Medical Collagen Market Report Scope and Overview:

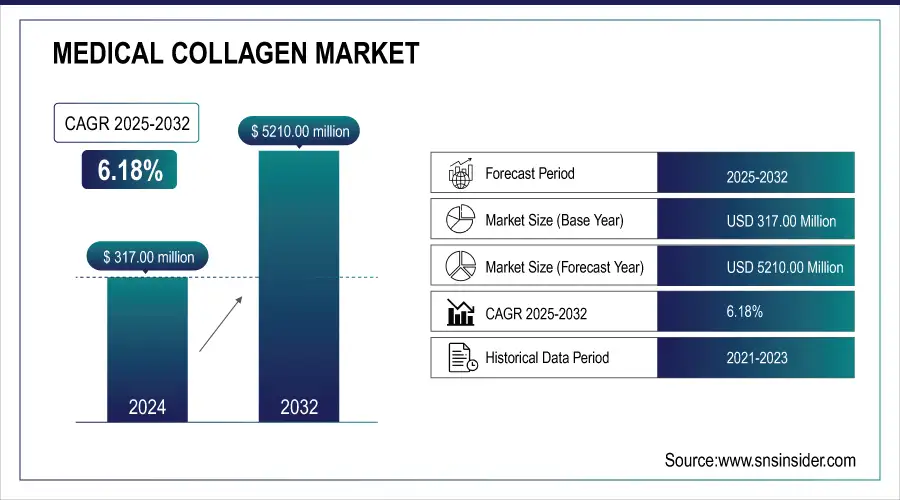

The Medical Collagen Market size was valued at USD 317.00 Million in 2024 and is expected to reach USD 5210.00 Million by 2032, growing at a CAGR of 6.18% over the forecast period 2025-2032.

The Medical Collagen Market encompasses the production and utilization of high-purity collagen derived from bovine, porcine, marine, recombinant, and plant-based sources for medical and pharmaceutical applications. Valued for its superior biocompatibility, biodegradability, tensile strength, and low immunogenicity, medical-grade collagen is widely used in tissue engineering, wound healing, orthopedic and cardiovascular surgeries, dental applications, and drug delivery systems. Market growth is driven by the increasing demand for regenerative therapies, rising incidence of chronic wounds and orthopedic disorders, and growing adoption of collagen-based materials in cosmetic and reconstructive procedures.

Get more information on Medical Collagen Market - Request Sample Report

Technological advancements in purification, cross-linking, and recombinant collagen synthesis are enhancing product safety, functionality, and regulatory compliance. Additionally, the market is witnessing a shift toward sustainable and next-generation collagen formulations, including plant-derived and synthetic variants. Supported by expanding healthcare investments, evolving biomedical standards, and increased R&D activity, the medical collagen market continues to evolve as a vital component of the global biopharmaceutical and regenerative medicine landscape.

Medical Collagen Market Size and Forecast:

- Market Size in 2024: USD 317.00 Million

- Market Size by 2032: USD 521.00 Million

- CAGR: 6.18% (from 2025 to 2032)

- Base Year: 2024

- Forecast Period: 2025–2032

- Historical Data: 2021–2023

Medical Collagen Market Highlights:

-

Patent-driven innovation is boosting regenerative collagen adoption through self-assembling scaffolds and polymeric biomaterials that enhance wound healing and tissue repair efficiency.

-

Strengthened intellectual property protection and rising R&D investments in biocompatible collagen materials are supporting advancements in regenerative and aesthetic medicine.

-

Manufacturing complexity and immune response risks associated with animal-derived collagen continue to limit large-scale adoption across clinical applications.

-

Challenges in scalability, cross-linking control, and product stability are slowing clinical translation of collagen-based micro and nanogels despite strong research interest.

-

Type I and III collagen matrices such as MiMedx’s HELIOGEN are improving tissue regeneration and wound care outcomes while offering easier handling and storage.

-

Growing demand for high-performance, easy-to-use collagen products in surgical, orthopedic, and wound management procedures is driving market expansion.

