Manned Security Services Market Report Scope & Overview:

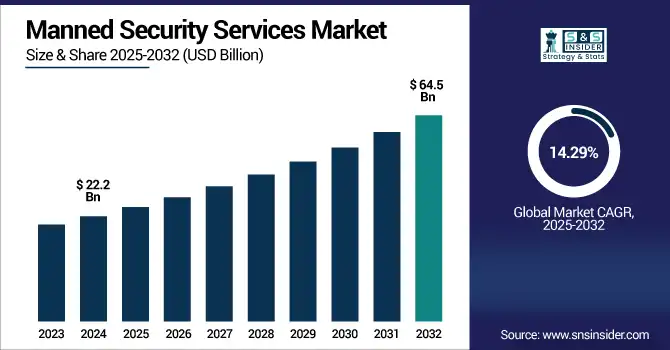

The Manned Security Services Market size was valued at USD 22.2 billion in 2024 and is expected to reach USD 64.5 billion by 2032, growing at a CAGR of 14.29% during 2025-2032.

To Get more information on Manned Security Services Market - Request Free Sample Report

The Manned Security Services Market growth is driven by the increased urbanization, leading to growth in air pollution, a rise in crime rates, and growing demand for protection of personnel, property, and assets. The investment of governments, corporates, and stiff residential areas in professional guarding solutions to boost the on-ground security. Various factors driving the growth of this market are adherence to safety regulations, growth in critical infrastructure, and the requirement for visibility in security. The diversification of on-site security roles is another key Manned Security Services Market trend. The evolution of the market from conventional guarding to smart and responsive safety services that are in consonance with contemporary safety requirements.

The U.S. Manned Security Services Market is experiencing steady growth, driven by increasing public safety concerns along with urban crime, and the growing infrastructure, both commercial and residential. In 2024, the market is valued at approximately USD 6.6 billion and is projected to reach around USD 18.9 billion by 2032. With a forecasted CAGR of 14.09% between 2025 and 2032, growth is fueled by greater adoption of integrated security solutions, including biometric access, real-time surveillance, and mobile patrols.

Market Dynamics:

Drivers:

-

As Cities Expand and Crime Rates Rise, Demand for On-Site Security Increases to Ensure Safety and Order

As cities become more densely populated due to rapid urbanization, new security challenges have emerged in residential, commercial, and industrial areas. As crime rates soar, with threats of theft, vandalism, and workplace violence, the need for dependable on-ground manned guarding solutions is greater than ever. Malls, transport hubs, corporate buildings. all would require a physical presence for rapid incident response and deterrence. This has led to investment in trained guards. In addition, the growing concerns for personal and asset safety in urban areas are forcing governments and private enterprises to provide extensive manned security services, making it a significant factor driving market growth.

For Instance, in 2024, physical security incidents climbed in 25% of U.S. businesses, with 87% expecting this trend to persist or worsen, leading many to invest in on-site guards and real-time surveillance systems

Restraints:

-

Expensive Guard Training, Wages, and Compliance Requirements Limit Affordability and Scalability of Services

High cost associated with personnel recruitment, training, and retention is a major restraint to the growth of the Manned security services market. On the contrary, manned guards have to be supervised constantly; they also need to be compliant with the law (through licensing, background verification, etc.) and are monitored formally for performance. It raises the cost for service delivery, due to increasing wages, growing overtime payments, higher insurance liabilities, and the necessity for continuous upskilling. These costs could be unsustainable for smaller businesses or institutions on tight budgets, resulting in a transition toward electronic surveillance or hybrid models. Additionally, service quality can be further degraded due to operational inefficiencies that arise from human error and absenteeism, which makes cost a significant hurdle to mass adoption.

For Instance, On average, firms allocate 10–15% of their annual revenue to guard training and equipment, significantly affecting profitability.

Opportunities:

-

The Adoption of AI, Surveillance, and Mobile Tools Enhances Service Value and Operational Efficiency

The growing trend of integrating manned guarding with advanced technologies presents a significant opportunity for market evolution. Security providers are now using AI surveillance, real-time communication systems, GPS-enabled patrols, and Mobile apps to increase the efficiency of guards. These technology-oriented solutions are able to lessen the response time, enhance situational awareness, and provide better reporting as well as compliance documentation. Not only does this hybrid model enhance the value proposition of traditional security services, but it also harmonizes them with the expectations of digitally transforming organizations. The growth potential is in bundled, intelligent guarding solutions combining human intelligence with machine efficiencies to make guarding services more scalable, data-driven, and agile to changing threats.

For Instance, 72% of security firms report faster real-time incident response thanks to AI, while AI-driven threat detection identifies 30–50% more incidents than traditional methods.

Challenges:

-

Low Retention and Limited Skilled Personnel Disrupt Service Consistency and Inflate Recruitment Costs

The single most important challenge faced by the manned security industry is high employee turnover and a lack of skilled labor. That is difficult to retain—long hours and mediocre pay with relatively high physical or mental stress. Additionally, background checks and training requirements further shorten the list of people who can legally use a gun. Firms spend a lot of time on hiring and onboarding, but soon end up getting high attrition within a few months. It hampers service continuity, cost escalations, which eventually affect profits and a decrease in customer delight. Client expectations are evolving towards professionalism and tech-savviness, and in this regard, the challenges of managing workforce issues must be addressed to ensure the continued growth of the manned security services market.

