Peptide and Anticoagulant Drugs Market Size & Trends:

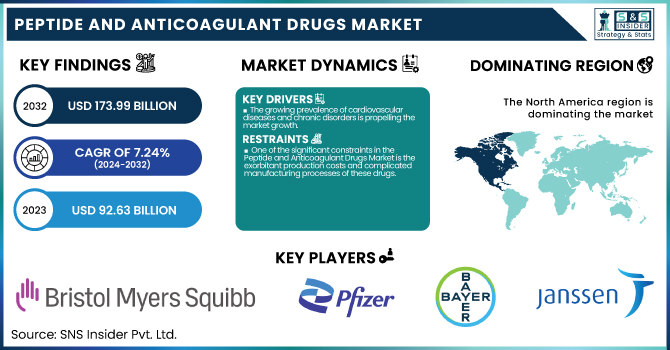

The Peptide and Anticoagulant Drugs Market was valued at USD 92.63 billion in 2023 and is expected to reach USD 173.99 billion by 2032, growing at a CAGR of 7.24% from 2024 to 2032.

To Get more information on Peptide and Anticoagulant Drugs Market - Request Free Sample Report

The report offers proprietary statistical analysis of the Peptide and Anticoagulant Drugs Market, with a focus on key healthcare trends. It covers incidence and prevalence figures, providing regional incidence of conditions targeted by these drugs. The report also examines prescription patterns by region, pinpointing prescribing habits and market trends. Moreover, it assesses healthcare expenditures by government, commercial, private, and out-of-pocket sources. A separate section on regulatory approvals and pipeline drugs monitors future developments, and treatment adherence and patient compliance findings uncover essential behavioral drivers influencing drug effectiveness. These exclusive features provide a holistic and fact-based market analysis.

Peptide and Anticoagulant Drugs Market Dynamics

Drivers

-

The growing prevalence of cardiovascular diseases and chronic disorders is propelling the market growth.

The rising incidence of cardiovascular diseases (CVDs) and chronic conditions like deep vein thrombosis (DVT), stroke, and metabolic disorders is a key growth driver of the Peptide and Anticoagulant Drugs Market. Cardiovascular diseases are the most common cause of death worldwide, responsible for more than 17.9 million deaths every year, as per the World Health Organization (WHO). This expanding disease burden has spurred greater demand for anticoagulant pharmaceuticals such as Eliquis, Xarelto, and Pradaxa to prevent blood clots and mitigate stroke risks. The increasing prevalence of metabolic conditions like diabetes and obesity further fueled demand for peptide drugs such as GLP-1 receptor agonists, such as Novo Nordisk's Ozempic and Eli Lilly's Mounjaro. Recent approvals of new anticoagulants and peptide drugs by the FDA further support market expansion.

-

Advancements in drug delivery and biopharmaceutical research are accelerating the market's growth.

Improvements in peptide drug synthesis technologies, delivery systems, and biopharmaceutical development are driving the Peptide and Anticoagulant Drugs Market heavily. Developments in oral peptide dosage forms, sustained-release injections, and nanoparticle-mediated drug delivery systems have improved bioavailability and patient compliance. In July 2024, for example, Pfizer reported the selection of a modified-release form for Danuglipron, its oral GLP-1 receptor agonist, based on the results of pharmacokinetic study data. In addition, Janssen Pharmaceuticals' Phase 2b clinical trial outcome in 2023 of its oral IL-23 receptor antagonist peptide (JNJ-2113) for plaque psoriasis highlights the broadening of peptide-based drugs into new areas of therapy. The increasing pipeline of peptide-based medications, investments in biopharmaceutical R&D, and partnerships between biotech companies and pharma giants will continue to drive market innovation and adoption.

Restraint

-

One of the significant constraints in the Peptide and Anticoagulant Drugs Market is the exorbitant production costs and complicated manufacturing processes of these drugs.

Peptide drugs need advanced synthesis methods, including solid-phase peptide synthesis (SPPS) and recombinant DNA technology, which need specialized machinery, highly controlled facilities, and strict quality assurance measures. The costliness of production tends to drive up drug prices, making it difficult to access in price-sensitive markets. Furthermore, anticoagulant medications have strict safety assessments because of their therapeutic index and risk of bleeding, further compounding the regulatory burden and drug development expenditures. Supply chain issues, such as raw material scarcity, complexity in peptide purification, and stability issues, also complicate production scalability. All these factors present entry barriers to small biotech companies and can slow down market growth, particularly in the developing world.

Opportunities

-

The Peptide and Anticoagulant Drugs Market is poised for significant growth due to advancements in drug delivery technologies.

