Medical Implant Market Report Scope & Overview:

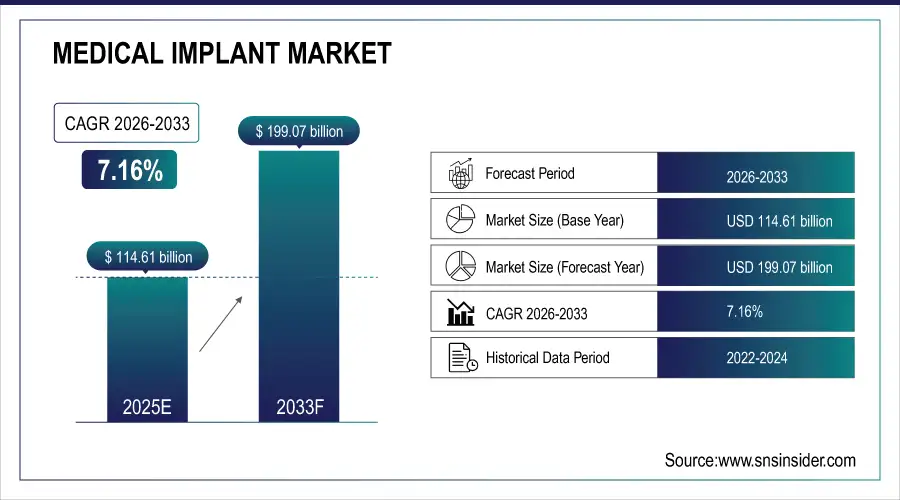

The Medical Implant Market Size is valued at USD 114.61 Billion in 2025E and is expected to reach USD 199.07 Billion by 2033 and grow at a CAGR of 7.16% over the forecast period 2026-2033.

The Medical Implant Market analysis, driven by Increasing incidence of chronic diseases coupled with increasing geriatric population in need of joint replacements, cardiovascular and dental implants. According to American Academy of Implant Dentistry (AAID), approximately 3 million people in the U.S. currently have dental implants, and this number is expected to grow by about 500,000 per year.

Market Size and Forecast:

-

Market Size in 2025: USD 114.61 Billion

-

Market Size by 2033: USD 199.07 Billion

-

CAGR: 7.16% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Medical Implant Market - Request Free Sample Report

Medical Implant Market Trends:

-

Smart implants gaining popularity due to real-time health monitoring and better recovery outcomes.

-

3D printing technology boosts customization of implants for enhanced patient compatibility.

-

Increasing implant demand driven by rising chronic conditions across aging populations worldwide.

-

Biocompatible material innovations improve durability, reduce complications, and enhance implant performance.

-

Minimally invasive surgeries rising as patients seek faster, safer implant procedures.

-

Growing healthcare investments in emerging countries expanding accessibility to advanced implants.

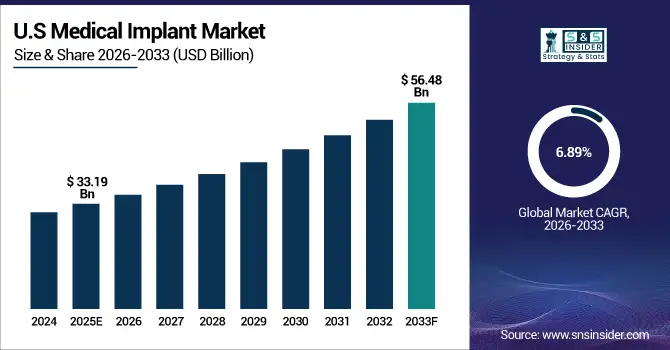

The U.S. Medical Implant Market size is USD 33.19 Billion in 2025E and is expected to reach USD 56.48 Billion by 2033, growing at a CAGR of 6.89% over the forecast period of 2026-2033, driving demand for orthopedic, cardiovascular, and neurological implants with continuous support from leading domestic manufacturers.

Medical Implant Market Growth Drivers:

-

Aging population and chronic diseases fuel rising demand for medical implants.

The rising prevalence of chronic diseases, such as osteoarthritis, cardiac problems and dental erosion coupled with the expanding geriatric population is boosting demand for medical implants. The older people get, the more prone they are to bone loss and joint complications that require orthopedic implants in order to maintain an active life such as hip or knee replacements. Now, with advancements in bloood vessel stenting, or applications such as heart pacemakers becoming more and more used to treat agerelated cardiac diseases.

