Payment as a Service Market Report Scope & Overview:

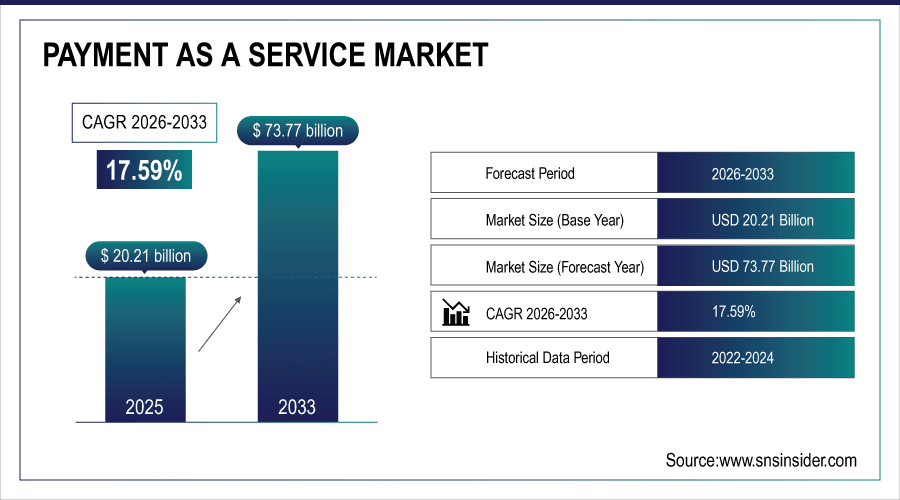

The Payment as a Service Market Size was valued at USD 20.21 Billion in 2025E and is projected to reach USD 73.77 Billion by 2033, growing at a CAGR of 17.59% during the forecast period 2026–2033.

The Payment as a Service Market analysis how businesses are transforming the way they handle transactions, from seamless cloud-based platforms to managed and professional services. Spread across multiple industries such as BFSI, retail, healthcare & travel; the market concentrates on credit/debit cards, digital wallets and bank transfer. Concurrently, rapid adoption by large corporations and SMEs is driving demand; cloud-based deployments and advanced payment methods are transforming commerce around the world through speed, security & convenience.

Cloud-based PaaS platforms accounted for nearly 62% of deployments in 2025, driven by scalability and ease of integration for enterprises and SMEs.

To Get More Information On Payment as a Service Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 20.21 Billion

-

Market Size by 2033: USD 73.77 Billion

-

CAGR: 17.59% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Payment as a Service Market Trends:

-

Managed services led by an expert are revolutionizing payment experiences, providing businesses personalized advice and hands-on assistance in managing complicated transactions.

-

There is rapid take-up of mobile and digital wallet services, as consumers seek super-fast, convenient transaction experiences.

-

BFSI and retail lead the digital revolution, transforming finance and reimagining commerce for today's consumer.

-

The Asia-Pacific is home to a new fintech powerhouse, e-commerce boom and digitally informed audience.

-

API-driven payment platforms are redefining 2025 by enabling businesses to consolidate numerous forms of payment and enhance the customer experience with ease.

U.S. Payment as a Service Market Insights:

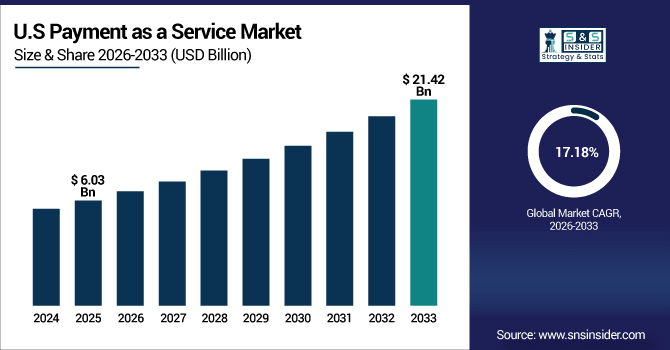

The U.S. Payment as a Service market reached USD 6.03 Billion in 2025E and is projected to hit USD 21.42 Billion by 2033 at a CAGR of 17.18%. Growth is accelerated by cloud platforms, digital wallets, increasing e-commerce penetration and need for frictionless, secure and contact-less payments services.

Payment as a Service Market Growth Drivers:

-

Rapid Shift Toward Digital and Contactless Payments Drives Adoption of PaaS Solutions Across Industries Globally.

