Irrigation Automation Market Report Scope & Overview:

The Irrigation Automation Market size was valued at USD 4.93 Billion in 2023 and is expected to grow to USD 20.27 Billion By 2032 and grow at a CAGR of 17.01% over the forecast period of 2024-2032. The Irrigation Automation Market is being fueled by the growing need for effective water management in agriculture and landscaping. The increasing worry about water scarcity impacting about 2 billion people globally, along with the requirement for sustainable farming practices, has led to a significant increase in the use of automated irrigation systems. These systems improve water efficiency, increase crop production, and lower labor expenses, making them a appealing choice for farmers and agricultural businesses. Research shows that automated systems can cut water usage in half, providing an effective solution for crops that require a lot of water. The current market trends involve incorporating cutting-edge technologies like IoT, AI, and machine learning that are improving the functionality of irrigation systems.

To Get More Information on Irrigation Automation Market - Request Sample Report

Intelligent irrigation systems enable users to customize watering schedules by using data from real-time monitoring to make decisions based on weather, soil moisture, and crop needs. Using Internet of Things sensors, there can be a 30% improvement in water-use efficiency, demonstrating the substantial effects of technological progress. This not just enhances effectiveness but also encourages sustainable methods by reducing water wastage. Moreover, the increasing use of precision agriculture is playing a key role in driving market expansion, as approximately 80% of farmers are either contemplating or currently utilizing precision irrigation methods. Farmers are putting more money into systems that offer accurate management of irrigation methods, which is causing an increase in the need for automation.

Irrigation Automation Market Dynamics

DRIVERS

- Water scarcity concerns are driving farmers and agricultural businesses to adopt irrigation automation systems that optimize water usage, ensuring sufficient moisture for crops while reducing wastage.

Farmers and agricultural businesses around the world are increasingly turning to irrigation automation systems due to the growing importance of water scarcity. With climate change worsening water shortages and changing rainfall patterns, effective water management is now more important than ever. These automated systems make use of state-of-the-art technologies like soil moisture sensors, weather data integration, and remote monitoring to maximize water efficiency. These systems deliver specific quantities of water straight to the base of crops, guaranteeing that plants get enough moisture without excessive watering that can cause waste and waterlogging. Furthermore, implementing these technologies not just saves water but also boosts both crop output and quality, leading to more sustainable and profitable agriculture. As the demand for food production rises and water resources face more pressure, farmers understand that investing in irrigation automation is no longer optional but essential. This change tackles both short-term water scarcity worries and helps build long-term resilience in agriculture, making sure that farming can succeed in difficult environmental conditions. Therefore, automated irrigation systems are increasingly essential in contemporary farming methods, promoting water conservation and effectiveness.

- The integration of IoT, AI, and machine learning in irrigation systems enhances real-time monitoring and automated decision-making, significantly improving irrigation efficiency through data-driven information.

The incorporation of IoT, AI, and machine learning into irrigation systems is a revolutionary progression in farming techniques. Farmers can track soil moisture levels, weather conditions, and crop health in real-time by using IoT sensors. AI algorithms analyze the large amounts of data gathered by these sensors, allowing for automated decision-making processes. For example, machine learning algorithms have the capability to forecast the best times and amounts for watering by analyzing past and present data. This leads to a major decrease in water waste and guarantees that crops get the exact irrigation they need for maximum growth. This method based on data not only improves irrigation effectiveness but also encourages responsible water usage, which is crucial in areas dealing with water shortage. Additionally, instant monitoring enables quick reactions to changing situations, like modifying irrigation schedules due to sudden rainfall. As a result, combining these technologies results in better crop health, increased production, and lower costs, ultimately helping farmers increase productivity while also reducing their impact on the environment. The combination of IoT, AI, and machine learning enables farmers to make informed decisions, ensuring that their irrigation practices are efficient and effective.

RESTRAIN

- The high upfront costs of installing advanced irrigation automation systems can deter small-scale farmers, particularly in developing regions, from adopting these technologies.

