Liver Disease Diagnostics Market Size Analysis

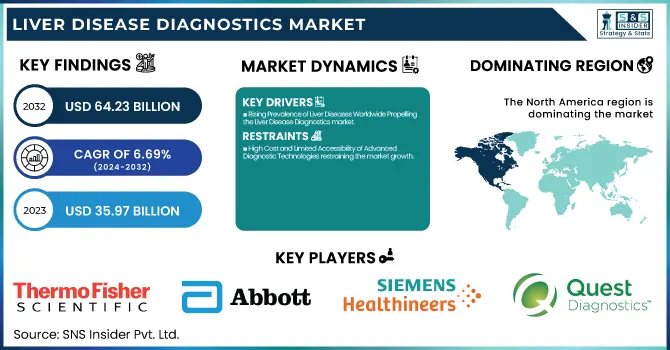

The Liver Disease Diagnostics Market was valued at USD 35.97 billion in 2023 and is expected to reach USD 64.23 billion by 2032, growing at a CAGR of 6.69% from 2024-2032. The Liver Disease Diagnostics Market report provides insights by presenting extensive incidence and prevalence data for liver diseases like NAFLD, NASH, fibrosis, cirrhosis, and HCC in prominent regions. We present diagnostic test use trends with the adoption of imaging, lab tests, and biopsies globally. The report also provides regional healthcare expenditure breakup, including government, commercial, private, and out-of-pocket spending. Additionally, we offer adoption rates for sophisticated diagnostic technology, such as AI-based imaging and biomarker-based detection, to provide an exhaustive market evaluation.

To Get more information on Liver Disease Diagnostics Market - Request Free Sample Report

Liver Disease Diagnostics Market Dynamics

Drivers

-

Rising Prevalence of Liver Diseases Worldwide Propelling the Liver Disease Diagnostics market.

The mounting global burden of liver diseases, such as non-alcoholic fatty liver disease (NAFLD), non-alcoholic steatohepatitis (NASH), fibrosis, cirrhosis, and hepatocellular carcinoma (HCC), is one of the major drivers for the liver disease diagnostics market. Liver diseases are reported to cause nearly 2 million deaths per year globally, with hepatitis B and C viruses contributing to over 1.3 million deaths every year, according to the World Health Organization (WHO). In addition, the growing incidence of metabolic disorders like obesity and diabetes has helped increase cases of NAFLD and NASH, prompting the demand for early and precise diagnostic options. New advances have seen developments in non-invasive diagnostic methods like liquid biopsies, transient elastography, and AI-powered imaging tools, which promote early detection and tracking, enhancing patient outcomes.

-

Technological Advancements in Diagnostic Tools driving the market growth.

The liver disease diagnostics market is experiencing strong growth with ongoing developments in diagnostic technology, such as biomarkers, imaging technologies, and molecular testing. Conventional liver function tests are increasingly being augmented by newer diagnostic tools like FibroScan, next-generation sequencing (NGS), and multiplex immunoassays that provide better accuracy and quicker results. For example, in 2023, Siemens Healthineers introduced an artificial intelligence-based liver imaging solution for better fibrosis and cirrhosis assessment. Moreover, the increased use of point-of-care testing (POCT) instruments and digital pathology is also increasing the detection of real-time liver diseases. The integration of machine learning-based predictive models has also added to the accuracy of liver disease diagnosis, making it easier for clinicians to customize treatment approaches. These technologies are anticipated to propel diagnostic efficiency, decrease the dependency on biopsies, and propel the entire market forward.

Restraint

-

High Cost and Limited Accessibility of Advanced Diagnostic Technologies restraining the market growth.

The exorbitant price of cutting-edge diagnostic technology makes them less accessible, especially in low- and middle-income economies. Although newer diagnostic technologies like transient elastography (FibroScan), liquid biopsies, and AI-based imaging are highly accurate, they are expensive, which makes them unaffordable for most healthcare institutions and patients. Moreover, the need for specialized training and equipment also contributes to the economic cost. The expenditure on innovative liver diagnostic processes can vary from a few hundred dollars to thousands of dollars, leading to inequalities in access to early and precise diagnosis. Also, in most areas, particularly rural ones, the absence of proper healthcare facilities and reimbursement problems further inhibit the use of these diagnostic options on a large scale.

