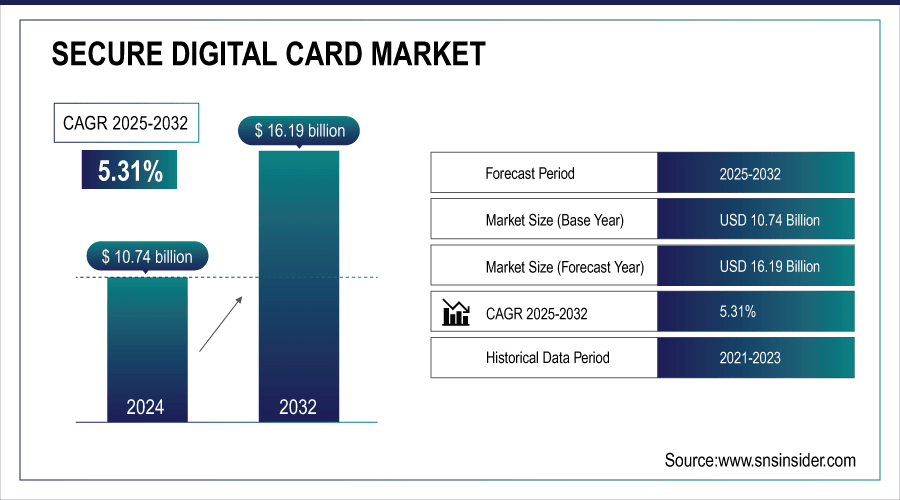

Secure Digital Card Market Size & Growth:

The Secure Digital Card Market size was valued at USD 10.74 Billion in 2024 and is projected to reach USD 16.19 Billion by 2032, growing at a CAGR of 5.31% during 2025-2032.

The global market is broken down by market dynamics, segmental analysis by type, capacity, distribution channel, and end-user and regional analysis, key drivers, restraints, and opportunities. This is fueling market growth as demand increases across several application segments including consumer electronics, automotive, and industrial, along with growing adoption of high-capacity storage solutions in smartphones, cameras, and the IoT devices. Further global market growth is being supported by the supply of integrated advanced technology and increasing digital content consumption.

-

Technological improvements allow over 80% faster file transfer and media rendering for content creators.

-

UHS-II/UHS-III SD cards allow up to 90% faster data transfers compared to standard SD cards.

To Get More Information On Secure Digital Card Market - Request Free Sample Report

Secure Digital Card Market Trends

-

High-capacity SD cards are increasingly used in smartphones, cameras, laptops, and gaming devices to manage large volumes of digital content.

-

Users prefer SD cards with faster read/write speeds and larger storage capacities, enabling smooth handling of photos, videos, and gaming data.

-

Modern SD cards feature waterproofing, shock resistance, encryption, and other durability enhancements to appeal to professional and industrial users.

-

SD cards are widely adopted in drones, high-speed cameras, IoT devices, and gaming consoles, supporting continuous and reliable performance.

-

The rise of hybrid storage and cloud integration complements SD card usage, providing flexibility and better manageability for users.

-

Continuous technological improvements drive frequent device and card upgrades, helping manufacturers differentiate products, build brand loyalty, and capture user interest.

Secure Digital Card Market Report Highlights

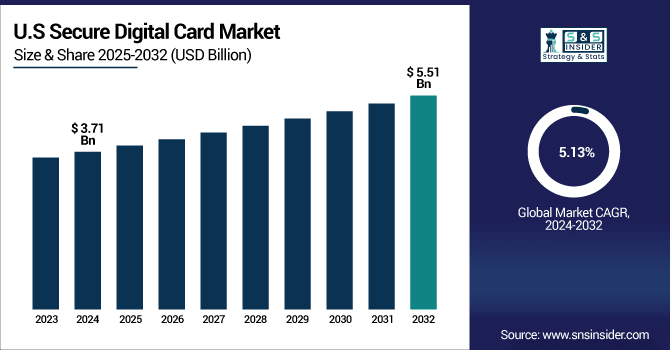

The U.S. Secure Digital Card Market size was valued at USD 3.71 Billion in 2024 and is projected to reach USD 5.51 Billion by 2032, growing at a CAGR of 5.13% during 2025-2032. Growth in the U.S. market is primarily due to increased smartphone and tablet penetration, growing digital content consumption, and the widespread adoption of high-capacity storage Devices in professional photography and videography. Continuous innovations in memory card format and increasing e-commerce footprint across the country are expected to provide an up thrust to growth of the market further. Such dynamics provide tremendous opportunities for both local and international players to expand their footprint and gain high market share in the U.S. space.