Over 240 million people are currently affected by osteoarthritis, a major cause of joint replacement surgeries.

Medical Implant Market Restraints:

-

High treatment costs and limited insurance coverage slow implant adoption.

Despite medical advancements, the Implant cost and implant-related surgery costs are still expensive in medical treatment due to current complex biomaterials, strict regulations approval and hospital facilities fees. Most implants, particularly more advanced technologies such as smart implants and neuromodulation devices are not fully reimbursed by insurance in many areas. This hurdle of cost reduces patient access in low- and middle-income countries, but even in developed healthcare systems it may slow adoption. Price sensitivity and reimbursement issues still inhibit the market’s full potential.

Medical Implant Market Opportunities:

-

Smart and 3D-printed implants unlock innovative growth in healthcare technology.

The implementation of smart implants having embedded sensors and 3D-printed patient-specific implants are creating new market opportunities. Intelligent implants provide monitoring of healing and device functionality in real time, which leads to better recovery. In the meantime, additive manufacturing allows customized implants based on the patient's own anatomy which will result in decrease of operating time and less complications. These breakthroughs are well in line with precision medicine trends and their adoption by manufacturers is prompting significant investments whilst unlocking lucrative trajectories in fields as wide-ranging as orthopaedics, neurology or dental restoration.

More than 500 hospitals globally have already integrated additive manufacturing labs for patient-specific implant production.

Medical Implant Market Segmentation Analysis:

-

By Product Type: In 2025, Orthopedic led the market with a share of 36.22%, while Dental is the fastest-growing segment with a CAGR of 9.80%.

-

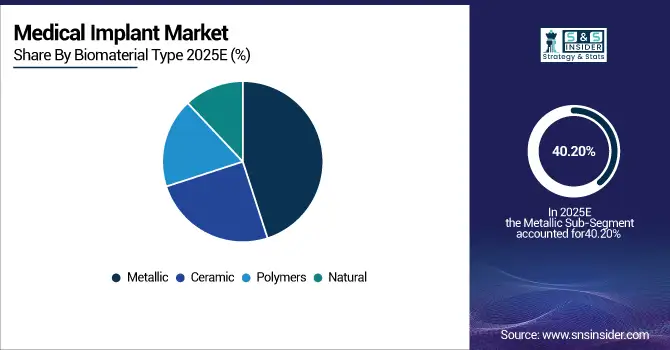

By Biomaterial Type: In 2025, Metallic held the highest market share of 40.20%, while Polymers is projected to grow at the fastest CAGR of 9.70%.

-

By Technology: In 2025, Conventional Implants accounted for share 70.50%, while Smart Sensor-Enabled Implants is expected to witness the highest CAGR of 8.34%.

-

By End User: In 2025, Hospitals dominated the market with a share of 45.54%, while Ambulatory Surgical Centres is anticipated to expand at the highest CAGR of 7.45%.

By Product Type, Orthopedic Lead Market and Dental Fastest Growth

The Orthopedic lead the market in 2025, driven by the increasing incidences of arthritis, sports injuries and age triggered bone degeneration are making hip, knee and spinal replacements more frequent as a reckoning to recover mobility endangered.

Meanwhile, dental implants are the fastest growing segment as worldwide awareness of oral health increases and tooth replacement options become more sophisticated and aesthetic. Increasing preference for minimally invasive dental procedures, rising cosmetic dentistry demand and high acceptance of titanium and zirconia implants drive the dental segment.

By Biomaterial Type, Metallic Leads Market and Polymers Fastest Growth

The Metallic lead the market in 2025, due to good strength, stability, and biocompatibility for orthopedic implants, dental implants and cardiovascular applications. Materials such as titanium and stainless steel are characterized by very high load carrying capability and long-term survival in vivo.

Meanwhile, the implants using polymers is the fastest growing segment, with rapid development in lightweight materials such as flexible and low-cost PEEK (polyether ether ketone) with bioresorbable which are emerging polymers. Such materials offer improved tissue integration, lower post-surgery complications and minimally invasive devices that are quickly adopted within orthopedic fixation, drug-eluting stent and reconstructive applications.

By Technology, Conventional Implants Lead Market and Smart Sensor-Enabled Implants Fastest Growth

The Conventional Implants leads the market in 2025, driven by their validated clinical history, larger presence in the market and lower price, especially in orthopaedic and dental applications which generated large demand.

