Medical Device Coating Market Report Scope & Overview:

Get E-PDF Sample Report on Medical Device Coating Market - Request Sample Report

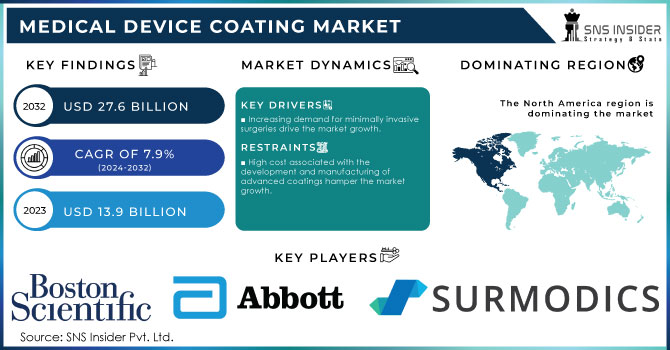

The Medical Device Coating Market Size was valued at USD 13.9 Billion in 2023 and is expected to reach USD 27.6 Billion by 2032 and grow at a CAGR of 7.9% over the forecast period 2024-2032.

The demand for medical device coatings has increased due to the rising prevalence of chronic diseases and the rising aging population. Additionally, advancements in medical technology have led to the development of innovative medical devices that require specialized coatings to ensure optimal functionality.

Demand for minimally invasive procedures is one of the key growth drivers for Medical Device Coating Market as such procedures require advanced coatings that improves device performance. Hydrophilic, anti-thrombogenic, and antimicrobial coatings for devices used during minimally invasive surgeries example laparoscopic, endoscopic or robotic-assisted surgeries to increase maneuverability while reducing friction and risk of infection Staple care, also appears to a be common concern since CDC reports that minimally invasive procedures have increasing demand for ease of operation and reduced postoperative complications.

As of 2021, Europe has imposed strict regulatory standards through the Medical Devices Regulation (MDR) developed by European Union that requires coatings protecting, specifically for use with medical devices to be biocompatible and long-lasting. Similar kinds of regulatory changes and growing usage of coated device in minimally invasive surgeries in turn fuel medical device coating market.

In 2022, DSM introduced a new hydrophilic coating designed for cardiovascular devices used in minimally invasive procedures. This coating improves lubricity, reduces friction during insertion, and enhances biocompatibility, which is crucial for devices like catheters and guidewires in cardiovascular interventions.

Rising medical device market in Asia-Pacific, increasing number of Medicare and Medicaid enrollees in the U.S., expanding geriatric population is expected to boost the demand for coated devices and revision surgeries owing to lifestyle diseases. Rising demand for quality, long-lasting medical devices with enhancing healthcare infrastructure and accelerated penetration of technologically advanced medical technology across China, India, Japan in the region are driving factors that contribute toward tracheostomy clinical trial market value.

For instance, in 2023, Biocoat launched its new HydroSleek PLUS coating, a next-generation hydrophilic coating designed to provide superior lubricity and durability for catheters and guidewires used in cardiovascular and urological procedures.

Market Dynamics

Drivers

-

Increasing demand for minimally invasive surgeries drive the market growth.

The growing preference for minimally invasive procedures has increased the demand for coated medical devices, as they offer improved biocompatibility and reduced risk of infection. Moreover, the rising incidence of chronic diseases, such as cardiovascular disorders and cancer, has propelled the demand for medical devices, thereby driving the growth of the coating market. The market is anticipated to experience significant growth owing to the increasing demand for medical devices, specifically implants, as well as robotic and minimally invasive surgical procedures. These advanced devices necessitate the utilization of high-performance and biocompatible specialty coatings to fulfill their clinical, engineering, and operational requirements, encompassing quality, cost, and delivery aspects.

In 2023, Advanced Polymer Coatings developed a new range of anti-corrosive and biocompatible coatings for use in orthopedic implants. These coatings are designed to increase the longevity and safety of implants, particularly in joint replacements, which are in high demand due to the rising incidence of osteoporosis and arthritis.

Growing demand in the market for minimally invasive surgeries is a primary growth prospect within the Medical Device Coating Market. Less invasive methods, such as laparoscopic and robotic-assisted surgeries and catheter-based interventions have gained popularity due to their ability to provide comparable efficacy of more traditional open surgeries but with less pain, quicker recovery times, and reduced risk of infection.

For example, in India, the National Health Mission has encouraged the use of such surgeries to enhance treatment outcomes and reduce hospitalization durations. Similarly, China's National Health Commission reported a sharp increase in the use of minimally invasive cardiovascular procedures, with a 20% rise in catheter-based treatments from 2018 to 2022.

Restrain

-

High cost associated with the development and manufacturing of advanced coatings hamper the market growth.

As compared to conventional coatings, the price of antimicrobial coatings is relatively higher. But there is a potential risk associated with these types of coatings. These risks include fluctuations in raw material prices, disruptions in supplier production, and capacity constraints. Factors such as increasing energy costs, supply disturbances, or the unavailability of specific raw materials can lead to significant damage to manufacturing capabilities or imbalances in the supply chain. Ultimately, these challenges can have a material adverse effect on a manufacturer's business and financial conditions, thereby restricting market growth.

