Marine Scrubber Market Report Scope & Overview:

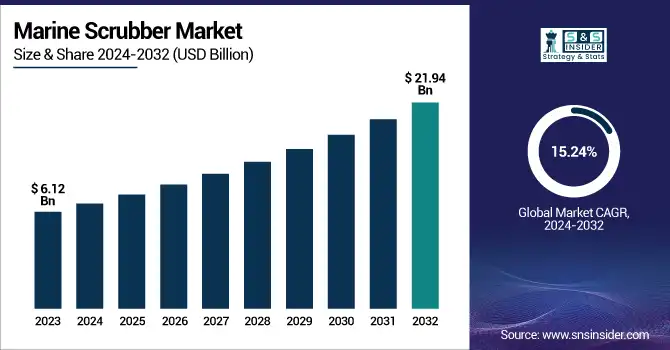

The Marine Scrubber Market was valued at USD 6.12 billion in 2023 and is expected to reach USD 21.94 billion by 2032, with a growing CAGR of 15.24% over the forecast period 2024-2032. This report offers a unique perspective on the Marine Scrubber Market by analyzing regional differences in manufacturing output and utilization efficiency, highlighting where capacity is being maximized. It explores maintenance and downtime patterns, showing how advancements in predictive maintenance are reducing operational disruptions. The study tracks technological adoption trends, emphasizing the rise of AI-integrated scrubber systems across key regions. Export and import flow analysis identifies emerging trade dynamics and shifts in supply chain hubs. Additionally, the report introduces carbon offset integration metrics, reflecting how scrubber technologies are aligning with evolving environmental compliance frameworks.

To Get more information on Marine Scrubber Market - Request Free Sample Report

The U.S. marine scrubber market is projected to grow from USD 1.67 billion in 2023 to USD 5.79 billion by 2032, expanding at a robust CAGR of 14.79%. This growth is driven by increasing environmental regulations and the rising adoption of emission control technologies across the maritime sector. The steady upward trend reflects strong investment in sustainable marine solutions.

Marine Scrubber Market Dynamics

Drivers

-

IMO 2020 regulations, limiting sulfur content in marine fuel to 0.5%, drive the demand for scrubbers to reduce SOx emissions and ensure compliance.

The introduction of IMO 2020 regulations has significantly impacted the marine industry by limiting the sulfur content in marine fuel to just 0.5% (down from 3.5%). This regulatory change is leading to rising demand for marine scrubbers, which are used to remove sulfur oxide (SOx) emissions from vessels that remain on high-sulfur fuel. To meet the new emission standards, vessels require scrubber systems. Scrubbers enable vessels to operate at peak performance during compliance with strict green regulations. These and other regulatory pressures are driving the scrubber market, forcing ship owners and operators to install new scrubber systems or retrofit existing vessels. In addition, this trend is stimulating technological innovation for scrubber design such as the emergence of hybrid and dry scrubbers providing higher efficiency and flexibility solutions respectively. In conclusion, an increase in regulations compliance and marine scrubber market's clean and eco-friendly manufacturing makes the marine scrubber market expected to grow throughout these years.

Restraint

-

High capital and installation costs, including retrofitting and maintenance, make marine scrubbers financially challenging for small and mid-sized fleet owners.

The high capital and installation costs associated with marine scrubbers pose a significant barrier to adoption, especially for small and mid-sized fleet owners. There can be substantial capital cost outlay required the scrubber system itself, installation on the vessel, and retrofits for existing fleet. Such changes may involve the vessel’s infrastructure, which can be either complex or time-consuming. Especially for smaller companies on tight budgets, the price tag overall may just be too high. The installation and regular maintenance necessitate specific technical know-how, which adds to the expenses and makes it difficult for the fleet owners to rationalize the cost. While scrubbers can lead to savings over time through cheaper high-sulfur fuel, the initial investment typically makes them less attractive, with ROI taking many years to show , creating a financial risk for fleet operators whose cash flows are sensitive.

Opportunities

-

The rising demand for LNG and hybrid fuel ships, combined with scrubber technology, creates opportunities for more sustainable and compliant maritime solutions

The increasing demand for LNG (Liquefied Natural Gas) and hybrid fuel ships is driving growth in the marine scrubber market. LNG has become increasingly popular within a shipping industry looking to transition away from fossil fuels, as it produces lower carbon emissions than its hydrocarbons counterparts. Hybrid fuel vessels capable of switching between LNG and more traditional fuels have been realised, improving efficiency and flexibility. This system of scrubbers / alternative fuels provides vessels with both high compliance with regulations, and operational efficiency. Scrubbers are also used to reduce sulfur oxides (SOx) and particulate matter emissions from traditional fuels and LNG reduces carbon emissions. Amid stringent compliance and regulatory requirements introduced by various their governments, the use of both alternative fuels and scrubbers allows the sector to fit into the new compliance environment. This change provides a space for more innovations in developing new solutions that are efficient and cleaner, creating new business opportunities in the emerging industry of sustainable shipping technologies.