Meanwhile, smart sensor-based implants are the fastest growing segment, as they bring into play real-time monitoring, improving outcomes for patients after surgery by being able to monitor healing and performance of devices along with early signs something is going wrong. These sophisticated implants are aligned with the trend of precision medicine and personalized therapy worldwide, fueling high demand for it in neurology, orthopedics, cardiovascular treatment and investment for future medical digitalization.

By End User, Hospitals Leads Market and Ambulatory Surgical Centers Fastest Growth

The Hospitals leads the market in 2025, as most of the implants such as orthopedic joint replacement and cardiovascular device implantation procedure need advanced infrastructure, trained surgeons and intensive care which hospitals can provide.

Meanwhile, ambulatory surgical centers (ASCs) are the fastest-growing segment, fueled by their affordability, diminished patient scheduling delays and greater use of minimally invasive procedures for same-day discharge. Increasing patient desire for cost-effective, time-saving care sites continues to drive more implant procedures into ASCs and grow the segment of total market.

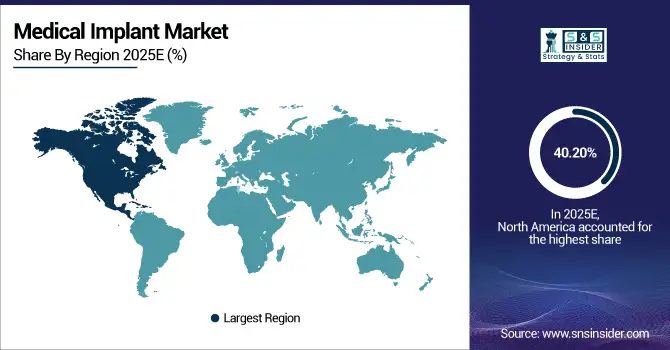

Medical Implant Market Regional Analysis:

North America Medical Implant Market Insights:

The North America dominated the Medical Implant Market in 2025E, with over 40.20% revenue share, driven by high adoption of advanced healthcare technologies, developed health care infrastructure, higher expenditure on health care and increase in population suffering from orthopedic, cardiovascular disease & dental diseases. The rapid adoption of cutting-edge solutions such as 3D-printed and smart sensor-added implants is facilitated by a mature clinical network and surgical workforce. Increasing inclination towards minimally invasive surgeries along with rising emphasis on patient mobility and quality of life will also stimulate product demand. The region is technologically far advanced due to ongoing investment in research and regulatory progress.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Medical Implant Market Insights

The U.S. and Canada lead the Medical Implant Market due to advanced healthcare infrastructure, strong reimbursement systems, high adoption of innovative implant technologies, rising chronic disease and aging populations, and the presence of major global implant manufacturers driving continuous product development and clinical advancements.

Asia Pacific Medical Implant Market Insights:

The Asia-Pacific region is expected to have the fastest-growing CAGR 8.56%, due to a booming geriatric population and increasing rates of orthopedic, dental and cardiovascular diseases. Rising investments in healthcare, better medical infrastructure, and increasing availability of advanced surgical techniques are promoting the uptake of implants. The area is also increasingly turning into a power-house for manufacturing, due to cost-effective manufacturing and availability of skilled manpower. Increasing realization of the potential of mobility restoration and government support to extend insurance coverage are other driving forces for growth, making Asia Pacific a lucrative opportunity for implant makers worldwide.

China and India Medical Implant Market Insights

China and India are rapidly growing in the Medical Implant Market driven by expanding healthcare access, large aging populations, rising chronic disease cases, increasing medical tourism, government investments in healthcare modernization, and greater awareness of advanced treatment options, fueling demand for affordable and innovative implant solutions.

Europe Medical Implant Market Insights

The Europe Medical Implant Market is well-established, due to developed healthcare systems in the region and high acceptance of advanced surgical technologies as well a significant number of leading implant products manufacturing companies. The area has a large elderly population and is growing in demand for joint replacements, dental implants and cardiovascular implants. The relentless pursuit of product innovation, fueled by the highest standards for quality in the industry, leads to lifesaving treatments that improve patient lives and outcomes. Increased demand for minimally invasive procedures as well as favorable reimbursement scenario are also expected to drive the implants market.

Germany and U.K. Medical Implant Market Insights

The U.K. and Germany are witnessing strong growth in the Medical Implant Market due to advanced healthcare infrastructure, high adoption of innovative implant technologies, robust reimbursement systems, strong presence of leading medical device manufacturers, and increasing orthopedic and cardiovascular procedures supported by aging populations and skilled medical professionals.

