Machine Learning in Logistics Market Report Scope & Overview:

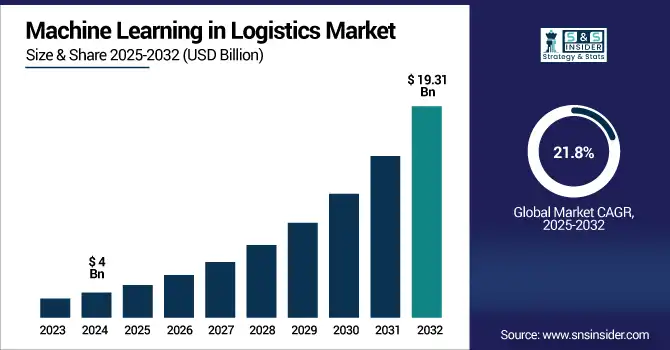

The Machine Learning in Logistics Market Size was valued at USD 4 billion in 2024 and is expected to reach USD 19.31 billion by 2032, growing at a CAGR of 21.8% over the forecast period of 2025-2032.

To Get more information on Machine Learning in Logistics Market - Request Free Sample Report

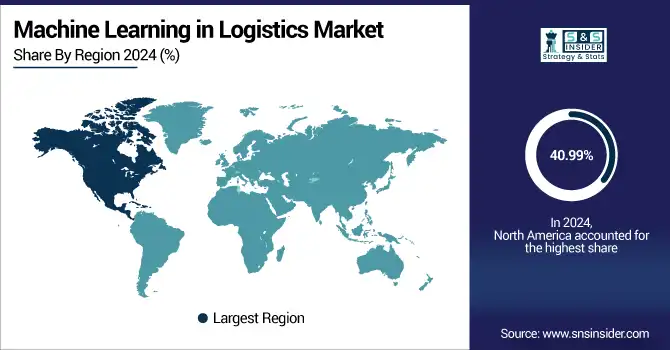

The Logistics Market for Machine Learning is experiencing significant growth as logistics companies implement AI to enhance their operations, reduce expenses, and boost customer satisfaction. The surge in e-commerce and global trade is propelling its adoption in various sectors, including retail, manufacturing, and healthcare. Both cloud-based and on-premises solutions provide integration flexibility, while big data and the IoT improve machine learning functionalities. North America currently commands the largest market share, whereas the Asia Pacific region is witnessing the fastest growth. Prominent companies such as Amazon, IBM, and SAP are at the forefront of innovation, contributing to the development of a more intelligent and agile logistics landscape.

According to resources, in 2024, the surge in e-commerce drove over 50% of the demand for AI-powered logistics, particularly in last-mile delivery and returns, while machine learning–based predictive analytics improved demand forecasting accuracy by 30–40%, reducing stockouts and excess inventory.

The U.S Machine Learning in Logistics Market reached USD 2.52 billion in 2024 and is expected to reach USD 12.57 billion in 2032 at a CAGR of 12.26% from 2025 to 2032.

This leadership is driven by advanced technological infrastructure, strong investment in AI and machine learning, and the presence of key players like Amazon, IBM, and Google. Additionally, the U.S. has a highly developed logistics and transportation network, widespread adoption of automation, and a strong focus on data-driven operations, all of which contribute to its dominance in the global logistics AI landscape.

Machine Learning in Logistics Market Dynamics

Drivers:

-

Rising Integration of AI and IoT Across Logistics Operations Enhances Efficiency and Cost Optimization.

One of the largest drivers for the growth of global logistics or supply chain management for international trade is the growing use of artificial intelligence and Internet of Things (IoT) systems for logistics functions that provide an increase in operational efficiency, the capacity to track in real-time, and high capabilities to manage costs. Logistics data is enormous, and can be ideal for machine learning models, which could anticipate how long it will take for products to be delivered, the best route to take, and how to manage inventory. Large logistics companies are implementing predictive analytics platforms to make their supply chain processes more efficient and minimize wastage. The need for speedy, data-driven decision-making is now further accelerating the adoption of ML technologies across logistics operations all over the world.

According to sources, around 35% of logistics companies globally are using IoT-enabled machine learning systems to monitor fleet health, warehouse conditions, and real-time shipment tracking.

Restraints:

-

Lack of Skilled Workforce and Technical Expertise Hampers the Widespread Adoption of Intelligent Logistic Systems.

