Sterilization Wrap Market Size Analysis:

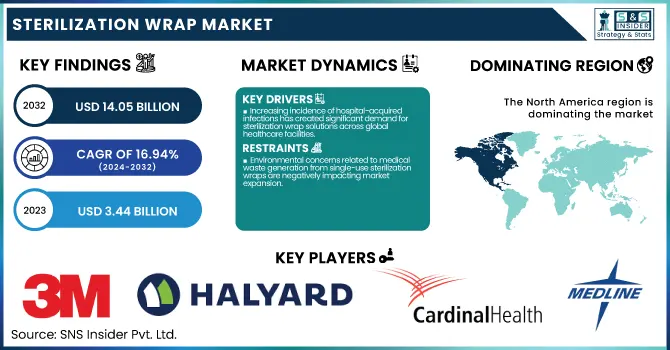

The Sterilization Wrap Market Size was valued at USD 3.44 Billion in 2023 and is expected to reach USD 14.05 Billion by 2032, growing at a CAGR of 16.94% over the forecast period 2024-2032.

To Get more information on Sterilization Wrap Market - Request Free Sample Report

This report provides the key statistical insights and analytics as well as trends shaping the Sterilization Wrap Market. The report discusses spending on infection control in healthcare, focusing on government and private investments. It examines facility-level adoption rates at hospitals and surgical centers and trends in regulatory compliance with global and regional standards. It also discusses the emerging trends in material innovation with the transition in the industry from standard to advanced nonwoven materials e.g. SMS etc. These insights collectively offer a comprehensive view of market drivers, regional performance, and evolving preferences in sterilization practices. One of the key drivers of the sterilization wrap market is the growing focus on healthcare regulations and hospital-acquired infections (HAIs). According to the United Nations Population Fund's 2023 statistics, the global geriatric population is rising, contributing to higher demand for surgical procedures and infection prevention measures.

The United States sterilization wrap market has experienced steady growth, rising from USD 98.01 million in 2023 to USD 137.74 million by 2032, at a CAGR of 3.86% during the forecast period. This growth is primarily due to factors such as the large volume of surgical procedures performed, rigorous infection control standards, and the high penetration rate of advanced nonwoven sterilization materials in hospitals and surgical centers. Such steady contributions toward healthcare infrastructure and regulatory compliance bolster market growth in the country. Globally governments are centralized putting strict sterilizing measures in place in hospitals for patient safety and legitimacy.

Sterilization Wrap Market Dynamics

Drivers

-

Increasing incidence of hospital-acquired infections has created significant demand for sterilization wrap solutions across global healthcare facilities.

The rising prevalence of hospital-acquired infections (HAIs) is directly propelling the demand for sterilization wraps as a preventive healthcare measure. Healthcare providers, including hospitals and medical facilities, are taking on more sterilization wraps to reduce infection in surgical and routine care. Nearly 1 in 31 hospital patients has at least one healthcare-associated infection on any given day in the U.S., according to the CDC, again underscoring the need for infection prevention solutions. These wraps serve as an essential barrier preventing microbial penetration, ensuring that surgical instruments remain sterile until their intended use. Detailed sterilization procedures are highly complicated, and with increasing regulations for healthcare systems, the need to minimize HAIs is persuading hospitals to adopt dependable sterilization processes such as wrap-based systems. In addition to this, various countries mandate sterilization through regulatory frameworks and accreditation standards, thereby boosting product penetration. This clearly defines sterilization wraps as the best choice over alternatives due to ease of use, cost benefits, and compliance. As healthcare systems worldwide adopt stricter infection control measures, the sterilization wrap market is bound to see continued growth as healthcare safety remains a primary concern.

Restrain

-

Environmental concerns related to medical waste generation from single-use sterilization wraps are negatively impacting market expansion.

