Industrial Refrigeration Market Report Scope & Overview:

Get more information on Industrial Refrigeration Market - Request Sample Report

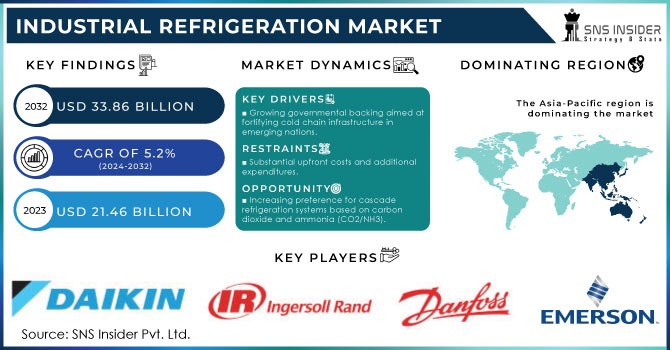

The Industrial Refrigeration Market size was valued at USD 21.46 Billion in 2023. It is estimated to reach USD 33.86 Billion by 2032 with a growing CAGR of 5.2% over the forecast period 2024-2032.

The Industrial Refrigeration Market plays a crucial role in the global industrial sector, catering to different industries in need of controlled temperatures. This list comprises food and drinks, medicines, substances, and oil-based substances, along with temperature-controlled storage and transportation. Industrial refrigeration systems are created to keep temperatures low in order to protect perishable items, avoid decay, and guarantee the safety and quality of temperature-sensitive products. The industry has experienced notable growth because of the rising need for frozen and chilled food items, particularly as the food processing sector expands. The increasing demand for industrial refrigeration solutions is fueled by the growing trend of ready-to-eat and convenience foods. The increasing world population and urbanization have raised the demand for effective cold storage options, particularly in emerging nations, pushing the market ahead. Technological progress is essential in influencing the market's development. New technologies like intelligent refrigeration systems, monitoring using IoT, compressors that save energy, and eco-friendly refrigerants such as CO2 and ammonia are decreasing energy usage and environmental effects. Manufacturers are increasingly turning to sustainable refrigeration practices due to environmental issues and strict regulations. The industrial refrigeration market is encountering obstacles like the expensive initial outlay for advanced systems and increasing energy expenses. Furthermore, the sector needs to overcome regulatory obstacles connected to the replacement of old-fashioned refrigerants with high global warming potential (GWP) and embrace greener alternatives.

Industrial refrigeration systems are essential in a wide range of industries, such as pharmaceuticals, food and beverage, processing, and chemicals. These systems play a crucial role in storing cold food, producing beverages, processing dairy, operating ice rinks, and in heavy industrial settings. They ensure specific temperatures are maintained by extracting heat from Applications or processes. The demand for efficient refrigeration has significantly increased due to the rapid growth of e-commerce grocery sales, which is surpassing physical grocery sales. Utilizing technologies like evaporator/passive coolers and absorption refrigerators is crucial in minimizing post-harvest spoilage through cold chains. Elevated temperatures and agricultural weather conditions also play a role in the demand for strong refrigeration options, specifically in areas with harsh climates. Yet, in developing nations, the implementation of cold chain systems is still restricted because of financial limitations and inadequate access to sophisticated machinery. In order to address these challenges, top companies are prioritizing technological progress, streamlining refrigeration systems, and improving efficiency. In June 2022, Emerson Electric Co. achieved a major milestone by placing 200 Billion Copeland compressors globally, recognized for their reduced global warming potential (GWP) and improved efficiency in commercial and residential uses. Businesses are increasingly opting for eco-friendly technologies such as Active Magnetic Regenerative (AMR) refrigeration, which can decrease energy usage by 30% by leveraging magnetocaloric effects. Besides AMR, advancements such as artificial intelligence (AI), next-gen technologies, and the Internet of Things (IoT) are creating new possibilities for manufacturers to enhance refrigeration efficiency. Johnson Controls showcased in September 2022 how their innovative financing choices and discounts are increasing access to residential energy efficiency, showcasing the sector's dedication to environmentally friendly and economical solutions.

