Medical Billing Outsourcing Market Report Scope & Overview:

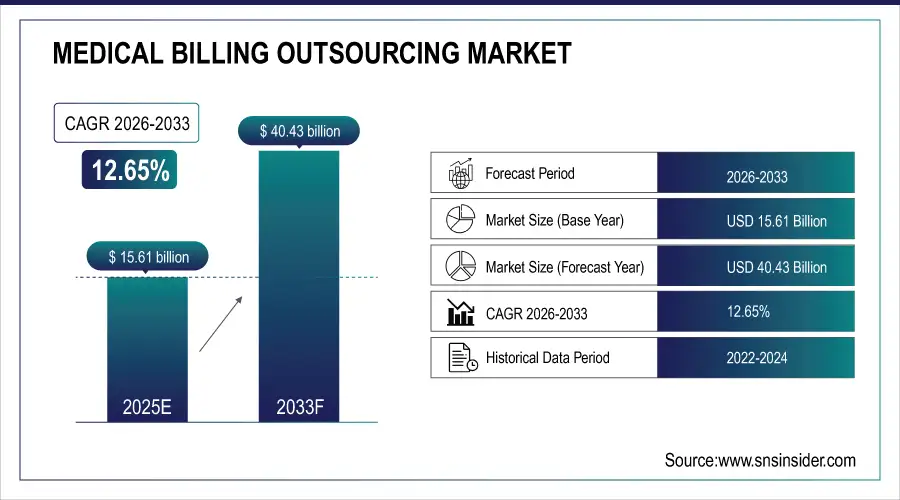

The Medical Billing Outsourcing Market size is valued at USD 15.61 Billion in 2025E and is projected to reach USD 40.43 Billion by 2033, growing at a CAGR of 12.65% during 2026-2033.

The Medical Billing Outsourcing Market analysis highlights the growing dependence of healthcare providers on these external billing services to minimize operational burdens and enhance revenue cycle effectiveness. Market Drivers The increasing complexity of medical codes, growth in healthcare digitalization and need for cost-effective operations are the factors that drive the market.

In 2025, 65% of medical billing vendors integrated EHR, practice management, and RCM platforms, enabling seamless data flow and reducing manual entry errors by up to 40%

Market Size and Forecast:

-

Market Size in 2025E: USD 15.61 Billion

-

Market Size by 2033: USD 40.43 Billion

-

CAGR: 12.65% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Medical Billing Outsourcing Market - Request Free Sample Report

Medical Billing Outsourcing Market Trends

-

Medical service professionals prefer the cloud for flexibility and on-demand access as well as to safeguard HIPAA data for billing in real-time.

-

Artificial intelligence powered automation It drives proactive, real-time solutions that increase accuracy and decrease claim denials while accelerating processing time for medical billing and revenue cycle management.

-

Smaller providers are also selling out of billing to minimize overhead costs and to maximize efficiency in collections.

-

Enterprises are providing a comprehensive RCM solution that includes coding, claim submission and payment posting for a friction-free financial value chain.

-

Regulatory oversight and the need to securely manage patient data serves as a force to adopt providers (with HIPAA-certified billing outsourcing services).

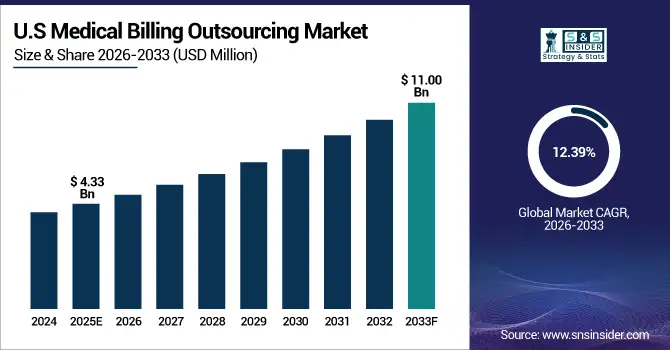

The U.S. Medical Billing Outsourcing Market size is valued at USD 4.33 Billion in 2025E and is projected to reach USD 11.00 Billion by 2033, growing at a CAGR of 12.39%during 2026-2033. Medical Billing Outsourcing Market growth is driven by high level of healthcare spending and complex reimbursement regulations. Growing adoption of sophisticated EHR-integrated billing solutions and Artificial Intelligence (AI) enabled automation is enhancing the accuracy and speed of claims processing.