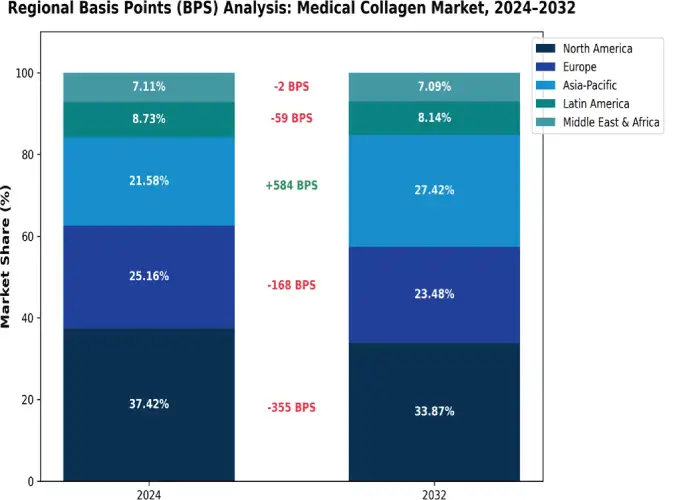

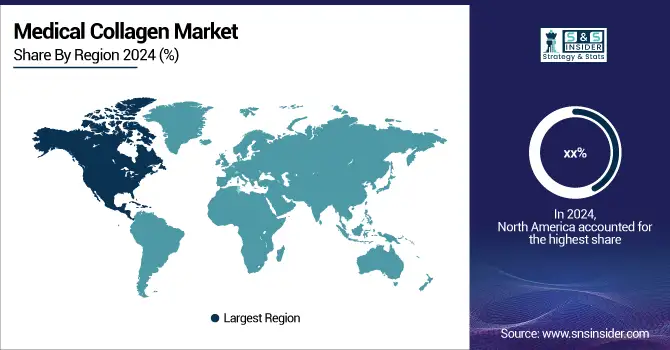

Performance Distribution and Regional Shifts in the Medical Collagen Market

-

North America (−355 BPS — 37.42% → 33.87%)

Interpretation: Mature market with slowing share.

R&D implication: Prioritize incremental innovations (cost, process efficiency, regulatory stability) and lifecycle improvements for existing products rather than heavy new-platform bets. Focus: manufacturing scale-up, regulatory labeling/claims, real-world evidence (RWE) to defend market share.

-

Europe (−168 BPS — 25.16% → 23.48%)

Interpretation: Slight decline driven by regulation and market maturity.

R&D implication: Emphasize compliance-ready formulations (low environmental footprint, traceability), and EU-specific regulatory dossiers. Focus: green/traceable sourcing, EU clinical comparators, sustainability proofs.

-

Asia-Pacific (+584 BPS — 21.58% → 27.42%)

Interpretation: Strong growth opportunity.

R&D implication: Allocate growth R&D here — localized formulations, cost-competitive production, tech transfer, and partnerships with regional CROs and hospitals. Focus: lower-cost recombinant/plant-based collagen, scalable upstream processes, country-specific clinical pilots.

-

Latin America (−59 BPS — 8.73% → 8.14%)

Interpretation: Small contraction; volatility risk.

R&D implication: Limited direct R&D investment; consider regional partnerships and regulatory support only where market entry or a local partner exists. Focus: adaptable, lower-cost SKUs and distribution-ready tech packages.

-

Middle East & Africa (−2 BPS — 7.11% → 7.09%)

Interpretation: Stable but low growth.

R&D implication: Monitor opportunistic demand; prioritize post-market surveillance and small, targeted clinical validations rather than new product builds.

