Bispecific Antibodies Market Size Analysis:

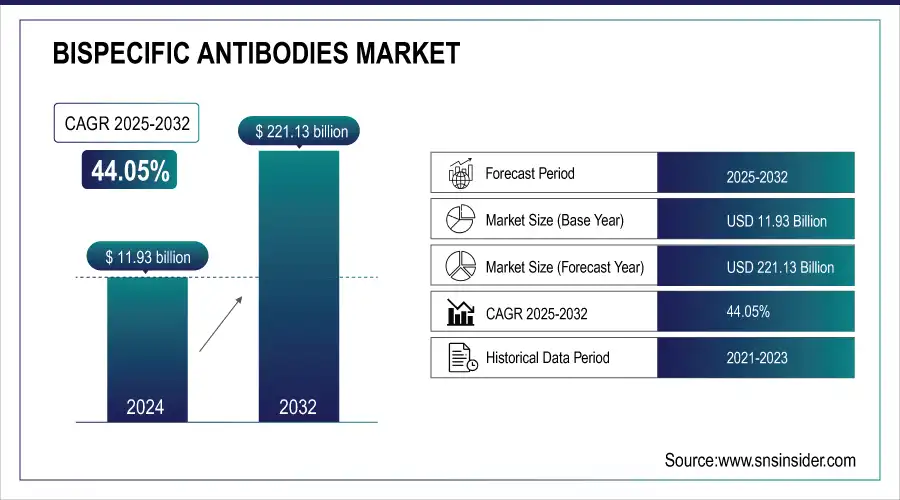

The Bispecific Antibodies Market was valued at USD 11.93 billion in 2024 and is expected to reach USD 221.13 billion by 2032, growing at a CAGR of 44.05% from 2025-2032.

The bispecific antibodies (BsAbs) market is advancing rapidly, driven by innovations in biotechnology and the growing demand for targeted therapies. BsAbs are engineered to simultaneously bind two distinct antigens, enabling precision treatment for complex diseases like cancer. This dual-targeting ability enhances therapeutic efficacy and minimizes off-target effects, positioning BsAbs as a game-changer in modern medicine.

Get more information on Bispecific Antibodies Market - Request Sample Report

Recent clinical and regulatory milestones highlight the transformative potential of BsAbs. For instance, Imdelltra (tarlatamab), approved in May 2024 for advanced small-cell lung cancer, demonstrated a tumor shrinkage rate of 40% and extended median survival to 14.3 months. Similarly, Ziihera (zanidatamab-hrii), approved in November 2024 for HER2-positive biliary tract cancer, achieved a 52% objective response rate. Another example is BLINCYTO (blinatumomab), which targets CD19-positive cells and received expanded approval in June 2024 to treat Philadelphia chromosome-negative B-cell precursor acute lymphoblastic leukemia in patients as young as one month old. These approvals underscore the clinical efficacy of BsAbs across diverse indications.

In clinical trials, BsAbs have demonstrated impressive results in refractory cases. For example, BsAbs targeting CD20 and CD3 in B-cell lymphomas have shown overall response rates exceeding 60%. In comparison, those targeting BCMA (B-cell maturation antigen) in multiple myeloma have achieved response rates of over 70%. Beyond oncology, BsAbs are gaining traction in autoimmune disorders, with agents targeting IL-17 and IL-23 pathways showing promise in inflammatory diseases like psoriasis.

Market Size and Forecast

-

Market Size in 2024: USD 11.93 Billion

-

Market Size by 2032: USD 221.13 Billion

-

CAGR: 44.05% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Bispecific Antibodies Market Trends

-

Rising prevalence of cancer, autoimmune, and infectious diseases is driving the bispecific antibodies market.

-

Advancements in antibody engineering and immunotherapy are enhancing efficacy and targeting precision.

-

Increasing adoption in oncology and hematology treatments is boosting market growth.

-

Expansion of clinical trials and R&D initiatives is accelerating pipeline development.

-

Focus on personalized medicine and combination therapies is shaping therapeutic strategies.

-

Collaborations between biotech firms, pharmaceutical companies, and research institutions are fostering innovation.

-

Regulatory approvals and strategic partnerships are facilitating commercialization and global market penetration.