Market segmentation

By Coating Type

The antimicrobial coatings dominated the coating type segment with a revenue share of about 33.5% in 2023. This is attributed to their competitive pricing and exceptional compatibility with a wide range of device materials, including composite materials, carbon fiber, metal, stainless steel, and plastic. Furthermore, this segment is poised for further growth due to the increasing research and development efforts and the increasing utilization of implantable devices. The prevalence of healthcare-associated infections (HAIs), such as pneumonia associated with ventilators and catheter-related urinary tract infections, has compelled medical device manufacturers to incorporate antimicrobial agents into their products.

By Product

Implamts held the largest the market with a share of 35.0% in 2023. Rise in the prevalence of chronic diseases such as cardiovascular diseases, diabetes and orthopedic conditions etc have largely fueled demand for advanced implants including joint replacements, dental implants and cardiovascular stents among others. Such appliances necesitate a performance layer which not solely ameliorates their biocompatibility, and the danger of disease however also amend reliability. For example, of course it seals the body fluid but also adds important coatings such as antimicrobial and hydrophilic which is very essential to make sure no further complications occur after surgery leading to a better patient outcome.

By Material

Metallic materials are currently leading in the material segment. It is because metallic materials have much better mechanical properties, are more durable and biocompatible. For example, metallic coatings are commonly used on stents, orthopedic implants and surgical instruments to increase strength properties and corrosion resistance. Those features are very important for any devices that needs to withstand the mechanical stresses of implantation and long-term use inside the human body.

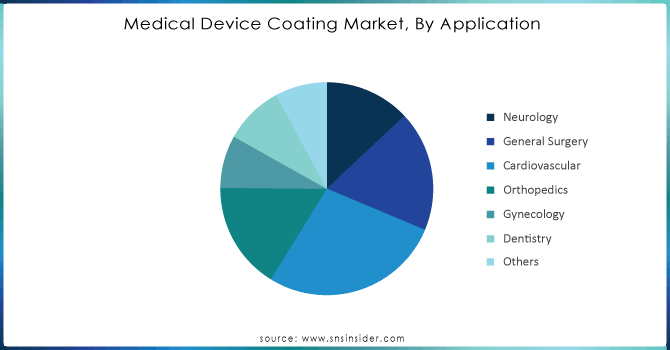

By Application

The cardiovascular application segment dominated the medical device coatings in 2023 with a revenue share of more than 27.5% of the overall revenue. This is owing to the surging popularity of cardiac pacemakers and implants, which have witnessed a significant rise in demand. Furthermore, the growth of this segment is fueled by the increasing need for drug-eluting coatings utilized in coronary stents. Several factors contribute to the flourishing cardiovascular application segment. Firstly, the expanding geriatric population, coupled with the prevalence of unhealthy dietary habits and sedentary lifestyles, has led to a surge in the occurrence of cardiovascular diseases (CVDs). This alarming trend necessitates the development and utilization of advanced medical device coatings to combat these diseases effectively.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Regional Analysis

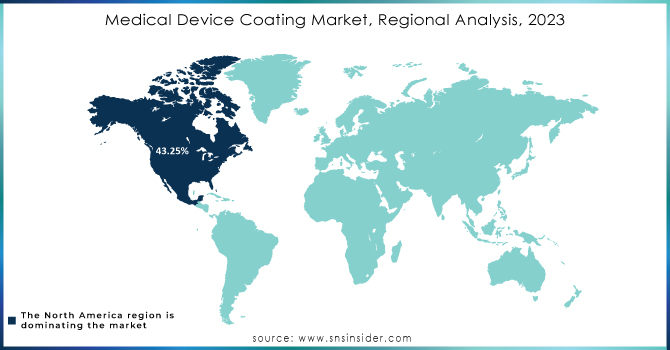

North America dominated the Medical Device Coating Market with the highest revenue share of about 43.25% in 2023. This growth is mainly attributed to its favorable healthcare resources and the rising incidence of cardiometabolic disorders, such as Deep Vein Thrombosis and Pulmonary Embolism. Additionally, the United States' growing healthcare infrastructure and high adoption rate of advanced surgical treatments are expected to drive product demand in the coming years. The region's dominance is further supported by the presence of various healthcare facilities, including diagnostic centers, and substantial investments in healthcare research and development. Several factors contribute to the market expansion in North America. The increasing use of medical devices, such as catheters, ventilators, and stents, in healthcare centers due to rising hospitalizations, advancements in medical technology, and the growing demand for home healthcare, plays a significant role. Furthermore, the growing export of medical devices and the rising prevalence of chronic diseases among the elderly population and infections have further fueled the use of these medical devices, contributing to the market's growth. North America stands out with the highest concentration of medical coating manufacturers compared to other regions. Some companies strategically collaborate with manufacturers, driving market growth. Strong partnerships between the US and Canadian medical device industries, facilitated by their similar quality standards, geographic proximity, and safety regulations, stimulate the growth of North America's medical coatings market.

