Managed Network Services Market Report Scope & Overview:

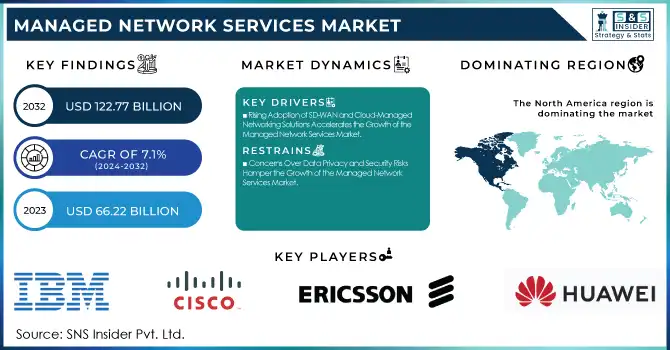

The Managed Network Services Market Size was valued at USD 66.22 Billion in 2023 and is expected to reach USD 122.77 Billion by 2032 and grow at a CAGR of 7.1% over the forecast period 2024-2032. This market focuses on enterprise adoption of managed services, the percentage outsourcing network management, and the rise of SD-WAN and cloud-managed networking. AI and automation enhance network efficiency and cost savings. Sector-wise demand (BFSI, IT & telecom, healthcare), cybersecurity priorities in managed services, and 5G adoption trends for network management are key factors.

Get more information on Managed Network Services Market - Request Sample Report

Managed Network Services Market Dynamics

Drivers:

-

Rising Adoption of SD-WAN and Cloud-Managed Networking Solutions Accelerates the Growth of the Managed Network Services Market

The increasing reliance on SD-WAN and cloud-managed networking is driving the managed network services market. Business enterprises are moving from traditional network infrastructure to software-defined and cloud-based solutions to accelerate agility, scalability, and cost-effectiveness. Growing demand for secure high-performance networking in hybrid and multi-cloud environments adds significant fuel to the fire. Moreover, trends of working remotely, digital transformation efforts, and expanding IoT and 5G networks force enterprises to outsource network management for optimized connectivity, security, and performance to accelerate growth in the market.

Restraints:

-

Concerns Over Data Privacy and Security Risks Hamper the Growth of the Managed Network Services Market

Despite the benefits of managed network services, concerns regarding data security, compliance, and privacy risks remain a significant restraint. Companies are hesitant to share their sensitive business and customer data with third-party service providers, considering the risks of breach, unauthorized access, or non-compliance with regulations. Additionally, ever-changing cybersecurity threats, strict data protection laws, and jurisdictional issues further make it difficult for managed service providers. Enterprises operating in highly regulated industries such as banking, healthcare, and government require high levels of security measures and strict adherence to compliance requirements, which limits market growth and increases operational costs for service providers.

Opportunities:

-

Rising Integration of Artificial Intelligence and Automation in Network Management Creates Growth Opportunities for the Market

The integration of AI and automation into network management presents a significant opportunity for market expansion. AI-driven predictive analytics, self-healing networks, and automated threat detection are transforming the way networks are monitored and maintained. Business houses are now increasingly adopting AI-powered network operations (AIOps) for better performance, reduced downtime, and enhanced security. Moreover, AI-driven automation allows real-time optimization of bandwidth, latency, and security configurations, thus requiring less manual intervention. As the enterprises look to have more efficient and cost-effective network solutions, managed service providers using AI and automation will emerge as a leader in the market.

Challenges

-

Complexity in Managing Multi-Vendor and Hybrid Cloud Environments Challenges the Growth of the Market

Enterprises increasingly operate in multi-vendor and hybrid cloud environments, making network management more complex. There should be an easy integration and interoperability between the on-premises, private cloud, and multiple public cloud providers to manage networks. This means service providers have to contend with compatibility, different security protocols, and optimization of performance on different network infrastructures. Additionally, enterprises experience vendor lock-in, network visibility, and compliance across jurisdictions. As companies increasingly demand flexible and customizable managed services, providers have to develop standardized yet adaptable solutions to effectively manage these complex environments while ensuring scalability, security, and cost efficiency.