The industrial refrigeration market is witnessing significant growth driven by the evolution of next-generation refrigerants that offer both economic and environmental benefits. The shift from traditional refrigerants such as ammonia, sulfur dioxide, and HFCs, which either posed safety risks or contributed to ozone depletion and global warming, has led to the development of hydrofluoroolefins (HFOs). These advanced refrigerants are non-toxic, non-flammable, and have a much lower global warming potential (GWP), breaking down in days rather than years in the atmosphere. This technological leap is critical as industrial refrigeration systems are essential across industries like food & beverage, pharmaceuticals, and manufacturing, where maintaining precise temperatures is paramount. HFOs have already prevented more than 200 Billion metric tons of greenhouse gas emissions globally, equivalent to the emissions from over 42 Billion cars. The refrigeration industry’s adoption of HFOs in automotive air-conditioning, commercial refrigeration, and air conditioning has contributed to a significant reduction in energy consumption by up to 10% and a threefold reduction in global warming potential. Additionally, the industry is poised for further growth as HFOs are increasingly adopted in data center cooling, heat pumps for electric power, and electric vehicle battery cooling, all critical sectors in today’s economy. The job market within this sector is also expanding, with the U.S. Bureau of Labor Statistics predicting a 5% increase in the HVACR workforce by 2029. The combination of economic growth, environmental protection, and job creation underscores the transformative impact of next-generation refrigerants in powering the industrial refrigeration market, contributing to a more sustainable and efficient global economy.

Market Dynamics

Drivers

- Navigating environmental laws to promote sustainable refrigeration solutions.

With the growing focus on the environment, industries are facing more regulations to reduce greenhouse gas emissions and eliminate damaging refrigerants such as CFCs and HFCs. This change is especially evident in the industrial refrigeration sector, where it is becoming increasingly crucial to use environmentally-friendly refrigerants. Governments around the world are enacting more stringent environmental regulations to safeguard the ozone layer and reduce carbon footprints from refrigeration systems. The Kigali Amendment to the Montreal Protocol is a notable instance, establishing ambitious goals for decreasing HFC emissions, potent greenhouse gases. By promoting the shift to eco-friendly refrigerants with low global warming potential, like hydrofluoroolefins (HFOs), the change backs environmental sustainability and adherence to changing rules. In the United States, the EPA has implemented initiatives to support the shift to eco-friendly options, emphasizing the importance of businesses embracing sustainable methods. Furthermore, business strategies are being more and more influenced by corporate sustainability initiatives, as companies understand the significance of aligning with environmental goals. This involves funding for cutting-edge refrigeration technologies that reduce environmental harm and improve efficiency.

- The Role of Industrial Refrigeration in Data Center Efficiency: Impact on Cooling in the Digital Age

The substantial growth of data centers globally, fueled by the rise in cloud computing, the Internet of Things (IoT), and big data analytics, has notably elevated the need for dependable and energy-saving cooling options. With the increasing volume of data being created and analyzed, it is crucial to maintain ideal operating conditions in data centers. Industrial refrigeration systems are important in preventing servers and IT equipment from overheating, allowing these facilities to function effectively without any interruptions. Conventional cooling systems frequently do not fully handle the increased heat loads found in today's data centers, making sophisticated refrigeration systems essential. The growing interest in sustainable design for data centers is increasing this need even more. Operators are increasingly concentrating on installing cooling technologies that reduce energy usage while maximizing efficiency. This involves implementing cutting-edge industrial refrigeration technologies, like those that use refrigerants with low-global warming potential, to improve cooling efficiency and support environmental objectives. By merging these systems, data centers can lower their carbon emissions and enhance energy efficiency, fulfilling regulatory requirements and corporate sustainability goals. Therefore, industrial refrigeration is not just a practical requirement; it plays a key role in the advancement of data center infrastructure, allowing businesses to handle the growing need for digital services while focusing on environmental sustainability.