Bispecific Antibodies Market Growth Drivers:

-

Bispecific Antibodies Transforming Precision Medicine with Dual-Targeting Therapies

Several key factors, including advancements in biotechnology, increasing prevalence of complex diseases, and growing demand for targeted therapies are driving the bispecific antibodies (BsAbs) market. The rising global cancer burden is a significant driver; according to the World Health Organization (WHO), cancer accounted for nearly 10 million deaths in 2020, highlighting the need for innovative treatments like BsAbs. These molecules offer dual-targeting capabilities, enabling precise action against tumor cells and enhanced therapeutic outcomes compared to conventional monoclonal antibodies.

The approval of novel BsAbs is also fueling market growth. For instance, Mosunetuzumab (Lunsumio), targeting CD20 and CD3, was approved in December 2022 for relapsed or refractory follicular lymphoma, with clinical trials showing a response rate of 80% among patients. BsAbs targeting BCMA, such as Teclistamab, have also demonstrated response rates exceeding 60% in multiple myeloma, addressing critical unmet medical needs.

Beyond oncology, the potential application of BsAbs in autoimmune and infectious diseases is gaining attention. Research indicates that BsAbs targeting IL-17 and IL-23 pathways in inflammatory diseases like psoriasis could deliver transformative results, expanding their therapeutic reach. Furthermore, advancements in molecular engineering have significantly reduced immunogenicity and enhanced pharmacokinetics, making BsAbs safer and more effective.

Bispecific Antibodies Market Restraints:

-

High Costs and Safety Concerns

The development and manufacturing of bispecific antibodies (BsAbs) involve advanced biotechnological processes, driving up production costs, with clinical trials often exceeding USD 1 billion. These high costs limit accessibility, especially in low- and middle-income countries. Additionally, safety concerns like immunogenicity and off-target effects, including cytokine release syndrome (CRS), impact patient outcomes, with up to 30% of patients on T-cell-targeting BsAbs experiencing CRS that requires additional interventions.

-

Regulatory and Competitive Challenges

The complex regulatory landscape demands extensive evaluation of BsAbs' dual-action mechanisms, resulting in longer approval timelines. Furthermore, the scarcity of skilled professionals and infrastructure for BsAb development in emerging markets hinders progress. Competition from established alternatives like monoclonal antibodies and cell-based therapies also poses challenges to BsAbs' broader adoption.

Bispecific Antibodies Market Segment Analysis

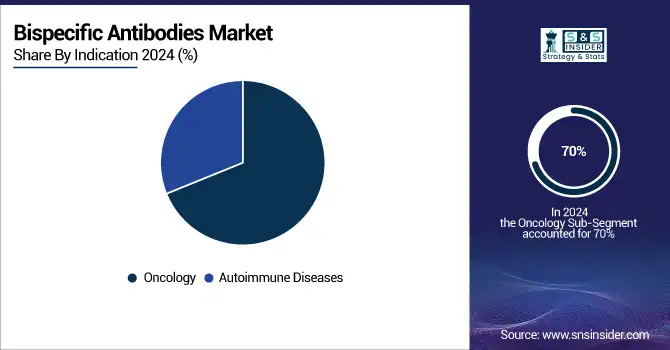

By Indication, Oncology dominates the bispecific antibodies market with over 70% share in 2024, while autoimmune diseases are the fastest-growing segment

In 2024, oncology was the dominant segment in the bispecific antibodies (BsAbs) market. Oncology accounted for over 70% of the market in 2024, driven by continuous clinical advancements, regulatory approvals, and the expanding pipeline of new therapies. The high global incidence of cancer, combined with the growing need for precision medicine, made oncology the focal point of bispecific antibody applications. BsAbs such as Blincyto (blinatumomab), targeting CD19 and CD3, have revolutionized treatment in hematologic cancers like leukemia and lymphoma. The segment's dominance is largely due to the remarkable success of BsAbs in treating refractory and relapsed cancers, especially in the hematologic oncology space.

The fastest-growing segment for bispecific antibodies throughout the forecast period is autoimmune diseases. After their success in oncology, bispecific antibodies are increasingly being explored for diseases such as rheumatoid arthritis, psoriasis, and lupus, where targeting multiple immune pathways simultaneously could lead to more effective treatments. BsAbs have shown promise in reducing inflammation and offering better control of immune responses than traditional therapies. The autoimmune segment is growing rapidly as more clinical trials progress and demonstrate positive outcomes, potentially addressing unmet needs in these complex conditions.