Secure Digital Card Market Trends include increasing adoption of high-capacity storage solutions, increased use of smartphones and cameras, an upsurge in digital content consumption, and applications in industrial, automotive, and IoT sectors.

Secure Digital Card Market Segment Analysis

-

By Type, SD card segment held the largest share of around 52.10% in 2024, whereas Micro SD card segment is projected to be the fastest-growing segment with a CAGR of 5.47%.

-

By Capacity, the SDXC (32GB - 2TB) dominated the market with approximately 57.10% share in 2024, while SDHC (2GB - 32GB) is expected to register the highest growth with a CAGR of 6.04%.

-

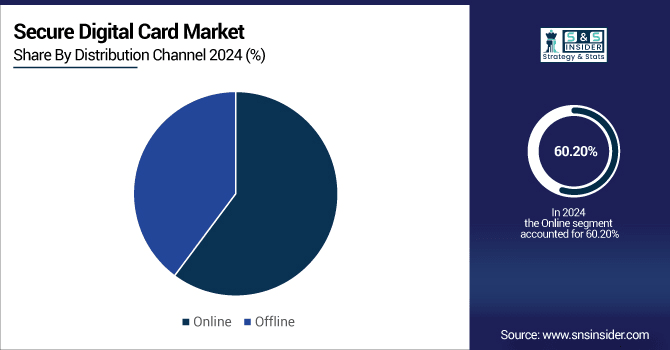

By Distribution Channel, Online segment accounted for the leading share of nearly 60.20% in 2024, and is anticipated to be the fastest-growing segment with a CAGR of 5.24%.

-

By End-User, the Consumer electronics led the market with about 45.20% share in 2024, while the Industrial is forecasted to grow the fastest at a CAGR of 7.07%.

By Distribution Channel, Online Lead And Registers Fastest Growth

The Online segment accounted for the highest revenue share of 60.20% in the Secure Digital Card Market in 2024 due to convenience, diversity, and competitive pricing, and is expected to be the fastest-growing with CAGR of 5.24% over 2024-2032 owing to growing e-commerce platforms and faster delivery channels. Amazon contributes dominantly and enables growth, due to its online marketplace.

By Type, SD Card Segment Leads Market While Micro SD Card Segment Registers Fastest Growth

SD card segment led the Secure Digital Card Market share, accounting for over 52.10% revenue share in 2024, due to their extensive adoption in cameras and laptops and other consumer electronic applications, while the Micro SD card segment is anticipated to grow at the highest CAGR of around 5.47% during 2024-2032 as they are smaller, thinner, lighter making them ideal for smartphones, drones, IoT, and many other devices. Since the latter is a crucial segment for the company to innovate in order to ensure it has its share of the market, SanDisk is one of the key players.

By Capacity, SDXC (32GB - 2TB) Dominate While SDHC (2GB - 32GB) Shows Rapid Growth

The SDXC (32GB - 2TB) segment led the Secure Digital Card Market with approximately 57.10% of revenue share in 2024 and is expected to maintain its lead due to the high-capacity storage demand for cameras, smartphones, and gaming devices, while SDHC (2GB - 32GB) segment will witness the fastest CAGR of about 6.04% during 2024-2032 as compared to its counterparts owing to sufficient storage demands for middle-range devices and for affordable storage solutions. Lexar is in the process of developing both the SDXC and SDHC products to meet the exploding demand.

By End-User, Consumer electronics Lead While Industrial Segment Grows the Fastest

Consumer electronics segment held the largest revenue share and manufacturing segment to show the fastest growth rate by 2032. The consumer electronics segment accounted for largest revenue share of approximately 45.20% in 2024, due to high demand for smart devices inclusive of smartphones, cameras, and laptops, whereas, the manufacturing segment is expected to register the fastest growth rate, growing at a CAGR of approximately 7.07% during 2024 to 2032, owing to growing demand for IoT, automation and data-logging industries. Sinopec has both consumer electronics and industrial-grade SD card-oriented solutions.

