Magnetic Refrigeration Market Report Scope and Overview:

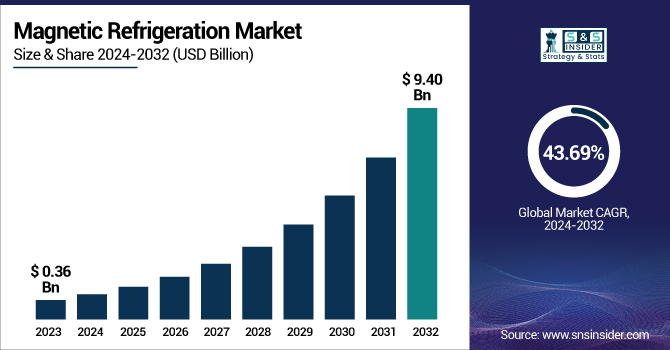

The Magnetic Refrigeration Market was valued at USD 0.52 billion in 2024 and is projected to reach USD 9.40 billion by 2032, growing at a CAGR of 43.70% from 2025 to 2032.

The market is driven by increasing demand for energy-efficient cooling solutions, strict environmental regulations, and the phase-out of harmful refrigerants under policies like the Kigali Amendment. The technology offers higher efficiency (20-30%) compared to conventional refrigeration, reducing energy consumption and carbon emissions by up to 60%.

To Get more information on Magnetic Refrigeration Market - Request Free Sample Report

Magnetic Refrigeration Market Size and Forecast:

-

Market Size (2024): USD 0.52 Billion

-

Market Size (2032): USD 9.40 Billion

-

CAGR (2025–2032): 43.70%

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Magnetic Refrigeration Market Highlights:

-

Rapid adoption in commercial refrigeration, air conditioning, and heat pumps with large-scale commercialization expected by 2030.

-

U.S. market valued at USD 0.09 billion in 2024 and projected to reach USD 1.87 billion by 2032 at a CAGR of 53.32%, driven by government incentives and sustainable cooling demand.

-

Magnetic refrigeration reduces energy consumption by 20–30% compared to traditional systems, eliminates compressors, and lowers maintenance costs.

-

Uses non-toxic refrigerants, meeting international regulations for greenhouse gas and global warming control.

-

Magnetocaloric materials often perform optimally at low temperatures, limiting efficiency in commercial and domestic applications while research continues to improve room-temperature performance.

-

Integration with smart technologies and IoT enables real-time optimization, predictive maintenance, and energy savings across industrial, medical, and food storage applications.

Adoption is accelerating, particularly in commercial refrigeration, air conditioning, and heat pumps, with large-scale commercialization expected by 2030. In the U.S., the market was valued at USD 0.09 billion in 2024 and is projected to surge to USD 1.87 billion by 2032, growing at an impressive CAGR of 53.32%, driven by strong government incentives and rising demand for sustainable cooling technologies in industrial and commercial applications.

Magnetic Refrigeration Market Drivers:

-

Revolutionizing cooling with magnetic refrigeration for a more energy-efficient future.

Magnetic refrigeration technology is emerging as a significant driver in the cooling industry due to its superior energy efficiency and cost-saving potential. Studies indicate that magnetic refrigeration systems can achieve a 20–30% reduction in energy consumption compared to traditional vapor-compression systems. This efficiency stems from the elimination of compressors, leading to simpler designs with fewer moving parts, thereby enhancing system durability and reducing maintenance costs. Moreover, a magnetic refrigeration system does not require the usage of toxic refrigerants, and therefore complies with the international environmental regulations in the field of global warming control. The U.S. Department of Energy has emphasized, that magnetocaloric refrigeration systems, have the potential to offer significant energy savings — up to an estimated 20% more than conventional systems. These factors together suggest that magnetic refrigeration is an emerging game-changing technology that offers significant potential for improving energy efficiency and reducing operating costs in a wide array of cooling applications.

Magnetic Refrigeration Market Restraints:

-

Inconsistent Efficiency of Magnetocaloric Materials at Room Temperature

Magnetocaloric materials used in magnetic refrigeration systems often exhibit peak efficiency at cryogenic or low temperatures, limiting their effectiveness in commercial and domestic cooling applications. This temperature dependence makes it challenging to maintain consistent cooling performance across varying environmental conditions. For applications such as household refrigerators, air conditioning, and retail refrigeration, the efficiency gap compared to traditional vapor-compression systems remains a hurdle. Researchers are actively developing new magnetocaloric alloys that can deliver stable cooling performance at room temperature, but large-scale commercialization is still in progress. Advances in nanostructured materials, composite refrigerants, and hybrid cooling technologies are being explored to enhance system efficiency. Until these breakthroughs translate into cost-effective solutions, performance inconsistencies remain a key barrier to widespread adoption of magnetic refrigeration in mainstream cooling markets.