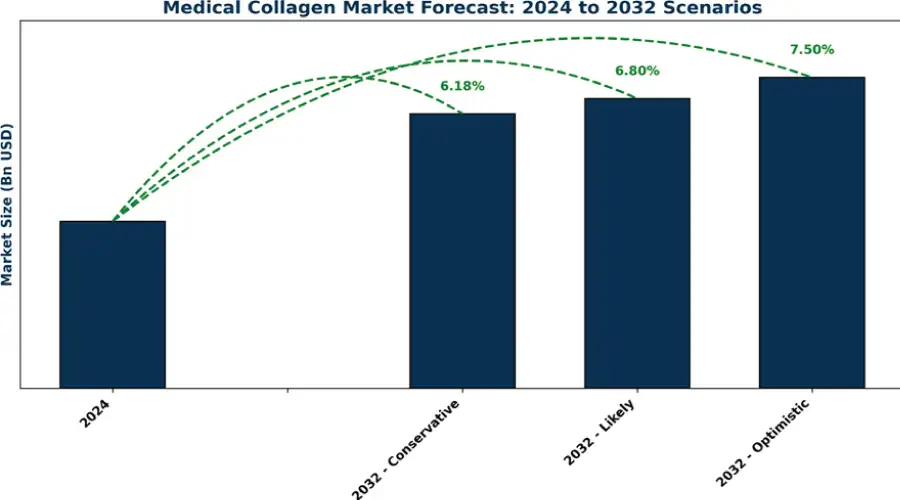

Comparative Assessment of Market Expansion under Varying Growth Assumptions

Scenario interpretations & R&D actions

-

Conservative (USD 5,210m by 2032; CAGR 6.18%)

R&D posture: Defensive. Prioritize high-ROI improvements, cost reduction, regulatory robustness, and incremental product line extensions. Maintain a small exploratory program for next-gen tech but keep capital spending limited. -

Likely (USD 5,500m; CAGR 6.80%)

R&D posture: Growth-with-discipline. Increase investment moderately in scale-up of promising recombinant/plant-based platforms and clinical evidence generation. Allocate resources to two to three medium-risk projects (e.g., new scaffold or injectable formulation) with defined milestones. -

Optimistic (USD 5,900m; CAGR 7.50%)

R&D posture: Aggressive growth. Ramp up strategic bets: advanced regenerative platforms, personalized collagen constructs, and partnerships for rapid market access. Hire/partner for accelerated clinical programs and manufacturing capacity expansion.

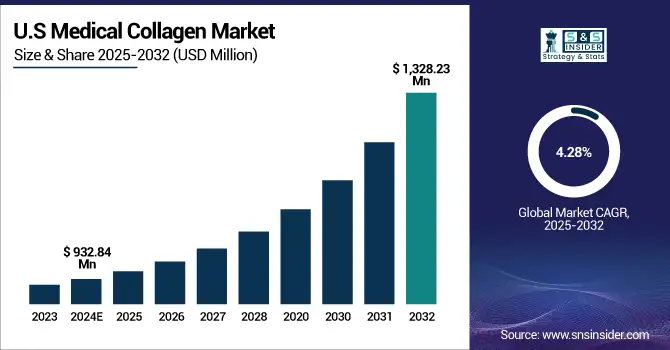

The U.S. dominates the North American medical collagen market, supported by advanced healthcare infrastructure, a strong biotechnology base, and rising demand for collagen-based wound care, orthopedic, and cosmetic products. Valued at USD 932.84 million in 2024, the market is projected to reach USD 1,328.23 million by 2032, growing at a CAGR of 4.28%. Growth is driven by the increasing prevalence of chronic wounds and bone disorders, FDA-backed innovation, and the presence of key players like Integra LifeSciences and DSM Biomedical. Future trends include the rise of bioengineered collagen, regenerative medicine integration, and expanding biotech-research collaborations

Medical Collagen Market Drivers:

-

Intellectual Property Advancements Fuel Regenerative Collagen Innovation

Strengthening intellectual property protection in collagen biomaterials is driving significant progress across the medical collagen market. Patented innovations in self assembling collagen scaffolds and polymeric biomaterials are enabling broader applications in wound healing, soft tissue repair, and therapeutic delivery. These technologies replicate natural collagen structures while minimizing inflammatory responses, improving clinical outcomes, and reducing recovery times. The growing emphasis on patent-backed, biocompatible materials is encouraging investments in research, manufacturing, and regulatory approvals, positioning regenerative collagen as a cornerstone of next-generation medical treatments and expanding opportunities across surgical, orthopedic, and aesthetic applications. In October 2024, GeniPhys, an Indianapolis-based MedTech innovator, received a new U.S. patent expanding protection for its Collymer regenerative collagen biomaterial platform, supporting applications in wound care, soft tissue repair, and drug delivery.

Medical Collagen Market Restraints:

-

Manufacturing and Immunogenicity Challenges Restrain Medical Collagen Adoption

The development and clinical application of collagen-based micro/nanogels face significant restraints that impact the broader medical collagen market. One major challenge is the potential immune response, particularly for animal-derived collagen, which can trigger inflammation or allergic reactions in patients, limiting its use in sensitive populations. Additionally, large-scale manufacturing of these advanced delivery systems remains complex and costly, as precise control over size, cross linking, and mechanical properties is critical for therapeutic efficacy. Environmental responsiveness, while advantageous, further complicates production and storage. These factors collectively slow the translation of innovative collagen technologies from laboratory research to commercial and clinical applications, constraining market growth despite rising demand in wound healing, tissue regeneration, and targeted drug delivery.