Peptide drugs have long been hampered by bioavailability issues owing to rapid breakdown in the gastrointestinal tract, restricting their efficacy in oral formulations. Nevertheless, nanoparticle-based delivery systems, lipid carriers, and new polymer-based formulations are improving peptide drug stability and absorption. Just so, new generation anticoagulants that have better safety profiles and prolonged half-lives are coming through, minimizing repeated dosing needs. Oral, transdermal, and injectable long-acting formulations are being invested in by companies to increase patient availability and compliance. Approvals from regulatory bodies of new delivery vehicles, including oral peptides and subcutaneous anticoagulants, bring with them value market growth potential. While drug companies take advantage of these developments, the industry is likely to experience enhanced compliance among patients, fewer side effects, and extended applications across various therapeutic classes.

Challenges

-

Regulatory obstacles and safety issues related to such drug classes remain a key challenge in the Peptide and Anticoagulant Drugs Market.

Peptide drugs are subject to strict regulation because of the intricate synthesis process, purification challenges, and their stability problems. Any variation in manufacturing or formulation can affect drug efficacy, resulting in longer approval times. Anticoagulant drugs also have a high risk of serious bleeding complications, requiring extensive clinical trials and post-marketing surveillance to confirm safety. The FDA, EMA, and other regulatory agencies place stringent demands, delaying product approvals and raising development expenses. Moreover, issues regarding drug-drug interactions, side effects, and monitoring requirements pose additional challenges. Smaller pharma firms face costs of compliance that may restrict innovation in the field. Bypassing these compliance hurdles is still a primary concern for continued market expansion.

Peptide & Anticoagulant Drugs Market Segmentation Analysis

By Route of Administration

The Parenteral segment dominated the peptide and anticoagulant drugs market with a 28.36% market share in 2023 because of its greater bioavailability, quick onset of action, and extensive clinical preference. Peptide drugs such as insulin, GLP-1 receptor agonists, and growth hormones are extremely prone to enzymatic degradation in the gastrointestinal tract and, thus, are difficult to administer orally. Parenteral delivery—mainly intravenous (IV), subcutaneous (SC), and intramuscular (IM) injections—provides maximum absorption and therapeutic effectiveness. Likewise, anticoagulant medications such as heparin and low-molecular-weight heparins (LMWHs) need accurate and on-demand blood-thinning activities, supporting injectable formulations in hospital and emergency environments. The increasing incidence of cardiovascular disease, diabetes, and cancer has fueled the demand for parenteral peptides and anticoagulants, supporting their market leadership. Moreover, the growth in biologics and biosimilars has further entrenched the segment's leadership position in 2023.

By Application

The Anticoagulant Drugs segment is expected to witness the fastest growth in the peptide and anticoagulant drugs market with the highest CAGR throughout the forecast period, owing to the escalating global cardiovascular disease burden (CVDs), rising aging population, and broadening indications for anticoagulant treatment. The World Health Organization (WHO) approximates that CVDs cause more than 17 million deaths each year, leading to demand for new oral anticoagulants (NOACs) like apixaban, rivaroxaban, and edoxaban, which have better safety profiles and lower monitoring burdens than conventional warfarin treatment. Also contributing to adoption are rising surgical interventions, heightened awareness of deep vein thrombosis (DVT) and pulmonary embolism (PE), and technological progress in anticoagulant drug formulations. The pipeline for future-generation anticoagulants, drug approvals, and growing healthcare coverage in emerging nations also add to the segment's growth at a rapid pace in the forecast years.

By End-Users

The Hospitals and Clinics segment dominated the peptide and anticoagulant drugs market with a 46.15% market share in 2023 because of the large number of patients demanding anticoagulation therapy and peptide-based interventions for severe diseases like cardiovascular conditions, cancer, and metabolic diseases. Hospitals are the first and foremost point of treatment for surgical patients, chemotherapy, and emergency procedures, where anticoagulant drugs are widely utilized to avoid blood clots and thromboembolic disorders. In addition, parenteral peptide drug delivery, which must be under professional healthcare supervision, is largely practiced in hospitals. As the prevalence of chronic conditions increases and the number of specialized healthcare centers continues to rise globally, hospitals and clinics continue to be the biggest users of these drugs, further cementing their market dominance.

The Research Center segment will show the fastest growth in the forecast years based on the growing drug discovery investments, clinical trials, and biotech developments related to peptide and anticoagulant treatments. There has been worldwide pressure to deliver new drug compounds, targeted medicine, and aimed therapeutics due to which increased research activities at academic and pharma R&D centers have seen a growth drive. In addition, an increase in government and private grants for peptide drug development and new-generation anticoagulants and facilitation of novel therapies by regulatory bodies is driving the growth. The rise of AI-based platforms for drug discovery and improvements in peptide synthesis technologies are also driving the rapid growth in the segment, and research centers are prime catalysts for future innovation in the market.

Peptide & Anticoagulant Drugs Market Regional Insights

North America dominated the peptide and anticoagulant drugs market with around 40.13% market share in 2023 as a result of its advanced healthcare infrastructure, superior healthcare expenditures, and solid footprint of important industry players, including Pfizer, Bristol-Myers Squibb, and Bayer. The area has a high rate of cardiovascular illnesses, cancer, and metabolic conditions, for which demand is growing for peptide and anticoagulant medicines. Moreover, positive regulatory environments, the speed of FDA approvals for drugs, and massive R&D expenditure are among the factors leading to market leadership. The global usage of sophisticated therapeutics, combined with favorable reimbursement policies and high awareness levels among healthcare professionals, further entrenches North America's leadership in the market.

