Application Server Market Report Scope & Overview:

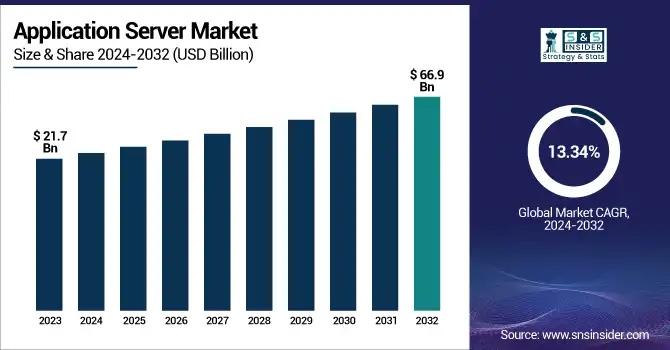

The Application Server Market was valued at USD 21.7 billion in 2023 and is expected to reach USD 66.9 billion by 2032, growing at a CAGR of 13.34% from 2024-2032. This report consists of insights into the Application Server Market, highlighting growth trends, regional adoption patterns, and market dynamics. Growth in application server deployments is driven by industries such as IT, BFSI, and e-commerce, leveraging servers for scalability and digital transformation. The adoption of microservices-based architectures is gaining momentum, particularly in North America and Europe, due to the demand for flexible and agile applications. Organizations of different sizes are increasingly evaluating open-source versus proprietary application servers, with open-source solutions gaining traction for cost-effectiveness. Additionally, the market share of key providers varies regionally, influenced by technological advancements and local industry preferences. The report explores emerging trends, such as serverless computing and edge integration.

To Get more information on Application Server Market - Request Free Sample Report

The U.S. The Application Server Market was valued at USD 7.4 billion in 2023 and is expected to reach USD 22.4 billion by 2032, growing at a CAGR of 13.15% from 2024-2032, driven by the growing adoption of cloud-native applications, microservices architecture, and digital transformation across industries. Increasing demand for real-time data processing and seamless integration in hybrid IT environments further boosts market growth. The future forecast indicates steady expansion supported by advancements in AI-powered servers, edge computing, and serverless technologies.

Application Server Market Dynamics

Drivers

-

Increased reliance on web, mobile, and cloud applications is driving the demand for scalable and efficient application servers.

Major drivers for the growth of the Application Server Market are the increasing implementations of web-based applications and the gradual digital transformation of various sectors. Application servers are becoming increasingly prevalent in many businesses, enabling higher efficiency, agility, and application support for web, mobile, and cloud usage. Demand is also skyrocketing as the shift to microservices architecture and containerized deployments boosts enterprise agility. In addition to the above, with the growth of e-commerce, remote work, and online services, there is an increasing demand for efficient, scalable, and secure application servers that allow for real-time communication and data processing as well as seamless integration with backend systems.

Restraints

-

The high costs of deploying and maintaining application servers are limiting adoption, especially for SMEs.

However, the integration of application servers may be obstructed by time-consuming and expensive deployment processes and infrastructure maintenance issues. On-premise application server management is resource intensive and this is why organizations, especially SMEs, find it tough to keep managing these servers. Operational overhead can also be increased because of problems like constant updating, patching, performance optimization, etc. Moreover, the complex effort to integrate legacy systems with modern applications servers can require an inordinate amount of customization, adding to time and cost-stack-up, leading to slower adoption rates in cost-sensitive markets.

Opportunities

-

The shift toward cloud-native and hybrid application servers is opening new opportunities for scalable, cost-effective solutions.

This shift towards Cloud and Hybrid Infrastructure opens extensive opportunities in the Application Server Market. With organizations now moving their workloads to cloud environments, demand for cloud-native application servers is booming as these application servers provide customers with the ability to scale up or down as demand changes, flexible configuration, and lower infrastructure cost. Hybrids, a combination of on-premise and cloud solutions, are coming into play, facilitating organizations in striking the right balance between data security and operating speed. The trend is being propelled by DevOps practices, containerization (e.g., Docker, Kubernetes), and serverless computing, and it presents a growth opportunity to vendors providing unique and cloud-based application server solutions.

