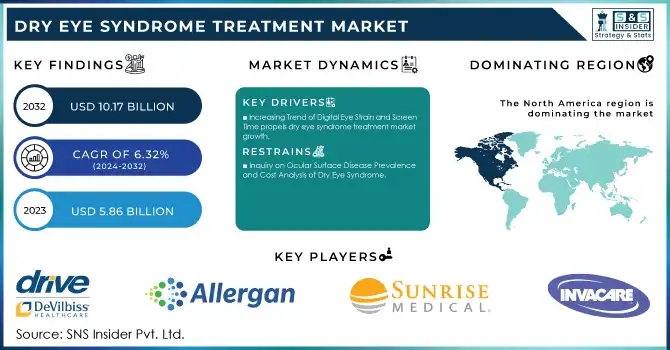

Dry Eye Syndrome Treatment Market Size & Overview:

The Dry Eye Syndrome Treatment Market size was valued at USD 5.86 billion in 2023 and is expected to grow at a CAGR of 6.32% to reach USD 10.17 billion by 2032. The increasing incidence of dry eye disease across the globe and the rising dry eye syndrome treatment market are majorly contributing revenue generation of dry eye syndrome treatment market. At present, between 16.7 million and 50.2 million individuals in America experience dry eyes. This constitutes 5-15% of the population.

To Get more information on Dry Eye Syndrome Treatment Market - Request Free Sample Report

This increase is due to many things like long hours on a screen, an older population, environmental circumstances, and underlying health issues such as diabetes and autoimmune disorders. In turn, the healthcare sector is creating a range of new treatment methods — from artificial tears to prescription medications and surgical options.

The year 2024 has seen industry leaders emphasizing the release of cutting-edge products. Novel interventions that enhance the hydration of the ocular surface, such as lipid-based eye drops and novel drug-device combination therapies, have gained considerable recognition. Additionally, the approval of novel anti-inflammatory agents in the management of dry eye symptoms has bolstered treatment options. Also, there is a good potential for gene therapy and biologics in chronic DES cases.

A significant market trend is the implementation of artificial intelligence and diagnostic methods in ophthalmology clinics for early detection and personalized treatment regimens. Portable devices and at-home treatment options are also becoming more popular, enhancing patient convenience and adherence.

From a regulatory standpoint, FDA approvals and accelerated pathways for innovative therapies have spurred R&D investment in the space. Partnerships between pharmaceutical companies and research institutions are also strengthening to broaden the pipeline of effective treatments.

Regionally, the market has been growing in all regions, with North America and Asia Pacific leading with high awareness levels and improving healthcare infrastructure. Emerging markets are especially well-timed for growth as DES incidence rises and healthcare services become more accessible.

Dry Eye Syndrome Treatment Market Dynamics

Drivers

-

Increasing Trend of Digital Eye Strain and Screen Time propels dry eye syndrome treatment market growth.

The use of digital devices has surged over the years, leading to a considerable increase in cases of digital eye strain, which is a significant contributor to dry eye syndrome. Watching screens for a long time depresses blink frequencies, resulting in tear film instability and dryness. In February 2024, CooperVision published a new report aimed at helping eye care professionals gain deeper insights into patients' experiences with digital eye strain. Drawing from recent research involving 750 U.S. adults aged 18-44 who require vision correction, the CooperVision report emphasizes significant opportunities for practitioners to proactively address various device-related habits and symptoms as part of routine eye care. This has been accelerated across age groups the global shift toward remote work, e-learning, entertainment, etc. Increased awareness of the connection between screen usage and eye health has spurred demand for effective treatments, including lubricating eye drops, anti-inflammatory drugs, and targeted therapies including blue light-blocking lenses. This thereby considerably drives the growth of the dry eye syndrome treatment market.

-

The growing incidence of dry eye syndrome in the aging population is a directly impacting factor driving the market growth.

Age also increases the risk of dry eye, due to reduced tear production, hormonal changes, and an increase in disease states such as arthritis and diabetes that increase the incidence of ocular surface disease. As global life expectancy rises, the number of elderly people needing treatment grows. The growing demand drove drug development, including drugs that target inflammation associated with aging and maintenance of the tear film. Moreover, the adoption of new diagnostic systems designed for elderly patients allows for earlier diagnosis, further contributing to market growth.

Restraint

-

Inquiry on Ocular Surface Disease Prevalence and Cost Analysis of Dry Eye Syndrome

The dry eye syndrome treatment market is driven by the high cost of advanced treatments such as prescription medication, biologics, and advanced therapies including intense pulsed light therapy; however, the high cost associated with these products is a key restraint for the dry eye syndrome treatment market. Although these alternative treatments may prove to be more effective and longer-lasting than traditional therapies, their high cost renders them out of reach for a large fraction of the patient pool, particularly within low- and middle-income countries. Insurance coverage or reimbursement for such treatments is also often limited, adding to the general disincentive for patients to seek or continue with advanced care. This financial constraint affects the overall adoption rate of innovative therapies, which is hindering the market.

