. The online and specialty retail channels are increasingly driving market adoption globally.

Rising construction and renovation activities drove nearly 38% of global Ceramic Tiles adoption in 2025, led by porcelain and glazed tiles.

Ceramic Tiles Market Restraints:

-

High raw material costs and fluctuating import-export tariffs are restricting adoption and slowing the growth of the ceramic tiles market.

Increasing prices of raw materials and varying import-export tariffs are factors that would act as brakes to the Ceramic Tiles Market growth. 30% of companies experience margin pressure and supply chain disruptions in North America, Europe impacting production and distribution schedules. These challenges lead to higher end-product costs, reduce adoption in price-sensitive residential and commercial applications and act as obstacles for small tile dealers to use these tiles. Raw materials are still volatile and prices vary, limiting global market expansion and overall growth.

Ceramic Tiles Market Opportunities:

-

Rising demand for sustainable, customizable, and digitally printed tiles offers significant growth opportunities in construction.

New opportunities in the Ceramic Tiles Market are driven by rising demand for sustainable, customizable, and digitally printed tiles. Nearly 2.8 billion square meters of tiles shipped in 2025 feature advanced finishes, designs, or eco-friendly materials, appealing to design-conscious residential and commercial buyers. Expansion of online retail, specialty stores, and home improvement channels is making these innovative tile solutions more accessible, supporting strong market growth and adoption through 2033.

Introduction of sustainable, digitally printed, and customizable tiles represented nearly 32% of global Ceramic Tiles shipments in 2025.

Ceramic Tiles Market Segmentation Analysis:

-

By Product Type, Porcelain Tiles held the largest market share of 42.35% in 2025, while Digital Printed Tiles are expected to grow at the fastest CAGR of 10.42%.

-

By End User, Residential accounted for the highest market share of 48.12% in 2025, and Hospitality is projected to record the fastest CAGR of 9.38%.

-

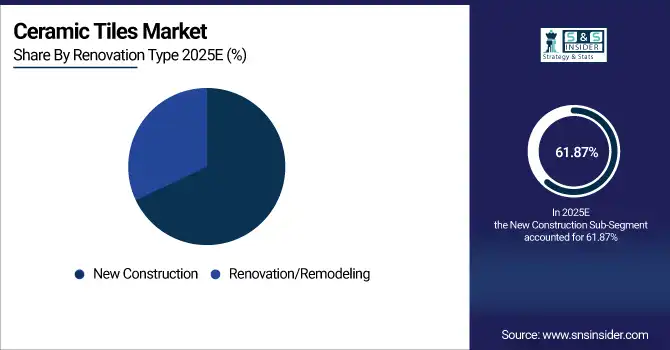

By Renovation Type, New Construction held the largest share of 61.87% in 2025, while Renovation/Remodeling is expected to grow at the fastest CAGR of 8.47%.

-

By Application, Flooring held the largest share of 55.26% in 2025, while Wall Cladding is projected to record the fastest CAGR of 9.12%.

-

By Distribution Channel, Specialty Stores held the largest share of 41.57% in 2025, while Online Retail is expected to grow at the fastest CAGR of 11.03%.

By Product Type, Porcelain Tiles Dominated the market while Digital Printed Tiles Fast-Growing

Porcelain Tiles segment dominated the Product Types and accounted for over 3.2 billion sq. mt. in 2025 with factors such as durability, low maintenance and application scope for residential and commercial buildings influencing demand. They maintain their market leadership positions partly due to their strong branding, pervasiveness and low-cost. Digital Printed Tiles are the fast-growing segment, with over 1.1 billion square meters by 2025, owing to increasing demand for customized designs, aesthetic appeal, and contemporary digitally-driven trends in interior decoration.

By End User, Residential Dominated the market while Hospitality Fast-Growing

Residential segment dominated the End User with more than 4 billion square meters in 2025 on account of housing expansion, urbanization and middle-class demand for the quality floor covering. There is steady demand throughout the segment, from new construction to continued development of homes. The hospitality segment is fast-growing, 1 billion square meters by 2025 and driven by hotel, resort and luxury apartment projects. It also grows as remodeled trends, need for durability in high-traffic spaces and the trend toward designer tile take hold.