Restraints

- The Effect of Expensive Installation Costs on Industrial Refrigeration Navigating Challenges

The industrial refrigeration market is heavily constrained by the costly installation expenses linked to these systems. Industrial refrigeration systems are intricate and necessitate a significant investment in components like compressors, condensers, and evaporators, which are crucial for their effective functioning. The advanced control systems needed to oversee these systems also increase the initial investment. Furthermore, numerous industrial refrigeration uses depend on substances such as ammonia and specific hydrocarbons, which, although efficient, come with safety hazards because of their flammability and corrosive nature. When working with ammonia, it is important to follow strict safety protocols, such as installing safety equipment to reduce the dangers of exposure, since inhaling high concentrations can be harmful or potentially deadly. These safety measures increase initial expenses and require continuous training for staff to guarantee safe operation, leading to increased operational costs. In addition to initial installation and training costs, industrial refrigeration systems also face significant ongoing expenses due to regular maintenance and energy consumption. Energy expenses can become significantly steep, particularly in extensive operations where refrigeration is vital for production and storage processes. These elements come together to form a monetary obstacle for numerous companies aiming to implement or enhance their refrigeration systems, ultimately hindering market expansion. The financial feasibility of advanced refrigeration technologies is a critical concern for companies, impacting decisions on system upgrades and investments in energy-efficient solutions due to high upfront and ongoing costs.

Segment Analysis

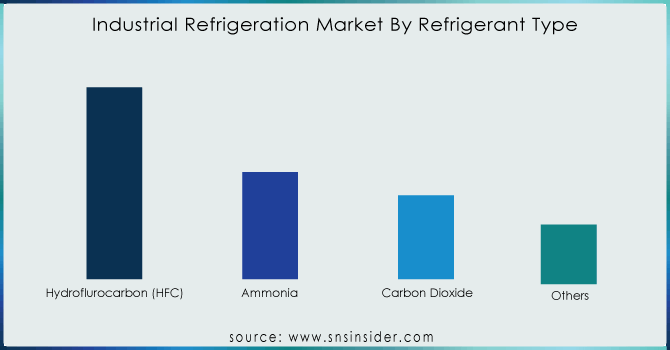

By Refrigerant Type

Based on Refrigerant Type, Ammonia has become the top refrigerant in the industrial refrigeration sector, holding a substantial 38% revenue share in 2023. The reason for this dominance is the superior cooling capacity of ammonia, which allows ammonia-based refrigeration systems to operate more efficiently than those using other refrigerants. The cost savings from using energy-efficient ammonia systems, as well as their support for environmental sustainability goals, makes them an appealing option for various industries. After January 1, 2020, with the global ban on hydrochlorofluorocarbons (HCFCs), companies are increasingly shifting towards industrial refrigeration alternatives that are compatible with ammonia. There are clear signs of advancements in this industry, as many companies are unveiling improved ammonia refrigeration systems that prioritize safety and efficiency. One recent product release is integrated monitoring systems using IoT technology to enhance performance, predict maintenance, so systems run efficiently, and minimize downtime. Furthermore, businesses are creating second-layer containment options and innovative safety measures to reduce the dangers linked to ammonia usage, tackling safety issues that may discourage potential users. Key industry leaders are also prioritizing the updating of current refrigeration systems to support ammonia, allowing operators to switch from old HCFC systems without having to completely remodel. These developments demonstrate the sector's dedication to sustainability and provide increased operational adaptability for companies. The increasing need for effective and eco-friendly refrigeration solutions is projected to enhance ammonia's role as a favored refrigerant, leading to further progress in industrial refrigeration technologies and methods.

By Capacity

Based on Capacity, 500kW-1,000kW is captured the largest share in Industrial Refrigeration market with 36% of share in 2023. This specific capacity sector is highly preferred in a wide range of industries such as food and beverage, pharmaceuticals, and chemical processing, where effective temperature control and cooling are crucial. These systems offer a perfect combination of energy efficiency and performance, making them well-suited for medium to large-scale operations. As companies place more importance on sustainability and energy efficiency, manufacturers are creating new products to address these demands. Prominent releases in this category consist of improved ammonia and CO2 refrigeration systems that boost cooling effectiveness and lower environmental harm. For example, some businesses have recently launched adaptable refrigeration units that can be adjusted to accommodate different cooling needs, especially in changing production settings. These modular systems come with intelligent controls and IoT features, allowing for immediate monitoring and optimization of energy consumption. Moreover, manufacturers are placing emphasis on integrating variable-speed compressors in this range of capacity in order to enhance efficiency and cut down on operational expenses. This is in line with the current industry shift towards implementing more environmentally friendly practices, with companies aiming to reduce their carbon emissions while also ensuring that their cooling systems remain dependable. With the increasing need for effective temperature control across various industries, the 500kW to 1,000kW segment of refrigeration systems is expected to expand further due to technological advancements. This trend highlights the importance of industrial refrigeration in modern manufacturing and processing, making it a crucial investment for companies looking to improve efficiency and sustainability.

