Managed DDoS Protection Market Report Scope & Overview:

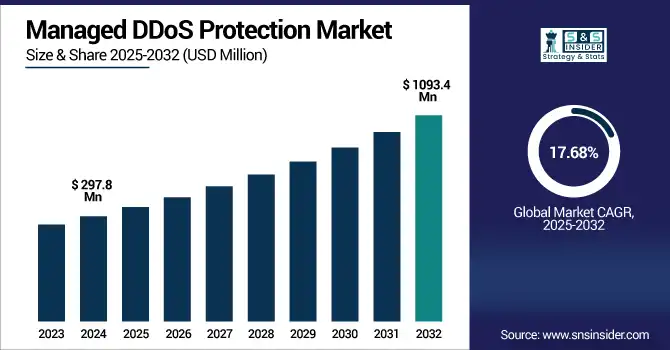

The managed DDoS protection market size was valued at USD 297.8 million in 2024 and is expected to reach USD 1093.4 million by 2032, growing at a CAGR of 17.68% during 2025-2032.

To Get more information on Managed DDoS Protection Market - Request Free Sample Report

Managed DDoS Protection Market growth is driven by the rising frequency, scale, and sophistication of cyberattacks targeting enterprises, governments, and critical infrastructure. With a higher speed of digital transformation and a shift towards a cloud-based environment, the need for continuous service availability has become the top priority. For businesses that lack in-house capabilities to protect against DDoS attacks and prevent them more generally, managed DDoS protection services are particularly appealing; they offer real-time monitoring and mitigation of threats as they happen, and high rates of scalability. Factors such as increasing dependence on e-commerce and financial platforms, rising awareness regarding DDoS threats, and stringent data protection regulations are expected to fuel demand for the market during the forecast period.

In the U.S. Managed DDoS Protection Market, growth is fueled by the growing adoption of cloud, increasing volumetric cyberattacks, and regulatory compliance requirements. managed DDoS protection market trend is indicative of change as it moves towards AI-based mitigation along with complete managed cloud-based services. The U.S. market is projected to grow from USD 80.0 million in 2024 to USD 288.6 million by 2032, at a CAGR of 17.42%.

Managed DDoS Protection Market Dynamics:

Drivers:

-

Rising Sophistication of Multi-Vector Cyberattacks Is Driving Increased Demand for Managed DDoS Protection Services

Traditional on-prem mitigation is insufficient in the face of the exponentially growing threat from multi-vector DDoS attacks those which combine volumetric, protocol, and application layer threats. As attacks become more complex and aggressive, organizations tend to use managed services to protect themselves against these changing threats. Managed DDoS protection providers deliver 24/7 monitoring, automated detection, as well as fast response times, and will all become essential as threat actors adopt AI and botnets to wreak larger, longer-term havoc. As digital platforms become core to business operations, even minimal downtime results in huge revenue losses and reputational damage, thus fuelling the need for outsourced and cloud DDoS mitigation solutions.

Restraints:

-

High Service Costs and Low Awareness Among SMEs Are Limiting Market Adoption and Penetration

Many large enterprises are adopting managed DDoS services quickly, but small and medium-sized enterprises (SMEs) are often budget-constrained and are unaware of the need for a dedicated focus on DDoS protection. DDoS attacks tend to be viewed as lower risk by many SMEs, but in fact, attackers often target smaller businesses where security defenses are not as strong. This segment is often averse to the exorbitant cost for constant monitoring, high-end cloud mitigation, and SLA-backed response services. Others rely on simple firewall or ISP-based protection, which has proven insufficient against sophisticated multi-vector threats. Such pragmatic and psychological hurdles effectively cap the market penetration, especially in nascent or less-digitized sectors.

For instance, only 8% of organizations with fewer than 50 employees have a dedicated cybersecurity budget, and 47% rely on existing IT staff without specialized protection measures.

Opportunities:

-

Growing Cloud Adoption and Edge Computing Expansion Are Creating New Avenues for Integrated DDoS Protection Solutions

This growing prevalence of cloud environments, edge computing, and content delivery networks (CDNs) is a key driver of the market. Since new applications are continuously deployed throughout multi-cloud and hybrid cloud platforms, the attack surfaces of organizations grow exponentially. This is where cloud-native DDoS protection services can easily plug into these ecosystems, by auto-scaling and providing regional mitigation to help keep sites up and well below latency thresholds. Moreover, the growth of edge computing is leading to the demand for localized threat detection and real-time mitigation closer to end users. This evolution in infrastructure provides a unique opportunity to providers who offer automated, API-based DDoS protection embedded into cloud or edge platforms.