Challenges

-

Growing cybersecurity threats and compliance requirements pose challenges to the secure deployment of application servers.

Application servers, which handle critical business processes and data, have thus become prime targets for cyberattacks. Increasing threats of data breaches, ransomware, and distributed denial-of-service attacks will create an immense challenge for market players. Application servers need around-the-clock monitoring, proactive threat detection, and rigorous security measures, which can be taxing on rod and pull resources. Moreover, ensuring regulatory compliance compounds the complexities, particularly for organizations with a global footprint. As risk and brisk worldwide business are critical approaches for all sellers and firms today, all real sellers should promptly address this as a critical test by securing application servers and recognizing that neither performance nor versatility ought to be traded off.

Application Server Market Segmentation Analysis

By Type

The Java segment dominated the market and accounted for the largest revenue share in 2024 at over 58%. Java is known for its dependency and suggestive power, which contribute significantly to enterprise development due to its usage response and known practices. Industries such as finance, retail, and telecommunications are also major contributors to their dependence on enterprise software development using Java. It is its compatibility with multiple platforms and its few extremes large scale and complex applications to this effect continues to gain adoption. Enterprise resource planning, customer relationship management, and supply chain management systems often use Java for its strong libraries and frameworks like Spring and Hibernate that can perform securely, at scale, and efficiently.

The Microsoft Windows segment is projected to expand at the fastest CAGR during the forecast period. Microsoft Windows application servers are used to host and manage applications in enterprises, such as Windows Server IIS (Internet Information Services). For enterprise IT infrastructure, Windows domination means that server applications will be better integrated with existing systems.

By Deployment

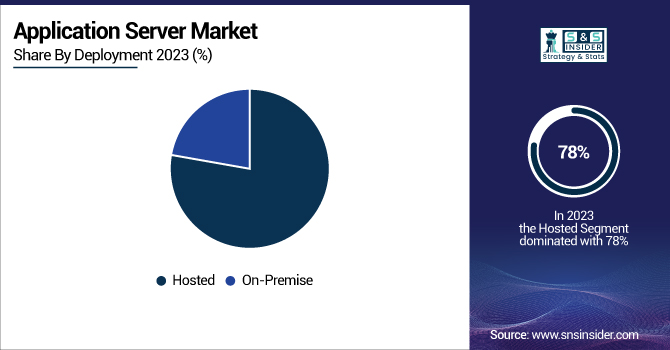

In 2023, the hosted segment dominated the market and accounted for 78% of the revenue share. Due to the challenges of the on-premises system management, organizations are transitioning to hosted application servers. Managed by third-party providers, hosted solutions take care of server setup, maintenance, security, and updates, freeing businesses to focus on their core operations. This is especially useful for small and medium-sized enterprises where IT resources are minimal. Outsourcing out of these features to internet hosting suppliers gives companies with expert control resulting in steady apps.

The on-premise segment is expected to register the fastest CAGR over the forecast period. Companies that operate within the finance, healthcare, and government sectors, for instance, still favor on-premise application servers as their operations are typically subject to strict security and data privacy regulations. On-premise structures give you full control over who has access to your servers and, in turn, allow you to protect sensitive information from external hackers.

By End-Use

In 2024, the IT & telecom segment dominated the market and accounted for a significant revenue share. The IT & telecom industry continues to be the most thriving sector of global digital transformation and is further driving the demand for scalable and resilient application servers. And with the explosion of 5G networks, IoT solutions, and data-driven applications, telecom companies need big iron servers that can efficiently handle large-scale workloads. The server application provides the back-end support required to manage traffic, facilitate smooth connectivity, and enhance service delivery.

The healthcare segment is projected to hold a substantial CAGR throughout the forecast timeline. The healthcare sector is rapidly adopting digital transformation strategies to better serve patients and improve operational efficiencies and health solutions. Application servers enable healthcare applications like EHRs (Electronic Health Records), telemedicine platforms, and mobile health apps to be deployed and managed.

