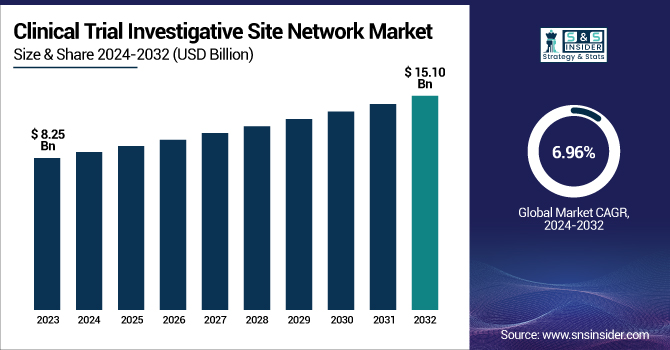

Clinical Trial Investigative Site Network Market Size Analysis:

The Clinical Trial Investigative Site Network Market Size was valued at USD 8.25 Billion in 2023 and is expected to reach USD 15.10 Billion by 2032 and grow at a CAGR of 6.96% over the forecast period 2024-2032. This report emphasizes growth in investigative site networks by geographies, driven by rising clinical research activity and demand for broad patient populations. The research focuses on trial success rates, enrollment, and retention patterns, with a focus on how site performance affects overall study results. The report also analyzes funding and investment trends in government, commercial, private, and CRO, mirroring the financial environment behind trial site growth. The report also evaluates the uptake of decentralized clinical trials (DCTs) and virtual site networks, underlining their potential in promoting patient access and operational effectiveness. Investigative site performance measures, efficiency, and digitalization patterns are evaluated, showing how technology uptake is rationalizing site operations and enhancing trial performance. Additionally, regulatory patterns driving the market are outlined, with a focus on policy impacting site network growth, compliance, and innovation.

To Get more information on Clinical Trial Investigative Site Network Market - Request Free Sample Report

Clinical Trial Investigative Site Network Market Dynamics

Drivers

-

Increasing clinical trial activity, rising demand for patient-centric trials, and growing pharmaceutical R&D investments.

The total number of registered clinical trials worldwide exceeded 450,000 in 2023, an indicator of a growing pipeline of drug development projects. The growth of precision medicine, especially in oncology, cardiology, and orphan diseases, has driven greater dependence on expert site networks to oversee intricate trials. Moreover, the emergence of decentralized clinical trials (DCTs) has improved patient access, lessening site visit burdens and enhancing retention rates. Integration of technology, including AI-based patient recruitment and electronic data capture (EDC) solutions, has also maximized trial operations. The urgency for quicker regulatory approvals and adaptive trial designs also hastens the requirement for well-established site networks. Additionally, collaborations between pharma companies and site management organizations (SMOs), like ICON Plc and Accellacare, facilitate smooth trial execution. The COVID-19 pandemic further underscored the significance of site networks in effectively carrying out large-scale, multi-site trials, accelerating market growth. With increased investments in clinical research and government programs encouraging trial diversity, the Clinical Trial Investigative Site Network Market is set to witness long-term growth.

Restraints

-

The high operational costs, stringent regulatory requirements, and investigator shortages.

Clinical trial complexity, particularly of Phase III trials that represent almost 50% of market share income, mounts financial pressures on site networks. Adherence to Good Clinical Practice (GCP) guidelines, FDA, and EMA regulations necessitates ongoing investment in infrastructure, training, and quality control, exacerbating cost pressures. Recruitment and retention issues also continue, with an estimated 30% of trials facing patient dropout, causing delays and additional costs. The lack of seasoned investigators continues to be a primary issue, with numerous clinical researchers transitioning to academic or private healthcare positions because of the rigorous nature of trial management. Data privacy laws such as HIPAA and GDPR also pose challenges for site networks dealing with patient data, necessitating strict compliance with cybersecurity standards. Limited diversity in clinical trials owing to geographic and demographic limitations further hinders the market's growth potential. In addition, the high initial investment in new site networks hinders entry into the market for new players, concentrating power in the hands of large organizations and restricting competitive leeway.

Opportunities

-

The expansion of decentralized trials, emerging markets, and AI-driven patient recruitment strategies.

