Mechanical Control Cables Market Report Scope & Overview:

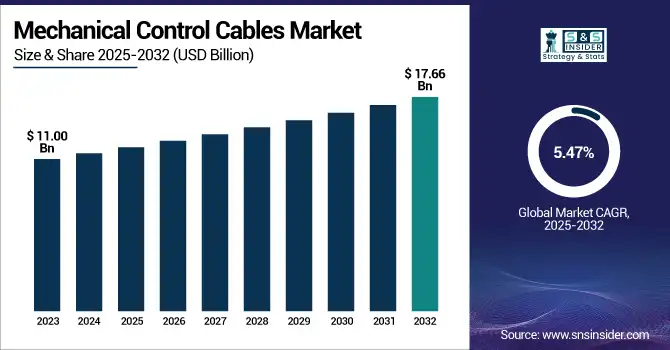

The Mechanical Control Cables Market size was estimated at USD 11.00 billion in 2023 and is expected to reach USD 17.66 billion by 2032, with a growing CAGR of 5.47% over the forecast period 2024-2032.

To Get more information on Mechanical Control Cables Market - Request Free Sample Report

The demand for mechanical control cables market is driven by factors such as the increasing utilization in aerospace, automotive, industrial equipment, and others. These cables are critical for controlling machinery and systems, providing high reliability and precision. The growing use of automated machinery as well as mechanized tools is expected to lead the market towards sustainable growth. Additionally, ongoing innovations like corrosion-resistant coatings and improved durability are optimizing the performance of mechanical control cables, establishing them as crucial elements in contemporary equipment. Another driving factor is the progress and innovations in cable manufacturing techniques, as well as an increasing focus on quality and safety in a wide range of applications.

The US Mechanical Control Cables Market was valued at USD 2.67 billion in 2023 and is expected to reach USD 4.19 billion by 2032, growing at a CAGR of 5.30% from 2024 to 2032. The U.S. Mechanical Control Cables Market is driven by the aerospace, defense, and automotive industries. Growing demand due to high military modernization and advanced aircraft systems investments. Moreover, the presence of prominent OEMs and continual infrastructure upgrades is driving the market forward, fostering the U.S. as a key global expansion area.

Market Dynamics

Key Drivers:

-

Rising Need for Lightweight and Durable Materials in Aerospace and Automotive Sectors Fuels the Mechanical Control Cables Market.

This is primarily due to the growing demand for superior mechanical control cables in aerospace and automotive applications, which is expected to fuel market growth. Industries are searching for materials that are lightweight, corrosion-resistant, and durable enough to enhance efficiency, fuel economy, and safety. As aerospace manufacturers are trying to reduce the weight of their aircraft with the same reliability and performance, the popularity of mechanical control cables constructed from advanced composites and stainless steel is rising. The same goes for automotive OEMs that are seeing an increased number of cable-controlled systems in electric vehicles and hybrid models, driving demand. Heightened emphasis on precision control in such systems, accelerator, clutch, brake, and transmission systems, especially in high-performance vehicles, is another factor fueling the growth. And defense refresh rates in nations such as the U.S. and increasing investments in aircraft production are buttressing this trend. This is prompting manufacturers to focus R&D efforts towards the creation of next-generation cable systems that resolve these changing performance metrics alongside sustainability factors.

Restraint:

-

Growth Potential of Market Hindered by High Maintenance Cost and Mechanical Control Cable Replacement.

In aerospace and marine applications, maintenance and replacement are very expensive, which will be one of the major restraints of the Mechanical Control Cables Market (for high-assurance Mechanical Control Cables). Under severe weather conditions, high temperatures, humidity, vibrations, and corrosive elements, the cables experience aging and damage. Regular checks, lubrication, and sometimes sophisticated replacement parts to maintain consistent performance can be expensive. In the defense and aviation sectors, downtime due to cable failure can have significant operational and safety ramifications, resulting in more frequent replacements and a stringent testing regimen. This not only raises the operational costs but also violates the cost-efficiency hopes of end-users. Additionally, in low-income countries where the budget is of utmost importance, such costs inhibit adoption. While advances in material science are improving the longevity of cables, the up-front investment and lifecycle costs still prevent a broad market penetration in cost-sensitive segments.