Dry Eye Syndrome Treatment Market Segmentation Insights

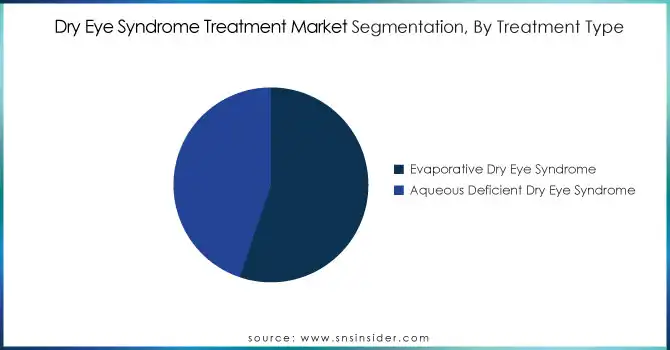

By Treatment Type

The evaporative dry eye segment dominated the market with a market share of 55% in 2023. EDE is one of the most prevalent types of dry eye syndrome, caused by low-quality cases of tear formation. Over time patients report grittiness, stinging, and blurred vision, discomfort with contact lenses, and eye fatigue. Essentially, EDE is primarily attributed to the blockage of the meibomian glands, which subsequently decreases the oil content in the tear film, causing its rapid evaporation. In addition to topical lubricating eye drops, these treatments include warm compresses and omega-3 fatty acid supplements that help alleviate symptoms and stimulate the production of tears to some degree.

The aqueous dry eye segment is projected to witness significant growth in the forecast period, owing to its surging prevalence and technological advancements in treatment. ADES is an outcome of defective lacrimal gland function and leads to inadequate production of aqueous tears. It is commonly associated with chronic inflammation and enlarged tear ducts. Various companies like I-Med Pharma, Novaliq GmbH, and Allergan have been increasingly focused on promoting therapeutic solutions for ADES to address the growing need for effective treatment. The growing awareness of ADES is expected to fuel the growth of the market, presenting exciting opportunities.

By Treatment Product Type

The artificial tears segment dominated the market with a market share of 42% in 2023. This is because of extensive research in the artificial tear sector, as well as comfort and ease of use for patients. For example, last May 2024, Eric Donnenfeld, an ophthalmic surgeon, presented the findings of a new artificial tear called "Blink Triple Care," made to treat disorders affecting the eye, before the annual meeting of the Association for Research in Vision and Ophthalmology.

The Topical Corticosteroids segment is expected to grow at the fastest CAGR during the forecast period, with support from new drug approvals in this segment. For instance, in October 2022, Novaliq received FDA approval for CyclASol, an innovative anti-inflammatory therapy specifically developed for the treatment of dry eye disease, or DED. These product launches and related activities will propel growth in the segment.

By Sales Channel

In 2023, the prescription segment dominated the major share of the market owing to the increasing prevalence of dry eye syndrome in the geriatric population. Over-the-counter products often have active ingredients that work to moisturize and lubricate the eye, helping to increase tear production for a brief period. Prescription medications are more effective for ophthalmic disorders, leading to a preference for prescription medications over OTC alternatives, thus driving their contribution to the growth of the dry eye treatment market.

The OTC drugs segment is anticipated to be the fastest-growing segment throughout the forecast period. Patents on many drugs have expired and generic options have become widely available, fueling this growth. OTC medications are more affordable thus, affordable to a larger pool of patient populations especially in low and middle-income countries.

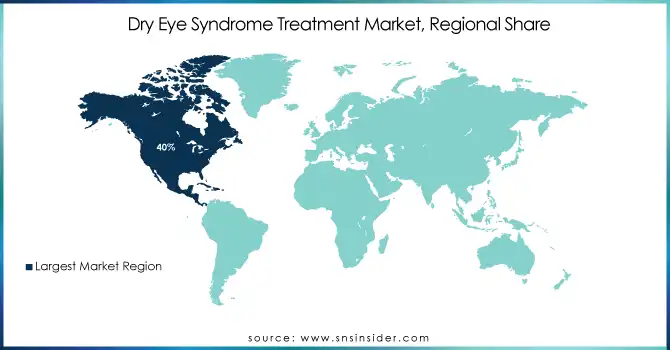

Dry Eye Syndrome Treatment Regional Outlook

North America dominated the market in dry eye syndrome treatment, contributing 40% of the market share in 2023. Several factors, including increasing incidence of eye diseases and favorable government support for the domain in the region, contribute to such dominance. Also, the increasing presence of regulatory bodies is expected to enhance the growth of dry eye treatment drugs in North American countries, as they will help in creating awareness regarding dry eye potential in the management of diseases.

These are bordered by strategic steps by leading industry players to strengthen market growth in the U.S. As an example, in January 2023, Bausch & Lomb Corporation, together with Novaliq GmbH, reported results of NOV03 used for dry eye diseases and symptoms of dry eye. Moreover, greater healthcare coverage of ophthalmic drugs has led to significantly reduced out-of-pocket costs in the past ten years, driving both treatment uptake and higher market growth.