One of the key limitations is the lack of experienced workers to develop, deploy, and maintain machine learning systems in logistics settings. The adoption of these technologies requires a productised mix of data science, AI, supply chain know-how, and IT infrastructure, which is in short supply and unevenly distributed across regions. In addition, for the small and medium-sized logistics companies, it is very difficult to obtain the talent or salary. The capability to deploy and scale intelligent solutions is retarded by the shortage of manpower, and particularly in emerging markets and fragmented logistics systems, market entry is slowed as operational logistics is more complex.

Opportunities:

-

Expansion of E-Commerce and Cross-Border Trade Creates New Avenues for Automation and AI-Driven Solutions.

E-commerce and global trade are growing rapidly, both are creating an enormous amount of opportunities for building machine learning tech in logistics. The inherent demands of daily millions of transactions also mean logistics providers demand more real-time, faster fulfilment and better warehousing. AI solutions that enable on-demand forecasting of consumer demand allow flex route optimization and customized local fulfilment programs. Recent shifts have seen logistics tech startups aligning with global e-commerce players to co-create intelligent AI models that are mapped to changing customer behaviour.

Challenges:

-

Data Privacy Concerns and Cybersecurity Threats Complicate the Adoption of Intelligent Logistics Systems.

ML OPS ML systems rely heavily on camping, transportation networks and ongoing data flow between customers and customers. This indicates a weakness that attackers could exploit. The latest ransomware attacks and procurement data violations against international shipping companies have attracted regulatory attention and attention. Companies are forced to invest heavily in protecting their ML infrastructure, increasing the cost of project schedule implementation and delays especially those without strong cybersecurity.

Machine Learning in Logistics Market Segment Analysis

By Component

The software segment led the market with 56.27% of the revenue share. This primacy is due to the rising need of operational analytics, immediate decision-making, and automation for logistics functions. Software Android and iOS solutions provide tools for demand prediction, routing, and stock management. Companies including I.B.M., SAP, and Oracle have added A.I. and machine-learning features to their logistics software offerings.

For example, in January 2024, Manhattan Associates rolled out a newly adapted Warehouse Management System (WMS), which includes an AI capability to run its warehouse operations to make processes more efficient.

The services segment is estimated to exhibit the fastest CAGR of 23.04%. This will be driven by the growing need for consulting, implementation, and managed services for driving the machine learning solution implementation in logistics. Businesses are looking for AI know-how to apply the technologies to their businesses.

For instance, in April 2024, Flexport released its AI-based logistics platform that can help optimize the routes of shipments and enhance delivery times. Focus on improving customer experience and operational efficiency is augmenting the growth of services in the market.

By Deployment Model

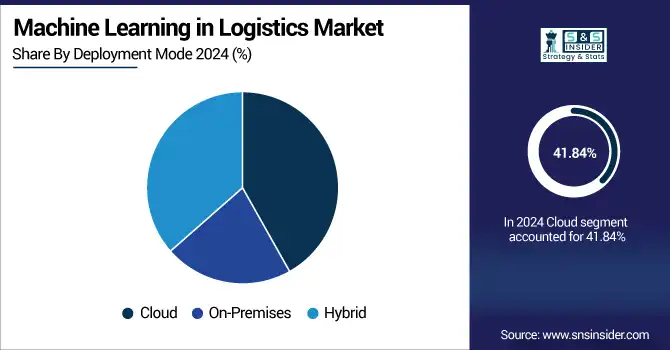

Cloud segment is estimated to exhibit the fastest CAGR of 41.84% revenue share by 2024. This is because cloud solutions are more scalable, agile, and cost-efficient. The cloud solutions provide access to data in real time and can be easily integrated with the systems already in use. In December 2023, AWS released AWS Supply Chain, a cloud-based application that provides better supply chain visibility and actionable information. Demand for elastic and nimble logistics operations is driving the uptake of cloud-based machine learning offerings.

The on-premises deployment model is anticipated to achieve a CAGR of 23.71%. This increase is likely due to organizations preferring to keep their data and certain system components localized, particularly in regions where regulatory challenges may arise. Canto's self-hosted solution offers enhanced security and greater customization. Businesses are enhancing their infrastructure to accommodate intricate machine learning tasks while ensuring data sovereignty and compliance.

By Application

Supply chain automation is projected to be the dominant segment, accounting for 31.41% of the revenue share. The incorporation of machine learning into supply chain process automation improves efficiency, minimizes errors, and speeds up decision-making. Firms such as Blue Yonder are creating AI-driven platforms aimed at optimizing logistics and warehouse management. The pursuit of more efficient operations and cost savings is propelling the uptake of automation solutions within the logistics sector.

