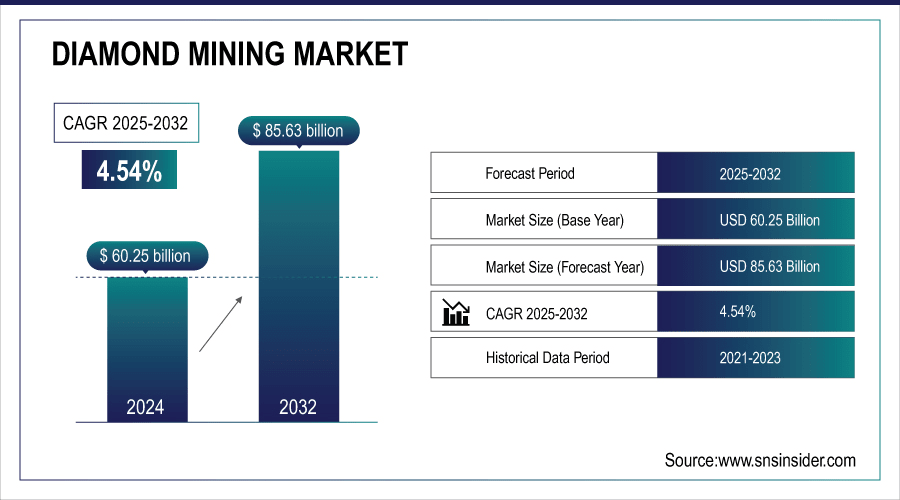

Diamond Mining Market Size & Growth:

The Diamond Mining Market size was valued at USD 60.25 Billion in 2024 and is projected to reach USD 85.63 Billion by 2032, growing at a CAGR of 4.54% during 2025-2032.

The Diamond Mining market has been encouraged by demand for luxury diamond jewelry and diamond investment across the globe. Increasing disposable income, particularly in developing countries, is fueling consumer spending. Increase in industrial applications, including cutting, grinding and drilling, is expected to supplement the market growth. And the increasingly successful marketing of lab-grown diamonds is further increasing new market uptake and diversification.

India and China together account for over 25% of global diamond jewelry demand, driven by rising middle-class consumers and wedding-related purchases.

To Get More Information On Diamond Mining Market - Request Free Sample Report

Diamond Mining Market Trends

-

The increasing demand for luxury jewelry, engagement rings, and investment class diamonds across different regions of the world is growing the market.

-

Diamonds are being used more and more in cutting, grinding, drilling and other industrial applications. This trend is driving demand beyond jewelry and is underpinning diversified market growth.

-

The popularity on lab-grown or cultured diamonds is steadily increasing, which is not only more affordable but also produced in an ethical way compared to natural diamonds.

-

Increasing demand in these areas is also expanding market potential and investment possibilities.

-

Advances in diamond extraction, processing, and artificial diamond production are increasing productivity and efficiency.

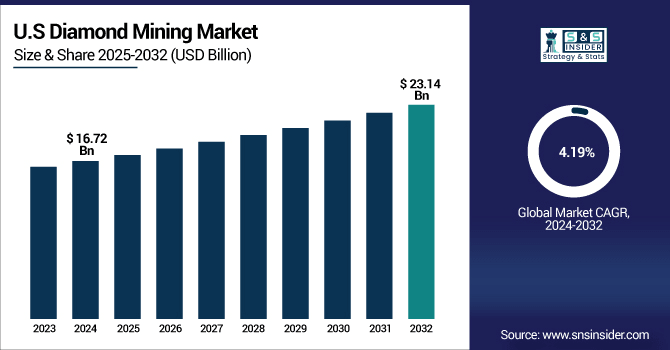

The U.S. Diamond Mining Market size was valued at USD 16.72 Billion in 2024 and is projected to reach USD 23.14 Billion by 2032, growing at a CAGR of 4.19% during 2025-2032. Diamond Mining Market growth is driven by consumer demand for natural and lab-grown diamonds especially for engagement rings, weddings and luxury jewelry. Growth has been driven by higher disposable incomes and growing consumer awareness of ethical sourcing. Effective and efficient mining and processing operations are enhancing approach to production.