By Renovation Type, New Construction Dominated the market while Renovation/Remodeling Fast-Growing

The New Construction segment dominated the market share by Renovation Type of more than 5.2 billion square meters in 2025 owing to growth in residential, commercial and industrial projects globally. Demand is supported by large-scale projects and government infrastructure programmes. Renovation/Remodeling is the fastest growing segment, projected to be 3.2 billion square meters in 2025, driven by city-wide renovation and beautification efforts, and consumer preferences for new tiles that are more modern and eco-friendlier. Luxury home and commercial property renovations are a large part of this growth.

By Application, Flooring Dominated the market while Wall Cladding Fast-Growing

Flooring dominated the application segment with more than 4.5 billion square meters by 2025, on account of its necessity in residential and commercial structures regarding the overall people's health, longevity, and safety. High usage is also achieved due to the wide choice of porcelain and glazed tiles. Wall cladding is fast-growing segment at 1.5 billion square meters in 2025, motivated by decorative exterior and interior trends. Digital printing, customisable surfaces and contemporary design trends are driving further uptake in luxury homes, offices and commercial building façades.

By Distribution Channel, Specialty Stores Dominated the market while Online Retail Fast-Growing

Specialty Stores dominated the market share for over 3.5 billion square meters by Distribution Channel in 2025 with diversified options, professional advices and customized services to buyers. Their brand credibility means there is a lot of repeat business on high margin products. Online retail is fast-growing at 1.9 billion square meters in 2025 during the expansion that’s brought by convenience, virtual visualization tools and doorstep delivery. The rapid adoption of online channels is driven by increasing penetration of e-commerce as and urban consumers’ preference to premium tiles and requirement for customisation.

Ceramic Tiles Market Regional Analysis:

Asia-Pacific Ceramic Tiles Market Insights:

Asia-Pacific Ceramic Tiles Market dominated with 46.42% market share, with more than 6.8 billion square meters sold in 2025 and China (3.2 billion square meters) being top contributor. m) and India (1.5 billion sq. m). The major share was taken by Porcelain and glazed tiles while Digital printed tiles are quickly growing. Urbanization, growing residential and commercial construction along with demand for long lasting, aesthetically appealing and environment-friendly types to proliferate the market supported by specialty stores & new online retail outlets.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

China Ceramic Tiles Market Insights:

In 2025, China used some 3.2 billion square meters of ceramic tiles, mostly porcelain and glazed surface tiles. 1.8 billion sq. m were sold via specialty stores and online retail, the balance through wholesalers and direct sales. Gains will be supported by increasing urbanization, gaining rate of residential and non-residential construction activity and interest in more resilient, visually appealing, and environmentally friendly flooring products.

North America Ceramic Tiles Market Insights:

North America Ceramic Tiles Market driven by strong product penetration of porcelain and glazed products will generate over 1.45 billion square meters shipments by 2025. The U.S. and Canada accounted for some 1.1 billion sq. m, underpinned by residential refurbs and commercial builds. Increasing need to use durable, aesthetic and easy to maintain tiles coupled with specialty stores and growing online retail sales is advancing tile demand throughout urban and suburban areas.

-

U.S. Ceramic Tiles Market Insights:

In 2025, the U.S. utilized more than 1.1 billion square meters of ceramic tiles produced by 200 major manufacturers. 650 million sq. m were sold direct from specialty stores and online, with the remainder through wholesalers. Residential refurbishments, commercial construction and increasing need for durable, aesthetic, eco-friendly tiles are driving the growth.

Europe Ceramic Tiles Market Insights:

Europe Ceramic Tiles Market crossed 1.3 billion square meters by the end of 2025, Germany represent more than 400 million sq. m, Italy 350 million sq. m, and that of France about 250 million sq. m. 700 million sq. m were sold through specialist stores and online retail, while the remainder was placed through wholesalers and direct sales. Growth will be stimulated by residential remodeling, commercial construction, and increasing demand for premium quality, durable, aesthetically pleasing tiles.

-

Germany Ceramic Tiles Market Insights:

Germany used more than 400 million sq. metres of ceramic tiles in 2025, around 220m sq. m through speciality stores and online retail, while the rest is sold with wholesale and direct sales. Porcelain & glazed tiles were the most widely used material owing to residential remodelling, commercial constructions, and increasing demand for durable, easy-to-maintain, eco- friendly flooring products.