Magnetic Refrigeration Market Opportunities:

-

Smart technology enhances magnetic refrigeration with real-time optimization and IoT integration.

The growing adoption of smart refrigeration systems and IoT-enabled cooling solutions presents a major opportunity for magnetic refrigeration. Such products can seamlessly integrate real-time energy optimization, allowing cooling performance to adapt dynamically by analyzing usage trends, environmental conditions, and predictive maintenance algorithms. Furthermore, the integration of IoT sensors and AI-driven software allows for temperature sensors to be optimized for accuracy leading to less energy being wasted and greater overall efficiency. Machine learning can boost the performance of magnetic refrigeration able to anticipate cooling needs and adjust performance to maximize efficiency. The increased connectivity capabilities also enable remote diagnostics and automatic fault detection, further reducing downtime and costs associated with maintenance. In the context of industrial refrigeration, medical storage, and intelligent food processing, combining magnetic refrigeration with IoT can reduce costs while also promoting efficiency in cooling.

Magnetic Refrigeration Market Segment Analysis:

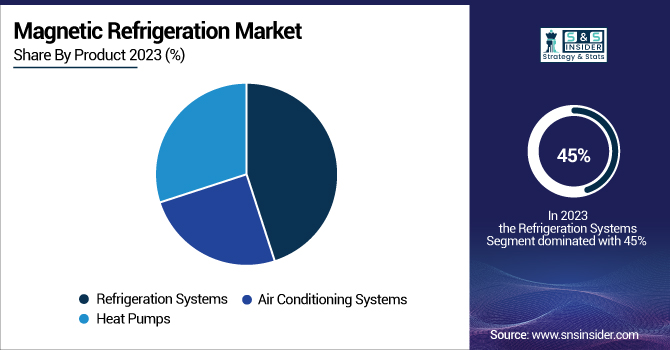

By Product

The Refrigeration Systems segment held the largest market share, accounting for approximately 45% of the total revenue in 2024. The segment dominance is attributed to the increasing adoption of energy-efficient and eco-friendly refrigeration systems across numerous commercial and industrial applications, as well as in medical applications. Magnetic refrigeration technology adoption presents a sustainable alternative to conventional vapor-compression cooling in refrigeration because of its low energy consumption and environmentally friendly design. This segment is supported by the booming food and beverage industry, as well as pharmaceutical storage, leading to further demand for accurate and reliable refrigeration systems. Research is also being conducted on magnetocaloric materials and system design to improve the efficiency of magnetic refrigeration, which may lead to its use in commercial products.

The Air Conditioning Systems segment is the fastest-growing in the magnetic refrigeration market, driven by the increasing demand for energy-efficient and eco-friendly cooling solutions. As governments globally tighten controls on refrigerant emissions under environmental regulations, industries are moving towards sustainable alternatives such as magnetic refrigeration. Whether it is residential or commercial, the installation of magnetocaloric air conditioning is increasing due to the lower energy, lower greenhouse gas emissions and almost non-existing maintenance requirement. Moreover, the development of smart cooling technologies and integration with IoT technology is improving system efficiencies, which in turn will propel market growth.

By Application

The Commercial segment dominated the magnetic refrigeration market, accounting for approximately 39% of total revenue in 2024. This leadership is bolstered by increasing adoption of energy-efficient cooling solutions in supermarkets, hotels, restaurants, and retail chains as refrigeration is vital for food preservation and storage. However, businesses are moving to magnetic refrigeration due to growing environmental concerns and regulations on conventional refrigerants. Climate change, along with rising electricity prices, is forcing companies to turn to more sustainable and cost-effective cooling technologies. Improvements in magnetocaloric materials further stimulate the demand through enhanced system efficiency and scalability. Since commercial refrigeration systems need to run 24/7, the superior durability and low maintenance of magnetic refrigeration systems is appealing.