Managed Network Services Market Segments Analysis

By Type

In 2023, the Managed LAN segment held the largest revenue share of 27% within the Managed Network Services Market. This is spurred by the fact that more reliable, scalable, and secure local area networks will be needed due to the high dependency of organizations on cloud services, remote working models, and IoT devices. Large companies, including Cisco, AT&T, and BT Group, have placed massive investments into managed LAN solutions that simplify the management of their network while giving the assurance of high uptime, seamless connectivity, and data security.

For instance, Cisco's launch of Cisco SD-WAN and Meraki Managed LAN solutions has further strengthened its position in the market, providing enterprises with advanced LAN capabilities that integrate AI-driven insights, network automation, and proactive management.

The Managed Wi-Fi segment is projected to experience the largest CAGR of 8.59% during the forecast period 2024-2032. The Managed Network Services Market is growing due to the increasing demand for high-speed, reliable wireless connectivity across industries. Masergy, Cisco, and CommScope have launched innovative products to cater to this growing demand.

For example, the solutions of Cisco's Meraki Wi-Fi integrate the cloud management aspect to enhance security, simplify deployments, and support remote management across businesses of various sizes. The same is done by CommScope's RUCKUS Cloud as it offers Wi-Fi as a service, providing businesses with Wi-Fi management, monitoring, and optimization without necessarily requiring extensive hardware on-site.

By Network Security

The Managed Firewall segment dominated the Network Security category, capturing a substantial 43% revenue share in 2023, driven by the increasing need for robust security solutions in the face of rising cyber threats. Advanced firewall technologies that ensure real-time protection, traffic filtering, and intrusion prevention are now being focused on by companies. Key players in the market such as Cisco, Palo Alto Networks, and Fortinet have recently introduced next-generation firewall solutions that help enterprises adapt to the growing security needs of their organizations. Managed firewalls are now crucial in light of the increasing complexity of network infrastructures and advanced threat prevention; therefore, this segment is dominant in the Managed Network Services Market.

The Managed IDS/IPS (Intrusion Detection System/Intrusion Prevention System) segment is anticipated to witness the highest CAGR of 8.12% within the forecasted period in the Network Security market. As more sophisticated cyberattacks and continuously new threats prevail, next-generation managed IDS/IPS solutions have gained popularity through enhanced threat detection and prevention in enterprises. Companies like Fortinet, Trend Micro, and Cisco are driving the adoption of next-gen IDS/IPS products that integrate machine learning and AI for real-time threat identification.

By Verticals

The BFSI Segment held the largest revenue share of 25% in the Managed Network Services Market in 2023. The growing demand in the BFSI sector for safe, compliant, and efficient network infrastructures drives the adoption of managed network services to protect sensitive financial data while ensuring smooth experiences for customers. Companies such as Cisco, IBM, and AT&T offer highly specialized solutions that cater specifically to the BFSI sector, which include secure SD-WAN, managed firewall services, and cloud-based solutions.

The Retail and Ecommerce vertical is experiencing the largest CAGR of 9.64% in the Managed Network Services Market, this is because of the increased demand for secure, high-performance networks to support e-commerce operations, supply chains, and customer interactions. The need for reliable, scalable, and secure networks becomes critical for handling high volumes of transactions, protecting customer data, and ensuring fast and uninterrupted service as businesses shift towards digital retail.