For instance, 94% of companies now use at least one cloud service, with 76% using multi-cloud environments, amplifying the need for distributed, integrated security solutions across varying platforms.

Challenges:

-

Difficulty in Real-Time Detection and Risk of False Positives Are Hindering Effective Threat Mitigation at Scale

One of the biggest hurdles in managed DDoS protection is the differentiation between a malicious surge of traffic and a legitimate increase of traffic, such as the kind seen during flash sales or promotional events. They even mimic the way a normal human user interacts with a website or a service, making detection and response to an advanced DDoS attack complicated. However, this is a critically important and technically complex area and includes areas such as real-time traffic analysis, behavioral modeling, and integration of threat intelligence. The disruption of user experience, resulting in lost revenue, can also occur due to false positives, i.e., blocking legitimate traffic. This necessitates ongoing training of AI models, expert personnel, and active and dynamic tuning of policy, bringing some vendors easy, ongoing, predictable high-scale tasks in traffic with consistent high accuracy, problematic.

Managed DDoS Protection Market Segmentation Analysis:

By Service:

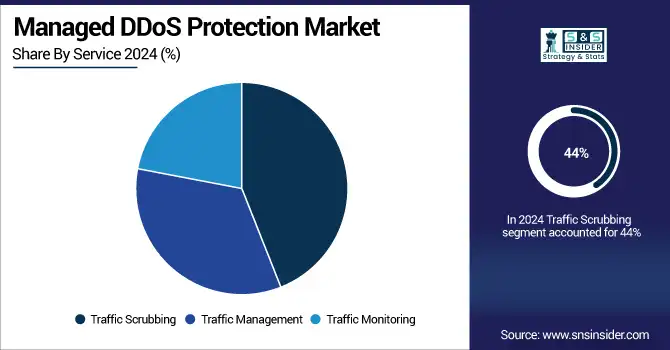

Traffic Scrubbing dominated the market in 2024 and accounted for 44% of the managed DDoS protection market share, as it can effectively filter out malicious traffic from legitimate one while maintaining real-time performance. The ability to support near real-time integration with cloud-based threat intelligence platforms and the high accuracy of volumetric and application layer attacks mitigation make it one of the favorites. In an increasingly digitised world, where attacks are likely to become more sophisticated and larger with respect to the scope of assets being attacked over time, this segment will only remain as important.

In April 2024, GTT Communications announced an expansion of its DDoS scrubbing capacity to 4 Tbps, enhancing its ability to absorb and neutralize large-scale attacks. This increase in bandwidth is integrated into GTT’s global Tier 1 IP backbone, utilizing Corero’s SmartWall ONE™ DDoS protection solution for sub-second detection and mitigation. The expansion aims to provide stronger protection for mission-critical applications

Traffic Monitoring is expected to register the fastest CAGR, Due to the increasing need for proactive threat detection, behavioral analytics, and real-time visibility into the activities of the network. A range of AI-enabled monitoring tools speed up its development, together with zero-trust architectures and compliance requirements. To achieve pre-attack identification and early mitigation, organizations must continually monitor their traffic — an investment they will need to make.

By Deployment:

The Cloud-Based deployment segment dominated the managed DDoS protection market and accounted for 51% of revenue share in 2024, due to its scalability, cost-effectiveness, and seamless integration with existing cloud infrastructures. This provides real-time mitigation, global threat intelligence distribution, and rapid consumption without a large upfront investment. Cloud is the clear solution for enterprises everywhere, with the flexibility to protect many locations and applications.

In June 2025, Cloudflare mitigated the largest DDoS attack ever recorded, peaking at 7.3 terabits per second (Tbps) and delivering 37.4 terabytes of data in just 45 seconds.

The Hybrid deployment segment is expected to register the fastest CAGR, due to the desire of organisations to achieve the benefits of on-premises control and cloud scalability simultaneously. Hybrid solutions enable organization-owned sensitive data to stay in-house but utilize the power of the cloud in large-scale attack mitigation. Rise in regulatory compliance and the need for customized security strategies are boosting the adoption of hybrid managed DDoS protection models.

By Industry:

The IT & Telecommunication segment dominated the managed DDoS protection market in 2024 and accounted for a significant revenue share, as this sector is vital to connectivity and digital services. This sector regularly experiences large-scale DDoS attacks, which are used to disrupt networks and services. With 5G and cloud infrastructure becoming popular, and more IoT devices getting connected, the demand for superior managed DDoS protection solutions will, to not compromise availability and continuity in business, continue to grow.