Predictive maintenance is expected to be the fastest-growing application segment, at a CAGR of 22.93%. Machine learning algorithms evaluate equipment data to foresee potential failures and arrange prompt maintenance, thereby reducing downtime and maintenance expenses. For example, in March 2024, AWS launched new machine learning tools for logistics aimed at aiding businesses in predictive analytics and route optimization.

By End-Use Industry

The retail segment commands a significant 31.33% share of the market revenue. Retailers are utilizing machine learning to enhance inventory management, tailor customer experiences, and improve supply chain processes. Major companies such as Walmart and Lowe's are investing in artificial intelligence technologies to boost productivity and profitability. The quest for greater customer satisfaction and operational efficiency is propelling the integration of machine learning within the retail industry.

The healthcare segment is anticipated to be the rapidly expanding end-use segment, exhibiting a CAGR of 23.25%. The implementation of machine learning in healthcare logistics improves the management of medical supplies, streamlines delivery routes, and guarantees the prompt availability of essential resources. The focus on enhancing patient care and operational efficiency is driving the incorporation of artificial intelligence technologies in healthcare logistics.

Regional Analysis

North America accounted for the largest Machine Learning in Logistics Market Share of 40.99%, emphasizing its leadership in AI-driven logistics innovation. North America plays a crucial role in the machine learning logistics market, propelled by advanced technology adoption, a solid logistics framework, and substantial AI investments from large corporations. This region hosts leading technology firms and logistics companies that are swiftly incorporating machine learning to improve operational efficiency and enhance customer satisfaction.

The United States leads the regional market, benefiting from a strong innovation ecosystem, significant research and development funding, and the early implementation of AI and automation in supply chain processes.

Europe is experiencing consistent growth in the utilization of machine learning within logistics, driven by innovations in smart logistics technologies, governmental backing for digital transformation, and the growth of cross-border e-commerce. The region prioritizes data-driven decision-making to enhance sustainability and transparency in the supply chain.

Germany is at the forefront in Europe due to its robust industrial foundation, an automation-focused logistics sector, and its leadership in manufacturing and transportation technologies.

The Asia Pacific region is anticipated to experience the fastest CAGR of 22.85%, indicating a swift transition towards intelligent logistics. The Asia Pacific market is the most rapidly expanding regional sector, driven by accelerated digital transformation, increasing e-commerce adoption, and a growing need for effective logistics solutions. Nations within this region are utilizing machine learning to enhance warehousing, optimize last-mile delivery, and improve demand forecasting in high-volume markets.

China leads the way due to its extensive logistics infrastructure, significant investments in artificial intelligence and smart technologies, and the influence of global e-commerce leaders such as Alibaba, which is propelling advancements in intelligent supply chain management.

The Middle East & Africa and Latin America are gradually adopting machine learning in logistics, driven by infrastructure development, digital transformation, and government-backed strategies. Growing interest in smart logistics hubs, AI-driven tools at ports, and rising demand for cost-effective, automated supply chain solutions support market growth in both regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players for the Machine Learning in Logistics Market are Microsoft, Oracle, Kinaxis, ClearMetal, IBM, Google, Salesforce, Siemens, SAP, BluJay Solutions, Amazon and others.

Key Developments:

-

In March 2025, Microsoft introduced innovative AI-driven frameworks, namely Adaptive Cloud for Logistics and AI-enhanced experiences, aimed at enhancing efficiency, fostering innovation, and increasing adaptability in logistics through the integration of generative and agentic AI.

-

In March 2025, Siemens introduced the Simatic Robot Pick AI Pro, an advanced AI-driven vision system designed to facilitate adaptive robotic picking in intralogistics, thereby improving warehouse automation through deep learning technologies.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4 Billion |

| Market Size by 2032 | USD 19.31 Billion |

| CAGR | CAGR of 21.8% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (Demand Forecasting, Route Optimization, Inventory Management, Supply Chain Automation, Predictive Maintenance) •By Deployment Mode (Cloud, On-Premises, Hybrid) •By End-Use Industry (Retail, Manufacturing, Transportation and Warehousing, Food and Beverage, Healthcare) •By Component (Software, Services, Platform) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Microsoft, Oracle, Kinaxis, ClearMetal, IBM, Google, Salesforce, Siemens, SAP, BluJay Solutions, Amazon and others |