Freight Transport Market Report Scope & Oveview:

Get More Information on Freight Transport Market - Request Sample Report

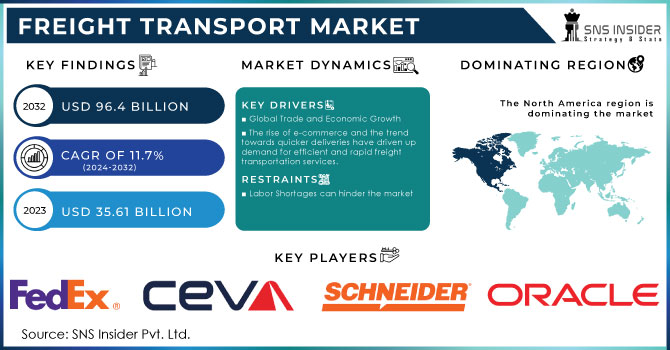

The Freight Transport Market size was USD 35.61 billion in 2023 and is expected to Reach USD 96.4 billion by 2032 and grow at a CAGR of 11.7 % over the forecast period of 2024-2032.

The market has been supported by reasonable shipping rates assigned to the freight transport providers and a variety of FTAs between countries. Such agreements will help to boost the freight market by reducing commodity prices and in doing so ensure an increased demand for transport. The internal controls needed to address logistics issues, which can be addressed with the use of various freight transport management solutions such as fleet tracking & maintenance, safety and monitoring systems, warehouse management systems or 3PL services, are missing from end users and manufacturers in emerging countries like India. The overall market will be stimulated by this factor.

Moreover, demand for specialized freight transport and supply chain performance capabilities has been fuelled by growth of e commerce and entrepreneurship. By reducing logistics costs, inventory costs and fixed costs, shippers benefit from the contracting of freight transport services. Globalization has created a situation in which several firms outsource the management of their freight transport operations because they have no ability to manage global supply chains. To maximise the efficiency of transport services, which have advantages like lower capital costs, door to door service, flexibility and less risk of collision during transit, cargo carriers offer enhanced and inventive ways to achieve this.

Due to the availability of efficient supply chain management, the presence of leading players on the eCommerce market and the needs for infrastructure, this sector has seen growth both in the US and Europe. The ability to monitor various products and freight in transit gives e-commerce companies a full view of their inventories and operations, which has an impact on demand for logistics solutions. In addition, shippers benefit from improving the customer service and control costs by moving goods at speed, minimising disruption, proactively managing status updates and mitigating risks. Therefore, a robust supply chain is expected to be established on the basis of sufficient visibility.

MARKET DYNAMICS

KEY DRIVERS:

-

Global Trade and Economic Growth

The level of international and domestic trade directly affects the demand for freight. As economies develop and trade volumes increase, so does the need to transport goods to and from different regions.

-

The rise of e-commerce and the trend towards quicker deliveries have driven up demand for efficient and rapid freight transportation services.

RESTRAIN:

-

Labor Shortages can hinder the market

Shortages of skilled labor, particularly drivers and warehouse workers, can lead to delays, increased labor costs, and challenges in meeting delivery timelines.

OPPORTUNITY:

-

Digitalization and Technology Adoption

The integration of digital technologies, such as IoT, blockchain, data analytics, and automation, presents opportunities to enhance supply chain visibility, optimize routes, reduce costs, and improve overall efficiency.

-

Providing access to underserved rural and remote areas can be a opportunity for companies to offer specialized logistics solutions

CHALLENGES:

-

High Operating Costs

Fuel costs, maintenance expenses, and compliance with environmental regulations can contribute to high operational costs, impacting profitability.

IMPACT OF RUSSIAN UKRAINE WAR

The war has also increased transportation costs. The closure of airspace over Ukraine, which has made it necessary to reroute flights, increasing fuel costs. The increased demand for shipping as businesses try to find alternative routes to get goods to their destinations. The rising cost of fuel, which is a major component of transportation costs. Due to these factors, freight transport market has been affected. Also, the price of shipping a container from China to Europe has increased by more than 50% since the start of the war. The cost of air freight has also increased significantly, making it more expensive to transport goods that are time-sensitive. There have been delays and cancellations of flights due to airspace restrictions over Ukraine and Russia. There have been shortages of trucks and drivers, making it difficult to move goods around Europe.

IMPACT OF ONGOING RECESSION

A study by the McKinsey Global Institute found that a recession could reduce global trade by up to 30%. This would lead to a decline in transportation volumes and revenue for logistics companies. Also, report by the World Bank found that a recession could increase unemployment by up to 5%. This would make it more difficult for logistics companies to find qualified workers and could lead to delays in shipments. A study by the Boston Consulting Group found that a recession could increase the cost of transportation by up to 20%. This would add to the financial burden of logistics companies and could make it more difficult for them to invest in new technologies. The impact of the recession on the freight transport market is likely to be felt for several years. The recession is expected to slow down the growth of the market and make it more difficult for logistics companies to innovate.

However, there are some opportunities for logistics companies to thrive during a recession. For example, logistics companies that can provide flexible and cost-effective solutions to businesses will be in high demand. Additionally, logistics companies that can focus on niche markets, such as e-commerce or healthcare, may be able to weather the recession better than other companies.