The Banking, Financial Services, and Insurance segment is expected to register the fastest CAGR, driven by the demand for securing financial data and regulatory compliance. Traditionally, cybercrime is an innovative business disrupting the traditional trust ecosystem in banks and related financial services, with the rise of online banking, mobile payments, digital transactions, wide attack surface. The increasing sophistication of cyberattacks, especially multi-vector DDoS attacks, is driving BFSI organizations to switch to an advanced, managed DDoS protection to eliminate immediate risk through real-time threat mitigation.

Managed DDoS Protection Market Regional Outlook:

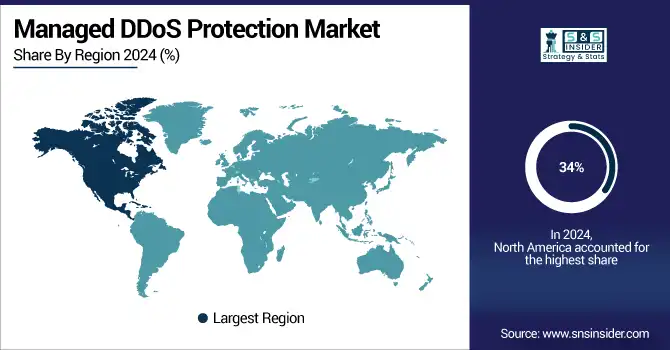

North America dominated the managed DDoS protection market in 2024 and accounted for 34% of revenue share, due to its developed digital infrastructure, rapid cloud penetration, and strict cybersecurity regulations.Upon. It is mainly increased by the presence of major managed security service providers and the rising frequency of cyberattacks. Continuous investment in next-generation technologies and heightened consciousness around the cruciality of cyber resilience are enabling the region to maintain its market prominence through 2032.

According to a managed DDoS protection market analysis, Asia-Pacific is expected to register the fastest CAGR during the forecast period, due to rapid digital transformation, increasing internet penetration and growing cloud adoption across the emerging economies. The growth rate is driven by increasing cyber threats, government initiatives to improve cybersecurity, and rising enterprise use of managed services. With businesses increasingly focusing on strong DDoS protection, the market in the region is expected to grow considerably.

Europe managed DDoS protection market growth is driven by the effective data privacy regulation such as GDPR, increasing sophistication of cyberattacks, and rising cloud adoption across industries. To 2032, the market will grow steadily, as listed investments in cybersecurity architecture and enhancements.

The United Kingdom dominates Europe’s managed DDoS protection market such as the digital markets act has led to low digital maturity, creating a demand for managed DDoS protection solutions. Driven by Growing Demand from Fintech and e-commerce Market Sectors. With businesses' strategic defence infrastructure increasingly prioritising elastic and clouds, strong growth is anticipated in the UK market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major managed DDoS protection market companies are Akamai Technologies, Cloudflare, Inc., Radware, Imperva, Neustar Security Services, NETSCOUT Systems, Arbor Networks, F5, Inc., Fortinet, Inc., A10 Networks, Amazon Web Services (AWS), Microsoft Azure, Google Cloud (Cloud Armor), Alibaba Cloud, Verizon Communications Inc., AT&T Inc., Lumen Technologies, StackPath, IBM Corporation, Huawei Technologies Co., Ltd. and others.

Recent Developments:

In February 2025, NETSCOUT enhanced its Arbor Threat Mitigation System with AI/ML capabilities, improving detection and mitigation of rapidly evolving DDoS attacks.

In June 2025, AWS introduced automatic application layer DDoS protection in AWS WAF, enabling faster detection and mitigation of DDoS events

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2024 |

USD 297.8 Million |

|

Market Size by 2032 |

USD 1093.4 Million |

|

CAGR |

CAGR of 17.68% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Service (Traffic Monitoring, Traffic Scrubbing, Traffic Management) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, ASEAN Countries, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar,Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America) |

|

Company Profiles |

Akamai Technologies, Cloudflare, Inc., Radware, Imperva, Neustar Security Services, NETSCOUT Systems, Arbor Networks, F5, Inc., Fortinet, Inc., A10 Networks, Amazon Web Services (AWS), Microsoft Azure, Google Cloud (Cloud Armor), Alibaba Cloud, Verizon Communications Inc., AT&T Inc., Lumen Technologies, StackPath, IBM Corporation, Huawei Technologies Co., Ltd. and others in the report |