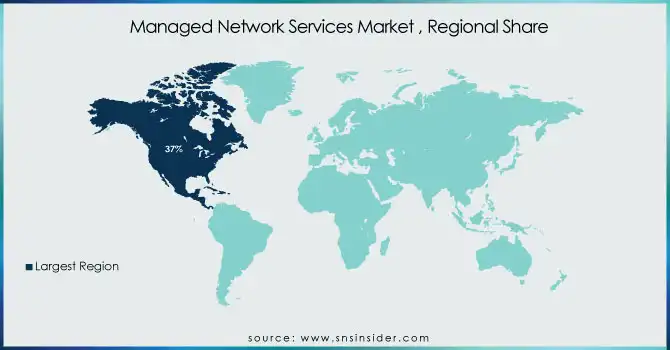

Regional Analysis

In 2023, North America held the dominant position in the Managed Network Services Market, accounting for an estimated 37% of the total market share. This dominance comes from the highly adopted advanced network technologies and cloud-based solutions through enterprises in this region. Also, the giant technology companies are the main promoters of the markets in the form of innovative propositions of SD-WAN, Cybersecurity, as well as the cloud-based managed services by prominent players such as Cisco, IBM, and AT&T. Lastly, the regional infrastructure is relatively well-developed, and many investments have gone into 5G networks while governments also facilitate digital transformation practices.

Asia Pacific is projected to be the fastest-growing region in the Managed Network Services Market, with an estimated CAGR of 8.72% during the forecast period. The region is experiencing an increase in digital transformation and network modernization as organizations shift to cloud-based solutions and use SD-WAN for efficient performance and scalability. China, India, and Japan are the main drivers of this expansion that is being spurred by the rapid growth in 5G networks, increasing secure IoT connectivity demand, and boom in e-commerce and smart manufacturing.

Need any customization data on Managed Network Services Market - Enquire Now

Key Players

Some of the major players in the Managed Network Services Market are:

-

IBM (IBM Managed Network Services, IBM Cloud Pak for Network Automation)

-

Cisco (Cisco SD-WAN, Cisco Meraki Managed Network)

-

Ericsson (Ericsson Managed Network Services, Ericsson Dynamic Orchestration)

-

Verizon (Verizon Managed SD-WAN, Verizon Secure Cloud Interconnect)

-

Huawei (Huawei Cloud Managed Network, Huawei SD-WAN)

-

AT&T (AT&T Managed Security Services, AT&T Business Wi-Fi)

-

BT Group (BT Managed WAN, BT Cloud Security)

-

Telefonica (Telefonica Global Solutions, Telefonica SD-WAN)

-

T-Systems (T-Systems Managed Network Services, T-Systems Cloud Connectivity)

-

NTT (NTT Managed Network Services, NTT SD-WAN)

-

Orange (Orange Flexible SD-WAN, Orange Business Secure Gateway)

-

Vodafone (Vodafone Business SD-WAN, Vodafone Managed LAN)

-

Fujitsu (Fujitsu SD-WAN, Fujitsu Network Automation)

-

Lumen (Lumen Managed Network Services, Lumen Adaptive Networking)

-

Masergy (Masergy SD-WAN, Masergy Managed Security)

-

Colt Technology Services (Colt SD-WAN, Colt Dedicated Cloud Access)

-

Telstra (Telstra Global SD-WAN, Telstra Managed Security)

-

CommScope (CommScope RUCKUS Cloud, CommScope Managed Wi-Fi)

Recent Trends

-

In November 2024, NTT DATA and Cisco expanded their partnership to deliver 5G eSIM connectivity across various industries. This collaboration aimed to enhance managed network services by providing seamless and secure 5G connectivity solutions.

-

In June 2024, Huawei announced a plan to integrate AI into networks to boost productivity. The initiative focused on building an ecosystem of RAN Intelligent Agents in collaboration with operators, aiming to enhance managed network services through increased automation and efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 66.22 Billion |

| Market Size by 2032 | US$ 122.77 Billion |

| CAGR | CAGR of 7.1 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Managed LAN, Managed Wi-Fi, Managed VPN, Managed WAN, Network Monitoring, Managed NFV, Managed Network Security) • By Network Security (Managed Firewall, Managed IDS/IPS, Other Managed Network Security) • By Verticals (Banking, Financial Services and Insurance, Retail and Ecommerce, IT and Telecom, Manufacturing, Government, Education, Healthcare, Media and Entertainment, Other Verticals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM, Cisco, Ericsson, Verizon, Huawei, AT&T, BT Group, Telefonica, T-Systems, NTT, Orange, Vodafone, Fujitsu, Lumen, Masergy, Colt Technology Services, Telstra, CommScope. |