Natural Dyes Market Report Scope & Overview:

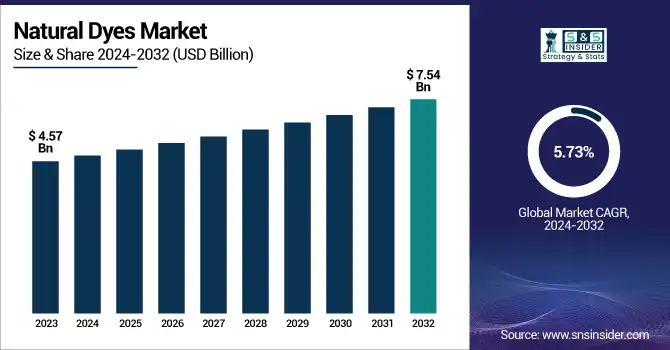

The Natural Dyes Market Size was valued at USD 4.57 Billion in 2023 and is expected to reach USD 7.54 Billion by 2032, growing at a CAGR of 5.73% over the forecast period of 2024-2032.

To Get more information on Natural Dyes Market - Request Free Sample Report

The natural dyes market is blooming with demand for eco-conscious alternatives across textiles, food, and cosmetics. As sustainability becomes a core focus, colorfastness and application performance data emerge as essential tools for evaluating dye longevity and suitability across materials, our report provides detailed insights on this. Regulatory clarity is equally vital, and the report explores the labeling standards and certifications landscape, covering GOTS, ECOCERT, and more. Governments worldwide are supporting this shift through incentives and subsidy programs, which our study outlines regionally, highlighting funding and policy support. To ensure consistency and safety, quality control and testing parameters are also examined, offering a comprehensive look into how producers maintain high standards while embracing nature-based formulations.

The US Natural Dyes Market Size was valued at USD 1.14 Billion in 2023 and is expected to reach USD 1.79 Billion by 2032, growing at a CAGR of 5.12% over the forecast period of 2024-2032.

The US natural dyes market is experiencing steady growth driven by increasing consumer preference for sustainable and non-toxic products across textiles, food, and cosmetics. Rising awareness about the environmental hazards of synthetic dyes has encouraged brands to adopt plant-based alternatives. Initiatives by organizations such as the USDA promoting organic certification, and the support from sustainability-focused associations like the Textile Exchange, are accelerating adoption. U.S.-based companies like Stony Creek Colors are leading innovation by partnering with farmers to grow indigo sustainably for denim production, while others are developing bio-based pigments for food and personal care. This movement aligns with national efforts to reduce chemical pollution and promote regenerative agriculture.

Natural Dyes Market Dynamics

Drivers

-

Expansion of Botanical Extraction Technologies Enhances the Efficiency and Quality of Natural Dye Production Processes Globally

Botanical extraction technologies have evolved significantly, bringing new levels of efficiency, yield, and pigment quality to the natural dyes market. Traditional dye extraction methods often labor-intensive and inconsistent are being replaced with advanced techniques such as supercritical CO₂ extraction, ultrasonic-assisted extraction, and microwave-assisted extraction. These technologies ensure better preservation of bioactive compounds, improve dye solubility, and reduce water and energy consumption, making the process more commercially viable and environmentally friendly. Companies in the United States, including research arms of institutions like the USDA Agricultural Research Service, have contributed to optimizing these technologies for scale. Improved extraction not only reduces costs but also opens the door to wider application of natural dyes in industries like cosmetics, pharmaceuticals, and food processing where purity and consistency are paramount. Additionally, enhanced botanical extraction supports the use of underutilized plant resources and agricultural waste, thus supporting circular economy goals. These modern methods also allow customization of dye intensity and shade variation, which previously limited the broader use of natural dyes. Brands focused on clean-label and green product lines are increasingly turning toward suppliers with these enhanced capabilities. As the demand for traceable and high-performance natural colors grows, companies leveraging modern extraction stand to gain a significant edge. The ability to scale production without compromising eco-credentials makes botanical extraction a cornerstone for the commercial growth of the natural dyes market in both domestic and global arenas.