Opportunity:

-

The rise of autonomous systems and the electrification of powertrains in mobility platforms can lead to new opportunities for mechanical control cable innovation within the vehicle.

As the world is embracing electric and autonomous mobility, massive opportunities are anticipated in this domain of innovation for the Mechanical Control Cables Market. High-precision, high-reliability, and low-latency mechanical control systems are needed as electric vehicles (EVs), unmanned aerial vehicles (UAVs), and autonomous ships are becoming new applications for such control systems. Even advanced extendable mobility setups still need mechanical linkages for their main functions, especially in hybrid systems, which consist of a hybrid of mechanical and electronic control architectures. Mechanical control cables aren't going away, though; they're still necessary for systems like emergency braking, steering, and throttle control that provide redundancy to boost safety. In addition, autonomous ground and aerial systems are being adopted by the military and defense sectors, thereby widening the scope of advanced cable solutions. Manufacturers are looking towards sensor-embedded cables and lightweight composites, which can fulfill the performance demands of future mobility.

Challenge:

-

Ongoing Supply Chain Disruptions and Shortages of Key Materials Affecting Production and Delivery Timelines in the Mechanical Control Cables Market.

The Mechanical Control Cables in these industries has also led to supply chain disruptions and material shortages including high-quality metals and specialized materials necessary for cable manufacturing. Moreover, these shortages, amplified by worldwide economic dynamics, trade barriers, and logistic issues lead to production delays and elevated product costs. As the demand for these cables in industries such as aerospace and automotive increases, the challenge of sourcing materials at a competitive price to fulfill that demand grows. It can ultimately affect market growth due to the strain it puts on the supply chain, which leads to project delays, reduced production capacity, and also prevents industry players from maintaining consistency in product quality.

Segments Analysis

By Type

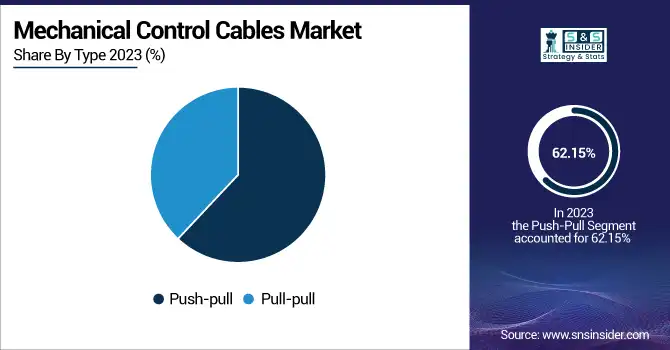

In 2023, the push-pull segment held the largest market share in the mechanical control cables market, 62.15%, as it can efficiently operate both the in and out actions of a device. This segment is a prominent segment with increasing product improvements and is extensively used in aircraft engine controls, marine throttle systems, and land vehicle transmissions. Among them, Cablecraft Motion Controls introduced a new line of upgraded push-pull assemblies with greater flexibility and resistance to corrosion, which are designed for use in aerospace and defense applications. Likewise, Triumph Group brought its mechanical systems portfolio to support next-gen aircraft. These innovations bolster the push-pull segment's stronghold, rendering it a pillar of the global mechanical control cables market.

Based on type, the pull-pull segment is anticipated to register the highest CAGR of 6.07% during the forecast period due to its lightweight space-saving design, which makes it suitable for applications requiring tension-only control, such as aircraft rudders and remote actuator systems. Bergen Cable Technologies unveiled 2023 custom pull-pull solutions made for thin air vehicles (UAVs) and small aerospace platforms, including systems made to meet innovation and durability needs within confined spaces. Loos & Co. also made gains in their pull-pull assemblies and began using aerospace-grade materials to improve strength-to-weight ratios. With the growth of electric and autonomous systems, particularly in aerial platforms, pull-pull cables are becoming more popular, helping propel their importance in the changing mechanical control cables market.

