Activated Bleaching Earth Market Size & Overview:

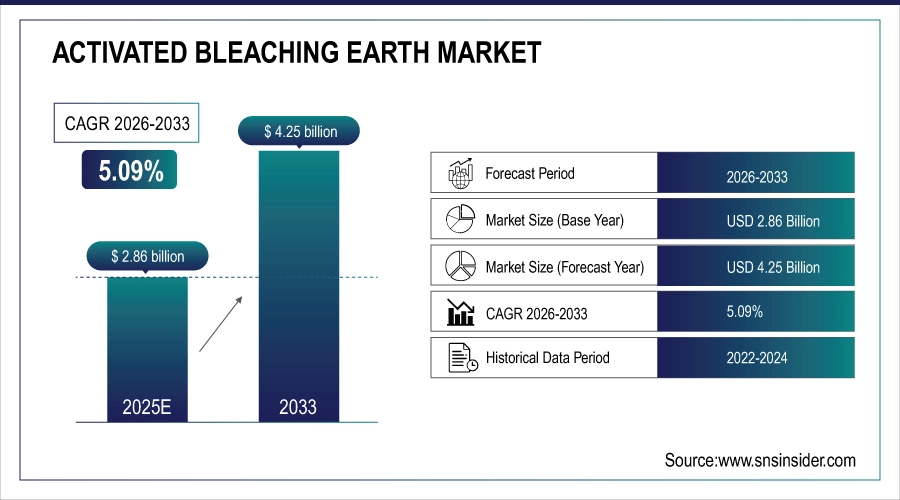

The Activated Bleaching Earth Market size was valued at USD 2.86 billion in 2025E and is expected to reach USD 4.25 billion by 2033, growing at a CAGR of 5.09% over the forecast period of 2026-2033.

The activated bleaching earth market is changing shape owing to increasing sustainability goals and growing demand for refined edible oil. Acid-activated bleaching earths are the most popular as they feature the highest degree of adsorption and help developments, such as Clariant’s TONSIL grades, and decrease 3-MCPD content. Improved dosing efficiency and digital process control are optimizing operations, as the activated bleaching earth companies branch out to cosmetics and wastewater treatment, driving the activated bleaching earth market growth and activated bleaching earth market share.

Activated Bleaching Earth Market Size and Forecast

-

Market Size in 2025E: USD 2.86 Billion

-

Market Size by 2033: USD 4.25 Billion

-

CAGR: 5.09% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Activated Bleaching Earth Market - Request Free Sample Report

Activated Bleaching Earth Market Trends

-

Rising demand for edible oil refining and purification is driving the activated bleaching earth market.

-

Increasing use in vegetable oil, animal fat, and biodiesel processing is boosting market growth.

-

Advancements in high-adsorption and eco-friendly bleaching earth products are enhancing efficiency and sustainability.

-

Growing focus on food safety, quality standards, and regulatory compliance is shaping adoption trends.

-

Expansion of industrial applications in chemicals, pharmaceuticals, and wastewater treatment is widening market scope.

-

Development of low-cost and high-performance bleaching materials is improving operational efficiency.

-

Collaborations between manufacturers, refiners, and research institutions are accelerating innovation and product optimization.

Activated Bleaching Earth Market Growth Drivers:

-

Rising Biofuel Production Escalates Demand for High-efficiency Activated Bleaching Earth Adsorption Solutions

The production of the U.S. biodiesel industry increased to about 2.8 billion gallons in 2024, creating an increased demand for effective desulfurization and decolorization adsorbents for use in the processing of vegetable oils. High-grade bleaching earth offers a particularly powerful response to exacting fuel-quality standards in several major refineries, in which 20% yield improvements have been recorded after the transition to high-grade bleaching earth. These operational improvements are spurring activated bleaching earth companies to enhance capacity and are consistent with prevailing trends in the activated bleaching earth market for low-impurity biofuels. Consequently, the market for bleaching clay is expected to gain a larger proportion of the renewable-fuels purifying activities, the U.S. Energy Information Administration reported.

