Folding Carton Packaging Market Key Insights:

The Folding Carton Packaging Market size was valued at USD 167.01 billion in 2023 and is expected to increase to USD 239.33 billion in 2031, growing at a compound annual growth rate of 4.6% Over the Forecast Period of 2024-2031.

In the coming years, the demand for folding cartons is expected to be mainly driven by an increasing preference for Recyclable Packaging over flexible plastic packaging.

The folding carton is a popular packaging choice for end-use industries because of its paperboard composition, wide availability and sustainability at a lower cost. Moreover, folding cartons can be produced in a variety of sizes as far as the end-user application is concerned compared with bulkier packaging solutions which further increases the attractiveness of these packages for consumer industries.

The largest revenue share on the market was accounted for by the food & beverages end-use segment, and it is expected to maintain its dominant position over the forecast period. During this forecast period, the electrical and electronics segment is expected to be one of the most rapidly growing end-use segments.

Get More Information on Folding Carton Packaging Market - Request Sample Report

The folding carton offers different advantages, including high printing efficiency, rigidity and flexibility as a result of these end-use industries. Folding cartons are primarily used for packaging small and medium-sized food & beverage products and consumer goods in the industrial sector due to this fact. In addition, the growing ban on single-use plastic packaging by regulatory authorities around the world, coupled with increasing consumer awareness of sustainability, has led to the adoption of eco-friendly and non-plastic packaging by the end-user industries. Over the coming years, this trend is further likely to lead to growth in demand for packing cartons.

Due to its excellent printability and durability, the folding trolley can easily be integrated with anticounterfeiting technologies such as RFID, embedded barcode or others. The market is further expected to be driven by increasing implementation of anticounterfeiting measures in product packaging as a result of rising counterfeiting. However, market growth is expected to be negatively affected by the price fluctuations in wood pulp as a result of the demand & supply gap and this will lead to significant reductions in profit margins for folding carton manufacturers.

MARKET DYNAMICS

KEY DRIVERS:

-

In the tobacco industry, there's an increasing demand for folding cartons

There will likely be immense opportunities in the market as folding cartons are increasingly used for tobacco packaging because of their printability and convenience. Despite the severe prohibitions and taxes, the tobacco industry accounted for significant growth, mainly due to the growing demand of the young population. Increased stress among young people has also increased the demand for tobacco-based products such as cigarettes. Therefore, in the coming years, there will be a strong demand for folded cartons due to the growth of the tobacco industry.

-

Manufacturers and retailers are increasingly using folding cartons made from paper and paperboard

RESTRAIN:

-

The growth of the market is expected to be hampered by the availability of folding carton alternatives, such as thinner cardboard.

In order to make it possible to provide protective cushioning of fragile products whilst maintaining print quality, thinner carton board can be made available as the substitute which may disrupt demand for folded boxes on the market.

OPPORTUNITY:

-

Growth and development in the electric and electronics sector

During the forecast period, the electrical and electronics end-use sector is expected to grow significantly. The evolution of technology has led to an increase in the number of electronic products. In addition, the growing shift towards compact electrical products also creates a lucrative opportunity for manufacturers to package in folding cartons as they are perfect packaging solutions for Compact Electrical Products. Therefore, the demand for folding cartons is expected to be influenced by strong growth in electrical and electronic industries over the next few years.

-

The market will also be stimulated by smart folding carton's increasing popularity.

CHALLENGES:

-

Volatile prices for raw materials such as wood pulp.

IMPACT OF RUSSIA-UKRAINE WAR

The Russia-Ukraine war had a strong impact on the supply of raw materials from one region to other. Both Russia and Ukraine are major suppliers of raw materials for the packaging industry. Glass, paper, metal and plastic are the main raw materials required in the custom packaging market. Russia alone produces almost 6% of the world's total raw materials production and is also the largest exporter of packaging raw materials to the world.

Turkey imports almost 30% of its raw materials from Russia and Japan. China imports almost 8-10% of its raw materials from Russia. The price of raw materials (plastic, polymers) soared as a result of the war. Imports of raw materials from Russia were minimized, affecting the packaging sector. This has also impacted the supply of raw materials for custom packaging such as paper, cardboard, plastics, and inks. Disruptions to supply chains caused by the war also added costs to the transportation of these raw materials. Also, the raw materials required to make the glass were expensive, which affected the entire custom packaging market.

As the European region is heavily dependent on energy supply from Russia and Ukraine, energy prices have also risen, affecting production costs and high inflation in the packaging industry across the European region.

IMPACT OF ONGOING RECESSION

According to AF&PA, production of cartons in the 1st quarter declined by 5 % as opposed to the 1st Quarter of 2022, with an 87.8 % carton production rate decreasing 6.1 % year on year. Compared with a 14.9 % growth rate for the services sector, manufacturing companies' earnings are forecasted to grow by 3.8 %. International Paper (IP) reported economic downtime in the first quarter of 2023. In addition to losses due to economic downturns amounting to 265,000 tonnes, WestRock declared loss of $2 billion as well as IP's report of 421,000 tonnes of lost time.

Despite the challenges, the recession could also present opportunities for the folding carton market. For example, some companies may decide to rebrand or launch new products during a downturn in order to gain market share. These efforts may require packaging updates and may provide opportunities for packaging manufacturers to offer innovative and customized folding carton solutions.