The Asia Pacific dry eye syndrome treatment market is anticipated to grow at the fastest CAGR between 2024 and 2032. Both developing and developed economies comprise the region, where increasing healthcare expenditure is one of the factors motivating market growth. Furthermore, the growing geriatric population along with rising awareness regarding dry eye syndrome are the primary factors anticipated to bolster demand in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Major Players in Dry Eye Syndrome Treatment Market

-

Invacare Corporation (TDX SP2 Power Wheelchair, Rollite Rollator Walker)

-

Sunrise Medical (Quickie Q500 M Power Wheelchair, Airgo Comfort-Plus Lightweight Rollator)

-

Drive DeVilbiss Healthcare (Titan AXS Electric Wheelchair, Nitro Euro Style Rollator)

-

Allergan (Restasis Eye Drops, Refresh Artificial Tears)

-

Novartis AG (Xiidra Ophthalmic Solution, Systane Lubricant Eye Drops)

-

Johnson & Johnson Vision (Blink Tears, Acuvue Theravision Contact Lenses)

-

Bausch + Lomb (Lumify Redness Reliever, Soothe XP Advanced Eye Drops)

-

Sun Pharmaceutical Industries Ltd. (Cequa Cyclosporine Eye Drops, Omidria Surgical Solution)

-

Santen Pharmaceutical Co., Ltd. (Ikervis Cyclosporine Eye Drops, Hyalein Sodium Hyaluronate Drops)

-

Hoya Corporation (MiYOSMART Lenses, Vision Simulator Devices)

-

Alcon Inc. (Tears Naturale Lubricant Drops, Pataday Allergy Relief Eye Drops)

-

Medicom Healthcare Ltd. (Evolve Preservative-Free Drops, Hydrosight Eye Care Solutions)

-

Otsuka Pharmaceutical Co., Ltd. (Mucosta Eye Drops, Dryzar Hyaluronic Acid Drops)

-

Hikma Pharmaceuticals PLC (Cyclosporine Ophthalmic Emulsion, Artificial Tears Drops)

-

Kala Pharmaceuticals, Inc. (Eysuvis for Dry Eye Flares, Inveltys Post-Surgical Drops)

-

Regener-Eyes (Regener-Eyes Pro Biologic Drops, Regener-Eyes Lite for Mild Dry Eye)

-

Oyster Point Pharma, Inc. (Tyrvaya Nasal Spray, Oyster Therapy Experimental Biologics)

-

Abbott Laboratories (Blink GelTears, Moisture Eyes Artificial Tears)

-

Croma-Pharma GmbH (EvoTears for Evaporative Dry Eye, EyeSol Stabilized Lipid Drops)

-

AFT Pharmaceuticals Ltd. (NovaTears for MGD, Maxigesic Eye Anti-inflammatory)

-

Nicox S.A. (Zerviate for Allergic Conjunctivitis, NCX-4251 for Inflammation)

-

Akorn, Inc. (Akten Lubricating Drops, HydroEye Nutritional Supplements)

-

Scope Ophthalmics (Hycosan Preservative-Free Drops, Optase Moist Heat Mask)

Recent Developments

-

In April 2024, Bausch + Lomb Corp announced that the journal Frontiers in Ophthalmology had published statistically significant results from a clinical study assessing the efficacy and safety of a new daily nutritional supplement designed to alleviate dry eye symptoms.

-

In June 2023, Novartis revealed an agreement to divest its ‘front of eye’ ophthalmology assets to Bausch + Lomb, a leading global eye health company, in a transaction valued at up to USD 2.5 billion. The deal includes an upfront payment of USD 1.75 billion, with additional milestone payments.

-

In April 2023, Sun Pharma introduced CEQUA, its specialty ophthalmology therapy, to the Indian market for the treatment of dry eye disease (DED), expanding its offerings in advanced eye care solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.86 Billion |

| Market Size by 2032 | US$ 10.17 Billion |

| CAGR | CAGR of 6.32% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Treatment Type (Evaporative Dry Eye Syndrome, Aqueous Deficient Dry Eye Syndrome) • By Treatment Drugs (Xiidra, Restasis, Cequa, Tyrvaya, Eysuvis, Others) • By Treatment Product (Artificial Tears, Cyclosporine, Topical Corticosteroids, Punctal Plugs, Oral Omega Supplements, Others) • By Dosage Form (Eye Drops/Solutions, Ointments and Gels, Capsules & Tablets (For Supplements), Other Dosage Forms) • By Sales Channel (Prescription, OTC, Others) • By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hikvision, Samsung Electronics, Comelit Group SpA, Legrand, Aiphone, 2N, TCS (Telecommunication Systems), Bosch Security Systems, Siedle & Sohne OHG, Panasonic, VTECH Communications, Geesa, Fermax, ABB, ZKTeco, Vivi, DoorBird, ButterflyMX, Vanderbilt, Valcom, and other players. |

| Key Drivers | •Increasing Trend of Digital Eye Strain and Screen Time propels dry eye syndrome treatment market growth. •The growing incidence of dry eye syndrome in the aging population is a directly impacting factor driving the market growth. |

| Restraints | •Inquiry on Ocular Surface Disease (OSD)Prevalence and Cost Analysis of Dry Eye Syndrome (DES) |