Opportunities

-

The growing preference for non-invasive diagnostic techniques presents a significant opportunity in the liver disease diagnostics market.

The increasing demand for non-invasive diagnostic methods is a major opportunity in the market for liver disease diagnostics. Conventional procedures like liver biopsies, as effective as they are, are invasive, painful, and associated with complications. Consequently, there is an increasing demand for safer, more effective substitutes like elastography, liquid biopsies, and AI-based imaging. From recent research, non-invasive testing such as FibroScan has proved highly accurate for evaluating liver fibrosis and cirrhosis, minimizing the requirement for invasive interventions. Additionally, the use of AI in diagnosing liver disease has improved imaging analysis and facilitated earlier detection and informed treatment. With regulatory agencies more and more approving non-invasive tests and medical practitioners moving towards patient-friendly diagnosis, the market will see increased innovation and uptake, especially in the developed world.

Challenges

-

Variability in Diagnostic Accuracy and Standardization challenging the market.

One of the biggest issues facing the liver disease diagnostics market is the heterogeneity of diagnostic performance and the absence of standard procedures across different tests. Though non-invasive diagnostic tests like serum biomarker testing and imaging methods are helpful, their specificity and sensitivity are not always the same, and therefore, they give variable results. For example, elastography-based fibrosis testing can give variable results depending on the level of expertise of the operator or patient-related variables like obesity. Also, tests based on biomarkers do not have universal thresholds, and thus, it becomes challenging to develop standardized diagnostic criteria in various healthcare environments. This discrepancy may result in misdiagnosis or delayed treatment initiation. To counter this challenge, research is continually ongoing to develop more refined diagnostic methods and incorporate AI-based analytics to enhance the accuracy and reliability of results in a wide range of patient populations.

Liver Disease Diagnostics Market Segmentation Analysis

By Technique

The imaging segment dominated the market with a 32.12% market share in 2023 due to its ease of use without invasive procedures, high degree of accuracy, and general availability. Imaging methods such as ultrasound, elastography, CT scans, and MRI are now the accepted methods for diagnosis of liver conditions such as fatty liver, fibrosis, cirrhosis, and hepatocellular carcinoma (HCC). The increasing trend towards the use of transient elastography, including FibroScan, has significantly enhanced early liver fibrosis detection and staging at the expense of invasive procedures. Recent research has shown that ultrasound-based liver screening is over 85% accurate in the detection of liver abnormality and, therefore, has become a favorite among healthcare practitioners. Moreover, ongoing technology advancements in imaging, such as AI-based diagnostics and contrast MRI, have only strengthened the hegemony of this segment in the diagnosis of liver diseases.

The biopsy segment will see the fastest growth with 7.62% CAGR during the forecast period based on its unmatchable accuracy in the diagnosis of liver disorders at the cellular level. Although non-invasive imaging techniques are commonly employed for screening, liver biopsy is still the gold standard for definitive diagnosis in complicated cases of NASH, autoimmune liver diseases, and early hepatocellular carcinoma. The increasing incidence of NASH has fueled the need for liver biopsies to determine disease severity and inform treatment. Also, the increasing use of minimally invasive biopsy methods, including ultrasound-guided and laparoscopic biopsies, has enhanced patient compliance as well as safety. The application of molecular and genomic analysis on biopsy samples further increases diagnostic accuracy, fueling the segment's explosive growth.

By Disease

The Non-Alcoholic Fatty Liver Disease (NAFLD) segment dominated the liver disease diagnostics market with a 24.51% market share in 2023 because of its growing prevalence and heightened awareness among healthcare professionals. NAFLD, which covers about 25% of the world's population, has become the most prevalent liver disorder primarily because of the rising incidence of obesity, diabetes, and metabolic syndrome. Given that an estimated 60–70% of obese patients get NAFLD, the market for early and precise diagnostics skyrocketed.

