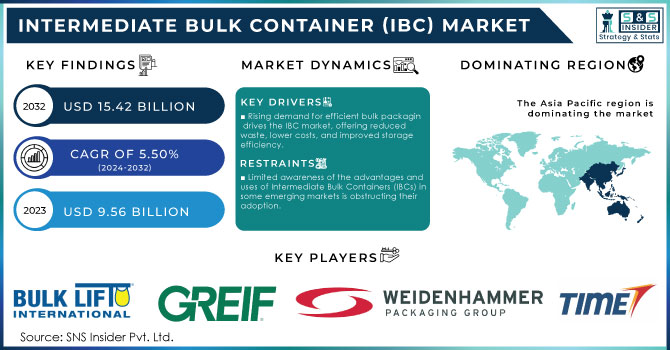

Intermediate Bulk Container (IBC) Market Report Scope & Overview:

The Intermediate Bulk Container (IBC) Market size was valued at USD 9.56 billion in 2023 and is expected to reach USD 15.42 billion by 2032 and grow at a CAGR of 5.50% over the forecast period 2024-2032.

To Get More Information on Intermediate Bulk Container (IBC) Market - Request Sample Report

The Intermediate Bulk Container (IBC) market is evolving rapidly, driven by the demand for efficient storage and transportation solutions across diverse industries. IBCs are extensively used in sectors like chemicals, pharmaceuticals, food and beverage, and oil and gas, to their ability to handle various liquids and semi-solids. Their robust design and reusability align with sustainability efforts, significantly reducing packaging waste. A key trend is the growing adoption of IBCs in the food and beverage sector, which is expected to account for about 25% of total IBC demand. This increase is fueled by stringent safety regulations and the need for quality assurance in transporting bulk liquids like juices and sauces. Additionally, around 30% of IBC manufacturers are developing eco-friendly containers using recyclable and biodegradable materials to meet consumer preferences and regulatory pressures.

| Technology | Description | Commercial Products |

|---|---|---|

| Rigid IBCs | Made from high-density polyethylene (HDPE) or steel, used for various liquids. | Mauser EcoBottle, Greif IBCs |

| Flexible IBCs | Constructed from flexible materials, ideal for bulk liquid transport. | Schütz Flexible IBC, Hoover Ferguson IBCs |

| Stackable IBCs | Designed for efficient storage and transportation, allowing multiple units to be stacked. | Snyder Industries Stackable IBCs |

| Heated IBCs | Equipped with heating elements to maintain specific temperature for sensitive contents. | Aesus IBC with Heating Jacket |

| Closed-Head IBCs | Features a sealed top for minimizing contamination and spillage. | Mauser Closed-Head IBCs |

| Open-Head IBCs | Allows easy access for filling and emptying, often used for solids. | Schütz Open-Head IBCs |

Technological advancements are also influencing the market, with companies integrating smart technology into IBCs. This integration can improve logistics efficiency by 20-30%, enabling better tracking and inventory management. The chemical sector remains a dominant force, representing over 40% of the market share, as regulations for hazardous materials create a steady demand for safe storage solutions. Furthermore, utilizing IBCs can lead to cost savings of up to 40% in transportation and storage due to their larger capacity and stack ability. Innovations like collapsible designs are reducing storage costs by approximately 30%, while the rise of e-commerce contributes to a growth rate of about 15% annually in IBC demand, underscoring the container's critical role in modern supply chains.

MARKET DYNAMICS

DRIVERS

- The rising demand for efficient bulk packaging in sectors like chemicals, pharmaceuticals, and food is propelling the IBC market due to their benefits of reduced waste, lower shipping costs, and enhanced storage efficiency.

The growing demand for bulk packaging is significantly influencing the Intermediate Bulk Container (IBC) market across several key industries, including chemicals, pharmaceuticals, food and beverages, and logistics. As these sectors continue to expand, the need for efficient packaging solutions that optimize operations becomes increasingly critical. IBCs are specifically designed to hold large volumes of liquids and granular materials, making them a preferred choice for bulk packaging. One of the notable advantages of IBCs is their ability to reduce packaging waste by up to 30% when compared to traditional packaging methods. This not only lowers material costs but also helps minimize environmental impact, aligning with the global push for sustainability.

Moreover, IBCs enhance supply chain efficiency by improving storage capabilities; they can be stacked, which conserves valuable warehouse space. This is particularly beneficial in industries facing high storage costs. Research indicates that utilizing IBCs can reduce shipping costs by as much as 15%, making them an economically attractive option for businesses. The increasing emphasis on sustainability and operational efficiency is driving the adoption of IBCs, as companies strive to meet environmental regulations and consumer expectations while optimizing their logistics and supply chains. Consequently, the IBC market is poised for robust growth, driven by these evolving industry needs.

- The growth of the chemical and pharmaceutical industries is driving the demand for Intermediate Bulk Containers (IBCs) due to their need for safe and efficient transport and storage of both hazardous and non-hazardous materials.