In May 2025, Chinese Medical Journal warns of challenges in translating collagen-based micro/nanogels from research to clinical practice due to immune response risks and large-scale manufacturing limitations.

Medical Collagen Market Opportunities:

-

Enhanced Handling and Performance of Collagen Matrices Drive Adoption in Surgical Wound Care

The medical collagen market holds significant growth opportunities through the development of easy-to-use products that enhance accessibility and efficiency in surgical and complex wound care. Advanced collagen matrices containing Type I and III collagen can closely mimic native connective tissue, supporting faster tissue regeneration and improved healing outcomes. These innovations reduce logistical challenges associated with storage and handling, while providing clinicians with versatile options for a variety of wound types. Increasing demand for effective, practical, and high-performance collagen-based solutions in surgical and wound management settings positions the industry for substantial expansion in the coming years.

In July 2024, MiMedx launched HELIOGEN Fibrillar Collagen Matrix, a shelf-stable xenograft with Type I and III collagen for complex surgical wounds.

Medical Collagen Market Segment Analysis:

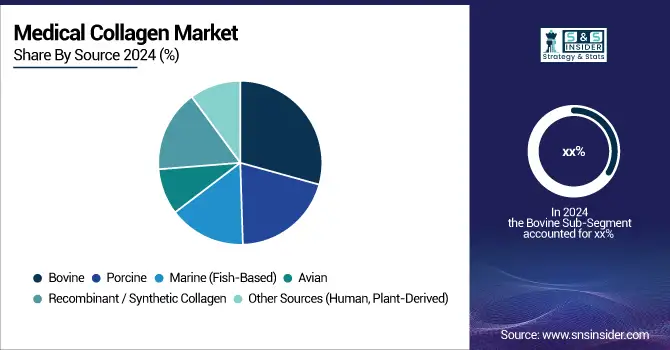

By Source

Bovine collagen leads the medical collagen market owing to its structural similarity to human collagen, biocompatibility, and cost-effectiveness. Widely used in wound care, orthopedic, and dental applications, it was valued at USD 1,106.13 million in 2024 and is projected to reach USD 1,656.27 million by 2032, growing at a CAGR of 4.94%. Supported by FDA-approved medical-grade variants and ongoing advancements in purification and cross-linking, bovine collagen remains essential for regenerative and orthopedic therapies, particularly in developing economies.

By Product Type

Gelatin dominates the medical collagen market owing to its excellent biocompatibility, biodegradability, and film-forming ability. Valued at USD 1,238.56 million in 2024, it is projected to reach USD 1,879.95 million by 2032, growing at a CAGR of 5.12%. Widely used in wound dressings, hemostatic products, drug delivery systems, and regenerative medicine, gelatin’s clinical acceptance and FDA safety approval drive its growth. Future innovations will focus on developing medical-grade variants with improved stability, bioactivity, and integration into smart wound dressings and composite biomaterials.

By Application

Orthopedic surgery and implants dominate the medical collagen market due to rising demand for bone graft substitutes, cartilage repair, and scaffolds. Valued at USD 692.70 million in 2024, the segment is projected to reach USD 1,038.04 million by 2032, growing at a CAGR of 4.95%. Collagen’s high strength, biocompatibility, and structural similarity to bone matrix drive its use in orthopedic applications. With FDA-approved products and advancements in cross-linked scaffolds, collagen will remain vital for regenerative and minimally invasive orthopedic procedures globally.

By Form

The medical collagen market by form includes powder, films & sheets, gels, and solutions/suspensions. Collagen powder dominates due to cost-effectiveness and versatility, reaching USD 1,842.59 million by 2032. Films & sheets, valued at USD 794.85 million by 2032, are preferred for surgical and dental applications. Collagen gels, the fastest-growing segment (CAGR 8.33%), support wound healing and regenerative uses. Solutions and suspensions aid in injectables and bioprinting, driving growth through innovation in bioactivity and biocompatible formulations.