Industrial use of diamonds in cutting, grinding, drilling, and precision tooling also drives the market growth. Lab grown diamonds are increasingly popular and offer affordable alternatives appealing to the green consumer. The development of e-commerce and online retail has made it easier and more convenient to buy diamonds, and market penetration has grown.

Diamond Mining Market Growth Drivers:

-

Rising Demand for Luxury Jewelry and Industrial Applications.

Rising consumer demand for luxury jewelry, engagement rings, and investment grade diamonds is driving the worldwide diamond mining market. Increasing industrial applications including cutting, grinding and drilling will further propel the market. Rising per capita income predominately in developing regions is driving demand for diamonds and, in turn, overall revenue growth.

Over 80% of industrial diamonds are used in cutting tools, grinding wheels, and drill bits for construction, mining, and semiconductor industries.

Diamond Mining Market Restraints:

-

Environmental Concerns and High Operational Costs

New diamond mining projects are constrained globally by environmental legislation and sustainability. The overhead and yields costs are high, and the smaller mines are less profitable. Volatile diamond prices interfere with investor confidence and long-term planning. The existence of high-quality natural diamond reserves hampers market growth over the long term.

Diamond Mining Market Opportunities:

-

Growth of Lab-Grown Diamonds and Emerging Markets in the Diamond Mining Market

The increasing demand for cultured diamonds paves the way for affordable, moral substitutes. APAC and MEA are emerging as potential markets and are increasingly demanding more luxury jewellery. Mining and further processing and even artificial diamond production technology advances to increase productivity and products. Further growth potential is being offered by the growing use of industrial diamond in applications like electronics and precision tools.

Over 20% by volume, due to lower prices (30–40% cheaper than natural diamonds) (De Beers "State of the Diamond Industry", 2023).

Diamond Mining Market Segment Analysis

-

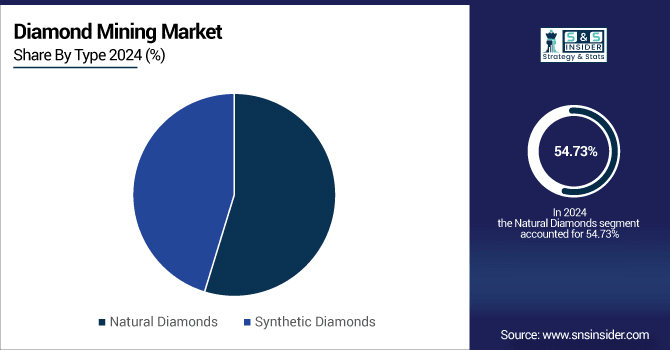

By type, Natural Diamonds led the market with approximately 54.73% share in 2024, while Synthetic Diamonds are the fastest-growing segment with a CAGR of 4.91%.

-

By mining method, Open Pit dominated with around 43.61% share in 2024, whereas Underground mining is the fastest-growing segment at a CAGR of 5.20%.

-

By application, Jewelry accounted for the largest share at about 58.32% in 2024, while Industrial applications are the fastest-growing segment with a CAGR of 5.21%.

-

By distribution channel, B2C held the majority share at approximately 73.86% in 2024, while B2B is the fastest-growing segment with a CAGR of 5.20%.

By Type, Natural Diamonds Leads Market While Synthetic Diamonds Registers Fastest Growth

On the basis of type, the natural diamonds segment is expected to lead the market owing to the well-established demand for these diamonds in luxury jewelry as well as for investment purposes. Nevertheless, synthetic diamonds are growing most quickly, as consumers continue to demand more environmentally friendly and cheaper options. Advancements in lab-grown diamond tech mean better quality at lower prices. The Increasing Market-Penetration Of Synthetic Diamonds That trend is redefining the diamond market today and opening new opportunities for manufacturers and retailers.

By Mining Method, Open Pit Dominate While Underground Shows Rapid Growth

By mining technique, the open-pit segment is expected to become more popular in the diamond market on account of its cost efficiency and high capacity to produce. On the other hand, underground mining is on the rise, since it permits the exploitation of deeper, high grade diamond resources. Mining Technology - developments in underground mining Technology - developments which have occurred since mid-1974 High-workface face cuts had been achieved safely at Hlobane Colliery since 1963 following extensive use of hydraulic equipment with hydraulic mining machines at face during 1974. This change is leading to growing investment and development in underground diamond mining projects.

