Time-Sensitive Networking Market Report Scope & Overview:

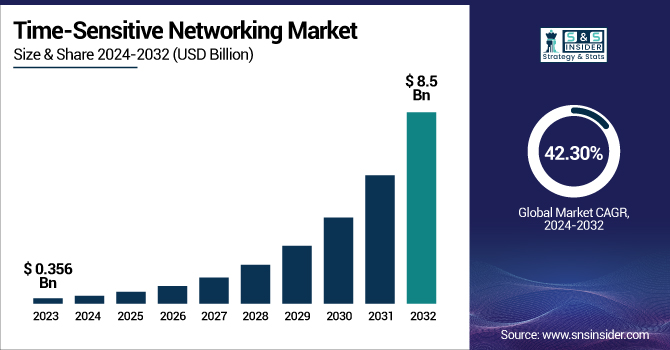

The Time-Sensitive Networking Market was valued at USD 0.356 billion in 2023 and is expected to reach USD 8.5 billion by 2032, growing at a CAGR of 42.30% from 2024-2032.

To Get more information on Time-Sensitive Networking Market - Request Free Sample Report

The adoption rates of TSN-enabled industrial automation solutions are accelerating as industries demand precise, synchronized, and deterministic communication for real-time control applications. Meanwhile, the expansion of TSN-integrated network infrastructure by region is seeing strong growth in North America and Asia-Pacific, driven by smart factory and smart city initiatives. Latency reduction trends in real-time communication networks highlight the role of TSN in minimizing delays and jitter in critical applications like robotics, automotive, and healthcare systems. Additionally, investments in TSN for automotive and Industrial IoT applications are surging, particularly for autonomous driving, factory automation, and edge computing, as companies prioritize reliability and seamless device interoperability. The report also features deeper analysis on TSN chipsets and controller trends, regional TSN policy initiatives, the integration of TSN with 5G networks for ultra-reliable low-latency communications, and the emergence of open-source TSN stack developments accelerating interoperability and innovation.

The U.S. Time-Sensitive Networking market was valued at USD 0.102 billion in 2023 and is projected to reach USD 2.4 billion by 2032, growing at a CAGR of 41.93% from 2024 to 2032. Growth is fueled by rising demand for real-time industrial control systems and expanding automotive Ethernet applications. The increasing focus on factory automation, smart transportation infrastructure, and low-latency communications is expected to further accelerate market expansion in the U.S.

Time-Sensitive Networking Market Dynamics

Driver

-

Rising adoption of industrial automation and Industry 4.0 is accelerating demand for real-time, deterministic networking.

The growing integration of industrial automation systems, driven by Industry 4.0, is significantly accelerating the demand for TSN solutions. Modern manufacturing plants require highly synchronized, real-time communication networks to manage robotics, process control, and distributed control systems with millisecond latency. TSN technology enhances determinism and reliability, ensuring seamless data transmission for time-critical applications. Additionally, the increasing use of Industrial IoT devices amplifies network congestion risks, making TSN crucial for optimizing data traffic and minimizing delays. The adoption of smart factories, digital twins, and predictive maintenance solutions globally is expected to further fuel market growth for TSN in manufacturing and industrial automation environments.

Restraint

-

High deployment, upgrade, and integration costs are limiting adoption, especially among SMEs.

Despite its advantages, the high initial investment required for deploying TSN infrastructure acts as a market restraint. Upgrading existing network systems to support TSN standards like IEEE 802.1 requires new compatible switches, gateways, and endpoints, increasing capital expenditure. Additionally, integrating TSN with legacy industrial protocols demands specialized engineering expertise and time-consuming network reconfigurations. This often poses a challenge for small and medium-sized enterprises with limited IT budgets. Moreover, compatibility concerns and a lack of uniform TSN adoption across industrial sectors can delay implementation, hindering market growth, particularly in developing regions where investment in advanced industrial networking remains constrained.

Opportunity

-

Increasing use of TSN in automotive Ethernet and connected vehicle systems is opening new growth avenues.