The Transportation segment is the fastest-growing in the magnetic refrigeration market from 2025 to 2032, driven by the increasing demand for energy-efficient and eco-friendly cooling solutions in logistics, cold chain supply, and automotive applications. As electric vehicles (EVs) and hybrid transport systems gain traction, the need for sustainable refrigeration in trucks, trailers, and shipping containers is rising. Magnetic refrigeration, with its low energy consumption and reduced environmental impact, is emerging as a viable alternative to traditional cooling systems. Additionally, stringent emission regulations and fuel efficiency standards are encouraging the adoption of zero-emission refrigeration technologies in transportation. The integration of smart cooling systems and IoT-enabled monitoring further enhances operational efficiency, reducing maintenance costs and ensuring precise temperature control for perishable goods.

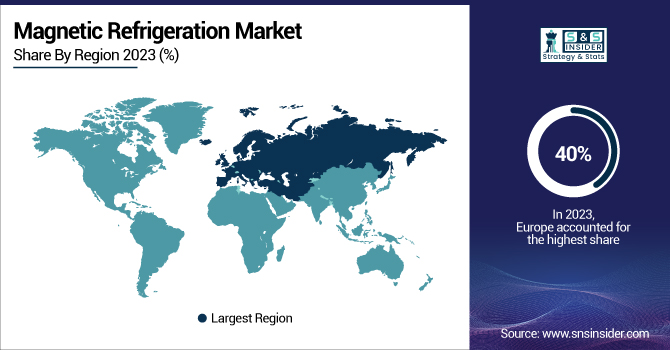

Magnetic Refrigeration Market Regional Analysis:

Europe Magnetic Refrigeration Market Trends:

The Europe region dominated the magnetic refrigeration market in 2024, accounting for approximately 40% of total revenue. This leadership is driven by strict environmental regulations, including the F-Gas Regulation, which limits the use of harmful refrigerants and promotes sustainable cooling technologies. European countries are rapidly adopting energy-efficient refrigeration systems across commercial, industrial, and transportation sectors to reduce carbon emissions and comply with climate goals. Additionally, high electricity costs in the region are encouraging businesses to invest in low-energy-consuming cooling solutions, further driving demand. The presence of leading research institutions and companies innovating magnetocaloric materials and system designs has also strengthened Europe's position in this market. With strong government incentives, rising demand for green refrigeration, and growing investments in sustainable cold chain logistics, the region is expected to maintain its market dominance in the coming years.

North America Magnetic Refrigeration Market Trends:

The North America region is the fastest-growing market for magnetic refrigeration from 2025 to 2032, mainly due to the accelerating provision for energy efficient and ecological friendly food production solutions in multiple end-use sectors. Strict environmental regulations, like the U.S. EPA’s restrictions on hydrofluorocarbons (HFCs), are propelling businesses toward sustainable refrigeration options. Moreover, high electricity prices along with growing consumer awareness of green technologies are driving up demand for magnetocaloric refrigeration in commercial, industrial and transportation applications. This easy access to cold chain is further driving the expansion of the cold chain industry, specifically in pharmaceuticals and food storage. Owing to robust research funding, breakthroughs in technology, and government incentives, North America is set for a rapid expansion with being the fastest growing region in the market.

Asia-Pacific Magnetic Refrigeration Market Trends:

Asia-Pacific is emerging as a highly attractive market for magnetic refrigeration, driven by rapid industrialization, urbanization, and rising demand for energy-efficient cooling solutions. Countries like China, Japan, South Korea, and India are prioritizing sustainable technologies to meet climate commitments and reduce dependency on hydrofluorocarbons (HFCs). The region’s booming retail and food processing sectors are fueling investments in next-generation refrigeration systems to strengthen cold chain logistics. Additionally, government initiatives promoting low-carbon technologies, coupled with rising consumer demand for eco-friendly appliances, are boosting market growth. With increasing R&D investments and collaborations between global players and regional manufacturers, Asia-Pacific is expected to register strong growth and become a leading hub for magnetic refrigeration innovation during the forecast period.

Latin America Magnetic Refrigeration Market Trends:

Latin America is gradually adopting magnetic refrigeration technologies, supported by rising demand for sustainable cooling solutions in food, beverage, and pharmaceutical sectors. Countries such as Brazil, Mexico, and Chile are driving adoption as they face growing electricity costs and stricter environmental regulations aligned with international climate agreements. The expansion of modern retail and logistics infrastructure in the region is further fueling demand for energy-efficient refrigeration systems. Although the market is still at an early stage, increasing investments from multinational players and regional governments’ emphasis on reducing greenhouse gas emissions are expected to accelerate adoption. Latin America presents a promising opportunity for long-term growth as awareness of green technologies expands.