By End-User Industry, Jewelry Lead While Industrial Registers Fastest Growth

Based on end-user industry, the jewelry segment is the major consumer of diamonds due to the high demand for luxurious and engagement products. Fastest growth is being experienced in industrial sector on account of increasing application scope in cutting, grinding and drilling tools. Advances in the technology for industrial diamond use are improving productivity and quality. Rapidly expanding industrial applications are driven by growing construction, electronic and manufacturing industry demand.

By Distribution Channel, B2C Lead While B2B Grow Fastest

Based on distribution channel, the B2C segment dominates the diamond market, as consumers tend to buy diamonds directly for jewellery and high-end luxurious products. The B2B portion is growing the most rapidly and is driven by demand among manufacturers, wholesalers and for industrial uses. Online and e-commerce B2B & B2C accessibility are on the rise. Adoption for lab-grown diamonds and industrial diamonds are providing further boosting to growth through both channels.

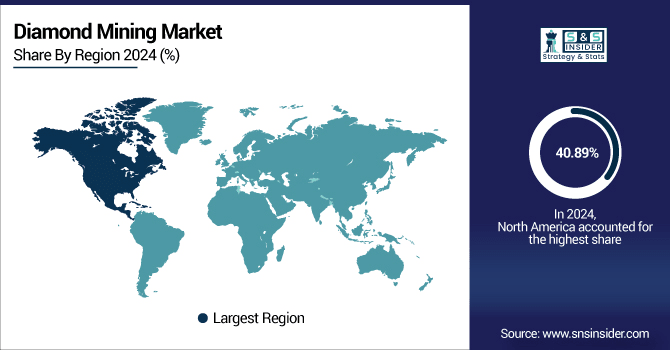

North America Diamond Mining Market Insights

In 2024 North America dominated the Diamond Mining Market and accounted for 40.89% of revenue share, this leadership is due to the robust consumer demand for luxury and engagement jewelry, as well as increased retailer acceptance of lab-grown diamonds. Recent developments in the mining and processing improve production efficacy and quality. Furthermore, established distribution network and high per capita disposable income drive the market growth in the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Diamond Mining Market

The diamond mining market in the United States is moderately fragmented in nature with presence of various players including Stornoway Diamond, De Beers, and Mountain Province Diamonds among others. Jewelry sales are being helped by growing disposable incomes and awareness of diamonds being ethically sourced. The expansion scenario is complemented by industrial uses such as precision tools cutting and drilling.

Asia-pacific Diamond Mining Market Insights

Asia-pacific is expected to witness the fastest growth in the Diamond Mining Market over 2025-2032, with a projected CAGR of 5.16% due to increase in disposable incomes, shift of consumers towards high-end jewelry and engagement jewellery along with rising awareness about the ethical and lab grown diamonds. Growth of retail and e-commerce channels increases market penetration. Moreover, fast-paced industrialization and development of infrastructure in the region are having a positive influence on industrial diamond applications.

China Diamond Mining Market

The China Diamond Mining Market Industry is a professional and in depth study on the current state of the Diamond Mining industry. Higher levels of discretionary spending and urbanization are pushing up purchases of both natural and lab-grown diamonds. Increasing retail and e-commerce penetration widened market access.

Europe Diamond Mining Market Insights

In 2024, Europe emerged as a promising region in the Diamond Mining Market, due to robust acceptance of man-made diamonds. Strong, established retail distribution networks and the growth of disposable incomes underpin steady demand. Further, improved mineral processing and mining technology improve production efficiency and product quality throughout the region.

Germany Diamond Mining Market

The Germany Diamond Mining industry continues to benefit from positive performance of both the luxury and ethical diamonds. “Growing awareness and increasing consumer preference towards lab grown diamonds to drive the market” The market is witnessing high growth due to increased awareness and preference of lab grown diamonds. Strong local retail penetration and large discretionary spend ensures stable jewelry sales.

Latin America (LATAM) and Middle East & Africa (MEA) Diamond Mining Market Insights

The Diamond Mining Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the rising awareness and demand for luxury and ethical diamonds. Compelling retail and e-commerce outlets are improving market accessibility. The industrial applications – cutting and drilling in particular – are growing. Positive government policies and investments in mining infrastructure are also contributing to the slow development of the market.