Technological advancements in diagnostic methods, including non-invasive imaging equipment (FibroScan, MRI-PDFF) and blood biomarkers (ALT, AST, FIB-4 score), have further contributed to the dominance of the segment. Moreover, growing screening programs and the creation of new AI-driven liver evaluation technologies have enhanced the rate of early detection, cementing NAFLD as the top segment for liver disease diagnostics. Pharmaceutical corporations are also keen on creating NAFLD-targeted drugs, encouraging greater investment in diagnostic technologies. Additionally, government-sponsored research initiatives and funding programs are encouraging sophisticated screening methods, further supporting the dominance of the segment.

By End Use

The Hospitals segment dominated the liver disease diagnostics market with 46.32% market share in 2023 as a result of growing patient visits for liver disease diagnosis and treatment. Hospitals are major healthcare facilities for complete liver function testing, providing an array of diagnostic services like imaging (MRI, CT, ultrasound), laboratory tests (ALT, AST, bilirubin), and biopsy procedures all under one umbrella. The availability of advanced diagnostic facilities, experienced healthcare workers, and combined patient care mechanisms boosts the hospitals' role in the management of liver diseases.

Hospitals also deal with a large number of severe and complicated liver disease cases, such as cirrhosis, fibrosis, and hepatocellular carcinoma (HCC), that require accurate and timely diagnosis. Government and private investments in hospital-based liver disease screening initiatives, telemedicine consultation, and artificial intelligence (AI)-based diagnostic tools further increase the dominance of the segment. Additionally, hospitals frequently partner with research institutions and drug firms for clinical trials, which opens up greater access to newer diagnostic technologies and treatments. The availability of insurance coverage and reimbursement schemes for hospital-based diagnostic tests is also a key factor in the market leadership of the segment.

Liver Disease Diagnostics Market Regional Insights

North America dominated the liver disease diagnostics market with a 40.25% market share in 2023 because of the prevalence of liver diseases, well-developed healthcare infrastructure, and robust research activities. The region has experienced a sharp increase in the incidence of non-alcoholic fatty liver disease (NAFLD) and non-alcoholic steatohepatitis (NASH) due to rising obesity and metabolic disorders. As per the CDC, close to 25% of the American population is suffering from NAFLD, emphasizing the need for early and precise diagnostic solutions. Moreover, the availability of major diagnostic players, including Abbott, Roche, and Siemens Healthineers, has enabled the swift development and adoption of sophisticated liver disease diagnostic tests. Governmental funding and favorable reimbursement policies further enhance market growth, making the latest diagnostic technologies accessible.

Asia Pacific is experiencing the fastest growth with 7.78% CAGR throughout the forecast period in the liver disease diagnostics market owing to the increasing burden of liver diseases, rising healthcare spending, and growing awareness. The region has high rates of hepatitis B and C infection, and China and India together contribute significantly to global cases. As per WHO, more than 70 million individuals in the Asia Pacific region are affected by chronic hepatitis B, driving the demand for precise diagnostic products. Moreover, the development of healthcare infrastructure, rising disposable incomes, and government-sponsored screening initiatives are boosting market penetration. The use of non-invasive diagnostic techniques, including elastography and liquid biopsies, is also increasing in this region because they are cost-effective and convenient. The speedy growth of diagnostic laboratories and the availability of new biotech companies play a supporting role in the speeded-up growth of the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Liver Disease Diagnostics Market

-

Abbott Laboratories (ARCHITECT AFP Assay, HBsAg Confirmatory Assay)

-

F. Hoffmann-La Roche Ltd. (Elecsys HBsAg II, Elecsys Anti-HCV II)

-

Thermo Fisher Scientific Inc. (AcroMetrix HBV DNA Panel, AcroMetrix HCV RNA Panel)