-

Expanding Cosmetic Formulation Applications Drive Diversification of Activated Bleaching Earth Portfolios

Cosmetics brands are continuing to use bleaching earth as a natural clarifier and colour stabilizer in their creams, lotions, and lipids, mirroring a 12% increase in clay-based ingredient launches in 2024. Bleaching clays have now been added to the EU’s COSIng database, under “adsorbents and absorbents” for cosmetic use, opening up new potentialities for the expanding activated bleaching earth market outside edible oils. Such diversification forces activated bleaching earth companies to develop the fine-grade and acid-treated products that strictly comply with the cosmetic safety thresholds, and also encourages activated bleaching earth market trends towards the application of multifunctional water-based ingredients, underpinning activated bleaching earth market size for personal-care applications extensively.

Activated Bleaching Earth Market Restraints:

-

Emerging Alternative Adsorbents, Such as Silica Gel, Hinder Market Penetration of Bleaching Earth

The current regulatory and technical literature, including EPA’s TSCA assessments, acknowledges silica gel, activated alumina, and activated carbon as proven adsorbents for impurities in oils and solvents. Its regenerability and uniform pore structure, and reduced disposal costs, explain 5% year-on-year growth in industrial use since 2023. Such competition has compelled activated bleaching earth producers to focus on high purity, small particle size and acid activation in an attempt to retain/secure share of the activated bleaching earth market, thus restraining the growth potential of the bleaching earth market to benefit from a consistent process requirement across varying end-uses.

Activated Bleaching Earth Market Segment Analysis

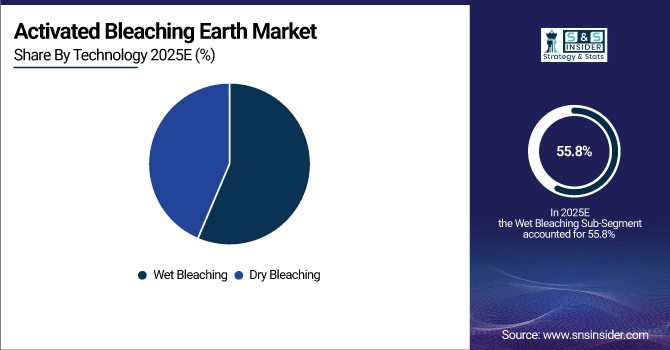

By Technology, Wet bleaching dominates; dry bleaching grows fastest due to sustainability and cost efficiency.

The wet bleaching segment dominated and is expected to increase the demand for the activated bleaching earth market as it accounts for the largest market share in 2025, with 55.8%. It is the most efficient method of filtering color bodies, sediments, and heavy metals out of oils. This technology is widely used in edible oils and fats refining, where much of the market exists. According to the U.S. Food & Drug Administration, wet bleaching can meet strict requirements for food safety, and therefore, constantly gains new users in the food processing industry, in particular. Moreover, the wet bleaching processes are preferred for large-scale production based on good quality, which is another reason for their preference.

The dry bleaching is expected to occur as the rapidly growing segment in the activated bleaching earth market, with a CAGR is around 5.67% for the period of 2026-2033. This expansion is a result of its environmental performance since it consumes less water than wet bleaching, which is in line with worldwide sustainability objectives. This approach has the added benefit of lower operating costs, as the U.S. refiners show by cutting down on their wastewater treatment costs. The current trend in the oil refining industry is toward dry bleaching because of growing concerns over cost, energy, and environmental issues.

By Application, Edible oils and fats lead; mineral oils and lubricants grow fastest globally.

In 2025, the edible oils and fats segment was the largest consumer of activated bleaching earth, holding 66.5% of the share. This section is largely dominated by the demand for processed of vegetable oils to meet the quality and safety needs of consumers. Activated bleaching earth is vital for the purification of edible oils by removing the undesired color, odor, and free fatty acid components. The U.S. Food and Drug Administration supports the application of activated bleaching earth in food production, reaffirming its position.