Competitive Landscape Diamond Mining Market

De Beers Group is the world’s leading Diamond Company with a large portfolio of natural Diamond mining assets and operations around the world. The firm is involved in quality diamonds extraction, cutting and marketing for both jewellery and industrial use. Through a commitment to creative design, superior craftsmanship, and responsible business, De Beers has developed a strong reputation in the global jewelry trade.

-

In May 2024, De Beers reported significant advancements in its 'Building Forever' sustainability strategy. Achievements include engaging 5,000 women and girls in STEM education ahead of schedule and establishing a Diamonds For Development Fund in Botswana with an initial investment of approximately USD 75 million. The company also made strides in renewable energy projects and expanded its diamond traceability platform, Tracr.

ALROSA, Ltd. is the world leader in production of high quality rough diamonds, with more than 99% of rough diamonds produced in Russia ALROSA relocates three administrative departments to new office Retrieved on 10-18-2008 The company focuses on high end rough diamond production for both the jewelry and interesting industrial markets.

-

In March 2025, ALROSA launched its Long-Term Investment Program through 2028, emphasizing sustainable development and maintaining stable diamond production. The company also acquired a significant gold deposit in Russia's Far East to diversify revenue streams and enhance financial stability. These initiatives aim to mitigate challenges from market fluctuations and international sanctions.

Rio Tinto Diamonds is one of the worlds top diamond producers and the second largest trading company, with its arms extended from Antwerp, Tel Aviv, Mumbai and especially in London where its headquarters are located. The company owns high-quality diamond mines, Diavik in Canada and Murowa in Zimbabwe, which serve both the jewelry and the industrial segments. Rio Tinto focuses on advanced mining techniques, sustainability and the promotion of responsible sourcing.

-

In October 2024, Rio Tinto's Diavik Diamond Mine in Canada's Northwest Territories commenced commercial underground production at its A21 kimberlite pipe. This transition follows a USD 40 million investment in Phase 1, which involved developing over 1,800 meters of underground tunnels. Phase 1 is projected to yield an additional 1.4 million carats of rough diamonds, with Phase 2 expected to contribute another 800,000 carats.

Petra Diamonds is one of the world’s leading independent mining groups and an increasingly important supplier of rough diamonds to the international market. The company owns and operates several high-quality diamond mines in Africa, including the Cullinan and Finsch mines in South Africa. Petra focus all its attention on the production of gem-quality diamonds, which are used for jewellery and industrial processes. As a pan-African mining company with 74 years of experience, Petra is leading growth for the diamond sector through modernization and transparency.

-

In April 2025, Petra Diamonds successfully implemented a new operational optimization program across its Cullinan and Finsch mines, improving production efficiency and diamond recovery rates. The company also enhanced its sustainability initiatives by expanding renewable energy usage and community development projects in local mining regions.

Diamond Mining Companies are:

-

ALROSA

-

Rio Tinto Diamonds

-

Petra Diamonds

-

Mountain Province Diamonds

-

Debswana Diamond Company

-

Anglo American plc

-

Gem Diamonds

-

Dominion Diamond Mines

-

Rockwell Diamonds

-

Stornoway Diamond Corporation

-

Firestone Diamonds

-

Trans Hex Group

-

Namdeb Diamond Corporation

-

Lucapa Diamond Company

-

Chidliak Diamond Project

-

Bayan Obo Mining Co.

-

Zimtu Capital Corp.

-

North Arrow Minerals

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 60.25 Billion |

| Market Size by 2032 | USD 85.63 Billion |

| CAGR | CAGR of 4.54% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Natural Diamonds and Synthetic Diamonds), • By Mining Method (Open Pit, Underground, Alluvial, Marine) • By Application (Jewelry, Industrial, and Research) • By Distribution Channel (B2B and B2C) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | De Beers Group, ALROSA, Rio Tinto Diamonds, Petra Diamonds, Lucara Diamond Corporation, Mountain Province Diamonds, Debswana Diamond Company, Anglo American plc, Gem Diamonds, Dominion Diamond Mines, Rockwell Diamonds, Stornoway Diamond Corporation, Firestone Diamonds, Trans Hex Group, Namdeb Diamond Corporation, Lucapa Diamond Company, Chidliak Diamond Project, Bayan Obo Mining Co., Zimtu Capital Corp., North Arrow Minerals. |