Middle East and Africa Ceramic Tiles Market Insights:

Middle East & Africa Ceramic Tiles Market will be 9.78% in the forecasted period of 2025-2033 and to a potential shipment valuation over 670 million square meters in 2025. Porcelain and glazed dominated the market while digital printed tiles are emerging with them achieving 400 million sq. m, through specialty stores and online retail, while the balance is sold through wholesalers.

Latin America Ceramic Tiles Market Insights:

In 2025, the Latin America’s ceramic tile consumption exceeded 320 million square meters, with Brazil (140 million sq. m), Argentina (80 million sq. m), and Chile (60 million sq. m) as the main markets. Around 160 million sq. m were marketed through speciality stores and 100 million sq. m via online retail.

Ceramic Tiles Market Competitive Landscape:

Mohawk Industries has dominated the manufacturer and supplier of carpet, wood, ceramic tile, area rugs, stone tile products and countertop for several years now. A diversified product portfolio, innovative design concepts and a dedication to retail and commercial partnerships have been our key to success in the United States. Mohawk is further developing our production capacity and environmentally conscious manufacturing practices to make Mohawk the favored choice for residential and commercial flooring projects globally.

-

In March 2025, Mohawk Industries launched its EcoTile Series, featuring recycled materials and water-efficient manufacturing, expanding sustainable flooring options across residential and commercial sectors.

Grupo Lamosa has been the leader in production of ceramic tiles in Latin America with more than 200 million square meters per year from its 12 plants. Its dominance in the market is attributed to a strong distribution base, high quality product tiles and regional knowledge on residential & commercial projects. By constantly innovating and upholding a high-quality standard, Grupo Lamosa has stayed at the forefront of the regional ceramic tiles industry.

-

In July 2025, Grupo Lamosa introduced the Lamosa Digital Print Collection, offering fully customizable designs with high-resolution patterns for premium residential and hospitality projects.

RAK Ceramics has led the industry in the Middle East and around the world, with an annual production of over 150 million square meters from 15 plants in Middle East and Asia. Its worst position in the industry is reinforced by its operating efficiency, and diversified products and services offerings and serves more than 100 countries. Enhancing its ceramic tiles strength as a significant force player in the industry, this industrial facility will invest the latest technologies and ecological solutions for advanced manufacturing.

-

In May 2025, RAK Ceramics unveiled its SmartTech Tile Line, incorporating anti-slip, stain-resistant, and lightweight technology for both indoor and outdoor applications.

Ceramic Tiles Market Key Players:

Some of the Ceramic Tiles Market Companies are:

-

Mohawk Industries

-

Grupo Lamosa

-

RAK Ceramics

-

Porcelanosa Group

-

Kajaria Ceramics

-

SCG Ceramics

-

Ceramica Carmelo Fior

-

Crossville Inc.

-

Atlas Concorde

-

Pamesa Cerámica

-

Dongpeng Ceramics

-

Guangdong Monalisa

-

Marco Polo

-

GANI Marble Tiles

-

Viglacera

-

Interceramic

-

Mulia

-

Platinum Ceramics

-

Somany Ceramics

-

Ceramica Sant’Agostino

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 213.76 Billion |

| Market Size by 2033 | USD 386.50 Billion |

| CAGR | CAGR of 7.71% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Glazed Tiles, Porcelain Tiles, Quarry Tiles, Mosaic Tiles, Digital Printed Tiles, Others) • By End User (Residential, Commercial, Industrial, Hospitality, Infrastructure, Others) • By Renovation Type (New Construction, Renovation/Remodeling) • By Application (Flooring, Wall Cladding, Outdoor, Countertops, Others) • By Distribution Channel (Specialty Stores, Home Improvement Retailers, Online Retail, Direct Sales, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Mohawk Industries, Grupo Lamosa, RAK Ceramics, Porcelanosa Group, Kajaria Ceramics, SCG Ceramics, Ceramica Carmelo Fior, Crossville Inc., Atlas Concorde, Pamesa Cerámica, Dongpeng Ceramics, Guangdong Monalisa, Marco Polo, GANI Marble Tiles, Viglacera, Interceramic, Mulia, Platinum Ceramics, Somany Ceramics, Ceramica Sant’Agostino |