The adoption of advanced irrigation automation systems by small-scale farmers, especially in developing regions, is often hindered by the significant upfront costs associated with installation. These systems, while highly effective in optimizing water usage and increasing crop yields, require substantial financial investment, which many smallholder farmers cannot afford. In areas where agricultural income is limited and access to credit is restricted, the financial burden of installing these technologies can be overwhelming. Moreover, small-scale farmers may prioritize immediate needs over long-term investments, opting to allocate their limited resources to essential farming inputs such as seeds, fertilizers, and labor. This reluctance is exacerbated by the lack of financial incentives or government support programs that could help mitigate these initial costs. As a result, despite the potential benefits of enhanced efficiency and productivity from automated irrigation, many farmers remain hesitant to invest in such systems. Consequently, the gap between technology advancement and actual adoption among small-scale farmers widens, perpetuating existing challenges in water management and agricultural productivity in these regions. Addressing the financial barriers through subsidies, micro-financing, or public-private partnerships could encourage wider adoption and help realize the benefits of modern irrigation practices.

Irrigation Automation Market Segmentation Analysis

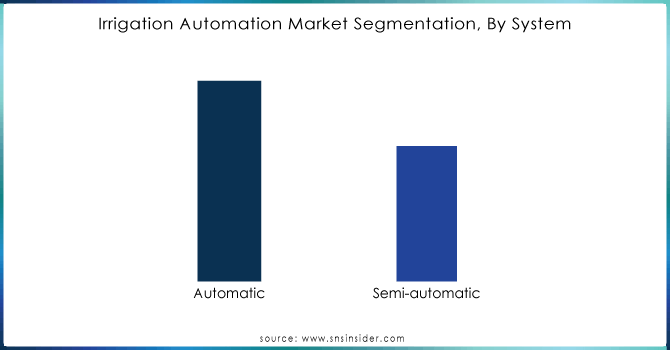

By System

Automatic segment dominated the market with a share of 62.12% in 2023, due to their ability to efficiently manage water resources, optimize irrigation schedules, and reduce labor costs. These systems can operate without manual intervention, making them attractive to both large-scale and small-scale farmers looking for convenience and efficiency.

Do You Need any Customization Research on Irrigation Automation Market - Enquire Now

By Irrigation Type

Drip segment dominated the market with a share of 42.03% in 2023, due to their water-saving capabilities and effectiveness in delivering water directly to the plant roots. This method is particularly favored in regions facing water scarcity and among high-value crops.

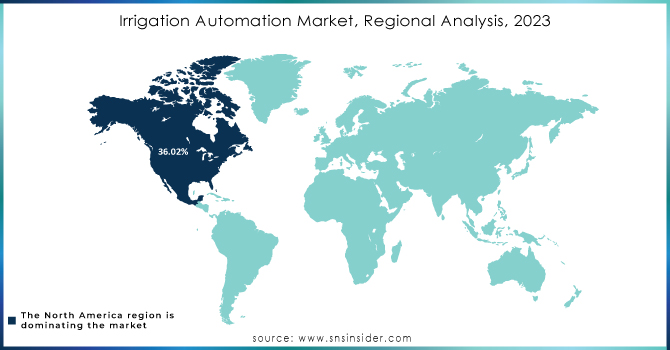

Irrigation Automation Market Regional Outlook

North America region dominated the market share over 36.02% in 2023, with significant investment in technology, and the increasing adoption of precision farming methods. The region's focus on optimizing water usage and enhancing crop yields through innovative irrigation solutions has led to substantial market growth.

The Asia-Pacific region is emerging as the fastest-growing market for irrigation automation, primarily driven by rapid urbanization, increasing population, and the rising demand for food production. Countries like India and China are investing heavily in modernizing their agricultural practices to address water scarcity and improve food security. Government initiatives promoting efficient irrigation technologies and increased awareness among farmers about the benefits of automation further contribute to this growth.