KEY MARKET SEGMENTATION

By Material

-

Biopolymer

-

Paper

-

Plastic

-

Others

By Structure Type

-

Straight Tuck End

-

Reverse Tuck End

-

Full Seal End

-

Tuck Top Auto-Bottom

-

Double Glued Sidewall

-

Tuck Top Snap-Lock Bottom

-

Others

By Dimensions

-

Less than 4 X 1.5 X 6 [Inch]

-

4 X 1.5 X 6 to 6 X 4 X 10 [Inch]

-

6 X 4 X 10 to 10 X 6 X 12 [Inch]

-

10 X 6 X 12 to 12 X 8 X 14 [Inch]

-

More than 12 X 8 X14 [Inch])

By Wall Construction

-

Single-Wall Corrugated Sheet

-

Double-Wall Corrugated Packaging

-

Triple-Wall Corrugated Packaging

By Order Type

-

Customized

-

Standard

Based on Style

-

Standard Straight Tuck

-

Mailer Lock

-

Airplane Style Straight

-

Tuck & Tongue

Based on Trends

-

Internet Of All Things

-

Environmentally Friendly Packaging

-

Improved Printing & Decorating Techniques

By End Use

-

Food & Beverages

-

Healthcare

-

Household

-

Electrical & Electronics

-

Personal Care & Cosmetics

-

Tobacco

-

Others

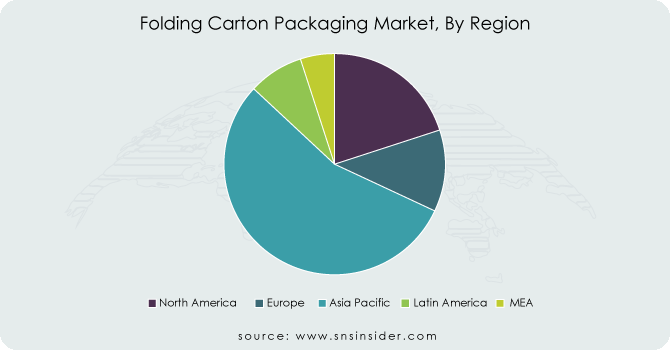

REGIONAL ANALYSIS

The Asia Pacific is dominating in the folding carton packaging market. There are several emerging economies in the Asia Pacific, such as China, India and Indonesia. The demand for folding cartons is expected to grow over the forecast period, as a result of changes in consumer lifestyles, rising disposable incomes and increasing demand for packaged foods such as ready-to-eat meals.

Moreover, the demand for packaged food products has been fuelled by an increased number of organized retailing outlets in the Asia Pacific region and this trend is benefiting the market as a whole. The largest online retailers in the world, for example, because of rigidity and sustainability, favour folding cartons to deliver goods to consumers. Therefore, in the years to come market growth is expected to be further increased by speeding up e-commerce markets in that part of the world.

Over the forecast period, there is an expected significant growth in the Middle East and Africa region. In the past years, factors like infrastructure development and urban expansion in the Middle East & Africa region are increasing the demand for food and beverages. Moreover, market growth in this region is expected to be stimulated by changes in consumer lifestyles as well as increased government efforts towards environment-friendly packaging.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The Major Players are WestRock Company, Graphic Packaging International LLC, Huhtamaki Oyj, Georgia-Pacific LLC, Bell Incorporated, Sonoco Products Company, Amcor Limited, Multi Packaging Solutions Inc, KapStone Paper & Packaging Corp, Paper Works and other players.

Bell Incorporated-Company Financial Analysis

RECENT DEVELOPMENTS

-

HP Hewlett Packard Launches PageWide T700i Printer for Paper Based Packaging. A new 67-inch press with a feed width of 1.7 m improves efficiency in mass production of both corrugated folding cartons and corrugated packaging.

-

Keystone Paper & Box Company, a leading specialty packaging company that produces high quality custom folding cartons for both consumer and medical end markets, was bought by Mill Rock Packaging Partners.

-

The assets of Canada based folding carton packaging solution retailer GrafPak have been bought by Packaging, envelopes and labelling solutions provider Supremex.

| Report Attributes | Details |

| Market Size in 2023 | US$ 167.01 Billion |

| Market Size by 2031 | US$ 239.33 Billion |

| CAGR | CAGR of 4.6% From 2023 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Biopolymer, Paper, Plastic, Others) • By Structure Type (Straight Tuck End, Reverse Tuck End, Full Seal End, Tuck Top Auto-Bottom, Double Glued Sidewall, Tuck Top Snap-Lock Bottom, Others) • By Dimensions (Less than 4 X 1.5 X 6 [Inch], 4 X 1.5 X 6 to 6 X 4 X 10 [Inch], 6 X 4 X 10 to 10 X 6 X 12 [Inch], 10 X 6 X 12 to 12 X 8 X 14 [Inch], More than 12 X 8 X14 [Inch]) • By Wall Construction (Single-Wall Corrugated Sheet, Double-Wall Corrugated Packaging, Triple-Wall Corrugated Packaging) • By Order Type (Customized, Standard) • By Style (Standard Straight Tuck, Mailer Lock, Airplane Style Straight, Tuck & Tongue) • By Trends (Internet Of All Things, Environmentally Friendly Packaging, Improved Printing & Decorating Techniques) • By End Use (Food & Beverages, Healthcare, Household, Electrical & Electronics, Personal Care & Cosmetics, Tobacco, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | WestRock Company, Graphic Packaging International LLC, Huhtamaki Oyj, Georgia-Pacific LLC, Bell Incorporated, Sonoco Products Company, Amcor Limited, Multi Packaging Solutions Inc, KapStone Paper & Packaging Corp, Paper Works |

| Key Drivers | • In the tobacco industry, there's an increasing demand for folding cartons • Manufacturers and retailers are increasingly using folding cartons made from paper and paperboard |

| Market Restraints | • The growth of the market is expected to be hampered by the availability of folding carton alternatives, such as thinner cardboard. |