Challenges

-

Regulatory uncertainty regarding open-loop scrubbers arises from regional bans, creating compliance risks and potential financial losses for ship owners.

The regulatory uncertainty surrounding open-loop scrubbers presents a significant challenge for the marine scrubber market. Open-loop scrubbers, which use seawater to neutralize sulfur in ship exhaust, release untreated water back into the ocean. But some areas, from China and Singapore to parts of Europe, have already moved or are moving to ban open-loop scrubbers because of fears the water will harm marine ecosystems. This poses a risk of non-compliance for shipping companies have spent money both purchasing open-loop scrubber systems and retrofitting existing vessels, and can face fines or be required to adjust their operations to meet local laws. Moreover, ships that use open-loop scrubbers need to reconsider whether to invest in them or not due to the financial consequences of these restrictions. Uncertainty regarding usage of open-loop scrubbers have been the main challenges for the ship owners and entire maritime industry; as regulatory frameworks are continuously evolving.

Marine Scrubber Market Segmentation Outlook

By Type

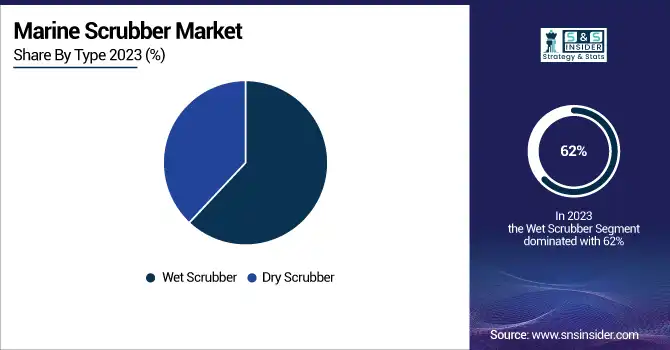

The Wet Scrubber segment dominated with a market share of over 62% in 2023, primarily due to its high efficiency in reducing sulfur emissions from ships. Wet scrubbers use water or an alkaline solution that captures sulfur oxides (SOx) from exhaust gases and neutralizes them, making this method effective and environmentally compliant with stringent regulations. To comply with IMO's tight regulations on sulfur emissions, wet scrubbers are increasingly being used in the shipping sector. They provide an economically viable alternative for ships wishing to continue burning conventional high-sulphur fuel but still complying with standards. Thus, wet scrubbers re considerably favored, particularly in the case of large vessels, guaranteeing lesser environmental impact and mutualizing with worldwide sustainability targets.

By Installation

The retrofit segment dominated with a market share of over 68% in 2023, as existing ships are being retrofitted to comply with increasingly stringent environmental regulations. The International Maritime Organization (IMO) has imposed stringent limits on sulfur emissions, leading shipowners to install scrubbers to cut sulfur emissions. Scrubbers are a cheaper way for existing and operational vessels to meet these regulations instead of constructing new build ships. This demand is important considering that a significant share of the world shipping fleet needs to be retrofitted to comply with these environmental norms. The retrofit segment is the largest segment of the market owing to the economic viability and cost effectiveness of upgrading vessels, which continues to be a major trend, and time efficiency of upgrading as opposed to new builds.

By Application

The Bulk Containers segment dominated with a market share of over 34% in 2023, due to several key factors. Usually, materials like these are shipped overseas, contributing around 10% of all global maritime trade, with each massive bulk cargo vessel carrying millions of tons of raw materials, ores, and grains. Environmental legislation like IMO 2020 is forcing strict sulfur emission rules so there has been a rising demand for scrubbers. Accordingly, it has become common practice for bulk container vessels to have scrubbers installed to mitigate sulfur oxides (SOx) in exhaust gases to help them meet environmental regulations while improving their operational efficiency. This trend is even more pronounced in the case of bulk cargo transportation market, which emerged as the largest segment in the market owing to the significant population of scrubbers.