The expanding adoption of Ethernet-based in-vehicle networking systems in autonomous and connected vehicles is creating significant opportunities for TSN technology. TSN’s ability to ensure deterministic, low-latency communication is critical for advanced driver-assistance systems, infotainment, and vehicle-to-everything applications. As automotive manufacturers transition toward software-defined vehicles, the need for reliable in-vehicle network infrastructure that supports simultaneous time-critical and non-critical traffic grows. Additionally, emerging electric and autonomous vehicle ecosystems require real-time control communications for sensors, controllers, and power management systems — all areas where TSN can deliver substantial value. This automotive application segment is expected to witness rapid growth through 2032.

Challenge

-

Complexity in standardizing TSN protocols and achieving interoperability across multi-vendor networks hinders market scalability.

One of the significant challenges facing the TSN market is the complexity involved in standardizing and achieving interoperability across devices and networks from multiple vendors. While the IEEE 802.1 TSN standards provide a framework, full implementation requires consistent support across industrial controllers, switches, gateways, and end devices, which is still evolving. Varying levels of TSN compatibility across product lines create integration difficulties, potentially limiting deployment flexibility and performance. Ensuring seamless real-time communication in mixed vendor environments demands rigorous testing and certification processes, often slowing down commercial rollouts. Overcoming these interoperability challenges is essential for achieving scalable, cross-industry adoption of TSN.

Time-Sensitive Networking Market Segmentation Analysis

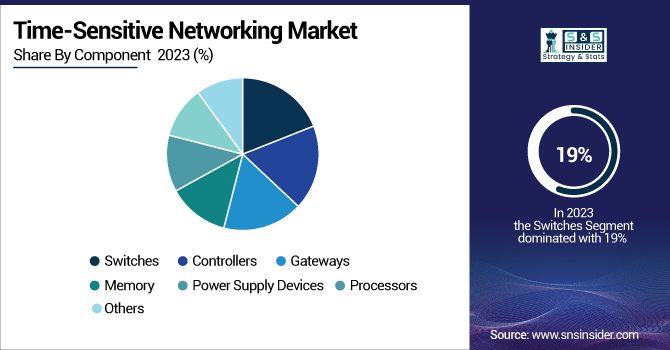

By Component

The switches segment dominated the market and accounted for 19% of revenue share in 2023. The switches are synchronized to transmit and receive packets with high precision for managing network traffic. Deterministic data transmission is crucial for applications involving real-time communication, including but not limited to industrial automation and autonomous vehicles, and TSN switches make this possible. Smart factories and the industrial Internet of Things (IIoT) environments require a robust network infrastructure. In addition to this, switch design is undergoing a major technological shift with optimised processing features and TSN standard support, thus expanding their market coverage.

The processors segment is anticipated to witness significant growth during the forecast period. As the TSN market grows, there is a rise in critical processor functions, essential for handling the complex computations and deterministic timing needed for instantaneous packetized data transmission. TSN processors are used to run advanced algorithms necessary for the synchronization and communication with the low-latency demands of industrial automation and autonomous vehicles.

By Standard

In 2023, the IEEE 802.1AS (Timing and Synchronization) segment dominated the market and held a dominant revenue share. It is IEEE 802.1 that is dominating the industry by offering Timing and Synchronization that are crucial for deterministic communication. It ensures that integrity is maintained across all network devices, a critical factor for real-time data transfer applications such as industrial automation and autonomous vehicles. With the standard promise of low-latency communication, it has found its way into the hands of manufacturers and producers requiring timely and consistent data delivery for many industries.

The IEEE 802.1Qch (Cyclic Queuing and Forwarding) segment will witness the fastest growth during the forecast period. IEEE 802.1Qch — Cyclic Queuing and Forwarding is gaining traction in time-sensitive networking when time-constrained applications need to manage data traffic effectively.

By Application

In 2023, the industrial automation segment dominated the market and accounted for a significant revenue share as it provides deterministic communication and exact synchronization it enables, enabling factors necessary for real-time applications. TSN provides a way to facilitate transmission of data in industrial environments where low-latency, reliable data transmission is imperative, well below the strict timing requirements of the automation systems. This technology enables the connection of various types of industrial devices and systems to allow for better flexibility and interoperability.

Automotive is expected to be the fastest growing segment during the forecast period. Automotive industry is now moving towards Time sensitive networking to meet the demands of high-end Intra-vehicle networks and real-time communication. By providing highly accurate synchronization and low-latency data transmission, TSN can help support autonomous driving, V2V communication, and ADAS.