The rising chemical and pharmaceutical industries are key drivers of demand for Intermediate Bulk Containers (IBCs), as these sectors increasingly seek safe and efficient transport and storage solutions for both hazardous and non-hazardous materials. The chemical industry is one of the largest consumers of IBCs, as they provide secure packaging for various chemicals, including solvents, acids, and intermediates. IBCs are designed to meet stringent safety standards, ensuring that hazardous materials are transported without risk of leakage or contamination. In fact, nearly 30% of all chemical shipments globally are transported in bulk containers, underscoring the importance of IBCs in this sector.

Similarly, the pharmaceutical industry relies on IBCs to handle active pharmaceutical ingredients (APIs) and finished products, which often require specific storage conditions and regulatory compliance. The rise of biologics and biosimilars, which typically require specialized handling, is also increasing the demand for IBCs. Studies indicate that nearly 40% of pharmaceutical companies are shifting towards bulk packaging to improve their operational efficiency and maintain the integrity of their products during transit. Moreover, the global push for sustainability has led both industries to prioritize reusable and recyclable packaging solutions, further enhancing the appeal of IBCs. Their ability to reduce packaging waste and lower transportation costs by optimizing space contributes to their growing adoption in these sectors.

RESTRAIN

- Limited awareness of the advantages and uses of Intermediate Bulk Containers (IBCs) in some emerging markets is obstructing their adoption.

Limited awareness regarding the benefits and applications of Intermediate Bulk Containers (IBCs) poses a significant challenge to their adoption in emerging markets. Many industries in these regions, including chemicals, food and beverages, and pharmaceuticals, may not fully recognize the advantages that IBCs offer over traditional packaging solutions. While IBCs can reduce packaging waste by approximately 30%, many companies still rely on conventional containers like drums or smaller packaging units, which do not optimize storage and transportation efficiencies. The lack of knowledge about IBCs’ ability to enhance operational efficiency, reduce shipping costs by up to 15%, and improve safety during handling can deter businesses from transitioning to these bulk solutions.

Moreover, the perception of IBCs as specialized products may contribute to the hesitance in adopting them. Companies often stick to familiar packaging methods due to concerns about the complexity of switching to a new system, which can lead to missed opportunities for cost savings and environmental benefits. Educational initiatives and awareness campaigns are essential to highlight the advantages of IBCs and demonstrate their applications across various sectors. Additionally, manufacturers and suppliers need to engage with local businesses, providing training and support to ease the transition. By addressing these awareness gaps, stakeholders can foster greater acceptance and encourage the adoption of IBCs in emerging markets, ultimately leading to improved efficiencies and sustainability in packaging practices.

KEY SEGMENTATION ANALYSIS

By Material

The plastic segment dominated the market share over 42.08% in 2023, due to its strength, durability, and lightweight nature. This material's affordability significantly contributes to its widespread adoption among manufacturers. In recent years, there has been a growing emphasis on sustainability, prompting manufacturers to incorporate sustainable plastic options in IBC production. This shift not only meets the demand for cost-effective solutions but also addresses environmental concerns by reducing plastic waste. According to the Environmental Protection Agency (EPA), plastic recycling rates remain low, with only about 9% of plastic waste being recycled in the U.S. However, the shift towards using recycled and sustainable plastics in IBCs represents a proactive step in mitigating these environmental challenges.

By Packaging Type

The rigid segment dominated the market share over 62.08% in 2023, driven by its superior strength, stability, and environmental benefits. Rigid IBCs, predominantly made from High-Density Polyethylene (HDPE), are 30% stronger than traditional metal or glass containers, ensuring safe storage and transport of liquids and sensitive materials. The cubic or rectangular design of rigid IBCs enhances logistics, increasing packing efficiency by approximately 25%. This design allows for better space utilization, reducing transportation costs by up to 20% compared to cylindrical containers. Additionally, rigid IBCs are highly stackable, optimizing storage and handling processes, which leads to fewer trips and reduced fuel consumption.

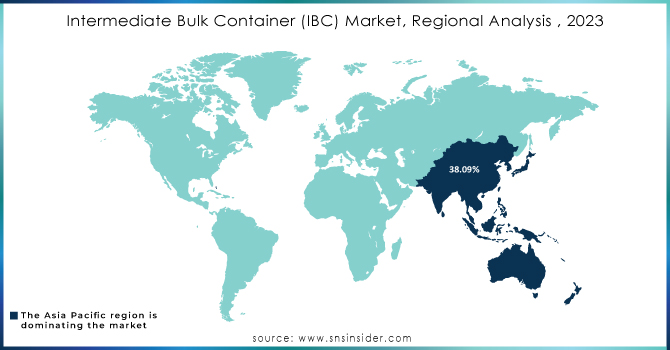

KEY REGIONAL ANALYSIS

The Asia Pacific region dominated the market share over 38.09% in 2023, driven by rapid industrialization and the growing need for efficient storage and transport solutions across multiple industries. Key sectors like agriculture, infrastructure, chemicals, and pharmaceuticals are contributing significantly to the demand for IBCs in the region. Countries such as China, India, and Japan are experiencing robust growth in infrastructure development, while the agricultural sector is expanding in regions like Southeast Asia, boosting the adoption of IBCs for bulk handling and transportation. Asia is responsible for nearly 60% of global chemical production, which is a key end-user of IBCs for safe and efficient material handling. Additionally, the agriculture industry in the region is rapidly modernizing, requiring improved storage solutions for chemicals, fertilizers, and other materials.