By End-Use

The medical collagen market by end-use includes hospitals & clinics, specialty clinics, pharmaceutical & biotech companies, research institutes, and CROs. Hospitals & clinics dominate, valued at USD 1,827.84 million by 2032, driven by extensive use in wound care and surgeries. Specialty clinics grow with demand for aesthetic and orthopedic procedures. Pharmaceutical and biotech firms utilize collagen in drug delivery and regenerative applications, while research institutes and CROs increasingly adopt bioengineered collagen for experimental, preclinical, and translational biomedical research.

Medical Collagen Market Regional Analysis:

North America Medical Collagen Market Insights:

North America remains the leading region in the global medical collagen market, driven by a strong healthcare ecosystem, advanced R&D infrastructure, and high adoption across wound care, orthopedic, dental, and cosmetic applications. The regional market was valued at USD 1,186.21 million in 2024 and is projected to reach USD 1,764.63 million by 2032, registering a CAGR of 4.85% (2025–2032). Growth is fueled by increasing prevalence of chronic wounds and orthopedic disorders, supportive FDA regulations, and technological advancements in recombinant and plant-based collagen.

U.S. and Canada Medical Collagen Market Trends:

|

Country |

2024 Value (USD Million) |

2032 Value (USD Million) |

CAGR (%) |

Key Growth Drivers |

|

United States |

932.84 |

1,328.23 |

4.28 |

Advanced healthcare infrastructure, strong biotechnology capabilities, and high demand for wound care, orthopedic, and cosmetic collagen products |

|

Canada |

253.38 |

436.39 |

6.77 |

Regenerative medicine R&D, sustainable collagen production, and rising clinical adoption |

Need any customization research on Medical Collagen Market - Enquiry Now

Europe Medical Collagen Market Insights:

Europe holds a significant share in the global medical collagen market, driven by advanced biomedical research, a strong pharmaceutical base, and rising demand for collagen-based medical devices. The Europe medical collagen market was valued at USD 797.57 million in 2024 and is projected to reach USD 1223.31 million by 2032, growing at a CAGR of 5.26% (2025–2032). Growth is supported by a strong focus on regenerative medicine, supportive EMA regulatory frameworks, and increasing collagen use in orthopedic, dental, and reconstructive surgeries. Future trends include the adoption of recombinant and plant-derived collagen, expansion of 3D bioprinting, and growing public-private funding for clinical innovations.

Germany, U.K., France, Italy, Spain, Russia, Poland, and Rest of Europe Medical Collagen Market Trends:

|

Country |

2024 Value (USD Million) |

2032 Value (USD Million) |

CAGR (%) |

Key Growth Drivers |

|

Germany |

171.32 |

241.60 |

4.15 |

Strong biomedical research ecosystem, advanced healthcare infrastructure, and innovations in recombinant collagen |

|

United Kingdom |

138.46 |

227.78 |

6.18 |

Expanding regenerative medicine sector and rising demand for medical-grade collagen in aesthetics and orthopedics |

|

France |

118.20 |

188.51 |

5.77 |

Integration of collagen biomaterials in tissue repair and wound management |

|

Italy |

93.08 |

151.45 |

6.04 |

Growing adoption of collagen implants and bioprinting technologies |

|

Spain |

71.30 |

112.06 |

5.58 |

Expanding R&D activities in regenerative and reconstructive medicine |

|

Russia |

60.06 |

96.89 |

5.92 |

Increasing domestic production and research collaborations in medical collagen |

|

Poland |

51.68 |

88.20 |

6.66 |

Rising biotechnological innovation and government-backed healthcare modernization |

|

Rest of Europe |

93.48 |

116.83 |

2.57 |

Moderate growth supported by limited but emerging biomedical research initiatives |

Asia-Pacific Medical Collagen Market Trends:

The Asia-Pacific region represents the fastest-growing market for medical collagen, fueled by rapid healthcare infrastructure development, rising disposable incomes, and growing adoption of advanced medical treatments. Demand is surging for collagen-based wound care, orthopedic, dental, and cosmetic applications amid an aging population and increasing chronic disease prevalence. Leading countries such as China, Japan, India, and South Korea are investing heavily in biotechnology, regenerative medicine, and local collagen production to ensure cost-effective access. Expanding medical tourism in India, Thailand, and South Korea is also accelerating collagen utilization in reconstructive and aesthetic procedures. The regional market was valued at USD 684.09 million in 2024 and is projected to reach USD 1,428.58 million by 2032, growing at a CAGR of 9.35%. Future growth will be shaped by the rise of recombinant and plant-derived collagen, integration in 3D bioprinting applications, and increasing public-private R&D collaborations that enhance innovation and sustainability.