Get Customized Report as per your Business Requirement - Request For Customized Report

Regional Analysis

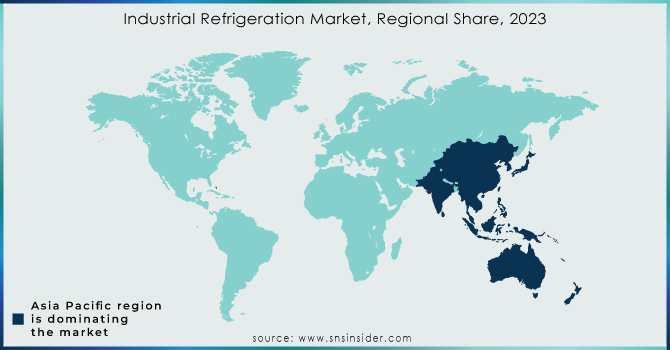

North America stands out as the dominant region in the industrial refrigeration market, holding a substantial revenue share of 34% in 2023. The substantial increase is largely due to the swift growth of the e-commerce sector, especially in the U.S. and Canada, where online grocery shopping has become a common practice among consumers. The move to online shopping has increased the need for better transportation and logistics, leading to a higher demand for improved refrigeration systems in order to safely transport fresh products. Therefore, companies are investing more in new refrigeration technologies to improve cold chain logistics. For example, some top companies have introduced new refrigeration systems tailored for the e-commerce industry, which allow for immediate temperature tracking and regulation while goods are being transported. Not only are these systems energy-efficient, but they also integrate IoT connectivity to enhance operational visibility. Moreover, the cold storage sector in North America is seeing significant expansion, driven by a continuous need for improved refrigeration systems capable of handling bigger stock and higher throughput. Businesses are reacting to this situation by creating large cold storage buildings that have advanced refrigeration technology like ammonia-based and CO2 systems for better cooling efficiency. Recent introductions of products consist of modular cold storage units that can be quickly set up and expanded to meet changing market needs. As e-commerce grows in North America and cold storage capabilities expand, the industrial refrigeration market is expected to prosper, with companies working to improve their products to meet the changing needs of food distribution and logistics. In such a fast-moving consumer market, the importance of advanced refrigeration solutions is emphasized in order to meet the constantly changing needs.

Asia-Pacific is the second fastest region in industrial refrigeration market with largest share revenue in 2023. Driven by substantial investments in cold chain storage facilities in countries like China, India, and Japan, the Asia-Pacific region has become the second fastest-growing in the industrial refrigeration market. China, the biggest fruits and vegetables producer globally, is increasing its cold storage capacity to aid both local consumption and international trade. Efforts by the Chinese government to improve cold chain logistics are increasing the need for high-tech refrigeration systems in industries such as pharmaceuticals and food and drinks. Likewise, there is a growing trend in India's industrial refrigeration sector because of the surge in cold storage facilities and the higher need for effective refrigeration options. Emphasizing agricultural exports, the government has invested in refrigeration technologies to guarantee the quality and safety of perishable products. The increase in international and domestic trade in Japan for temperature-sensitive products has led to a need for advanced refrigeration systems; U.S.-Japan trade reportedly hit USD 309 billion in 2022, as stated by the International Trade Administration. Significant product releases in the area consist of energy-saving ammonia refrigeration systems created for large-scale operations, indicating a shift towards eco-friendly cooling options. Moreover, businesses are launching modular refrigeration units that can be quickly set up to address the growing need from the e-commerce industry. With ongoing investments in infrastructure and technology, the industrial refrigeration market in Asia-Pacific is expected to experience significant growth, highlighting the crucial importance of refrigeration in maintaining food safety and enhancing supply chain efficiency throughout the region.