By Route of Administration, Injectables lead with 67.2% share due to rapid, precise delivery; oral bispecific antibodies grow fastest

Injectables were the dominant route of administration for bispecific antibodies with a share of 67.2% in 2024. The intravenous and subcutaneous injectable forms are preferred due to their direct and effective delivery into the bloodstream, ensuring rapid therapeutic action. Most bispecific antibodies approved for clinical use, such as Blincyto and Teclistamab, are delivered via injection, which contributed to injectables holding the largest market share. Injectables accounted for approximately 85% of the market in 2023, driven by the need for precise dosing and the established safety profile of these administration methods.

The oral route of administration is the fastest-growing segment for bispecific antibodies. Although still in the early stages, the potential for oral bispecific antibodies is significant due to the ease of use and patient convenience. Oral administration eliminates the need for injections, enhancing patient compliance and accessibility. With ongoing advancements in drug formulation and delivery systems, oral bispecific antibodies are expected to gain traction, offering a more convenient treatment option for chronic conditions, and expanding the reach of these therapies.

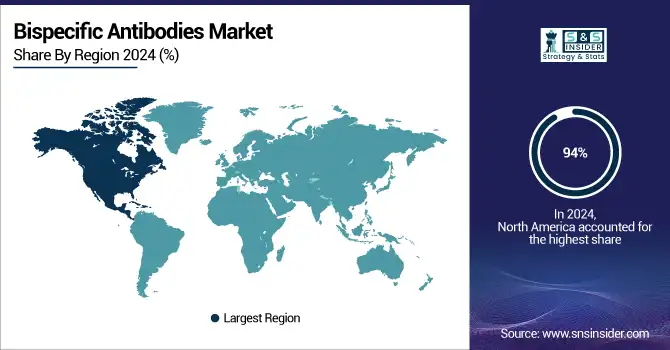

Bispecific Antibodies Market Regional Analysis

North America Bispecific Antibodies Market Insights

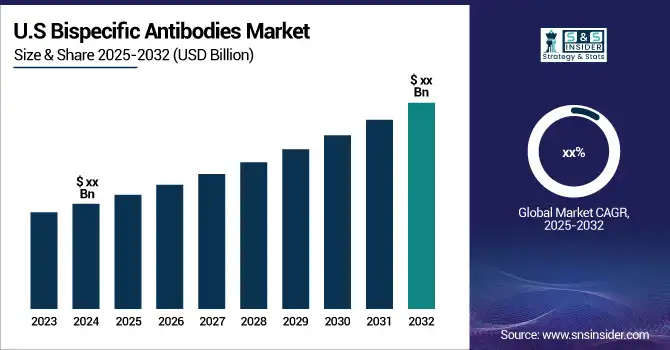

In 2024, North America dominated the bispecific antibodies (BsAbs) market with a 94% share, driven by a strong healthcare infrastructure, high healthcare spending, and a well-established regulatory framework. The U.S. remains a leader in the adoption of advanced therapies, with numerous FDA approvals for bispecific antibodies in oncology and autoimmune diseases. The presence of major biotech companies and ongoing clinical trials further contribute to North America's market leadership. This region is also a hub for innovation, particularly in the development of new BsAb therapies.

Need any customization research on Bispecific Antibodies Market - Enquire Now

Europe Bispecific Antibodies Market Insights

Europe followed as a significant market for bispecific antibodies, with countries like Germany, France, and the U.K. leading in adoption. European healthcare systems are increasingly adopting novel therapies for cancer and autoimmune disorders, with regulatory agencies like the European Medicines Agency (EMA) facilitating approvals. However, the market in Europe faces challenges such as varying reimbursement rates and market access issues across different countries, which slightly hinder growth compared to North America.

Asia Pacific Bispecific Antibodies Market Insights

Asia-Pacific is the fastest-growing region for bispecific antibodies, driven by an expanding patient population, increasing cancer rates, and rising healthcare investments in countries like China, Japan, and India. While the region lags behind North America and Europe in market share, it is witnessing rapid development due to the rising adoption of advanced therapies, improved healthcare infrastructure, and government initiatives promoting biotechnology innovation.

Middle East & Africa and Latin America Bispecific Antibodies Market Insights

The Middle East & Africa and Latin America bispecific antibodies market is growing steadily, driven by rising prevalence of cancer and autoimmune diseases. Increasing healthcare infrastructure, government support for advanced therapies, and adoption of innovative biologics are fueling market expansion. Collaborations between global pharmaceutical companies and regional healthcare providers enhance access to bispecific antibody treatments, while ongoing clinical trials and awareness programs further accelerate adoption in these regions.