Marine Scrubber Market Key Regional Analysis

North America region dominated with a market share of over 38% in 2023, due to a combination of stringent environmental regulations and a significant number of shipping vessels operating in the region. Demand for scrubbers is driven primarily by the IMO 2020 regulations that place stiffer limitations on sulphur (SOx) emissions from ships with the U.S. and Canada leading that charge. Indeed, many vessels in North America have turned to scrubber technology, used to reduce emissions of sulfur oxides, to meet such standards. North America can also boast of a large number of global shipping companies, port authorities, and sufficient maritime infrastructure. Ongoing enforcement of environmental standards and matchless demand for these solutions contribute towards making the region an epitome of marine scrubber industry.

The Asia-Pacific region is the fastest-growing market for marine scrubbers, driven by rapid industrialization and increased shipping activities. Countries including China, Japan, and South Korea are implementing stricter emission control regulations that will incentivize the use of scrubbers to achieve IMO 2020 sulfur emission requirements. The demand for scrubbers has skyrocketed as the shipping industry in the region continues to boom, especially with the increase in larger container vessels and oil tankers. With their eye on compliance and competition in international trade, Asia-Pacific companies are investing heavily in scrubbers. The combination of such regulatory pressure and increasing maritime trade is driving the region's fast growth in the marine scrubber market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Marine Scrubber Market key players are:

-

ALFA LAVAL (Exhaust Gas Cleaning Systems)

-

ANDRITZ (Marine Scrubber Systems)

-

Fuji Electric Co., Ltd. (Exhaust Gas Scrubber Systems)

-

KWANG SUNG (Marine Scrubber Systems)

-

MITSUBISHI HEAVY INDUSTRIES, LTD. (Exhaust Gas Scrubber Systems)

-

Pacific Green (Pacific Green Group of Companies) (Marine Scrubber Systems)

-

Valmet (Marine Scrubber Technology)

-

Wärtsilä (Exhaust Gas Cleaning Systems)

-

Yara (Okapi Energy Group) (Exhaust Gas Scrubbing Systems)

-

Drizgas Tech (Marine Scrubber Systems)

-

CR Ocean Engineering (Exhaust Gas Scrubbers)

-

SAACKE (Exhaust Gas Cleaning Systems)

-

EcoScrub (Marine Scrubbers)

-

MAN Energy Solutions (Exhaust Gas Treatment Systems)

-

Hyundai Heavy Industries (Marine Scrubber Systems)

-

FMS Tech (Exhaust Gas Scrubber Systems)

-

Norwegian Clean Seas (Marine Scrubber Solutions)

-

Wartsila Sulphur Recovery (Scrubber Systems)

-

Jiangsu Jiayuan Marine Environmental Protection Engineering (Marine Scrubber Systems)

-

Shanghai Huanqiu Marine Scrubber Systems (Exhaust Gas Cleaning Systems)

Suppliers for (large-scale scrubber installations and offering tailored solutions to meet the diverse needs of vessel operators in the marine industry) on Marine Scrubber Market

-

Wärtsilä Corporation

-

Alfa Laval

-

Yara Marine Technologies

-

Samsung Heavy Industries

-

MAN Energy Solutions

-

Mitsubishi Heavy Industries

-

EcoScrub

-

Wärtsilä Hamworthy

-

Valmet

-

SYSTEC

Recent Development

In July 2024: Wärtsilä entered into a Lifecycle Agreement with Nautica Ship Management to maximize the performance of the marine scrubber systems aboard the MTT Senari and MTT Saisunee vessels. These feeder container vessels are equipped with Wärtsilä’s hybrid scrubber systems.

In August 2023: Wärtsilä began providing feasibility assessments for carbon capture and storage (CCS) to ship owners, evaluating various vessel types. They assess the technical feasibility of integrating CCS from the design phase and are studying both new and existing vessels. Wärtsilä’s CCS-Ready scrubbers make it easier to retrofit CCS systems once the technology is commercially available.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.12 Billion |

| Market Size by 2032 | USD 21.94 Billion |

| CAGR | CAGR of 15.24% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Wet Scrubber (Open Loop, Closed Loop, Hybrid), Dry Scrubber) • By Installation (New Builds, Retrofit), by Application (Bulk Containers, Container Ships, Oil Tankers, Chemical Tankers, Cruises, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ALFA LAVAL, ANDRITZ, Fuji Electric Co., Ltd., KWANG SUNG, MITSUBISHI HEAVY INDUSTRIES, LTD., Pacific Green (Pacific Green Group of Companies), Valmet, Wärtsilä, Yara (Okapi Energy Group), Drizgas Tech, CR Ocean Engineering, SAACKE, EcoScrub, MAN Energy Solutions, Hyundai Heavy Industries, FMS Tech, Norwegian Clean Seas, Wartsila Sulphur Recovery, Jiangsu Jiayuan Marine Environmental Protection Engineering, Shanghai Huanqiu Marine Scrubber Systems |