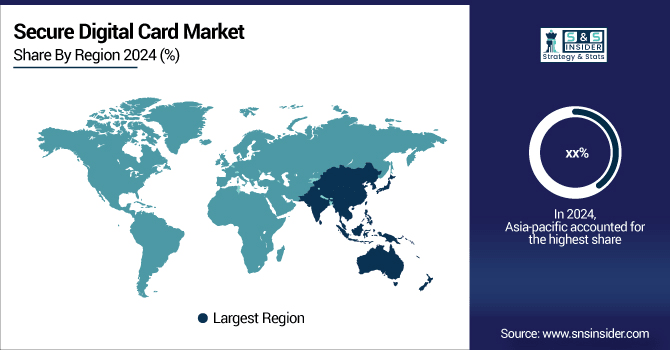

Asia-pacific Secure Digital Card Market Insights

Asia Pacific will register fastest CAGR of approximately 6.05% during 2024-2032 due to rapid adoption of smartphones, rising digital content creation, and expanding e-Commerce platforms. The robust demand for secure digital cards in the region from emerging economies, owing to the strong growth in the consumer electronics, gaming devices, and industrial applications, coupled with the increasing disposable income levels, and improved technology infrastructure, is expected to propel the market growth.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Secure Digital Card Market Insights

In 2024, North America accounted for the largest revenue share of approximately 40.50% in the Secure Digital Card Market. Due to high penetration of consumer electronics, advanced technological infrastructure, availability of large capacity storage devices, and presence of robust e-commerce, this is the case. This further contributed to the leadership of the region in the market due to the early adoption of new technologies and use for professional purposes by the photography, videography, and industrial applications.

Europe Secure Digital Card Market Insights

Europe accounted for a substantial share in the Secure Digital Card Market owing to rapid adoption of consumer electronics, high penetration of smartphone and cameras along with larger usage of professional photography and videography equipment. High demand for high-capacity storage solutions, strong e-commerce infrastructure, and increasing industrial applications are some of the other factors that are expected to boost the growth of the market. Major players including SanDisk and Samsung are continuously trying to strengthen their foothold in the region.

Latin America (LATAM) and Middle East & Africa (MEA) Secure Digital Card Market Insights

Middle East & Africa and Latin America is experiencing slow but determined growth in the Secure Digital Card Market due to smart phone and camera proliferation, growing e-commerce and digital content consumption. Demand across consumer electronics and industrial applications is driven by key countries such as UAE, Saudi Arabia, Brazil and Argentina.

Secure Digital Card Market Growth Drivers:

-

Rising Adoption of High-Capacity Memory Cards Driving Market Growth Globally

Consumer demand for high-capacity SD cards is driving market growth, such as those needed in smartphones, cameras and laptops. As such, users are gravitating towards high-speed, high-storage SD cards, used to manage ever-growing swathes of digital content, whether for photos, videos, or gaming data. This has resulted in even higher storage and transfer speeds, making SD cards a must-have in certain professional and personal applications. Cloud services and hybrid storage solutions have also been on the rise, which fits well with the use of SD cards. The concept of manageability with these types of cards released, combined with the cheap cost with high capacity cards is another factor that's speeding the global market in developed or a developing world.

High-speed SD cards support 4K/8K video capture without dropped frames in more than 85% of cases.

Over 80% of smartphone and camera users prefer SD cards of 128GB or higher.

Secure Digital Card Market Restraints:

-

Compatibility Issues with Certain Devices Restricting Broader Market Adoption

The applicability of some of the latest formats of the SD card is not as expansive, which strangles the growth of the global market as not all devices are compatible with it. Adoption hurdles come in the form of legacy gear — older cameras, laptops, and mobile devices have high-capacity SDXC cards or UHS-II standards support. But when newer cards are mixed with legacy devices, it also makes things less convenient for consumers, while also somewhat locking them into a limited number of new usage scenarios. The use of proprietary specification and associated requirements unique to each device manufacturer compounds the complexity for the user. This incapability causes lots of returns, bad customers experience & less repeat purchases. To achieve wider penetration and acceptance of SD card solutions, however, manufacturers are going to have to solve some significant technical challenges.

Secure Digital Card Market Opportunities:

-

Technological Advancements Enabling New Product Offerings and Market Expansion

Higher storage capacities, faster transfer rates, and enhanced durability are few innovations among others that will continue to create new growth opportunities in SD card technology. To appeal to professional and industrial users, manufacturers are coming up with cards that boast advanced features, including waterproofing, shock resistance and encryption. Allows a broad range of audience, including new devices, high speed cameras, drones and gaming consoles. Such technological improvements also serve ever-changing consumer needs and spur on upgrades with increasing frequency, generating revenue. With the ever-changing storage landscape, there are always ways (and subjects) for manufacturers to help their products stand out from the pack, drive brand loyalty, and capture a chunk of the rapidly growing SD card market.

MicroSD and SDXC cards are used in over 85% of drones, high-speed cameras, and gaming consoles globally.

Cards with advanced features like V90 and UHS Speed Class 3 support over 80% of continuous 8K RAW video recording without interruption.