The use of DCTs grew more than 30% over the last two years, as drug companies try to increase patient access and minimize site burdens. The adoption of wearable devices, remote monitoring, and eConsent solutions within studies further propels market opportunity. Developing markets, such as Asia-Pacific, Latin America, and the Middle East, offer new opportunities for site networks because trial costs are lower and patient populations are expanding. Firms such as IQVIA and Parexel are working diligently to enhance their site networks within these areas to leverage low-cost trial operations. The need for real-world evidence (RWE) studies and post-market surveillance trials also offers growth opportunities, especially in the management of chronic diseases. AI and big data are transforming site selection, maximizing recruitment efficiency, and improving patient matching, all with a substantial shortening of trial times. Also, public-private collaborations and government funding in greater amounts, including the NIH's Accelerating Medicines Partnership (AMP), are driving innovation in clinical trial site networks. These developments place the market for further growth, especially in patient-focused trial models and digitalization.

Challenges

-

The Clinical Trial Investigative Site Network Market faces key challenges, including patient recruitment barriers, trial complexity, and site sustainability concerns.

More than 80% of clinical trials are delayed, and recruitment is responsible for almost 50% of these delays. Identifying eligible patients continues to be challenging, particularly in rare disease trials where patient numbers are small. Trial complexity is on the rise, especially in oncology, where precision medicine and biomarker-led studies demand specialized site infrastructure and expertise. The move towards hybrid and virtual trials introduces logistical complexities, necessitating significant investment in digital technology and training. Moreover, site sustainability is a significant concern, as most independent investigative sites face erratic trial pipelines, resulting in financial instability. Small sites lack the means to adopt sophisticated technologies such as AI-based recruitment tools, placing them at a disadvantage relative to large site management organizations (SMOs). Changes in regulations and protocol amendments add to the complexity of trial execution, resulting in higher administrative burdens. Investigator burnout is another key challenge, with several seasoned professionals abandoning the profession due to the workload and regulatory stress. These challenges will need innovative patient recruitment, enhanced regulatory harmonization, and ongoing investment in site training and infrastructure to facilitate market sustainability.

Clinical Trial Investigative Site Network Market Segmentation Analysis

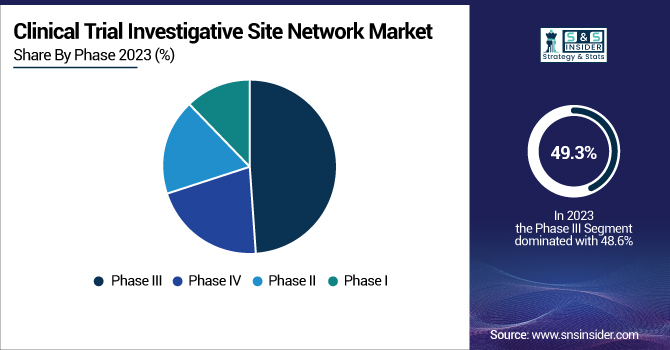

By Phase

The Phase III segment held the largest share in the market in 2023, representing 49.3% of the overall revenue share. This is mainly attributed to the widespread patient enrollment needed, increased trial expense, and regulatory complexity of Phase III trials, which necessitate well-established investigative site networks. Pharmaceutical and biopharmaceutical firms also give high priority to Phase III trials since they are essential to secure regulatory approval prior to commercial launch.

The Phase I segment is estimated to experience the most rapid expansion in the near future. It is fueled by the growing volume of early-phase drug discovery projects, increased first-in-human trials demand, and the development of precision medicine that necessitates a greater number of specialized investigative sites to carry out intricate trials.

By Therapeutic Areas

Oncology dominated the market in 2023 at 32.1% in terms of revenues, based on the high rate of current oncology trials, increasing funding into targeted treatments, and increased worldwide cancer prevalence. The greater oncology trial complexity with specialist site networks demanded by them has added to the supremacy. Biomarker-guided research and personalized medication strategies have further solidified the leadership position of oncology within the market.

The pain management market is likely to see tremendous growth over the coming years. The increase is due to the soaring prevalence of chronic pain disorders, a trend toward non-opioid pain therapeutics, and a broadening pipeline of innovative analgesics. The advancement in neuromodulation treatments and the increasing emphasis on alternative pain treatment measures are also fueling demand for expert research sites in this area.

By End Use

The pharmaceutical & biopharmaceutical companies sector led the market in 2023, capturing the biggest share. This is because these firms have high volumes of clinical trials, they spend heavily on R&D, and there is rising demand for trial outsourcing to reputable site networks in order to become efficient and adhere to regulatory guidelines. As drug development becomes more complex, pharmaceutical and biopharmaceutical organizations continue to depend on investigative site networks to recruit patients, manage trials, and ensure compliance with Good Clinical Practice (GCP) guidelines.