Segmentation Analysis:

By Type:

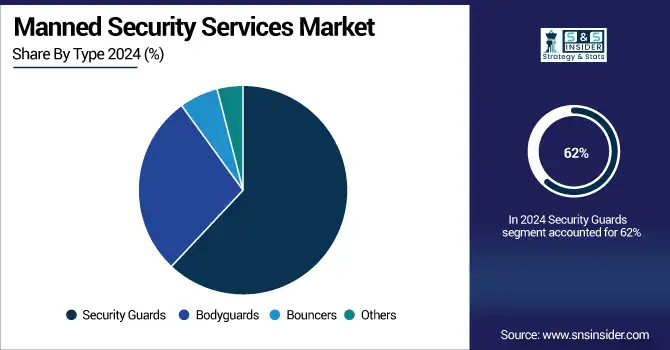

The Security Guards segment dominated the market in 2024 and accounted for 62% of the manned security services market share, due to the high implementation of these services in commercial complexes, critical infrastructure, residential societies, and public institutions. Sustained growth is being driven by population boom, increasing urbanization, rising crime, and a growing demand for visible deterrents. The versatility of these robots in various industries alongside their affordable to implement nature is what is making them a crucial asset in facilitating 24-hour a day safety and unbroken operations.

The Bodyguards segment is expected to grow at the fastest pace. Due to growing threats posed to public figures, executives, and high-net-worth individuals, the Bodyguards segments are predicted to grow at the highest rate. Demand is driven by political tensions, celebrity culture, and the need for more private event security. This segment is being adopted rapidly in both developed and emerging markets, alongside customized, close-protection services that use heavy training in surveillance, defense, and protocol management.

By End-Use:

The Commercial segment dominated the manned security services market in 2024 and accounted for 49% of revenue share, owing to high demand from commercial spaces such as offices, retail stores, malls, banks, and educational institutions. Increasing foot traffic, the requirement for asset protection, and growing compliance with safety regulations drive the adoption of indoor positioning systems among private and public institutions. Increasing implementation of integrated manned and electronic security systems in commercial hubs will maintain the segment dominance for this segment through sophisticated and real-time tracking and access control systems.

The Industrial segment is projected to grow at the fastest CAGR due to various investments in manufacturing, energy, logistics, and critical infrastructure. Such facilities are high-risk targets for theft, sabotage, and operational disruption. In addition, there is increasing requirement for well-trained guards, perimeter patrols, and tech-enabled security protocols leading to the development of industrial sites as a crucial component to propel the growth of manned security services market.

Regional Analysis:

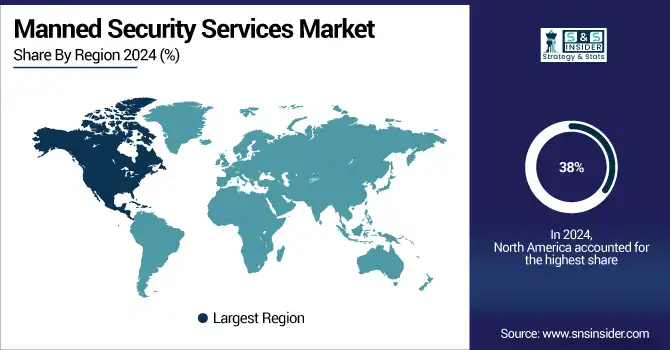

North America dominated the manned security services market in 2024 and accounted for 38% of revenue share, developed infrastructure, policies and extreme security consciousness. This demand across commercial, residential, and critical infrastructure sectors is reinforced by insurance and compliance requirements creating consistent investments for manned guarding complimented with intelligent monitoring and access technologies. This leadership role is projected to last through 2032, further entrenching the region as a powerhouse.

Asia Pacific is poised to achieve the fastest growth during the forecast period, by increasing industrialization and rising crime awareness in countries like China, India, and Japan. Increased commercial and residential projects require greater security coverage, while hybrid manned-plus-tech models drive faster market penetration. Forecast through 2032 expects fecund CAGR consistent with growth in infrastructure and economy in urbanized centers.

The European market is driven by High urbanization coupled with stringent labor and safety regulations and rising shift toward integrated physical-digital guarding is fueling the European market. Infrastructure upgrades in addition to increased threats of terrorism is anticipated to keep demand for the manned security remaining stable throughout the region.

The United Kingdom dominates the European market owing to high use of regulated security personnel in the region, excellent regulatory framework and high commercial and public demand. Sustained investment in event security, critical infrastructure protection, and surveillance-enabled manned services will fuel continued growth going forward.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players :

The major manned security services market companies are G4S plc, Securitas AB, Allied Universal, Prosegur, GardaWorld, ICTS Europe, SIS India, Axis Security, U.S. Security Associates, Loomis AB, and others.

Recent Developments:

-

On April 4, 2025, Allied Universal introduced the Unified Command Center solution, a mobile real-time analytics and incident management hub, which received honors at ISC West.

-

In February 2025, Allied Universal was recognized for its security personnel's life-saving actions during critical incidents, reflecting strong training and responsiveness.

-

In May 2024, Prosegur began 6G-powered smart crowd monitoring trials in Madrid as part of the EU TrialsNet initiative for large-scale event surveillance.

-

In August 2024, Prosegur launched maritime port security operations in Puerto Banús, Marbella, using watercraft patrol for enhanced coastal protection.

|

Report Attributes |

Details |

|

Market Size in 2024 |

US$ 22.2 Billion |

|

Market Size by 2032 |

US$ 64.5 Billion |

|

CAGR |

CAGR of 14.29% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Security Guards, Bodyguards, Bouncers, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

|

Company Profiles |

G4S plc, Securitas AB, Allied Universal, Prosegur, GardaWorld, ICTS Europe, SIS India, Axis Security, U.S. Security Associates, Loomis AB and others in the report |