Middle East & Africa Magnetic Refrigeration Market Trends:

The Middle East & Africa region is experiencing rising interest in magnetic refrigeration due to growing energy demand, high ambient temperatures, and the urgent need for sustainable cooling technologies. Gulf countries, including the UAE and Saudi Arabia, are investing heavily in advanced refrigeration solutions as part of their sustainability and diversification strategies. Meanwhile, in Africa, rapid urbanization and improvements in food storage and pharmaceutical cold chains are driving adoption. Government initiatives promoting energy-efficient technologies, coupled with international collaborations, are helping to build awareness and foster deployment. While adoption is currently limited compared to other regions, strong infrastructure development and rising demand for green technologies position the Middle East & Africa as a steadily growing market for magnetic refrigeration in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Magnetic Refrigeration Market Key Players:

-

Haier Smart Home Co., Ltd. (China)

-

Camfridge Ltd (UK)

-

Astronautics Corporation of America (US)

-

VACUUMSCHMELZE GmbH & Co. KG (Germany)

-

BASF SE (Germany)

-

ERAMET (France)

-

Samsung Electronics Co., Ltd. (South Korea)

-

Toshiba Corporation (Japan)

-

Sigma-Aldrich Corporation (US)

-

General Electric (US)

-

Magnotherm Solutions (Germany)

-

ALTO Refrigeration Manufacturing Co., Ltd. (China)

-

kiutra (Germany)

-

Cooltech Applications (France)

-

Magnoric (France)

-

Ubiblue (France)

-

Gree Electric Appliances (China)

-

Aqwest (US)

-

Elekta AB (Sweden)

List of Suppliers of raw material and component for Magnetic Refrigeration Market:

-

General Engineering & Research LLC USA

-

VACUUMSCHMELZE GmbH & Co KG Germany

-

MAGNOTHERM Solutions GmbH Germany

-

AMT&C Group Russia

-

CamCool Research Ltd UK

Magnetic Refrigeration Market Competitive Landscape:

Haier Smart Home Co., Ltd., established in 1984, is a global leader in home appliances and smart home solutions, serving over 1 billion households across 200+ countries. With strong brand recognition, extensive manufacturing and sales networks, and strategic acquisitions, Haier excels in innovation, sustainability, and market expansion worldwide

-

In January 2025: Haier named No. 1 global major appliances brand by Euromonitor International for the 16th consecutive year, leading refrigerators, laundry, freezers, and wine coolers. Haier expands globally with new facilities in Thailand and Egypt, and strategic acquisitions including Kwikot and Carrier Commercial Refrigeration, strengthening its presence in 200+ countries.

Camfridge, established in 2005, is the oldest magnetic refrigeration company, pioneering sustainable cooling solutions with low-cost, gadolinium-free refrigerants. Leveraging extensive R&D, compact system designs, and strong OEM partnerships, Camfridge focuses on energy-efficient, environmentally friendly refrigeration technologies, aiming to reduce carbon emissions and enable scalable, commercially viable magnetocaloric cooling solutions worldwide.

-

In December 2024: Camfridge, founded in 2005 and the oldest magnetic cooling company, is ready to scale its Net Zero solution using low-cost, gadolinium-free refrigerants. The company leverages over a decade of R&D, compact system design, and partnerships with OEMs to reduce carbon impact and energy consumption in refrigeration.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 0.52 Billion |

| Market Size by 2032 | USD 9.40 Billion |

| CAGR | CAGR of 43.70% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Refrigeration Systems, Air Conditioning Systems, Heat Pumps) • By Application (Domestic, Commercial, Transportation, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Haier Smart Home Co., Ltd., Camfridge Ltd, Astronautics Corporation of America, VACUUMSCHMELZE GmbH & Co. KG, BASF SE, ERAMET, Samsung Electronics Co., Ltd., Toshiba Corporation, Whirlpool Corporation, Sigma-Aldrich Corporation, General Electric, Magnotherm Solutions, ALTO Refrigeration Manufacturing Co., Ltd., kiutra, Cooltech Applications, Magnoric, Ubiblue, Gree Electric Appliances, Aqwest, Elekta AB |