Bispecific Antibodies Market Competitive Landscape:

Merck KGaA

Merck KGaA, founded in 1668 and headquartered in Darmstadt, Germany, is a global science and technology company specializing in pharmaceuticals, life sciences, and performance materials. In pharmaceuticals, Merck focuses on oncology, immunology, and precision therapies, developing innovative biologics, small molecules, and antibody-based treatments. The company emphasizes research-driven development, strategic collaborations, and global commercialization to advance healthcare solutions, particularly in cutting-edge therapies such as bispecific antibodies for oncology and immuno-oncology applications.

-

December 2024: Merck finalized an exclusive global license agreement with LaNova Medicines Ltd. for LM-299, an investigational bispecific antibody targeting PD-1 and VEGF. Merck will develop, manufacture, and commercialize LM-299.

BioNTech SE

BioNTech, founded in 2008 and headquartered in Mainz, Germany, is a biotechnology company focused on next-generation immunotherapies, including mRNA vaccines and bispecific antibodies. The company specializes in oncology, infectious diseases, and precision medicine, developing targeted treatments to enhance immune response. BioNTech emphasizes strategic acquisitions, technological innovation, and scalable manufacturing to accelerate development of advanced therapies, particularly in the rapidly evolving bispecific antibodies market for cancer and immunotherapy applications.

-

November 2024: BioNTech’s recent acquisition strengthened its capabilities in the development and production of next-generation bispecific antibodies, accelerating progress in oncology therapies.

Navigator Medicines

Navigator Medicines, a biotechnology company based in the U.S., focuses on developing novel bispecific antibodies and immunotherapies for autoimmune diseases and cancer. The company emphasizes early-stage innovation, clinical development, and strategic partnerships to advance therapies that target multiple immune pathways. Navigator Medicines leverages cutting-edge biologics platforms to create highly specific, efficacious treatments with improved safety profiles, aiming to transform patient care in immune-mediated disorders and expand access to next-generation therapeutics.

-

August 2024: Navigator Medicines secured USD 100 million in Series A financing, co-led by RA Capital Management and Forbion, to advance NAV-240, an anti-OX40L/anti-TNFα bispecific antibody for autoimmune diseases in Phase 1. Dana McClintock, MD, joined as Chief Medical Officer.

Canopy Health

Canopy Health, a leading digital oncology care platform, develops technology-driven solutions to enhance patient monitoring, therapeutic management, and clinical decision support. The platform integrates remote monitoring, data analytics, and AI-driven algorithms to improve patient outcomes, particularly in complex therapies such as bispecific antibodies. Canopy emphasizes continuous care, safety, and precision management, supporting clinicians in managing immune-related adverse events like CRS and ICANs while enabling scalable, technology-enabled oncology care.

-

September 2024: Canopy introduced platform-wide support for bispecific antibodies, including Remote Therapeutic Monitoring, smart triage algorithms, and decision-support pathways for managing CRS and ICANs.

Key Players

Some of the Bispecific Antibodies Market Companies

-

Roche

-

Akeso, Inc.

-

Janssen

-

Taisho Pharmaceutical

-

Sanofi S.A.

-

AbbVie Inc.

-

Pfizer Inc.

-

Johnson & Johnson

-

Portola Pharmaceuticals

-

Bristol-Myers Squibb

-

Ganymed Pharmaceuticals

-

OncoMed Pharmaceuticals

-

Merck & Co.

-

Bayer AG

-

Daiichi Sankyo Company Limited

-

Regeneron Pharmaceuticals

-

Xencor, Inc.

| Report Attributes | Details |

| Market Size in 2024 | USD 11.93 billion |

| Market Size by 2032 | USD 221.13 billion |

| CAGR | CAGR of 44.05% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Indication (Autoimmune Diseases, Oncology) • By Route of Administration (Oral, Injectables) • By End User (Hospitals, Specialty Clinics, Homecare) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amgen, Roche, Genentech, Akeso, Inc., Janssen, Taisho Pharmaceutical, Immunocore, Sanofi S.A., AbbVie Inc., Pfizer Inc., Johnson & Johnson, Portola Pharmaceuticals, Bristol-Myers Squibb, Ganymed Pharmaceuticals, OncoMed Pharmaceuticals, Merck & Co., Bayer AG, Daiichi Sankyo Company Limited, Regeneron Pharmaceuticals, Xencor, Inc. |