Sterilization wraps are predominantly made from polypropylene, a type of plastic that contributes to significant amounts of medical waste when used as single-use products. The growing awareness about environmental sustainability and the negative implications of plastic disposal is compelling healthcare facilities and governments to reconsider single-use medical products. Regulatory authorities are increasingly scrutinizing the environmental impact of disposable wraps, encouraging the adoption of eco-friendly alternatives or reusable sterilization methods. As a result, hospitals may face rising pressure to limit or replace traditional sterilization wraps, especially in regions with strong environmental regulations. This is particularly significant in developed markets like Europe, where healthcare waste reduction is a legislative focus. Moreover, the cost of proper disposal and environmental compliance adds an additional financial burden to healthcare institutions. This restraint has the potential to influence procurement decisions and shift demand toward more sustainable packaging and sterilization solutions. Consequently, despite the clinical advantages of sterilization wraps, their environmental footprint could slow down overall market growth, especially in areas prioritizing green healthcare practices and regulatory accountability.

Opportunities

-

Expansion of healthcare infrastructure in emerging markets presents new growth avenues for sterilization wrap manufacturers.

Emerging markets are experiencing rapid economic growth, leading to increased government investment in healthcare and the formation of lucrative opportunities for sterilization wrap manufacturers. Countries such as India and Brazil and those in Southeast Asia are enhancing healthcare systems, boosting hospital capacities, and introducing infection-control standards that meet global best practices. These transformations are developing a solid base to initiate high-end sterilization processes, comprising high-quality wraps. With these markets urbanizing, the number of surgical procedures and diagnostic interventions is increasing dramatically resulting in an immediate need for Sterile instruments. Furthermore, globalization and the inflow of foreign investments in healthcare infrastructure are accelerating the transfer of technology and increasing the availability of modern sterilization solutions. As infection-related morbidity and mortality decrease due to the enforcement of sterilization protocols by local governments, the market indirectly benefits. By providing cost-effective, customized, on-demand sterilization wrap products, specifically designed to meet the local needs of the emerging healthcare systems, manufacturers can make use of these growing markets. Companies operating in this space stand to add significant revenue streams and achieve geographic diversification through this opportunity.

Challenges

-

High competition and pricing pressures in the sterilization wrap market limit profitability and affect smaller players' sustainability.

The sterilization wrap market is becoming increasingly saturated, especially in developed regions where several manufacturers compete for the same customer base. The presence of established global players with strong brand loyalty, extensive distribution networks, and pricing leverage makes it difficult for new or smaller companies to gain a foothold. Hospitals and procurement agencies often prioritize cost savings, driving competitive bidding processes that result in downward pricing pressure. This price-centric purchasing behavior reduces profit margins and limits the scope for innovation unless companies can justify a premium with clear value differentiation. Additionally, private-label and local wrap producers further intensify market competition by offering low-cost alternatives. For companies with limited R&D or marketing budgets, it becomes challenging to scale operations or invest in product innovation. The competitive dynamics not only affect revenue potential but also limit long-term strategic planning, leading to frequent exits or consolidations in the market. This challenge is a significant barrier to sustainable growth and innovation in the sterilization wrap landscape.

Sterilization Wrap Market Segmentation Analysis

By Material Type

In 2023, the sterilization wrap market was dominated by the plastic & polymer segment, due to superior material properties, as well as its widespread adoption across healthcare facilities. They provide outstanding durability, puncture resistance, and microbial barrier performance in order to maintain sterility during the storage and transport of medical devices. They are resistant to different sterilization methods such as steam, ethylene oxide (EO), and hydrogen peroxide vapor, making them versatile and reliable in a variety of healthcare settings. Innovations in material science, including spunbond-meltblown-spunbond (SMS) technology, have also improved the breathability and strength of polymer wraps while keeping sterility. One important driver for this adoption is government regulations. Such as example FDA-approved wraps from Ahlstrom’s Reliance Fusion provide for U.S. infection prevention standards that practically guarantee its use with hospitals and clinics. Furthermore, polymer wraps are coming up with eco-friendly innovations in polymer wraps and are gaining popularity as healthcare facilities state the need for sustainability without affecting its performance.