The Payment as a Service market is growing rapidly as businesses increasingly adopt digital and contactless payment solutions for efficiency and convenience. PaaS-based transaction volume throughput in BFSI, retail & e-commerce to reach 1.2 billion worldwide by 2025. This expansion is being powered by healthy fintech innovation, frictionless APIs and rolling mobile wallet adoption further empowering the digitalisation of businesses (and SME’s), helping them modernise operations to adjust overheads in line with increasing consumer focus on fast n’ secure payments.

Rapid adoption of digital and contactless payments drove 34% of global PaaS deployments in 2025, reflecting strong demand for faster, secure, and seamless transaction solutions across enterprises and SMEs.

Payment as a Service Market Restraints:

-

Complex Regulatory Compliance and Security Concerns Hinder PaaS Adoption and Slow Global Market Expansion.

The Payment as a Service market is affected by stringent regulations and security issues. Compliance tightened around the throats of just shy of 22% of businesses that were still on the fence about PaaS commerce by way into 2025 while reservations regarding data breaches or integration risks came to around 17%. These barriers curb adoption particularly for SMEs and traditional companies. Furthermore, with different security protocols and evolving regulations, scaling internationally is a challenge even as demand for frictionless digital payments grows at a rapid pace.

Payment as a Service Market Opportunities:

-

Accelerated Growth of E-Commerce and Fintech Innovation Creates Vast Opportunities for PaaS Adoption and Global Market Expansion.

The expansion of digital commerce and fintech innovation is fueling significant growth in the global PaaS market. More than 1.5 billion transactions were conducted on PaaS platforms in 2025, and almost 40% of these used API-driven integrations for tailored payment services. Increasing acceptance of online retail and consumer choice of smooth non-touch transactions also is driving platform penetration. These would expand through 2033, as digital infrastructure and novel payment technologies transform global transactions.

Expansion of digital commerce and API-driven payment solutions accounted for 28% of global PaaS adoption in 2025, reflecting rising demand for seamless, customizable, and secure transaction experiences.

Payment as a Service Market Segmentation Analysis:

-

By Component, Platform held the largest market share of 75.1% in 2025, while Professional Services is expected to grow at the fastest CAGR of 21.23%, reflecting the rising need for expert-led payment solutions.

-

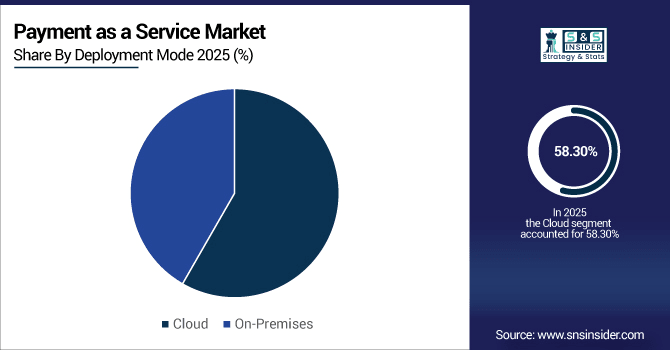

By Deployment Mode, Cloud dominated with a 58.3% share in 2025, while On-Premises is projected to grow steadily at a CAGR of 19.12%, catering to organizations preferring in-house solutions.

-

By Organization Size, Large Enterprises captured the largest share of 69.4% in 2025, while SMEs are anticipated to expand at the fastest CAGR of 21.23% due to increasing digital adoption.

-

By Industry Vertical, BFSI held the dominant 35.02% share in 2025, while Healthcare is expected to grow fastest at a CAGR of 20.1%, driven by the need for secure patient billing and payment management.

-

By Payment Method, Digital Wallets contributed the largest share of 50.07% in 2025, while Bank Transfers are forecasted to grow at the fastest CAGR of 23.41%, fueled by global digital payment adoption.

By Deployment Mode, Cloud Dominates, On-Premises Remains Relevant:

Cloud-based deployments drove payment solutions for over 650,000 businesses by 2025 and provided the ability to scale quickly, reduce infrastructure expenses and be accessed remotely. On-Premises packages are still popular among customers who value data control and number nearly 200,000 users across the globe. As hybrid mechanisms and secure integration paths gain more trust, we can expect both deployment models to thrive in driving infinite progress and adoption in digital payments up until 2033.

By Component, Platform Retains Market Leadership, Professional Services Gain Popularity:

As of 2025, there were more than 800k businesses that used the platform for frictionless payments, auto-activity and systemization. Professional services, meantime, are quickly gaining interest, with nearly 300,000 organizations looking to get that hands-on assistance in order to streamline workflows. With continued demand for API-led personalization and tailored advisory, supply is expected to boom by 2033 so long as providers invest in ideal solutions that cater for ever-more sophisticated sectoral needs across the planet.