KEY MARKET SEGMENTS

By Offering

-

Solutions

-

Services

The market shall be classified according to the offering in terms of solutions and services. The largest share of revenue was accounted for by the services segment. There are three categories of the service offering: managed services, business services and system integration. The growth of this segment is mainly due to the growing demand for freight management services enabling businesses to transport and complete their supply chains in an efficient and affordable manner. In order to maintain minimal storage space and low shipping inventories, this service allows businesses from all sizes to comply with orders through the provision of Just In Time production.

During the forecast period, the solution segment is expected to be the fastest growing. The adoption of innovative freight transport management systems across the world can be attributed to this. Freight traffic management schemes help to reduce freight transport costs, increase the efficiency of consignments and provide real time supply chain visibility for businesses in a range of sectors. To enhance time to value, cloud solutions allow users to effectively manage logistics processes, connect & cooperate with their business partners, reuse and share supply chain data.

By Transport Mode

-

Railways

-

Seaways

-

Airways

The freight market is divided into road, rail, waterway or air transport based on mode of transport. The roadways segment accounted for a significant revenue share and is expected to retain its dominance during the forecast period owing to the fastest door-to-door services for short distances. In addition, given that it involves lower investment in capital compared to other modes of transport, this ensures cost effectiveness. Moreover, this mode of transport offers a large capacity to carry goods and therefore it is one of the preferred routes for freight. The growth of this segment is also being driven by increasing government efforts to promote road transport across the world.

During the forecast period, the airways segment is expected to show significant growth. The faster delivery, rapid airport development in developing countries and the adoption of sustainable aviation fuel for climate change can be seen as contributing to this growth.

By Vertical

-

Retail & E-commerce

-

Pharmaceuticals

-

Energy

-

Automotive

-

Aerospace & Defense

-

Others

The freight transport industry is divided into retail & e commerce, automobiles, aerospace and defense, pharmaceuticals, energy or other sectors based on vertical. In view of the increasing sales of eCommerce across borders and a growing freight transport market, the retail & online segment accounts for an important revenue share and is projected to maintain its dominance over the forecast period. Freight transport involves movement of products in the field of retail and online trade, e.g. groceries, electronic devices, personal care items, furniture, clothing and footwear. There's a lot of room for growth in retail and e commerce. Venture capitalists around the world invest heavily in ecom logistics business ventures to take advantage of this potential.

During the forecast period, the pharmaceuticals segment is projected to grow at a significant CAGR. Pharmaceutical transport is the most important link in a logistics supply chain as these products are intended to be consumed by humans. In order to ensure that the medicinal products reach their intended consumers in an appropriate manner, full control of the entire distribution chain is required.

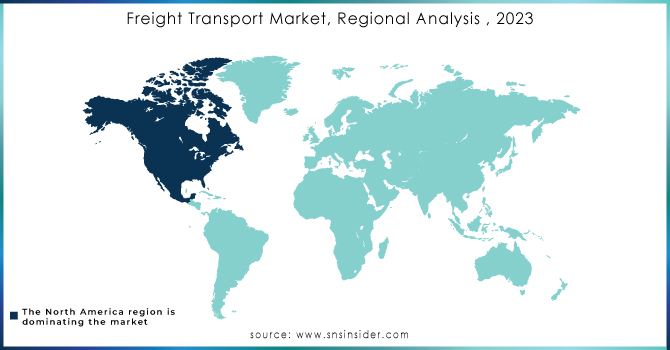

REGIONAL ANALYSIS

The market is dominated by North America, which has been expected to maintain this dominance due to the presence of a number of major freight solution providers, logistic companies and logistics players during the forecast period. The biggest e commerce company in the United States and Canada. In addition, the growth of this market is supported by factors such as continuous development and uptake of new technology like Artificial Intelligence, Near Field Communication or Machine Learning. As a result of huge demand for freight transport services in production, retail trade and e commerce, the U.S. is projected to maintain its dominant position over the forecast period.

In the forecast period, Asia Pacific's expansion will be substantial and at a high compound annual growth rate for the remainder of the forecast period. The region's thriving opportunities for automobile, packaging, healthcare and other applications can be a major contributor to this growth. The growth of the Asia Pacific freight transport market can also be attributed to an increase in production capacity, given various government incentives, low labour costs and sufficient land availability on large markets.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some major key players in the Freight Transport market are Schneider National Inc, CEVA Logistics, Oracle, FedEx, SAP SE, United Parcel Service of America Inc, Deutsche Post AG and other players.

RECENT DEVELOPMENT

-

DHL is investing in drones to deliver packages in urban areas, and UPS is investing in self-driving trucks.

-

Nine new innovative freight projects have received a total of £1.2 million from government funding, including the use of drones to deliver packages on remote Scottish islands.

| Report Attributes | Details |

| Market Size in 2023 | US$ 35.61 Bn |

| Market Size by 2032 | US$ 96.4 Bn |

| CAGR | CAGR of 11.7 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Offering (Solutions, Services) • by Transport Mode (Roadways, Railways, Seaways, Airways) • by Vertical (Retail & E-commerce, Pharmaceuticals, Energy, Automotive, Aerospace & Defence, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Schneider National Inc, CEVA Logistics, Oracle, FedEx, SAP SE, United Parcel Service of America Inc, Deutsche Post AG |

| Key Drivers | • Global Trade and Economic Growth • The rise of e-commerce and the trend towards quicker deliveries have driven up demand for efficient and rapid freight transportation services. |

| Market Restraints | • Labor Shortages can hinder the market |