By End-Use

In 2023, the hospitals and clinics segment dominated the sterilization wrap market, accounting for a significant revenue share of 68%. This dominance is attributed to the high volume of surgical procedures performed in hospitals globally, which has increased the demand for efficient sterilization to prevent hospital-acquired infections (HAIs). The increasing adoption of minimally invasive surgical methods for chronic conditions (like cardio disorders and cancers) is increasing the number of surgical procedures, and consequently, the growth of the sterilization wraps market. These sterilization wraps are essential for maintaining sterility when handling surgical instruments, trays, and a variety of medical devices.

Hospitals are required to follow strict infection prevention policies mandated by law. An example is the guidelines for sterilization practices in the U.S. by the Centers for Disease Control and Prevention (CDC), which focuses on infection prevention and control practices that can help reduce HAIs. One of the most important aspects of sterilization wraps is how well they keep up with these vital standards to protect the health of a patient. Their versatility means use across hundreds of departments within hospitals, including from operating rooms to diagnostic labs making them vital for daily operations.

Sterilization Wrap Market Regional Insights

North America dominated the global sterilization wrap market in 2023, accounting for 35% of the market revenue. This leadership can be credited to its advanced healthcare infrastructure, strict protocols related to infection control, and high awareness levels of hospital-acquired infections (HAIs). Regulatory authorities such as the U.S. Food and Drug Administration (FDA) maintain rigorous oversight and regulations that require the use of sterile supplies and approved sterilizing materials in hospitals and clinics. The region’s proactive stance on infection prevention ensures widespread adoption of high-quality wraps that meet regulatory requirements. North America’s dominance is further supported by technological advancements introduced by key players such as STERIS Corporation and Ahlstrom-Munksjo. With rising environmental awareness among healthcare facilities, eco-friendly biodegradable wraps have also gained popularity. The priorities of a growing elderly population with chronic illnesses and increasing high surgical volumes drive demand for effective disease prevention solutions.

Meanwhile, Asia-Pacific emerged as the fastest-growing region with a significant compound annual growth rate (CAGR) from 2024-2032. Key growth drivers are increased investments in healthcare infrastructure, for example, China’s network of hospitals or India’s intensive development towards medical tourism. Additionally, the growing population base of the region acts as a direct contributor to the rising surgical volumes, thus requiring effective sterilization solutions. Asia-Pacific’s growth trajectory mirrors its evolving healthcare landscape marked by the rising adoption of advanced sterilization technologies such as ethylene oxide gas and hydrogen peroxide vapor systems. Institutions in which governments have also gone above and beyond to allocate funds to ensure that hospitals are updated on new sterilization technologies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Sterilization Wrap Market Key Players

-

3M Company

-

Halyard Health (Owens & Minor)

-

Medline Industries, LP

-

SteriMed Group

-

Mölnlycke Health Care

-

DuPont de Nemours, Inc.

-

Berry Global Inc.

-

Wipak Group

Recent Developments in the Sterilization Wrap Market

-

In January 2023, Jiaherb, Inc. acquired J-Pac Medical, a provider of manufacturing, packaging, and sterilization services for medical and diagnostic devices.

-

Propper Manufacturing Co., Inc. launched the Steri-Wrap Unite 60 SMS Sterilization Wrap in 2023, an ethylene oxide, steam, and vaporized hydrogen peroxide sterilization methods.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 383.6 million |

| Market Size by 2032 | USD 543.03 Billion |

| CAGR | CAGR of 3.95 From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material Type (Plastic & Polymer, Paper & Paperboard, Others) • By End-use (Hospitals and Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M Company, Halyard Health (Owens & Minor), Cardinal Health, Medline Industries, LP, SteriMed Group, Dynarex Corporation, Mölnlycke Health Care, DuPont de Nemours, Inc., Berry Global Inc., Wipak Group |