-

Siemens Healthineers (ADVIA Centaur HBsAg II Assay, Dimension EXL HCV Antibody Assay)

-

bioMérieux SA (VIDAS Anti-HCV Assay, VIDAS HBsAg Ultra)

-

Bio-Rad Laboratories, Inc. (Monolisa HCV Ag-Ab ULTRA, GS HBsAg Confirmatory Assay)

-

Randox Laboratories Ltd. (Hepatitis B Surface Antigen Test, Hepatitis C Antibody Test)

-

Fujifilm Corporation (Fujifilm Wako Shikibo Total Bile Acids Test, Liver Fat Assessment)

-

HORIBA Medical (HELICAB 25 Analyzer, ABX Pentra 400 Clinical Chemistry Analyzer)

-

Laboratory Corporation of America Holdings (HCV RNA Quantitative Real-Time PCR, HBV DNA Quantitative PCR)

-

Quest Diagnostics Incorporated (FibroTest-ActiTest, Hepatitis C Antibody with Reflex to HCV RNA)

-

PerkinElmer Inc. (GSP Neonatal GGT kit, Liver Profile Assay)

-

Ortho Clinical Diagnostics (VITROS Anti-HCV Assay, VITROS HBsAg Assay)

-

DiaSorin S.p.A. (LIAISON XL Murex HBsAg Quant, LIAISON XL Murex Anti-HCV)

-

Grifols S.A. (Procleix Ultrio Elite Assay, Procleix HEV Assay)

-

AbbVie Inc. (HCV Genotype Test, HBV DNA Quantification Test)

-

Bristol-Myers Squibb Company (Hepatitis B Surface Antigen Test, Hepatitis C Virus RNA Test)

-

Gilead Sciences, Inc. (HCV Antibody Test, HBV Surface Antigen Test)

-

Merck & Co., Inc. (HCV RNA Quantitative Test, HBV Genotype Test)

-

Novartis AG (HBsAg Quantification Assay, HCV RNA Detection Assay)

Suppliers (These companies offer a range of diagnostic products essential for the detection and management of liver diseases.)

-

Merck KGaA

-

Thermo Fisher Scientific Inc.

-

PerkinElmer Inc.

-

Bio-Rad Laboratories, Inc.

-

Fujifilm Wako Pure Chemical Corporation

-

Randox Laboratories Ltd.

-

Siemens Healthineers

-

Roche Diagnostics

-

Ortho Clinical Diagnostics

-

DiaSorin S.p.A.

Recent Development in the Liver Disease Diagnostics Market

-

In May 2024, Thermo Fisher introduced a biomarker-based testing service for kidney transplant patients to enhance early rejection detection. This is indicative of the increasing use of biomarker-based diagnostics, which may be applied in liver disease diagnosis for early detection of liver fibrosis, cirrhosis, or transplant rejection.

-

November 2024, Abbott's FDA clearance of CGMs during imaging procedures underscores the demand for real-time monitoring solutions. In the diagnosis of liver disease, non-invasive imaging methods such as elastography and AI-driven liver scans are increasingly being used, eliminating the need for invasive biopsies while providing real-time liver health monitoring

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 35.97 billion |

| Market Size by 2032 | US$ 64.23 billion |

| CAGR | CAGR of 6.69% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technique (Laboratory Tests, Imaging, Endoscopy, Biopsy, Others) • By Disease (NAFLD, NASH, Fibrosis, Cirrhosis, HCC, Others) • By End Use (Hospitals, Laboratories, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Siemens Healthineers, bioMérieux SA, Bio-Rad Laboratories, Inc., Randox Laboratories Ltd., Fujifilm Corporation, HORIBA Medical, Laboratory Corporation of America Holdings, Quest Diagnostics Incorporated, PerkinElmer Inc., Ortho Clinical Diagnostics, DiaSorin S.p.A., Grifols S.A., AbbVie Inc., Bristol-Myers Squibb Company, Gilead Sciences, Inc., Merck & Co., Inc., Novartis AG, and other players. |