By Material

In 2023, the Wire Material segment dominated the mechanical control cables market and held the largest revenue share of approximately 52%, due to growing applications in aerospace and defense. High-tensile, corrosion-resistant stainless steel and other advanced alloys have become so much in demand. High-performance control cables such as those from Loos & Co., Inc. and Bergen Cable for the engine and braking systems of aircraft were presented at the show, improving the durability and responsiveness of these critical systems. Cablecraft Motion Controls also added wire-based products to its portfolio to meet FAA requirements. The scroll dominance in this segment is ascribed to grits and belts' crucial role in facilitating "precision" mechanical movement, particularly across aviation, marine, and automotive systems that require strength and reliability.

The Jacket Material segment accounted for the fastest-growing market with a CAGR of 6% during the forecast period, due to advancements in polymer technology, as well as a few innovations in newer coatings for these cables, coupled with rising demand for flexible and weather-resistant cable systems. Trelleborg Sealing Solutions and Lexco Cable recently launched performance advancements in thermoplastic and fluoropolymer jackets, increasing heat resistance and reducing abrasiveness for extreme environmental applications. These materials are being adopted for land and marine platforms where cables will be subject to moisture, chemicals, and vibration. The segment has been a significant contributor to the Mechanical Control Cables Market owing to its applications in the rapidly growing industries such as electric vehicles and industrial automation, which also enhances cable lifespan, reducing total maintenance cost.

By Application

The Engine Control segment accounted for the largest revenue share of 42.57% in 2023, due to the growing demand for precision and reliability in automotive engine management systems. Companies such as Delphi Technologies and Continental have released sophisticated engine control units (ECUs) with upgraded fuel efficiency, emissions management, and real-time diagnostics capabilities. So, just some of the power behind these advances is the overall making of vehicles that are more efficient and safer today. They typically require significantly more torque to operate compared to mechanical cables, correlating with a potential decrease in the mechanical control cables market, yet at the same time, the demand for advanced cable solutions for throttle and other components within the engine continues to increase, driven by advancements in engine control technology.

The Brake Control segment is anticipated to have a significant CAGR of 6.29% during the forecast period due to increased safety protocols and technological advancements in braking systems. Pioneering Firms, Which Includes EBS and Hybrid Braking Systems, Such As ZF Friedrichshafen and Bosch It makes the vehicle safer, more efficient, and performance-oriented. The increase in demand for the Mechanical Control Cables Market is in sync with the growth of the Brake Control segment because cable is an integral part of mechanical brake systems, which in turn increases the demand for heavy-duty, reliable, and better-performing cables for usage in automotive applications.

By End User

On the basis of End user, the Commercial segment reported the highest revenue share of 60% in 2023, as the demand in the commercial segment is increasing in various industries like automotive, aerospace, industrial applications, and so on, in recent years. Innovations like high-performance cables for commercial vehicles were introduced by companies including Nexans (Kabelmetal) and Prysmian Group, helping reduce the overall weight of vehicles while increasing efficiency. The products under development also included smart mechanical cables with embedded sensors for predictive maintenance. This growth is in line with the growing importance of automation and control systems. Aimed at improving the smooth and efficient functioning of various sectors, such as industrial machines and control systems, the healthy 5.49% CAGR for the segment indicates the need for such cables for commercial applications.