By Organization Size, Large Enterprises Lead, SMEs Show Rapid Growth:

By 2025, main enterprise adoption of PaaS solutions will consolidate over 700,000 small IoT end-point device vendors, enabling advanced payment automation for efficiency and risk management. SMEs are quickly coming up, with around 350,000 businesses adopting PaaS to facilitate operations and compete digitally. By 2033, the explosion of SME uptake will have rewritten market dynamics with providers being pressured to provide more scalable, flexible and cost-effective solutions for the world’s smaller businesses.

By Industry Vertical, BFSI Leads, Healthcare Expands Fastest:

BFSI businesses used PaaS to process large volumes of transactions securely, serving over 500,000 institutions by 2025. Healthcare is rapidly following suit, with 220,000 hospitals and clinics leveraging digital payment solutions to help them streamline the handling of patient billing and insurance claims. The growing digitization of the healthcare sector will foster innovation in response, where providers will form bespoke, secure and compliance-driven payment solutions to cater for different industry demands by 2033.

By Payment Method, Digital Wallets Dominate, Bank Transfers Grow Rapidly:

Digital wallets enabled billions of transactions for more than 600,000 users globally in 2025 and were the payment method of choice because they make everyday payments fast, convenient and contactless. The traditional Bank Transfer was a runaway success, adopted by over 280,000 businesses for secure and traceable payments. The continued rise of e-commerce, fintech and cross-border payments is set to transform both methods of payment by 2033, providing consumers and businesses with more convenient and flexible ways to transact.

Payment as a service Market Regional Analysis:

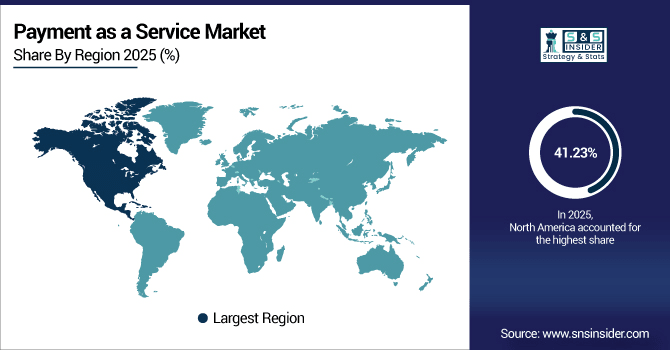

North America Payment as a Service Market Insights:

In 2025, North America accounted for 41.23% of the global Payment as a Service market, serving over 420,000 enterprises. The big business end of town made up 290,000 users, with SMEs adding a 130,000-strong verse of adopters. Cloud-based software was backed by 250,000 organizations and the company’s professional and managed services served 170,000 customers. BFSI and retail industries were early adopters, while digital wallets and API-based solutions simplified transactions. The market is projected to expand at a moderate pace through 2033, supported by continued fintech advancements and e-commerce growth.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Payment as a Service Market Insights:

The 2025 US market for PaaS catered to over 420,000 companies: 250,000 senior level corporations and 170,000 mid-sized businesses; digital wallets conducted 180 million transactions, cloud platforms served up to 260,000 entities while API integrations were implemented by 150,000 firms. It is driven by e-commerce, fintech innovation and the need for fast, secure and contactless payments.

Asia-Pacific Payment as a Service Market Insights:

The Asia-Pacific Payment as a Service market, the fastest-growing region, is projected to expand at a CAGR of 18.80% through 2033. In 2025, PaaS adoption will exceed 360,000 companies with China profiting the most (140,000), followed by India (110,000) and Japan (45,000). Cloud services were delivered to 220,000 organizations and digital wallets handled 160 million transactions. Digital payments are rapidly expanding across the region, prompted by increasing e-commerce sales, fintech innovation and mobile payment uptake.

China Payment as a Service Market Insights:

In 2025, the number of participants of China Payment as a Service market has surpassed 140,000 which includes about 70,000 large firms and around 70,000 SMEs. Cloud platforms were used by 90,000 organizations and digital wallets processed 65 million transactions. Adoption was further buoyed by e-commerce penetration, mobile payments, and API-led integrations that laid the groundwork for massive market growth through 2033.

Europe Payment as a Service Market Insights:

In 2025, Europe’s Payment as a Service market empowered over 210,000 enterprises, with Germany leading at 55,000, the UK at 50,000, and France at 45,000. Billing clouds were used by 120,000 businesses, and digital wallets processed 95 million transactions. Automation became more acceptable to big businesses, small and midsize enterprises picked swift adaptations and market growth will be dynamic through 2033 under the impetus of fintech dynamics, e-commerce spike and those for safe, convenient, contactless payments.