The mineral oils and lubricants are the largest growing segment in the global activated bleaching earth market, at a CAGR of 6.11% during 2026-2033. The demand for cleaner and better-performing railway lubricants for industrial applications is increasing. As there is growing demand for cleaner lubricants to enhance machinery efficiency and prolonged operation, the application of activated bleaching earth in the refinement of these oil products is more and more essential. This tendency is encouraged by advocacy organizations, such as the American Petroleum Institute instructs on the benefits of using more highly hydroprocessed lubricants.

By End-Use Industry, Food & beverages dominate; cosmetics and personal care show highest growth rate.

Food and beverages sector continues to stand as the leading end-use industry for the Activated Bleaching Earth, with 62.1% of the market share in 2025. Clean, safe and quality edible oils are in demand, and this growing demand continues to drive this sector. Activated bleaching earth is essential to the purification of edible, mineral, and waste oil including the removal of contaminants thereby maintaining the appearance, taste, and shelf life of the processed oil, particularly in the refining of vegetable and animal fats. Governmentally approval, such as FDA guidelines reinforce the trustability on bleaching clays in food applications to meet food safety levels.

Cosmetics and Personal Care Industry is the fastest growing end-use industry segment growing with a CAGR of 6.63% over forecast period of 2026-2033. Activated bleaching earth is now being used to purify and refine oils found in beauty products including lotions, skincare, and soaps. Increasing consumer inclination toward natural and eco-friendly personal care products has led manufacturers to introduce activated bleaching earth for enhanced product quality. The trend is in line with broader market shift toward sustainable beauty products as more consumers become aware of the environment and regulations become more stringent.

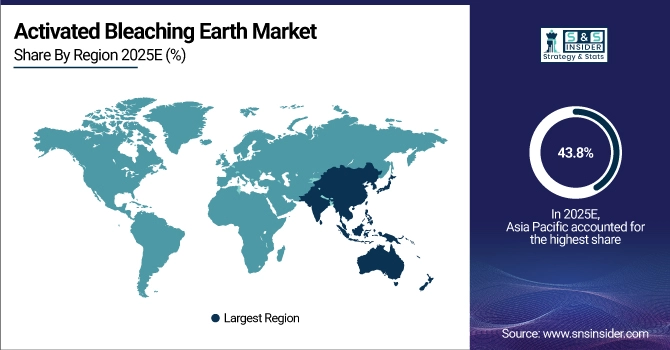

Activated Bleaching Earth Market Regional Analysis

Asia Pacific Activated Bleaching Earth Market Insights

Asia Pacific holds the largest market with a market share of 43.8%, driven by the growing edible-oil and biodiesel industry in China. Guidelines for edible-oil quality (2025) of the Ministry of Agriculture in China forced the bleachers to apply acid-activated bleaching earth by which 25% more colour removal was obtained. In India, demand from major palm-oil refiners is supported by FSSAI approvals for certified bleaching clay. This, along with growing urbanization and consumer preference towards processed edible oil, makes APAC the crux of the worldwide bleaching earth market.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Activated Bleaching Earth Market Insights

North America is the fastest growing region in the market for activated bleaching earth government in with the highest CAGR of 6.49% during the forecast period of 2026-2033. The increase is supported by the challenging sustainability standards and the consolidation of biodiesel and edible-oil refining capacities. The U.S. leads the North America activated bleaching earth market with a market value of USD 299.18 million with a market share of about 65% in 2024. Grants by the U.S. Environmental Protection Agency under the renewable fuel standard, for which refiners are using acid-activated bleaching earth to process low-impurity oil, have slashed wastewater 18% year-on-year. In addition, agreements between activated bleaching earth producers and the U.S. Department of Agriculture have facilitated the growth of the organic-certifiable bleaching clay grades and have underscored the leadership of North America in creative bleaching clay applications.