Medical Billing Outsourcing Market Growth Drivers:

-

Rising Healthcare Administrative Burden and Need for Cost-Effective Revenue Cycle Management Solutions

Growing complexity of the current medical billing process, coding regulations and insurance industry procedures it has been very expensive to handle in-house. Medical service providers are outsourcing the billing to dedicated companies in an effort to cut down on administrative work and errors, which can increase the time taken to receive payments from patients’ insurance. This trend allows hospitals and clinics to concentrate the more on the patient care, while improving revenue cycle process as well driving massive market growth for medical billing outsourcing services.

Physicians spend nearly 50% of their workday on administrative tasks, with billing and coding among the top time drains—prompting 68% of practices to consider or adopt outsourcing

Medical Billing Outsourcing Market Restraints:

-

Data Security Concerns and Risk of Non-Compliance with Healthcare Regulations

The Medical Billing Outsourcing Market faces several restraints that may hinder its growth potential. Given the huge volume of sensitive patient data involved, medical billing outsourcing poses a potential threat in terms of data breaches and privacy infringements. Stringent regulations such as HIPAA and GDPR demand high level of data security and compliance, making it difficult for outsourcing providers. Lack of up-to-date and security compliance with network can lead to the financial penalty, legal complexity, and lack of trust between health organizations which is expected to limit the growth of healthcare cyber security market.

Medical Billing Outsourcing Market Opportunities:

-

Growing Adoption of AI and Automation in Billing and Coding Processes

The artificial intelligence, RPA and analytics aspects of billing systems are ripe for large-scale growth. Tools powered by AI improve coding accuracy, decrease manual hours and streamline the claim process, ultimately resulting in quicker reimbursements and better financial results. With healthcare organizations continuing acceleration into digital transformation, third-party-outsourcing firms armed with next-generation technology can stand out in the crowd while enhancing throughput and tapping into growing demand for smart-billing solutions.

AI-powered coding tools improved accuracy by 25–30% in 2024, reducing claim denials and cutting manual review time by half in early-adopter hospitals

Medical Billing Outsourcing Market Segment Analysis

-

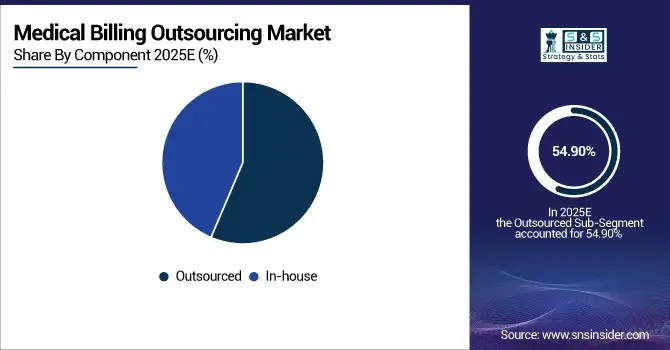

By Component, outsourced medical billing services led the market with a 54.90% share, while the in-house segment is projected to be the fastest growing, recording a CAGR of 12.50%.

-

By Service Type, front-end services dominated with a 46.28% market share in 2025, whereas back-end services are expected to grow fastest at a CAGR of 13.54%.

-

By End-User, hospitals accounted for the largest share of 50.61% in 2025, while ambulatory surgical centers are anticipated to expand most rapidly with a CAGR of 14.37%.

-

By Deployment, cloud-based solutions held the majority share of 60.53% in 2025, and the on-premise segment is forecasted to witness the highest growth at a CAGR of 13.40%.

-

By Specialty, radiology billing dominated with a 31.15% share in 2025, while anesthesia billing emerged as the fastest growing segment, registering a CAGR of 14.32%.

By Component, Outsourced Leads Market While In-house Registers Fastest Growth

The outsourced billing services segment dominates the market, since health care providers are outsourcing their in-house billing procedures to external companies, due to reduced operational costs and quicker claim processing with accurate results. Decentralizing administrative activities during the leasing process to generate compliance with regulations, leads to adoption throughout. In-house segment expected to record the highest growth as hospitals are using enhanced software and automation tools for greater control over revenue cycle and data management within internal teams.