Restraints

-

High Cost of Production and Limited Shelf Life Continue to Restrict Wider Commercialization of Natural Dyes Across Industries

Despite rising awareness and demand, the natural dyes market faces a significant restraint in the form of high production costs and limited product shelf life. Natural dyes require more intensive processing, labor, and raw material input than synthetic dyes, contributing to higher unit costs. Additionally, natural dyes often lack the long shelf stability of their synthetic counterparts, especially when in liquid form or in formulations lacking preservatives. This can deter manufacturers and retailers who depend on extended storage and transport durations for global distribution. The inconsistency in natural dye supply caused by seasonal crop availability, weather dependence, and regional sourcing further complicates production planning and inventory management. Moreover, color yield can vary depending on batch and source material, leading to reproducibility challenges in large-scale applications. While niche brands can accommodate such variability, mass-market players may hesitate to switch from established synthetic systems. Even with advances in encapsulation and stabilization technologies, ensuring long-term shelf life without synthetic additives remains a hurdle. This cost-performance disparity limits the competitiveness of natural dyes in price-sensitive sectors such as fast fashion, mass cosmetics, or conventional printing inks. As a result, until more scalable and economically viable solutions are developed, these constraints are expected to limit the full-scale adoption of natural dyes across high-volume applications.

Opportunities

-

Rising Investments in Biobased Alternatives Open New Application Segments for Natural Dyes in Packaging and Bioplastics

As the global shift toward sustainable materials intensifies, natural dyes are finding promising new applications beyond traditional sectors. One of the most significant opportunities lies in their integration into biobased packaging materials and bioplastics. These innovations are being explored for use in eco-friendly food packaging, biodegradable containers, and compostable consumer goods. With growing bans on single-use plastics in the United States and abroad, manufacturers are turning to plant-derived colorants to align product aesthetics with environmental performance. Organizations such as the U.S. Bioplastics Council and Sustainable Packaging Coalition are promoting the use of fully renewable, biodegradable materials—providing an opening for natural dye manufacturers to supply colorants compatible with these substrates. Natural dyes not only enhance the visual appeal of packaging but also improve branding for companies marketing eco-conscious credentials. Their low toxicity and compatibility with cellulose-based and starch-based polymers further reinforce their utility. As circular economy initiatives gain momentum, the demand for fully sustainable packaging solutions is expected to rise, creating substantial commercial opportunity for natural dye producers who can tailor their offerings to this emerging domain.

Challenge

-

Seasonal Availability of Raw Materials and Agricultural Risks Lead to Supply Inconsistencies in the Natural Dyes Market

One of the most persistent challenges in the natural dyes market is the seasonal and agricultural dependency of raw materials. Natural dyes are primarily derived from plants, insects, and minerals, many of which are highly sensitive to climate, soil conditions, and pest infestations. A poor monsoon season or extreme weather event can severely impact the yield and quality of key dye crops like indigo, turmeric, and madder. This vulnerability introduces unpredictability in the supply chain, making it difficult for manufacturers to ensure year-round consistency in production. Furthermore, most cultivation takes place in fragmented and small-scale farming systems, which are less equipped to implement modern agricultural practices or climate resilience strategies. These variables increase lead times, force price fluctuations, and reduce scalability, especially for companies aiming to serve global markets. The lack of robust supply chain infrastructure in rural sourcing areas further compounds the issue. Addressing these risks requires coordinated investment in climate-resilient agriculture, farmer training, and regional warehousing solutions to buffer seasonal disruptions. Until these solutions are widely implemented, supply volatility will remain a major challenge in scaling the natural dyes market reliably.

Natural Dyes Market Segmental Analysis

By Type

Plant-based natural dyes dominated the Natural Dyes Market in 2023 with a market share of 63.4%, led primarily by Henna and Indigo subsegments. The dominance of plant-based dyes can be attributed to their wide availability, sustainability, and long historical use across various cultures and industries. Among subsegments, Henna and Indigo are the most widely used due to their vibrant color profiles, safety, and cultural significance. Henna, derived from the Lawsonia inermis plant, remains a staple in the cosmetic and textile sectors, particularly in South Asia and the Middle East. Indigo, on the other hand, plays a major role in the dyeing of denim textiles globally. Supportive policies promoting natural ingredients in cosmetics and food from bodies like the U.S. Food and Drug Administration (FDA) and European Chemicals Agency (ECHA) have encouraged manufacturers to shift from synthetic to plant-based options. Furthermore, sustainability guidelines from the United Nations Environment Programme (UNEP) and government programs supporting organic farming have elevated the status of plant-based dyes over their animal and mineral counterparts, especially in clean-label product development and natural fashion trends.