Key Players

Some of the major key players of Irrigation Automation Market

- Valmont Industries Inc..: (Valley Irrigation Systems)

- Hunter Industries: (Hydrawise Irrigation Management)

- Rain Bird Corporation: (ESP-LXIV Series Controllers)

- Lindsay Corporation: (FieldNET Irrigation Management)

- Toro Company: (Toro Smart Irrigation Solutions)

- Galcon: (Galcon G-1100 Series Controllers)

- Jain Irrigation Systems: (Jain Remote Management System)

- Netafim: (NetBeat Irrigation Management Platform)

- Rubicon Water: (Rubicon Water Management Solutions)

- Nelson Irrigation: (Nelson 3030 Series Rotating Sprinklers)

- Weathermatic: (SmartLink Irrigation Control System)

- Rivulis Irrigation: (Rivulis Drip Irrigation Solutions)

- Calsense: (Calsense Irrigation Management Systems)

- Agri-Inject: (Agri-Inject Chemigation Systems)

- RainSmart Technologies: (RainSmart Controller)

- AquaSpy: (AquaSpy Soil Moisture Sensors)

- CropX: (CropX Soil Sensor Technology)

- Aqua-Turf International: (Irrigation Automation Solutions)

- SkyDrop: (SkyDrop Smart Irrigation Controller)

- Dig Corporation: (Dig Smart Irrigation Solutions)

Recent Developments

In March 2024: Afara Agricultural Technologies Inc. developed AFARA-COTTON; an autonomous mobile robot designed to collect cotton spilled on the ground after the mechanical harvesting process. The Turkish company has also developed automation for seeding, irrigation, disinfestation, and weeding.

In February 2024: Lumo, a smart irrigation company that supports growers and tackles water challenges head-on using the most advanced water technology available, announced its exclusive retail partnership with Central Valley, a leading supplier of vineyard equipment and materials in Northern California.

In September 2023: The Toro Company and Lowe’s Companies, Inc. announced a strategic retail partnership. As a result of this partnership, Lowe’s will carry Toro zero-turn riding mowers, walk mowers, portable power equipment, and snow blowers in both the gas and rapidly expanding battery categories.

In June 2023: Hunter Industries released two new field servers, the Hunter FS-3000 and FS-1000, which are designed to provide custom irrigation management in automation platforms. With these new field servers, users can easily integrate resource management and irrigation control into their custom facilities.

In March 2023: Jain Irrigation completed its merger with Rivulis, initially announced. This transaction forms one of the world's largest leaders in global irrigation and climate solutions. The merged entity focuses on technological innovation, environmental sustainability (ESG), and advanced agricultural inputs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.93 Billion |

| Market Size by 2032 | USD 20.27 Billion |

| CAGR | CAGR of 17.01% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By System (Automatic, Semi-automatic) • By Irrigation Type(Sprinkler Irrigation, Drip Irrigation, Surface) • By Component(Controllers, Sensors(Weather-based, Soil, Fertigation)Valves, Sprinklers, Other components) • By Automation Type(Time-based,Volume-based, Real-time Feedback, Computer-based Irrigation Control) • By End Use(Agricultural(Open Field, Greenhouse)Non-agricultural(Residential, Turf & Landscape, Golf Courses) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Valmont Industries Inc.,Hunter Industries, Rain Bird Corporation, Lindsay Corporation, Toro Company, Galcon, Jain Irrigation Systems, Netafim, Rubicon Water, Nelson Irrigation, Weathermatic, Rivulis Irrigation, Calsense, Agri-Inject, RainSmart Technologies, AquaSpy, CropX, Aqua-Turf International,SkyDrop, Dig Corporation |

| Key Drivers | • Water scarcity concerns are driving farmers and agricultural businesses to adopt irrigation automation systems that optimize water usage, ensuring sufficient moisture for crops while reducing wastage. • The integration of IoT, AI, and machine learning in irrigation systems enhances real-time monitoring and automated decision-making, significantly improving irrigation efficiency through data-driven information. |

| Restraints | • The high upfront costs of installing advanced irrigation automation systems can deter small-scale farmers, particularly in developing regions, from adopting these technologies. |