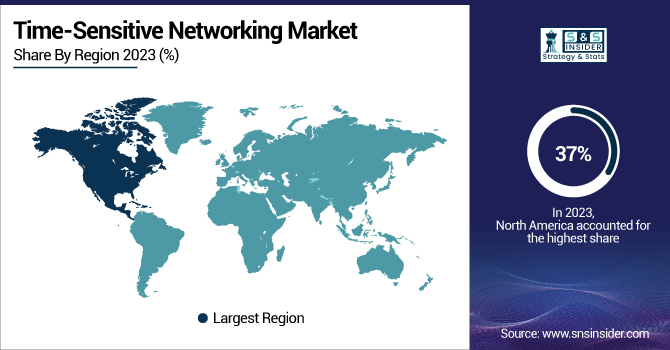

Regional Landscape

In 2023, North America dominated the market and accounted for 37% of the revenue share. A well-developed communications infrastructure in North America also facilitates the rollout of advanced networking technologies like time sensitive networking. It highlights the need for high-speed internet connectivity, dependable data centers, and most importantly, a reliable telecommunications network that provides real-time communications.

The Asia Pacific is expected to register the fastest CAGR during the forecast period. The adoption of Time-Sensitive Networking in the manufacturing and industrial automation space within the Asia Pacific is growing. This is due to its ability to enhance productivity as well as reduce latency and improve synchronization amongst machines and systems of a factory. A focus on Industry 4.0 initiatives in the region drives the deployment of TSN-enabled solutions as companies look to realize higher productivity and greater flexibility in manufacturing processes.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The Major key players, along with their products, are

-

Cisco Systems, Inc. — Cisco Catalyst IE3400 Rugged Series Switches

-

NXP Semiconductors N.V. — NXP Layerscape LS1028A

-

Intel Corporation — Intel Ethernet Controller I225 Series (with TSN support)

-

Broadcom Inc. — Broadcom StrataXGS® Trident 4 Series

-

Texas Instruments Incorporated — Sitara AM64x Processors

-

Analog Devices, Inc. — ADIN2299 Industrial Ethernet Switch

-

Belden Inc. — Hirschmann RSP Series TSN Switches

-

Marvell Technology, Inc. — Marvell Prestera CX 8500 Ethernet Switch

-

Microchip Technology Inc. — LAN8840/60 TSN Ethernet Controllers

-

HMS Networks AB — IXXAT TSN Ethernet Switch

-

TTTech Computertechnik AG — TTTech Edge TSN Switch

-

National Instruments Corporation — NI Industrial Controller IC-3173

-

Moxa Inc. — Moxa TSN-G5008 Series Ethernet Switches

-

Advantech Co., Ltd. — Advantech EKI-8510G TSN Switch

-

Schneider Electric SE — Schneider EcoStruxure™ Automation Expert with TSN

Recent Developments

-

June 2024: Cisco introduced the Catalyst IE3400 Heavy Duty Series switches, designed for harsh industrial environments. These IP67-rated, fanless switches support industrial protocols and are compliant with various industry standards, making them suitable for locations like factories, mines, and farms.

-

April 2024: NXP expanded its TSN capabilities with the Layerscape LS1028A processor, providing a reference design for industrial IoT applications. This processor supports TSN standards and is aimed at facilitating real-time communications in factory automation and other industrial settings.

-

October 2024: Analog Devices announced the ADIN2299, a multiprotocol industrial Ethernet switch platform. It supports various industrial protocols like PROFINET, EtherCAT, and Modbus TCP, and features secure boot and update capabilities to enhance cybersecurity in industrial networks.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 0.356 Billion |

|

Market Size by 2032 |

US$ 8.5 Billion |

|

CAGR |

CAGR of 42.35 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Switches, Controllers, Gateways, Memory, Power Supply Devices, Processors, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Cisco Systems, Inc., NXP Semiconductors N.V., Intel Corporation, Broadcom Inc., Texas Instruments Incorporated, Analog Devices, Inc., Belden Inc., Marvell Technology, Inc., Microchip Technology Inc., HMS Networks AB, TTTech Computertechnik AG, National Instruments Corporation, Moxa Inc., Advantech Co., Ltd., Schneider Electric SE |