By Form

Powder form dominated the Natural Dyes Market in 2023 with a market share of 71.2%, due to better shelf life, ease of transportation, and storage benefits. Powder dyes are more stable than liquid forms and offer extended usability without the need for preservatives, making them ideal for export and industrial-scale applications. Industries such as food processing, cosmetics, and textiles prefer powdered forms for their precise measurability, controlled solubility, and better integration in manufacturing pipelines. For example, powdered turmeric dye is extensively used in traditional Indian snacks and sauces, while powdered indigo finds widespread application in denim production across global textile hubs. The U.S. Department of Agriculture (USDA) has highlighted the growth of organic and natural powdered food colorants in its reports on natural additives. Moreover, the rising use of powdered dyes in eco-conscious packaging and sustainable art supplies contributes further to this dominance, as companies continue to prioritize eco-friendly and waste-reducing formats. Liquid forms, while gaining ground in certain personal care applications, are hindered by stability concerns and refrigeration requirements.

By Application

Dyeing and coloring applications dominated the Natural Dyes Market in 2023, holding a market share of 52.6%, owing to high demand from the textile and food sectors. The increasing consumer preference for eco-friendly clothing and clean-label food items has led to a surge in demand for natural dyes in coloring applications. In textiles, natural dyes are increasingly used to produce non-toxic, biodegradable fabrics, especially in sustainable fashion brands and artisanal textile manufacturing. For instance, organizations like the Global Organic Textile Standard (GOTS) advocate for natural dye use in certified eco-textile production. In the food industry, plant-based dyes such as annatto and turmeric are preferred for coloring dairy, snacks, and beverages, aligning with regulatory frameworks from authorities like the European Food Safety Authority (EFSA) and U.S. FDA. Furthermore, coloring applications are expanding into biodegradable packaging and decorative art materials, driven by growing environmental awareness and the move away from petroleum-based synthetics. The compatibility of natural dyes with multiple substrates and their non-toxic nature further solidify their widespread use in this application category.

By End-use Industry

Food and Beverage industry dominated the Natural Dyes Market in 2023 with a market share of 35.2%, due to the surge in demand for clean-label and organic products. Consumers increasingly favor natural over synthetic food additives due to perceived health benefits, driving manufacturers to replace artificial dyes with plant-based alternatives like beetroot red, annatto, and turmeric. Major food companies such as Nestlé, Danone, and General Mills have committed to phasing out artificial dyes, opting instead for natural colorants that align with health-focused branding and regulatory compliance. The U.S. FDA and EFSA regulations encourage the use of safe, plant-derived colorants, boosting demand in this sector. Additionally, rising health awareness in emerging economies has accelerated the inclusion of natural dyes in beverages, confectionery, and bakery products. In beverages, for instance, natural spirulina extract is used for vibrant blue coloring without synthetic chemicals. The growing vegan and organic food trends further reinforce the food and beverage sector's dominance, as natural dyes fulfill consumer expectations for transparency and sustainability in ingredient sourcing.

Natural Dyes Market Regional Outlook

North America dominated the Natural Dyes Market in 2023 with a market share of 34.6%, primarily led by the United States due to strong regulatory support, consumer awareness, and innovations in natural product formulations. The region’s dominance stems from the increasing adoption of clean-label products and organic food and textiles, which are major drivers for natural dye usage. The U.S. Food and Drug Administration has issued numerous guidelines encouraging food producers to reduce synthetic additives, promoting the integration of plant-based dyes such as annatto, turmeric, and beetroot into processed foods. In textiles, the growth of sustainable fashion brands like Patagonia and Eileen Fisher, which prioritize natural dyes, adds to the demand. Canada, another key player in this region, has supported natural dye adoption through government grants and research on sustainable agriculture. Moreover, U.S.-based research institutions and universities are actively involved in the development of scalable extraction methods for plant-based dyes, further encouraging industrial uptake. The North American consumer base is also more environmentally conscious, prompting industries to switch from synthetic to biodegradable alternatives in textiles, cosmetics, and packaging applications.