Regional Landscape

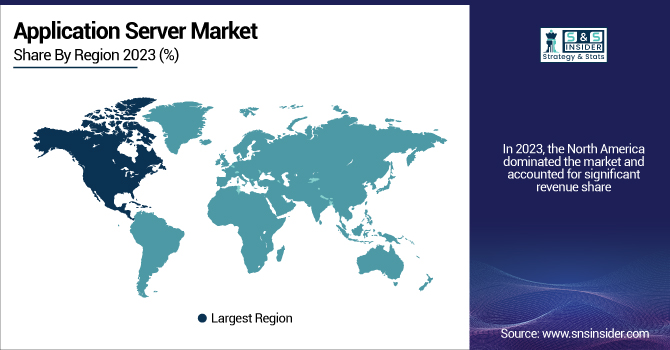

In 2023, the North America dominated the market and accounted for significant revenue share. The rise of the usage of cloud computing and hybrid IT solutions in North America is also fueling the application server market. With many organizations moving toward cloud-native applications and hybrid environments, the application server underpins business operations.

The Asia Pacific is expected to register the fastest CAGR during the forecast period, owing to higher technology adoption across the banking, healthcare, retail, and manufacturing sectors. Governments and businesses across the globe are investing massively in IT infrastructure to advance operational efficiencies and customer experiences. The much-required infrastructure to deploy, manage, and scale cloud and on-premises applications is provided by application servers, which are a key component in supporting this transformation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

The major key players along their their products are

-

IBM Corporation – WebSphere Application Server

-

Oracle Corporation – Oracle WebLogic Server

-

Microsoft Corporation – Azure App Service

-

Red Hat, Inc. – JBoss Enterprise Application Platform

-

Fujitsu Limited – Interstage Application Server

-

SAP SE – SAP NetWeaver Application Server

-

Apache Software Foundation – Apache Tomcat

-

HCL Technologies – HCL WebSphere Liberty

-

VMware, Inc. – Tanzu Application Service

-

TIBCO Software Inc. – TIBCO ActiveMatrix

-

NGINX, Inc. – NGINX Application Platform

-

Google LLC – Google App Engine

-

Adobe Inc. – Adobe ColdFusion

-

Amazon Web Services (AWS) – AWS Elastic Beanstalk

-

Pivotal Software, Inc. – Pivotal Cloud Foundry

Recent Developments

-

March 2024 – Oracle Corporation and NVIDIA Collaboration: Oracle and NVIDIA joined forces to deliver sovereign AI solutions by integrating Oracle's cloud infrastructure with NVIDIA's AI technologies. This collaboration aims to enhance operational control, improve data security, and streamline AI deployments.

-

March 2024 – Fujitsu Limited and AWS Partnership: Fujitsu strengthened its partnership with Amazon Web Services (AWS) to accelerate legacy application modernization on AWS Cloud. This initiative focuses on helping businesses seamlessly migrate critical applications from mainframes and UNIX servers to the cloud.

-

May 2024 – Broadcom Inc. and Microsoft Partnership: Broadcom expanded its collaboration with Microsoft to enhance VMware Cloud Foundation support on Azure VMware Solution, enabling smoother license transfers between on-premises environments and Azure for greater flexibility and scalability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 21.5 Billion |

| Market Size by 2032 | US$ 35.7 Billion |

| CAGR | CAGR of 5.79 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Components, Software, Services) • By Communication Protocol (Fieldbus, Industrial Ethernet, Wireless) • By Vertical (Automotive, Aerospace and Defense, Food and Beverages, Electrical and Electronics, Pharmaceuticals & Medical Devices, Oil & Gas, Chemicals & Fertilizers, Energy & Power, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | EasyPost, Google, IBM, Axway, Vizion, Shippo, ClickPost, ShipEngine, OptimoRoute Inc., Routific Solutions Inc., Iris Software, Inc., ShippyPro, gravitee.io, Celigo, Inc., C.H. Robinson |