By Service Type, Front-End Services Dominate While Back-End Services Shows Rapid Growth

Front-end services dominate the market such as patient registration, insurance verification and scheduling have a substantial presence on the market thanks to their necessity in preventing claim denials and keeping billing clean. These are the principles that serve as a crucial base of healthy and successful revenue cycle management. Meanwhile, back-end services are growing rapidly such as claims generation, denial management, payment posting driven by the focus on maximizing reimbursement rates and minimizing revenue leakages for healthcare providers.

By End-User, Hospitals Lead While Ambulatory Surgical Centers Registers Fastest Growth

Hospitals hold a prominent share in this market as they have more number of patients to serve, require special billing requirements and also outsource their operations for better response. Even huge hospital chains hire outside billing specialists in order to get the billing right. While, Ambulatory Surgical Centers are projected to grow the fastest as they outsource their billing more frequently in order to better handle increased patient throughput, cut down on operational costs and maintain a timely reimbursement amidst surging demand for outpatient care.

By Deployment, Cloud-Based Lead While On-Premise Grow Fastest

Cloud-based segment leads the market due to as healthcare providers are adopting cloud solutions for billing, charting, and other operations that offer flexibility, scalability, and cost-effectiveness. Such solutions provide online access, instant update and easy interface with electronic health records (EHR). While, on-premise is growing quickly due to data-sensitive institutions who want more control, security and ability to customize. The emergence of hybrid models that add a blend of both deployment types to the mix also works to encourage growth in digital billing systems across healthcare enterprises.

By Specialty, Radiology Billing Lead While Anesthesia Billing Grow Fastest

The Radiology Billing is dominate the market due to high number of imaging services and the intricate documentation needs and coding expertise required specialization. The use of out-sourcing intensifies as radiology providers strive for accuracy and regulatory compliance. Meanwhile, anesthesia billing is set to grow most quickly, as the need for more procedures further necessitates advanced billing systems capable of managing complex timed-based coding/claim concerns contrasted by payment sprawl and updates in reimbursement.

Medical Billing Outsourcing Market Regional Analysis:

North America Medical Billing Outsourcing Market Insights

In 2025 North America dominated the Medical Billing Outsourcing Market and accounted for 45.25% of revenue share, this leadership is due to high application of medical services and technology. The requirement for code accuracy, claim management and compliance are what drives need in the region.” Outsourcing also allows to minimize administrative expenses and streamline the revenue cycle at healthcare facilities. Competitive pressures are strengthened by the considerable presence of large billing service companies.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Medical Billing Outsourcing Market Insights

The U.S. currently dominates the worldwide Medical Billing Outsourcing Market based on revenue share owing to intricate reimbursement systems and insurance legislations in place. Hospitals and practices are outsourcing more billing to keep administrative workloads manageable and cut down on claims errors.

Asia-Pacific Medical Billing Outsourcing Market Insights

Asia-Pacific is expected to witness the fastest growth in the Medical Billing Outsourcing Market over 2026-2033, with a projected CAGR of 13.37% due to increasing adoption of digital practice among healthcare provider for billing services. India and the Philippines are among countries becoming outsourcing centres of some lifelines including cheaper skilled labour. Increasing use of cloud billing platforms, and rise in medical tourism also boosts the demand.

China Medical Billing Outsourcing Market Insights

China Medical Billing Outsourcing is a steadily growing market driven by the upgrading of medical infrastructure and taking up of e-records. The government’s emphasis on digital transformation in healthcare is fuelling outsourcing demand from hospitals and clinics.

Europe Medical Billing Outsourcing Market Insights

European Medical Billing Outsourcing Market is growing continuously and the market is expected to grow at steady pace owing to increasing billing issues from healthcare providers and service vendors. The increasing usage of electronic health record systems along with GDPR-related focus on compliance is shaping hiring trends. The UK and Germany are among the major contributor due to advanced healthcare facilities in Western European Countries.

Germany Medical Billing Outsourcing Market Insights

Germany is flourishing driven by the hospitals and clinics concentrated towards improving revenue management systems. The growth in electronic billing combined with standardized coding tables and automation tools supports both the efficiency and accuracy of data.

Latin America (LATAM) and Middle East & Africa (MEA) Medical Billing Outsourcing Market Insights

The Medical Billing Outsourcing Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to addition of better healthcare infrastructure and rise in digital transformation efforts. Outsourced billing is going to become more popular in these areas as well, especially with the reduction of admin-time and increased efficiency. Rising healthcare expenditure and private hospital expansion are driving demand.