Asia Pacific is the region with the fastest growth in the peptide and anticoagulant drugs market with 8.34% CAGR throughout the forecast period, fueled by growing disease burden, rising investments in healthcare, and expanding need for new therapies. China, India, and Japan are the countries that are witnessing fast-paced urbanization, aging populations, and a spike in chronic conditions, especially cardiovascular diseases and diabetes. Government efforts to increase healthcare access, increase generic drug manufacturing, and enhance clinical research capabilities are driving market growth. Furthermore, the availability of low-cost manufacturing bases, rising foreign investments, and a boosting number of clinical trials are leading to faster expansion in the peptide and anticoagulant drug market in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Leading Companies in Peptide & Anticoagulant Drugs Market

-

Bristol-Myers Squibb Company (Eliquis, Orencia)

-

Pfizer Inc. (Fragmin, Xeljanz)

-

Bayer AG (Xarelto, Kogenate)

-

Janssen Pharmaceuticals, Inc. (Xarelto, Remicade)

-

Eisai Co., Ltd. (Lixiana, Fycompa)

-

Boehringer Ingelheim GmbH (Pradaxa, Actilyse)

-

Daiichi Sankyo Company (Savaysa, Efient)

-

AmbioPharm, Inc. (Custom Peptide Synthesis Services, Generic Peptide APIs)

-

PolyPeptide Group AG (Goserelin, Leuprolide)

-

CordenPharma (GMP Peptide APIs, Peptide Drug Products)

-

Innopep Inc. (Custom Peptide Synthesis, Peptide Libraries)

-

Creative Peptides (Cosmetic Peptides, Therapeutic Peptides)

-

SB-PEPTIDE (Custom Peptide Synthesis, Peptide Process Development)

-

VarmX (VMX-C001, VMX-C002)

-

ExCulture (Anticoagulant Enzyme Products, Diagnostic Reagents)

-

Oxurion (fka ThromboGenics) (Jetrea, THR-149)

-

Alveron Pharma (Cyclodextrin-Based Anticoagulant Reversal Drug, Anticoagulant Platform Technology)

-

Cytovance Biologics (Microbial-Expressed Peptide Drugs, Mammalian-Expressed Peptide Drugs)

-

G.M. Collin (Bota-Peptides Serum, Diamond Cream Moisturizer)

-

Meitheal Pharmaceuticals (Enoxaparin Sodium Injection, Argatroban Injection)

Suppliers (These companies play a crucial role in the production, formulation, and supply of peptides and anticoagulant drugs for pharmaceutical applications.) in Peptide and Anticoagulant Drugs Market

-

AmbioPharm, Inc.

-

CordenPharma

-

PolyPeptide Group AG

-

Bachem Holding AG

-

Lonza Group

-

WuXi AppTec

-

Thermo Fisher Scientific

-

BASF SE

-

Merck KGaA (MilliporeSigma)

-

Cytovance Biologics

Recent Developments in Peptide & Anticoagulant Drugs Market

-

July 2024 – Pfizer Inc. reported that, following results from the ongoing pharmacokinetic study (NCT06153758), the company has chosen its preferred once-daily modified-release formulation of danuglipron, an oral glucagon-like peptide-1 (GLP-1) receptor agonist. Pfizer intends to start dose optimization studies in the second half of 2024, evaluating several doses of the chosen formulation to enable registration-enabling studies.

-

July 2023 – The Janssen Pharmaceutical Companies of Johnson & Johnson announced positive topline results from the Phase 2b FRONTIER 1 clinical trial. The trial assessed JNJ-2113, the first and sole oral interleukin-23 receptor (IL-23R) antagonist peptide, in adult patients with moderate-to-severe plaque psoriasis (PsO), showing encouraging efficacy.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 92.63 billion |

| Market Size by 2032 | US$ 173.99 billion |

| CAGR | CAGR of 7.24% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Route of Administration (Peptide Drugs, Parenteral, Oral, Mucosal, Other Routes of Administration, Anticoagulant Drugs, Oral, Injectable) • By Application (Peptide Drugs, Anticoagulant Drugs) • By End-Users (Hospitals and Clinics, Research Center, Diagnostic Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bristol-Myers Squibb Company, Pfizer Inc., Bayer AG, Janssen Pharmaceuticals, Inc., Eisai Co., Ltd., Boehringer Ingelheim GmbH, Daiichi Sankyo Company, AmbioPharm, Inc., PolyPeptide Group AG, CordenPharma, Innopep Inc., Creative Peptides, SB-PEPTIDE, VarmX, ExCulture, Oxurion, Alveron Pharma, Cytovance Biologics, G.M. Collin, Meitheal Pharmaceuticals, and other players. |