Regional Analysis

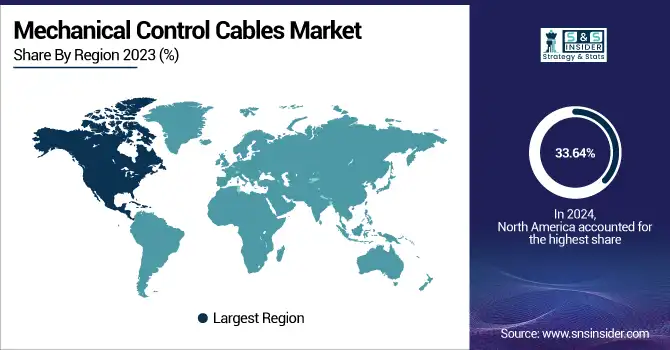

North America held the largest share of the mechanical control cables market and accounted for 33.64% of revenue share in 2023. The highest market share of the northern region is due to the region having advanced manufacturing capabilities and a solid automotive industry, as well as the growing demand for high-quality mechanical control cables in various applications. Some companies, such as General Cable, Prysmian Group, and Southwire, launched new products like corrosion-resistant cables for use in marine, automotive, etc. This is in line with the growing Automation and smart manufacturing trend across North America. With a high demand for reliable and durable mechanical control solutions for automotive and industrial applications, the region leads in terms of production and consumption.

The Asia Pacific has the highest CAGR of nearly 6.45% within the forecast period, owing to rapid industrialization, the growing automotive production, along with development in both the commercial and residential infrastructural sectors. In Asia, China, India, and Japan are experiencing a large growth in demand for mechanical control cables, and companies such as Sumitomo Electric Industries and LS Cable & System have developed new cable solutions, in line with the regional demand. These advancements in product support the mechanical control cables market growth by providing economical, high-performance cables for automotive, construction, and industrial applications. Asian production fuels this growth also through adding to the internal supply, yet demand as well as global exports, having a very important manufacturing base.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Aero Assemblies, Inc. (Aircraft Control Cables, Custom Control Cables)

-

Bergen Cable Technology, Inc. (Steel Control Cables, Custom Engineered Cable Assemblies)

-

Drallim Industries Limited (Control Cables, Push-Pull Cables)

-

Escadean Ltd. (Push-Pull Control Cables, Custom Cables)

-

Glassmaster Controls Company, Inc. (Automotive Control Cables, Marine Control Cables)

-

Grand Rapids Controls, LLC (Control Cables, Industrial Cable Assemblies)

-

Jersey Strand & Cable, Inc. (Stainless Steel Cables, Mechanical Control Cables)

-

Küster Holding GmbH (Control Cables, Specialty Cables)

-

Loos & Co. Inc. (Control Cables, Aircraft Cables)

-

Motion Control Technologies, Inc. (Push-Pull Control Cables, Actuation Systems)

-

Orscheln Products LLC (Push-Pull Control Cables, Vehicle Control Cables)

-

St. Pierre Manufacturing Corporation (Control Cables, Cable Assemblies)

-

Triumph Group, Inc. (Aerospace Control Cables, Custom Cable Assemblies)

-

Tyler Madison, Inc. (Custom Control Cables, Military Cables)

-

VPS Control Systems, Inc. (Push-Pull Cables, Control Cable Assemblies)

Recent Trends

-

December 2023 – Bergen Cable Technology highlighted its role in advancing critical industries by delivering custom cable solutions that exceed performance expectations. The company emphasizes precision engineering, safety, and innovation across aerospace, defense, and medical sectors, reinforcing its reputation as a trusted partner in mission-critical applications.

-

January 2023 - Triumph Group received an award from Airbus for its exceptional performance in supplying control cables for the A330, A320, and A350 aircraft programs. The recognition highlights Triumph’s commitment to quality, on-time delivery, and customer support, reinforcing its role as a trusted partner in the global aerospace supply chain.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 11.00 Billion |

| Market Size by 2032 | US$ 17.66 Billion |

| CAGR | CAGR of 5.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type – (Push-pull, Pull-pull) • By Platform – (Aerial, Land, Marine) • By Material – (Wire Material, Jacket Material) • By Application – (Engine Control, Auxiliary Control, Landing Gears, Brake Control, Others) • By End User – (Commercial, Defence, Non-aero Military) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aero Assemblies, Inc., Bergen Cable Technology, Inc., Drallim Industries Limited, Escadean Ltd., Glassmaster Controls Company, Inc., Grand Rapids Controls, LLC, Jersey Strand & Cable, Inc., Küster Holding GmbH, Loos & Co. Inc., Motion Control Technologies, Inc., Orscheln Products LLC, St. Pierre Manufacturing Corporation, Triumph Group, Inc., Tyler Madison, Inc., VPS Control Systems, Inc. |