The segment of medical device companies is likely to witness significant growth during the following years. The increased need for clinical validation of new medical devices, heightened regulatory needs, and growing adoption of digital health technology are major drivers of this growth. Wearable device expansion, remote monitoring devices, and AI-based diagnostics further drive the increased demand for investigative site networks that specialize in medical device trials.

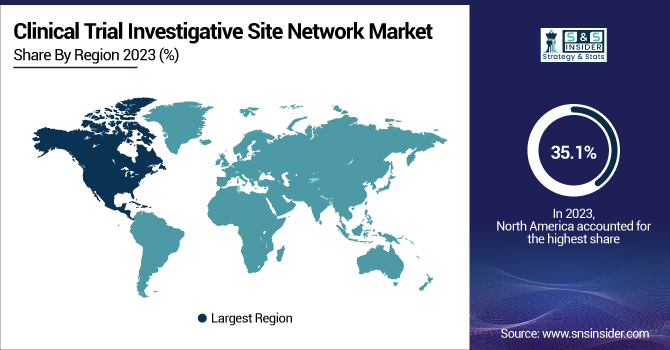

Clinical Trial Investigative Site Network Market Regional Insights

North America was the market leader in the worldwide clinical trial investigative site network market in 2023, contributing 35.1% to the overall revenue share. Leadership is attributed to a well-developed pharmaceutical and biopharmaceutical sector, a robust regulatory environment, and a high density of clinical research organizations (CROs) and investigative site networks. The availability of the world's leading pharmaceutical companies, sophisticated healthcare facilities, and proximity to a vast patient pool make the market in the region strong. The U.S. Food and Drug Administration (FDA) also facilitates clinical trials by offering streamlined approval procedures and regulatory incentives, further accelerating site network growth.

The Asia-Pacific region is likely to experience the most rapid growth in the forecast years. This growth is driven by growing clinical trial outsourcing, declining operational expenses, and a fast-growing patient population. Nations such as China, India, and South Korea are emerging as primary locations for clinical research as a result of encouraging regulatory changes, growing healthcare investments, and advancements in digital health technologies. The region is also seeing higher adoption of decentralized clinical trials (DCTs), which increase patient accessibility and site efficiency. With the global pharmaceutical industry seeking to diversify trial locations and enhance recruitment timescales, the role of Asia-Pacific in the market is likely to grow immensely.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Clinical Trial Investigative Site Network Market

-

ICON Plc: Accellacare Site Network

-

Velocity Clinical Research: Clinical research site services

-

IQVIA Inc.: One Home clinical trial technology platform

-

Elligo Health Research: Goes Direct approach

-

WCG Clinical: Clinical services and solutions

-

ClinChoice: Clinical research services

-

Access Clinical Trials Inc.: Clinical trial site management

-

FOMAT Medical Research, Inc.: Clinical research site services

-

SGS Société Générale de Surveillance SA.: Biologics testing services

-

KV Clinical Research: Clinical trial site services

-

SMO-Pharmina: Site management organization services

-

Xylem Research LLP: Clinical research services

-

The Aurum Institute: Clinical research services

Recent Developments in the Clinical Trial Investigative Site Network Market

-

In Jan 2025, HOPE Therapeutics, Inc., a subsidiary of NRx Pharmaceuticals, Inc., announced its planned acquisition of Kadima Neuropsychiatry Institute in La Jolla, CA, as part of its previously announced Letter of Intent. Kadima will serve as the flagship clinic for HOPE’s upcoming international network of interventional psychiatry clinics, aimed at providing advanced treatments for depression, anxiety, and PTSD.

-

In Jan 2024, SSM Health and Circuit Clinical formed a strategic partnership to expand access to advanced oncology clinical trials across Illinois, Missouri, Oklahoma, and Wisconsin. This collaboration aims to accelerate patient participation in cutting-edge cancer research, particularly in underserved Midwest communities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.25 billion |

| Market Size by 2032 | USD 15.10 billion |

| CAGR | CAGR of 6.96% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Phase [Phase I, Phase II, Phase III, Phase IV] • By Therapeutic Areas [Oncology, Cardiology, CNS Conditions, Pain Management, Endocrine, Others] • By End Use [Pharmaceutical & Biopharmaceutical Companies, Medical Device Companies, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ICON Plc, Velocity Clinical Research, IQVIA Inc., Elligo Health Research, WCG Clinical, ClinChoice, Access Clinical Trials Inc., FOMAT Medical Research, Inc., SGS Société Générale de Surveillance SA, KV Clinical Research, SMO-Pharmina, Xylem Research LLP, The Aurum Institute. |