Germany Payment as a Service Market Insights:

In 2025, Germany’s Payment as a Service market counted more than 55,000 businesses; among them there were 30,000 large enterprise and about 25,000 SMEs. 35,000 organizations were on cloud platforms and 25 million transactions went through digital wallets. Hiked e-commerce market growth, fintech innovation and need for safe, seamless and contactless payments are also anticipated to drive market growth up to 2033.

Latin America Payment as a Service Market Insights:

The Payment as a Service market in Latin America had over 35,000 contributors in 2025 with Brazil, Mexico and Argentina carrying the lead. Of these, 20,000 were large enterprises and about 15,000 were SMEs. 22,000 organizations were enabled with cloud platforms, and 18 million transactions were carried out through digital wallets. The e-commerce surge, mobile payment and fintech innovations will lead to robust adoption until 2033.

Middle East and Africa Payment as a Service Market Insights:

In 2025, the Payment as a Service market in MEA was catering to over 8,500 enterprises across the region around 5,000 large enterprises and about 3,500 SMEs. The cloud platform handled 6,000 organizations and digital wallets processed 4 million transactions. Growth is driven by increasing e-commerce, the adoption of mobile payments and the demand for secure, frictionless, and contactless options through 2033.

Payment as a Service Market Competitive Landscape:

And since 1998, PayPal has been the trusted infrastructure for digital payments and by 2025 it had over 430 million active accounts. It offers an effective, secure and simple way to connect buyers with sellers on a global scale from e-commerce to peer-to-peer transactions. Breakthroughs such as cross-border payments and digital wallets is what keeps PayPal in the number one position in the PaaS world–retaining lifelong customers, reusage while determining how online financial transactions can be performed globally.

-

In September 2025, in a deal with Google, PayPal will add AI and analytics to payment services. It also rolled out “PayPal World” to make cross-border transactions easier, integrating with domestic systems like India’s UPI for more efficient international payments.

Stripe, founded in 2010, is reimagining how businesses pay out funds and enables more than 2 million companies in over 2025 by providing intuitive APIs and a global payment infrastructure that processes transactions across 135 countries. Startups and multinational companies around the world harness Stripe’s software to accept payments, expand their businesses online and start new companies. Has been darling for the fans, focus on Developers, relentless innovation in product offering and rewritten the digital payment experiences to compete with market leader as a strong PaaS powerhouse.

-

In July 2025, Stripe launched Managed Payments to power tax, dispute and global checkout features for sellers. And it rolled out AI-powered dispute tools and 25 new payment methods to access global payments.

The company the San Francisco-based company founded in 2009, provides integrated point-of-sale systems, mobile payments and financial and marketing services to more than 3 million merchants in 2025. From small corner stores to e-commerce giants, its products help commerce go faster. With simplicity, scale, innovation Square’s thought leadership of the PaaS universe has leveraged everyday transactions to keep Square dominant today and for years to come worldwide.

-

In May 2025, Square announced “Square Releases,” which included its pocket-size Square Handheld device for mobile sales and inventory management. It also offered a new version of Square Online to help businesses more effectively manage their e-commerce presence.

Payment as a Service Market Key Players:

Some of the Payment as a Service Market Companies are:

-

PayPal

-

Stripe

-

Square (Block, Inc.)

-

Adyen

-

Worldpay (Global Payments)

-

FIS

-

Visa

-

Mastercard

-

American Express

-

Apple Pay

-

Google Pay

-

Alipay

-

WeChat Pay

-

Klarna

-

Affirm

-

Braintree (a PayPal service)

-

Toast

-

Remitly

-

ACI Worldwide

-

Paysafe

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 20.21 Billion |

| Market Size by 2033 | USD 73.77 Billion |

| CAGR | CAGR of 17.59% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Platform, Professional Services, Managed Services, Others) • By Deployment Mode (Cloud, On-Premises, Others) • By Organization Size (Large Enterprises, SMEs, Others) • By Industry Vertical (BFSI, Retail & E-commerce, Healthcare, Travel & Hospitality, Government, Others) • By Payment Method (Credit/Debit Cards, Digital Wallets, Bank Transfers, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | PayPal, Stripe, Square (Block, Inc.), Adyen, Worldpay (Global Payments), FIS, Visa, Mastercard, American Express, Apple Pay, Google Pay, Alipay, WeChat Pay, Klarna, Affirm, Braintree (a PayPal service), Toast, Remitly, ACI Worldwide, Paysafe |