Latin America (LATAM) and Middle East & Africa (MEA) Medical Implant Market Insights

Latin America and the Middle East & Africa are witnessing steady expansion in the Medical Implant Market driven by increasing healthcare modernization, rising prevalence of orthopedic and cardiovascular disorders, and improving access to advanced surgical procedures. LATAM benefits from expanding private healthcare infrastructure and medical tourism, particularly in Brazil and Mexico. Meanwhile, MEA experiences growing demand due to investments in specialized hospitals and government initiatives for chronic disease management, especially in GCC nations. However, both regions face challenges like reimbursement limitations, cost-sensitive patient populations, and uneven availability of skilled surgical expertise, which can slow adoption of high-end implants.

Medical Implant Market Competitive Landscape:

Medtronic is one of the world’s most influential leaders in the medical implant landscape, offering advanced cardiovascular, neurological, and spinal implants that support millions of patients every year. The company continues pushing boundaries through minimally invasive and smart implant technologies aimed at improving clinical outcomes and reducing recovery times. Medtronic’s vast global presence, robust R&D investments, and strong surgeon education programs strengthen trust and adoption across both mature and emerging healthcare markets.

-

In October 2025, Medtronic plc announced a collaboration with Techsomed Ltd. to integrate its BioTraceIO360™ software with Medtronic’s Emprint™ microwave ablation system for advanced image-guided tumor ablation.

Johnson & Johnson MedTech plays a dominant role in orthopedic, cardiovascular, and ophthalmic implants through globally recognized brands and digital-surgery innovations. Its implant strategy emphasizes evidence-based design, durability, and robotics-assisted precision to enhance patient mobility and surgical success. With a diversified product portfolio and close partnerships with surgeons, the company drives widespread adoption of next-generation implants across hospitals worldwide while pushing advancements in personalized implants and data-driven surgical planning.

-

In March 2025, Johnson & Johnson MedTech revealed new digital orthopaedics solutions at AAOS 2025, combining robotic-assisted platforms and data-driven implants targeting joint reconstruction and spine.

Boston Scientific is a powerhouse in cardiac rhythm management, neurostimulation, and other active implantable medical devices that address complex chronic diseases. The company focuses on innovation that improves quality of life, such as miniaturized devices, advanced battery technologies, and features enabling real-time patient monitoring. Strong clinical trial data, regulatory successes, and expansion in emerging markets continue to elevate Boston Scientific’s role as a preferred provider of life-sustaining and mobility-restoring implant systems globally.

-

In July 2025, Boston Scientific Corporation received U.S. FDA expanded approval for its FARAPULSE pulsed-field ablation system to treat persistent atrial fibrillation, boosting its active-implantable portfolio.

Medical Implant Market Key Players:

Some of the Medical Implant Market Companies are:

-

Medtronic plc

-

Johnson & Johnson

-

Abbott Laboratories

-

Stryker Corporation

-

Zimmer Biomet Holdings

-

Smith+Nephew plc

-

Boston Scientific Corporation

-

BIOTRONIK SE & Co. KG

-

Conmed Corporation

-

Globus Medical, Inc.

-

Integra LifeSciences Holdings Corporation

-

Straumann Group

-

Dentsply Sirona

-

Osstem Implant Co., Ltd.

-

GC Aesthetics

-

Arthrex, Inc.

-

Cook Group

-

B. Braun Melsungen AG

-

Enovis Corporation

-

3M Company

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 114.61 Billion |

| Market Size by 2033 | USD 199.07 Billion |

| CAGR | CAGR of 7.16% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Cardiovascular, Orthopedic, Neurostimulators, Spinal, Ophthalmic, Facial, Dental, Breast) • By Biomaterial Type (Ceramic, Metallic, Polymers, Natural) • By Technology (Conventional Implants, 3-D Printed or Additive Manufactured Implants, Smart Sensor-Enabled Implants) • By End User (Hospitals, Specialty Clinics) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Medtronic plc, Johnson & Johnson, Abbott Laboratories, Stryker Corporation, Zimmer Biomet Holdings, Smith+Nephew plc, Boston Scientific Corporation, BIOTRONIK SE & Co. KG, Conmed Corporation, Globus Medical Inc., Integra LifeSciences Holdings Corporation, Straumann Group, Dentsply Sirona, Osstem Implant Co. Ltd., GC Aesthetics, Arthrex Inc., Cook Group, B. Braun Melsungen AG, Enovis Corporation, 3M Company, and Others. |