Asia Pacific is expected to grow with a high CAGR of about 8.4% in the Medical Device Coating Market during the forecast period. This growth is attributed to the increasing demand for advanced healthcare facilities and the rising number of hospitals in the region. Furthermore, the growing elderly population and the increasing cases of obesity, which are associated with a higher risk of cardiac diseases, are expected to drive the demand for medical device coatings in the coming years. Additionally, the expanding home healthcare market and the ease of access to private health insurance will further contribute to the growth of the industry. Asia-Pacific faces the highest burden of elderly individuals with chronic conditions, leading to a rise in hospital admissions and the need for various medical devices such as diagnostic and surgical instruments, stents, and guidewires, among others. Non-communicable diseases, particularly cardiovascular diseases, diabetes, cancer, and chronic respiratory diseases, are responsible for a significant number of deaths in the region, particularly in the Western Pacific and Southeast Asia. Liver cancer, in particular, accounts for more than 75% of global cases in Asia, with Hong Kong and China alone contributing to 57% of new diagnoses. Moreover, major Asian countries also have a high prevalence of hepatitis B, which causes liver inflammation. The increasing prevalence of these diseases consequently leads to a rise in hospital admissions across the region, thereby driving the demand for medical devices.

Key Players

- Infinita Biotech Pvt. Ltd.

- Boston Scientific (Bard® Stent System, Antibacterial Coating Technologies)

- Abbott Laboratories (Xience® Drug-Eluting Stents, FreeStyle® Libre Sensor)

- SurModics Inc., (Hydrophilic Coatings, Drug-Eluting Balloon Technology)

- Biocoat Inc. (HydroSoft® Coating, HydroSleek® Coating)

- AdvanSource Biomaterials (Bioresorbable Coatings, Hydrophilic Coatings)

- DSM (Akulon® Coating, BioCare® Coating)

- Precision Coating Company, Inc. (PTFE Coatings, Hydrophilic Coatings)

- Harland Medical Systems (UltraCoat® Coating, Hydrophilic Coating Solutions)

- Advanced Polymer Coatings (Anti-Corrosive Coatings, Biocompatible Coatings)

- Axalta Coating Systems

- Specialty Coating Systems (Parylene Coatings, Biocompatible Coatings)

- Hydromer Inc. (Hydrophilic Coatings, Antimicrobial Coatings)

- Covalon Technologies Ltd. (IvaMed® Coating, MicrobeCare® Coating)

- Acelity L.P. Inc. (KCI® Wound Dressings, Advanced Dressings with Coatings)

- Medline Industries, Inc. (SilverCoat® Technology, Antimicrobial Coated Devices)

- Hernia Repair Products, Inc. (Surgical Mesh with Coatings, Biodegradable Mesh)

- Trelleborg Sealing Solutions (Medical Grade Seals with Coatings, Silicone Coatings)

- Materion Corp.

- Sono-Tek Corp

Recent Development:

-

In Oct 2023, Surmodics, Inc., a global leader in medical device coating technologies, announced the commercial launch of its most advanced hydrophilic medical device coating technology, Preside™ hydrophilic coatings.

-

In May 2023, Precision Coating announced the acquisition of Providence Texture, LLC in Smithfield, RI. This acquisition brings innovative surface technologies, a knowledgeable team, and the ability to integrate laser technology into Precision Coating's current portfolio of coatings and surface treatments, which includes ion implantation, anodic coatings, and fluoropolymer coatings.

-

In March 2022, DSM Biomedical and Svelte Medical Systems collaborated to develop DISCREET Bioresorbable Coating Technology for use with SLENDER IDS® and DIRECT RX® Bioresorbable Coated Drug-Eluting Stent (DES) Systems.

-

In July 2021, Sono-Tek Corporation, the leading developer and manufacturer of ultrasonic coating systems, announced the launch of a new program for the development of Roll-to-Roll coating equipment. This equipment is specifically designed for the high-volume manufacturing of proton-exchange membrane (PEM) fuel cells.

| Report Attributes | Details |

| Market Size in 2023 | US$ 13.9 Bn |

| Market Size by 2031 | US$ 27.6 Bn |

| CAGR | CAGR of 7.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Coating Type (Antimicrobial Coatings, Hydrophilic Coatings, Anti-thrombogenic Coatings, Drug-eluting Coatings, and Others) • By Product (Implants, Catheters, Electrosurgical Instruments, Stents, and Others) • By Material (Metallic and Non-metallic) • By Application (Neurology, General Surgery, Cardiovascular, Orthopedics, Gynecology, Dentistry, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | DSM, Infinita Biotech Pvt. Ltd., Sono-Tek Corp, Covalon Technologies Ltd., SurModics Inc., Materion Corp., Hydromer Inc., Specialty Coating Systems, Precision Coating Company Inc., Axalta Coating Systems |

| Key Drivers | • Increasing demand for minimally invasive surgeries drives the market growth. • Rising prevalence of chronic diseases |

| Market Restraints | • High cost associated with the development and manufacturing of advanced coatings hamper the market growth. |