China, India, Japan, South Korea, Australia, and Rest of Asia-Pacific Medical Collagen Market Trends:

|

Country |

2024 Value (USD Million) |

2032 Value (USD Million) |

CAGR (%) |

Key Growth Drivers |

|

China |

194.76 |

438.86 |

10.39 |

Strong domestic biomanufacturing ecosystem and government-backed regenerative medicine initiatives |

|

India |

120.60 |

270.57 |

10.33 |

Expanding medical tourism sector and growing use of collagen in wound care and aesthetic procedures |

|

Japan |

104.25 |

209.57 |

8.83 |

Advanced biomedical R&D, aging population, and rising regenerative medicine investments |

|

South Korea |

74.29 |

161.14 |

9.87 |

Leadership in cosmetic and reconstructive surgery and innovation in collagen biomaterials |

|

Australia |

51.44 |

102.14 |

8.66 |

Increasing clinical applications and investment in regenerative healthca |

Latin America Medical Collagen Market Trends:

The Latin America medical collagen market is witnessing steady growth, driven by rising healthcare investments, modernization of hospitals, and increasing adoption of collagen-based wound care, dental, and cosmetic products. Countries such as Brazil, Mexico, Argentina, and Colombia are leading this expansion through regenerative medicine initiatives and collaborations with international biotech firms. The regional market was valued at USD 276.74 million in 2024 and is projected to reach USD 424.09 million by 2032, growing at a CAGR of 5.25%. Growth is supported by government-backed biomedical research, growing demand for reconstructive applications, and the shift toward sustainable, recombinant, and plant-based collagen innovations integrated into regenerative therapies and tissue engineering.

Brazil, Argentina, Mexico, Colombia, and Rest of Latin America Medical Collagen Market Trends:

Brazil leads the region, growing from USD 95.97 million in 2024 to USD 153.73 million by 2032 (CAGR 5.83%), followed by Argentina (CAGR 6.04%), Mexico (CAGR 5.54%), and Colombia (CAGR 4.22%). The Rest of Latin America, including Chile, Peru, and Venezuela, is growing moderately at 2.46% CAGR. Government initiatives supporting regenerative medicine, expanding medical infrastructure, and collaborations between domestic and international firms are enhancing product innovation, accessibility, and the adoption of advanced recombinant and plant-based collagen solutions across the region.

Middle East & Africa Medical Collagen Market Trends:

The Middle East & Africa medical collagen market was valued at USD 225.39 million in 2024 and is projected to reach USD 369.39 million by 2032, growing at a CAGR of 6.14% (2025–2032). Growth is driven by expanding healthcare infrastructure, rising demand for wound care, orthopedic, and cosmetic procedures, and increasing adoption of regenerative medicine. Government support, medical tourism, and collaborations between domestic and international firms are enhancing innovation, accessibility, and quality across the region.

UAE, Saudi Arabia, Qatar, Egypt, South Africa, and Rest of Middel East & Africa Medical Collagen Market Trends:

The UAE leads with strong medical tourism and innovation, while Saudi Arabia (CAGR 6.73%) and Qatar (CAGR 7.08%) show rapid growth due to modernization and regenerative medicine initiatives. Egypt and South Africa are advancing through hospital development and international collaborations to enhance collagen-based wound care and reconstructive applications. The Rest of MEA including Oman, Kuwait, Nigeria, and Kenya—continues moderate growth supported by rising healthcare investments and expanding local production of medical-grade collagen solutions.

Competitive Landscape of the Medical Collagen Market:

Advanced Medical Solutions Group Plc Founded in 1991, is a UK-based global leader in tissue-healing technologies. The company develops and manufactures advanced wound care, surgical, and collagen-based biomaterial solutions. With operations spanning multiple regions, AMS focuses on innovation in tissue repair, skin closure, and regenerative medical applications worldwide.