Secure Digital Card Market Competitive Landscape:

SanDisk, a Western Digital brand — the flash memory storage leader, offering high-performance flash storage in the form factor of SD and microSD cards, for consumer electronics, professional photography, as well as various industrial applications. SanDisk Extreme PRO SDXC UHS-I Card, providing extreme transfer speeds needed for the 4K video and professional use, and SanDisk Ultra MicroSDXC Card, delivering a reliable, high-quality, high-capacity storage for smartphones, tablets and other portable devices, ensuring uncompromised performance and durability across all applications around the globe.

-

In July 2025, SanDisk launched the Extreme PRO SDXC UHS-II Card, offering enhanced read/write speeds and improved durability for professional photographers and videographers.

Samsung Electronics is the world leader in advanced memory technology, providing a wide range of high-performance and high-quality SD and microSD cards that are ideal for any application, built to capture more memories, for longer, with faster speed, durability and reliability. The truly high-capacity Samsung EVO Plus micro SDXC Card boasts fast and smooth transfer rates for mobile devices and the Samsung PRO Endurance SD Card is designed for long-lasting performance, ideal for continuous video recording and industrial use, strengthening the company's presence in the global Secure Digital Card Market.

-

In April 2024, Samsung announced the latest iteration of its EVO Select and EVO Plus microSD cards, boasting increased transfer speeds of up to 160 MB/s, a 23% improvement over their predecessors.

Kingston Technology Company, Inc., the world largest independent manufacturer of memory products, offers dependable SD and microSD consumer, professional and industrial cards. The Kingston Canvas Select Plus SD Card provides reliable space for cameras and laptops, and the Kingston Canvas Go! Building on Kingston's quality and innovation pedigree in the Secure Digital Card Market, Plus microSD Card delivers a high-speed enhancement to internal memory for mobile devices and Internet of Things (IoT) applications.

-

In May 2025, Kingston released the Canvas Select Plus microSD card, providing reliable performance with speeds up to 150MB/s, ideal for cameras and full HD video recording.

Lexar is a global leader in advanced digital storage solutions for flash memory cards enabling photographers, videographers, and tech enthusiasts in the continuous pursuit of their passions. Lexar Professional 2000x SDXC Card: Featuring super-fast read/write speeds designed for professional content creation, the new Lexar Professional 2000x SDXC Card and523Lexar High-Performance 633x microSD Card: Provides reliable high-capacity storage ideal for smartphones, drones and IoT devices623 The addition of the Lexar brand name combined with a strong emphasis on performance, compatibility, and innovation strengthens its foothold in the Secure Digital Card Market.

-

In May 2025, Lexar's Professional 2000x SD Card GOLD Series saw a price reduction, with the 128GB model priced at $95, reflecting its continued competitiveness in the high-speed storage market.

Toshiba Corporation, the inventor of flash memory technology, provides next-generation SD and microSD cards for consumer, industrial and professional use with high capacities and durability. Toshiba's Exceria Pro SDXC Card delivers fast read/write speeds needed for continuous shooting photography and videography while the Toshiba Exceria High-Speed microSD Card provides reliable smartphone, tablet and IoT device storage while firming up Toshiba's global presence in the market for Secure Digital Card.

-

In January 2025, Toshiba's EXCERIA PRO SD cards, compliant with UHS-II and UHS Speed Class 3 (U3), offer high-speed performance suitable for 4K video recording, catering to professional content creators.

Secure Digital Card Companies are:

-

Samsung Electronics

-

Kingston Technology

-

Lexar

-

Toshiba Corporation

-

PNY Technologies

-

Sony Corporation

-

Micron Technology

-

ADATA Technology

-

Patriot Memory

-

Apacer Technology

-

Integral Memory

-

Team Group

-

Verbatim Corporation

-

HP Inc.

-

Silicon Power

-

Strontium Technology

-

Lexar Media

-

Corsair Memory

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 10.74 Billion |

| Market Size by 2032 | USD 16.19 Billion |

| CAGR | CAGR of 5.31% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (SD card, Mini SD card and Micro SD card) • By Capacity (SDSC (Up to 2GB), SDHC (2GB - 32GB) and SDXC (32GB - 2TB)) • By Distribution Channel (Online and Offline) • By End-User (Consumer electronics, Automotive, Industrial, Healthcare, Retail, Military & defense and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | SanDisk, Samsung Electronics, Kingston Technology, Lexar, Toshiba Corporation, Transcend Information, PNY Technologies, Sony Corporation, Micron Technology, ADATA Technology, Patriot Memory, Apacer Technology, Integral Memory, Team Group, Verbatim Corporation, HP Inc., Silicon Power, Strontium Technology, Lexar Media and Corsair Memory. |