Europe is witnessing substantial growth in the Intermediate Bulk Container (IBC) market, largely driven by its well-established industrial base and stringent waste management regulations. The European Union has implemented strict policies promoting sustainability, waste reduction, and the circular economy, pushing industries to adopt reusable and recyclable packaging solutions like IBCs. These containers are increasingly favored across various sectors, including chemicals, food & beverage, and pharmaceuticals, due to their eco-friendly attributes and durability. Europe plays a critical role in supporting this market growth. The chemical industry, which is one of the largest sectors in the region, has been rapidly adopting IBCs to comply with safety and environmental standards.

Do You Need any Customization Research on Intermediate Bulk Container (IBC) Market - Inquire Now

KEY PLAYERS

Some of the major key players of Intermediate Bulk Container (IBC) Market

-

Bulk Lift International (Flexible Intermediate Bulk Containers - FIBC)

-

Greif Inc. (Steel Drums, Plastic Drums, IBCs)

-

Weidenhammer Packaging (Composite Containers, IBCs)

-

Berry Plastics (Plastic IBCs)

-

Mauser Packaging Solutions (Plastic, Steel, and Composite IBCs)

-

Schuetz Container System (Plastic and Composite IBCs)

-

Time Technoplast Ltd. (Plastic IBCs, Composite IBCs)

-

OMCE di (Steel IBCs)

-

TPL Plastech Ltd. (Plastic IBCs, FIBCs)

-

Rocchetti Amleto S.p.A. (Metal IBCs, Tanks)

-

Snyder Industries, Inc. (Plastic and Steel IBCs)

-

Global-Pak Inc. (FIBCs)

-

Bulk Containers Ltd. (Flexible IBCs, Liquid IBCs)

-

Conitex Sonoco USA, Inc. (Fiber Drums, FIBCs)

-

Camex Equipment (Heavy-Duty Steel IBCs)

-

Hoover Ferguson (Metal, Composite IBCs)

-

Precision IBC, Inc. (Custom IBCs, Metal IBCs)

-

Transtainer (Plastic IBCs, Customized IBCs)

-

Envirotainer (Temperature-Controlled IBCs)

-

TranPak, Inc. (Plastic IBCs, Custom IBC Solutions)

Suppliers for Known for durable and high-quality plastic IBCs with innovative spill containment solutions of Intermediate Bulk Container Market:

-

Snyder Industries

-

Mauser Packaging Solutions

-

Greif Inc.

-

Schuetz Container Systems

-

Hoover Ferguson

-

Thielmann

-

Time Technoplast

-

Berry Global

-

MaschioPack North America

-

C.L. Smith

RECENT DEVELOPMENTS

-

In 2024: Mauser Packaging Solutions and Rikutec Packaging have formed a partnership aimed at enhancing sustainable Intermediate Bulk Container (IBC) solutions. This collaboration focuses on reducing plastic waste and increasing recyclability within the IBC market.

-

In February 2024: Aran Group, a major manufacturer of sustainable liquid packaging based in Israel, acquired IBA Germany. This acquisition enables Aran Group to develop 1,000-liter IBCs and facilitates their entry into the large German market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.56 billion |

| Market Size by 2032 | USD 15.42 billion |

| CAGR | CAGR of 5.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Plastic, Metal, Paper & Paperboard) • By Packaging Type (Rigid, Flexible) • By End-use Industry (Industrial Chemical, Food & Beverage, Building & Construction, Pharmaceutical, Agriculture, Paint & Coating, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bulk Lift International, Greif Inc., Weidenhammer Packaging, Berry Plastics, Mauser Packaging Solutions, Schuetz Container System, Time Technoplast Ltd., OMCE di, TPL Plastech Ltd., Rocchetti Amleto S.p.A., Snyder Industries, Inc., Global-Pak Inc., Bulk Containers Ltd., Conitex Sonoco USA, Inc., Camex Equipment, Hoover Ferguson, Precision IBC, Inc., Transtainer, Envirotainer, and TranPak, Inc. |

| Key Drivers | • The rising demand for efficient bulk packaging in sectors like chemicals, pharmaceuticals, and food is propelling the IBC market due to their benefits of reduced waste, lower shipping costs, and enhanced storage efficiency. • The growth of the chemical and pharmaceutical industries is driving the demand for Intermediate Bulk Containers (IBCs) due to their need for safe and efficient transport and storage of both hazardous and non-hazardous materials. |

| RESTRAINTS | • Limited awareness of the advantages and uses of Intermediate Bulk Containers (IBCs) in some emerging markets is obstructing their adoption. |