-

In March 2024, Advanced Medical Solutions Group Plc acquired Peters Surgical in March 2024 to strengthen its global leadership in tissue repair and skin closure, expanding its surgical product portfolio and geographic reach. The acquisition, valued for €84 million in annual revenue, is expected to deliver high single-digit earnings accretion by FY2025.

dsm-firmenich (established in 2023 through the merger of DSM and Firmenich) is a global leader in nutrition, health, and beauty innovation. Headquartered in Kaiseraugst, Switzerland, the company develops sustainable, science-based solutions spanning biotechnology, peptides, and aroma technologies, driving advancements in well-being, skincare, and environmental responsibility worldwide.

-

In April 2025 – dsm-firmenich launched SYN®-COLL CB, an eco-conscious, high-performance tripeptide developed through Green Chemistry to boost collagen, support sustainable well-aging, and reduce environmental impact.

Evergen Founded in 2016, Evergen is a Slovakia-based nutraceutical manufacturer specializing in collagen-based and functional supplements. The company has rapidly grown into a leading private-label producer with over 1,500 product formulations. Recognized by Forbes Slovakia for its exceptional growth, Evergen emphasizes innovation, quality, and sustainable nutrition solutions.

-

In March 2025 – Evergen was featured in Forbes Slovakia as the fastest-growing medium-sized company in Eastern Slovakia (2022), highlighting its €24 million revenue milestone, expansion to 1,500+ supplement formulations, and strategic leadership in collagen-based nutrition innovation.

GELITA AG Founded in 1875, GELITA AG is a Germany-based global leader in gelatin and collagen peptides for medical and clinical applications. The company develops high-purity, biocompatible collagen for wound dressings, tissue engineering, and regenerative medicine, enhancing patient outcomes and advancing next-generation medical and biotechnological solutions.

-

In 2024, GELITA AG launched novel collagen-based scaffolds for dental and orthopedic surgery, emphasizing improved structural integrity and regenerative support for complex tissue repairs.

Medical Collagen Market Key Players:

-

Advanced Biomatrix

-

Advanced Medical Solutions Group Plc

-

Collplant Biotechnologies

-

Dsm-Firmenich

-

Baxter International Inc

-

Cologenesis Healthcare Pvt. Ltd.

-

Regenity Biosciences

-

Stryker Corporation

-

Tianjin Century Healthcare Biomedical Engineering Co., Ltd.

-

Darling Ingredients

-

Encoll Corp

-

Evergen

-

Gelita Ag

-

Greenpharm S.R.O.

-

Integra Lifesciences Corporation

-

Nitta Gelatin Na Inc.

-

Protein S.A.

-

Smith & Nephew Plc

-

Symatese Lab

-

Harbin Medisan Pharmaceutical Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 317.00 Million |

| Market Size by 2032 | USD 521.00 Million |

| CAGR | CAGR of 6.18% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Bovine, Porcine, Marine/Fish-Based, Avian, Recombinant/Synthetic Collagen, Other Sources – Human, Plant-Derived) • By Product Type (Gelatin, Hydrolyzed Collagen, Native Collagen, Collagen Peptides, Synthetic/Engineered Collagen) • By Application (Orthopedic Surgery & Implants, Dental Applications, Cardiovascular Surgery, Plastic & Reconstructive Surgery, Drug Delivery Systems, Tissue Engineering & Regenerative Medicine, Wound Care, Other Applications – Ophthalmology, Neurology, Urology) • By Form (Collagen Powder, Collagen Films & Sheets, Collagen Gels, Collagen Solutions/Suspensions, Injectable Collagen) • By End-Use (Hospitals & Clinics, Specialty Clinics – Orthopedic, Dental, Plastic Surgery, Pharmaceutical & Biotech Companies, Research & Academic Institutes, Contract Research Organizations, Others – Veterinary Applications) • By Distribution Channel (Direct Sales to Healthcare Institutions, Distributors/Wholesalers, Online Sales Platforms) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Advanced Biomatrix, Advanced Medical Solutions Group Plc, Collplant Biotechnologies, Dsm-Firmenich, Baxter International Inc, Cologenesis Healthcare Pvt. Ltd., Regenity Biosciences, Stryker Corporation, Tianjin Century Healthcare Biomedical Engineering Co., Ltd., Darling Ingredients, Encoll Corp, Evergen, Gelita Ag, Greenpharm S.R.O., Integra Lifesciences Corporation, Nitta Gelatin Na Inc., Protein S.A., Smith & Nephew Plc, Symatese Lab, Harbin Medisan Pharmaceutical Co., Ltd. |