Moreover, Asia Pacific is projected to be the fastest-growing region in the Natural Dyes Market during the forecast period, with a highest CAGR, driven by abundant raw material availability, rising exports, and traditional usage. Countries such as India, China, and Indonesia dominate both the cultivation and export of natural dye-yielding plants like indigo, turmeric, and henna. India, in particular, has a long history of using plant-based dyes in textiles and cosmetics and has seen increasing international demand for its naturally dyed organic textiles. The government of India, under the Ministry of Textiles, has launched schemes to promote handloom and handicraft clusters that rely heavily on natural dyes. Additionally, the growing demand for clean-label cosmetics and food products in emerging economies like Vietnam and Thailand is boosting regional consumption. China's textile industry is gradually shifting toward sustainable alternatives, creating opportunities for domestic and imported natural dyes. The Asia Pacific region benefits from a cost-effective supply chain, skilled labor in natural dyeing techniques, and rising environmental regulations that discourage synthetic dye use, making it the most dynamic growth hub for the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Abbey Color (Cochineal, Carmine, Logwood)

-

AMA Herbal Laboratories (Herbal Henna, Natural Indigo, EcoGreen Dyes)

-

Aroma Natural Dyes (Madder, Pomegranate, Indigo)

-

Aura Herbal Textiles (Natural Indigo, Myrobalan, Harda Extract)

-

Biocolor (Annatto, Chlorophyll, Beta Carotene)

-

Biodye India (Indigo, Catechu, Madder)

-

Colorful World Dyes (Turmeric, Henna, Indigo)

-

Couleurs de Plantes (Weld, Madder, Woad)

-

Dharma Trading Co. (Logwood, Cochineal, Cutch)

-

Earthues (Madder, Fustic, Quebracho)

-

Green Matter Natural Dye Company (Indigo, Madder, Marigold)

-

Hennahub India (Henna Powder, Indigo Powder, Amla Powder)

-

Maiwa (Cochineal, Myrobalan, Lac)

-

Natural Dye Company (Indigo, Marigold, Pomegranate)

-

Pylam Products Company, Inc. (Logwood, Annatto, Brazilwood)

-

Renaissance Dyeing (Weld, Madder, Woad)

-

Sam Vegetable Colours (Henna, Indigo, Annatto)

-

Stony Creek Colors (Bio-based Indigo, Liquid Indigo, Pre-reduced Indigo)

-

Sun Food Tech (Paprika, Annatto, Beetroot Red)

-

Wild Colours (Madder, Logwood, Onion Skin)

Recent Developments

-

January 2025: Walmart initiated efforts to source natural dyes from India as part of its broader sustainable supply chain strategy. The move aimed to reduce environmental impacts associated with synthetic dyes and strengthen ties with Indian suppliers, particularly those using plant-based materials. Walmart’s initiative aligned with its commitment to eco-conscious manufacturing and supported traditional Indian dyeing techniques that offer lower water and chemical usage.

-

May 2024: Filipino creatives participated in an art workshop to explore natural dyeing processes on local textiles. The event highlighted indigenous dye sources like indigo and turmeric while promoting sustainable artistry. Participants learned traditional and modern dyeing methods to reconnect with cultural heritage and support eco-friendly alternatives in art and fashion. The initiative fostered local innovation and elevated awareness about nature-based design practices.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.57 Billion |

| Market Size by 2032 | USD 7.54 Billion |

| CAGR | CAGR of 5.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Plant based [Henna, Indigo, Annatto, Turmeric, Spinach, Others], Animal based [Cochineal, Lac, Others], Mineral based [Ochre, Malachite, Others]) •By Form (Powder, Liquid) •By Application (Tanning, Dyeing & Coloring, Paints & Coatings, Printing Inks, Others) •By End-use Industry (Food & Beverage, Cosmetic & Personal Care, Pharmaceutical, Pulp & Paper, Packaging, Stationery & Art Supplies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Stony Creek Colors, AMA Herbal Laboratories, Couleurs de Plantes, Abbey Color, Biodye India, Green Matter Natural Dye Company, Earthues, Maiwa, Aura Herbal Textiles, Renaissance Dyeing and other key players |