Europe Activated Bleaching Earth Market Insights

High regulatory standards in Europe under REACH and the European Green Deal are driving strong demand for acid-activated bleaching earth in the food, cosmetics, and biofuel markets. The German Federal Office of Consumer Protection enforces stringent color and impurity specifications for its edible oils, which leads top bleaching earth suppliers to provide extra-fine grades. Low-waste bleaching earth regeneration is additionally supported through Horizon Europe funding from the European Union, which in turn strengthens Europe’s position in a 20.3% share of the global bleaching clay market and the sustainable purification technology industry.

Middle East & Africa and Latin America Activated Bleaching Earth Market Insights

Growth in the activated bleaching earth market in LAMEA is supported by biofuel policies and refineries transformation in Latin America, the Middle East, and Africa. In Brazil, 12% spike in biodiesel production in 2023 means that high performance bleaching earth is required to conform to EN 14214 which high viscosity, while in Mexico, the energy reform is pushing producers there to buy bleaching clay from companies that moved to upgrade processes, and thus reduce contaminant load by 30%. Acid-activated bleaching earth. The modernization requirements of Vision 2030 of the Kingdom of Saudi Arabia led to the implementation of acid-activated bleaching earth for color reduction and free fatty acid (FFA) removal. The South African Department of Agriculture has reported a 10% increase in refining capacities, alluding to their collaborations with Bleaching Earth companies.

Activated Bleaching Earth Market Competitive Landscape:

Clariant

Clariant, founded in 1995 and headquartered in Switzerland, is a global specialty chemicals company focused on sustainable solutions for industries such as agriculture, textiles, coatings, and oil refining. The company develops innovative chemical products that enhance performance, efficiency, and environmental compliance. With a strong emphasis on research and regional production capabilities, Clariant continues to expand its global footprint, providing tailored solutions to meet local market demands and supporting industrial growth across diverse sectors.

-

2017: Clariant opened a new bleaching earth production site in Gresik, Indonesia, expanding its Tonsil® bleaching earth capacity by ~35% to serve Asia-Pacific customers faster.

-

2016: Clariant expanded bleaching earth (Tonsil) production capacity in Mexico by 30% at its Puebla site to better support edible oil refining in North & South America.

Key Players:

The major activated bleaching earth market competitors include

-

Taiko Group of Companies

-

Oil-Dri Corporation of America

-

Ashapura Perfoclay Limited (APL)

-

BASF SE

-

EP Minerals / EP Engineered Clays Corporation

-

Musim Mas Holdings Pte. Ltd.

-

The W Clay Industries Sdn. Bhd.

-

20 Microns Limited

-

Terram Chemical

-

Shri Paras Enterprises

-

Mangalam Earth

-

Global Active Clay LLP

-

Benton Bleach-Chem India Pvt Ltd

-

Krishna Antioxidants Pvt. Ltd.

-

Lakshmiwadi Mines & Minerals (P) Ltd.

-

Nav Bharati Chemicals Pvt Ltd

-

Premier Bentclay Industries Pvt Ltd

-

Sunny Earth Minerals Pvt Ltd

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.86 Billion |

| Market Size by 2033 | USD 4.25 Billion |

| CAGR | CAGR of 5.09% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Technology (Dry Bleaching, Wet Bleaching) •By Application (Edible Oils & Fats, Mineral Oils & Lubricants, Others) •By End-use Industry (Food & Beverages, Cosmetics & Personal Care, Chemicals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles |

Clariant, Taiko Group of Companies, Oil-Dri Corporation of America, Ashapura Perfoclay Limited (APL), BASF SE, EP Minerals / EP Engineered Clays Corporation, Musim Mas Holdings Pte. Ltd., The W Clay Industries Sdn. Bhd., Refoil Earth Pvt. Ltd., 20 Microns Limited, Terram Chemical, Shri Paras Enterprises, Mangalam Earth, Global Active Clay LLP, Benton Bleach-Chem India Pvt Ltd, Krishna Antioxidants Pvt. Ltd., Lakshmiwadi Mines & Minerals (P) Ltd., Nav Bharati Chemicals Pvt Ltd, Premier Bentclay Industries Pvt Ltd, Sunny Earth Minerals Pvt Ltd |