Key Players

Here are some major key players in the industrial refrigeration market along with their products and offerings:

- Daikin Industries (Refrigeration systems, scroll compressors)

- Emerson Electric (Copeland compressors, refrigeration controls)

- GEA Group (Industrial refrigeration systems, heat exchangers)

- Ingersoll Rand (Refrigeration compressors, air management systems)

- Carrier (Refrigeration units, HVAC solutions)

- Danfoss (Compressors, electronic controls, and valves)

- Evapco (Cooling towers, evaporators, and condensers)

- Johnson Controls (Integrated cooling solutions, smart building technologies)

- LU-VE Group (Heat exchangers, refrigeration units)

- Mayekawa (Ammonia refrigeration systems, heat pumps)

- BITZER (Reciprocating compressors, condensing units)

- Mitsubishi Heavy Industries (Chillers, heat pumps)

- Panasonic (Commercial refrigeration systems, inverter technology)

- Thermo King (Transport refrigeration units, temperature control solutions)

- Carlyle Compressors (Centrifugal and reciprocating compressors)

- Baltimore Air Coil (Cooling coils, heat exchangers)

- Frascold (Compressors for refrigeration Refrigerant Types)

- Kuhnke (Control systems for industrial refrigeration)

- Sanden (Refrigeration systems for food retail)

- Toshiba Carrier (Variable refrigerant flow systems, chillers)

- Others

Recent Development

-

May 22, 2024: Isuzu Commercial Truck of America is developing an all-electric NRR EV truck featuring the Thermo King e300 transport refrigeration unit, showcasing innovations in EV powertrains at the Advanced Clean Transportation Expo in Las Vegas this week.

-

April 9, 2024: Evapco introduces its Ejet system, combining liquid recirculation performance with direct expansion (DX) design and technology for low-charge ammonia systems, calling it "the best of both worlds."

-

In November of 2023, DAIKIN Industries Ltd. launched a new line of transport refrigeration products that are fully electric or plug-in hybrid, with the goal of decreasing emissions from traditional internal combustion engines.

-

In June 2023, Johnson Controls purchased M&M Carnot, a company that offers natural refrigeration solutions with extremely low global warming potential. This purchase is expected to assist Johnson Controls in aiding customers achieve sustainability objectives. The purchase also enhanced Johnson Controls' product range, in compliance with environmental laws.

-

In March 2023 Emerson released The new Vilter-branded trans-critical CO2 compressor. The company stated that this compressor is specifically created for managing high-pressure industrial CO2 refrigeration.

-

In February, Danfoss revealed plans in February 2023 to build a factory for producing compressors and sensors in Apodaca, Mexico. The goal of this expansion strategy was to fulfill the need for cooling technology in the U.S.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 21.46 billion |

| Market Size by 2032 | USD 33.86 billion |

| CAGR | CAGR of 5.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Evaporator, Compressor, Control, Condenser, Other) • By Refrigerant Type (Hydrofluorocarbon (HFC), Ammonia, Carbon Dioxide, Other) • By Capacity (<100>5,000 Kw) • By Application (Fruit And Vegetable, Dairy And Ice Cream, Meat, Poultry, And Fish Processing, Beverage, Petrochemical, Chemical, Pharmaceutical) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Daikin Industries, Emerson Electric, GEA Group, Ingersoll Rand, Carrier, Danfoss, Evapco, Johnson Controls, LU-VE Group and Mayekawa ,BITZER ,Mitsubishi Heavy Industries ,Panasonic ,Thermo King ,Carlyle Compressors ,Baltimore Air Coil ,Frascold ,Kuhnke ,Sanden ,Toshiba Carrier & Others |

| Key Drivers |

• Navigating environmental laws to promote sustainable refrigeration solutions. • The Role of Industrial Refrigeration in Data Center Efficiency: Impact on Cooling in the Digital Age |

| Restraints | • The Effect of Expensive Installation Costs on Industrial Refrigeration Navigating Challenges |