Medical Billing Outsourcing Market Competitive Landscape:

R1RCM Inc. is a leading provider of technology-driven and data-enabled revenue cycle management services which transform a health system’s revenue cycle performance across setting of care. It provides fully integrated solutions ranging from patient registration, coding and claims processing to payment management. Its AI-driven platform improves work flow efficiencies and minimizes claim denials for hospitals and physician groups.

-

In May 2025, R1RCM Inc. announced a strategic investment from Khosla Ventures and launched its “R37” AI lab to accelerate innovation in AI-driven healthcare revenue management, enhancing automation, efficiency, and intelligence across end-to-end billing and reimbursement operations.

Veradigm LLC focuses on delivering integrated health data and technology services (e.g., medical billing, RCM). The company’s platforms enable providers to increase claim accuracy, accelerate reimbursements, and stay in compliance with regulations. Veradigm’s interoperability offerings integrate billing systems and EHRs to facilitate the free flow of patient data. Its data-infused insights empower customers with the ability to maximize financial performance.

-

In May 2025, Veradigm LLC’s board expanded its 2024 Stock Incentive Plan by six million shares, totaling eleven million grants, to strengthen employee retention, align executive incentives, and support ongoing innovation in digital health and revenue cycle management solutions.

eClinicalWorks provides complete healthcare IT solutions including EMR, practice management, patient portal, and revenue cycle management. The cloud-based EHR and billing systems facilitate efficiency while saving on administrative headaches for medical practices. eClinicalWorks uses automation combined with real-time analytics to reduce errors and enhance cash collection. The open, integrated application of FIS allows communications between the clinical components and financial systems.

-

In February 2025, eClinicalWorks introduced new AI-powered tools at HIMSS25, including ambient listening, “healow Genie” scribe technology, and document-data extraction, enhancing accuracy, productivity, and automation across its EHR and practice management platforms for healthcare providers.

Oracle offers its leading cloud-based healthcare applications for automating billing, managing claims and analysis of financials. Using it’s Oracle Health platform the company provides scalable and secure RCM software that optimize workflows while minimizing risk of non-compliance. Its analytics-intensive methodology allows for faster reimbursements and greater financial clarity. Oracle gained a stronger foothold in healthcare billing technology through its acquisition of Cerner.

-

In August 2025, Oracle unveiled its next-generation “Oracle Health EHR,” featuring AI and voice-enabled workflows for ambulatory providers in the U.S., with additional acute-care functionalities scheduled for 2026, advancing automation and integration in healthcare billing and clinical systems.

Medical Billing Outsourcing Market Key Players:

Some of the Medical Billing Outsourcing Market Companies are:

-

R1RCM Inc.

-

Veradigm LLC

-

eClinicalWorks

-

Oracle

-

Kareo Inc.

-

Quest Diagnostics Incorporated

-

AdvancedMD Inc.

-

Promantra Inc.

-

McKesson Corporation

-

Athenahealth

-

DrChrono

-

CareCloud

-

Invensis

-

GeBBS Healthcare Solutions

-

Omega Healthcare Management Services

-

24-7 Medical Billing Services LLC

-

MediBillMD

-

iCareBilling

-

Unity Communications

-

SupportYourApp

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 15.61 Billion |

| Market Size by 2033 | USD 40.43 Billion |

| CAGR | CAGR of 12.65% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (In-house and Outsourced) • By Service Type (Front-End Services, Middle-End Services, and Back-End Services) • By End-User (Hospitals, Physician Offices, Ambulatory Surgical Centers, and Diagnostic & Imaging Centers) • By Deployment (Cloud-Based and On-Premise) • By Specialty (Radiology Billing, Pathology Billing, Anesthesia Billing, Cardiology Billing, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | R1RCM Inc., Veradigm LLC, eClinicalWorks, Oracle, Kareo Inc., Quest Diagnostics Incorporated, AdvancedMD Inc., Promantra Inc., McKesson Corporation, Athenahealth, DrChrono, CareCloud, Invensis, GeBBS Healthcare Solutions, Omega Healthcare Management Services, 24-7 Medical Billing Services LLC, MediBillMD, iCareBilling, Unity Communications, SupportYourApp |