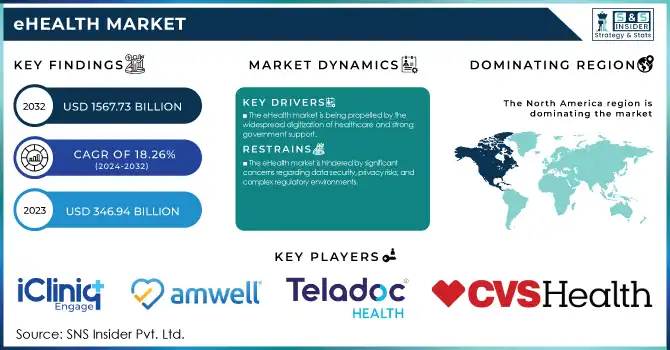

Global eHealth Market Size and Overview:

The eHealth Market size was valued at USD 346.94 billion in 2023 and is expected to reach USD 1567.73 billion by 2032, growing at a CAGR of 18.26% over the forecast period 2024-2032.

Get more information on eHealth Market - Request Sample Report

The eHealth market is undergoing rapid transformation, fueled by technological advancements and increasing consumer willingness to embrace digital healthcare solutions. A 2023 report by the Consumer Technology Association highlighted that 80% of consumers are open to adopting digital health tools, reflecting a substantial shift toward virtual and technology-driven healthcare services.

One of the most notable trends in this sector is the growth of telemedicine, which saw a dramatic rise in adoption from 11% in 2019 to 46% in 2020 primarily driven by the COVID-19 pandemic. This momentum has persisted as patients and healthcare providers recognize the convenience, accessibility, and efficiency of remote consultations. Virtual healthcare services continue to expand, covering a wide range of specialties, from primary care to mental health support. Mobile health (mHealth) applications have also surged in popularity. By 2021, more than 350,000 health-related apps were available, catering to various healthcare needs, including chronic disease management, mental health support, and fitness tracking. The increasing reliance on these applications underscores the growing demand for accessible, on-the-go health management tools. Another significant driver of the eHealth market is wearable technology. In 2020, approximately 21% of U.S. adults used smartwatches or fitness trackers, a number that has been steadily increasing. These devices enable real-time health monitoring, encouraging users to actively manage their well-being by tracking vital signs, physical activity, and sleep patterns.

Governments and global organizations are also playing a pivotal role in advancing eHealth. For example, the World Health Organization's Global Strategy on Digital Health seeks to enhance global healthcare accessibility and efficiency by promoting the development and adoption of digital solutions. Furthermore, artificial intelligence is revolutionizing healthcare, offering enhanced diagnostic accuracy, personalized treatment plans, and predictive analytics. AI-driven algorithms are being increasingly utilized to detect diseases such as diabetic retinopathy with high precision, demonstrating their potential to improve patient outcomes.

eHealth Market Dynamics

Drivers

-

The eHealth market is being propelled by the widespread digitization of healthcare and strong government support.

The adoption of electronic health records, telehealth platforms, and digital patient management systems has significantly enhanced healthcare efficiency. Governments worldwide are introducing policies to facilitate digital transformation, such as the HITECH Act in the U.S., which promotes secure data exchange among healthcare providers. Additionally, the European Health Data Space aims to improve cross-border healthcare access and data sharing within the EU. Emerging economies are also embracing eHealth initiatives, with countries like India launching the Ayushman Bharat Digital Mission to create a unified digital health infrastructure. These efforts are reducing administrative burdens, improving patient outcomes, and ensuring seamless coordination between healthcare professionals. As regulatory frameworks continue to evolve, the integration of digital solutions into mainstream healthcare is expected to accelerate, making eHealth a critical component of modern medicine.

-

The increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory illnesses is fueling the demand for eHealth solutions.

Remote patient monitoring, AI-driven diagnostics, and wearable health devices are playing a crucial role in managing chronic conditions efficiently. For instance, continuous glucose monitoring systems have revolutionized diabetes care, allowing real-time tracking and data-driven treatment adjustments. Additionally, the aging global population is driving the need for home-based healthcare services. The World Health Organization estimates that by 2050, one in six people will be over the age of 65, necessitating remote care solutions to reduce hospital visits and improve quality of life. Digital health applications, such as virtual physical therapy platforms and AI-powered elderly care assistants, are emerging to cater to this growing demographic. As chronic disease cases and elderly populations rise, the demand for eHealth solutions is set to grow exponentially.

-

Advancements in AI, blockchain, 5G, and cloud computing are revolutionizing the eHealth market, enabling faster, more secure, and data-driven healthcare solutions.

AI-powered tools are being used to enhance diagnostics, with machine learning algorithms capable of detecting diseases such as lung cancer and diabetic retinopathy with high accuracy. Blockchain technology is improving data security and interoperability, ensuring safe and seamless patient record management. Meanwhile, 5G connectivity is facilitating real-time telehealth consultations with minimal latency, enhancing the effectiveness of virtual care. Simultaneously, growing consumer awareness and acceptance of digital health tools are driving adoption rates. A 2023 survey found that over 75% of consumers prefer digital health solutions for convenience and accessibility. The rising popularity of wearables, health apps, and AI-powered chatbots is transforming patient engagement, making healthcare more proactive and personalized. As technology continues to advance, the adoption of eHealth solutions is expected to expand further.

Restraints

-

The eHealth market is hindered by significant concerns regarding data security, privacy risks, and complex regulatory environments.

As healthcare becomes more digitized, patient data has become increasingly susceptible to cyber threats, with cyberattacks targeting healthcare systems rising sharply in recent years. Breaches in electronic health records can compromise sensitive medical data, leading to potential identity theft and financial losses. Additionally, the eHealth sector must navigate a maze of regional regulations, such as the GDPR in Europe and HIPAA in the U.S., which impose stringent requirements for data protection and compliance. These regulations often entail substantial costs for eHealth providers to ensure they meet standards. Moreover, the lack of interoperability between different digital health systems complicates the seamless exchange of patient data. Overcoming these challenges with improved cybersecurity measures, unified regulatory frameworks, and better interoperability solutions is essential for the continued growth and trust in the eHealth market.

eHealth Market Segmentation Insights

By Product

In 2023, the Health Information Systems (HIS) segment dominated the eHealth market, holding a market share of 38.5%. This dominance is driven by the growing need for electronic health records (EHRs), hospital management systems, and other HIS solutions that enhance healthcare efficiency. HIS technologies streamline administrative processes, improve patient safety, and ensure compliance with healthcare regulations. The adoption of HIS is heavily influenced by government initiatives and regulations such as the Health Information Technology for Economic and Clinical Health (HITECH) Act in the U.S., which incentivizes healthcare providers to digitize health records. As a result, the Health Information Systems segment continues to be a key player in the eHealth market, particularly as the demand for data interoperability and patient-centered care rises.

The e-prescribing segment emerged as the fastest-growing segment in the eHealth market over the forecast period, with a notable increase in adoption across various regions. E-prescribing allows healthcare providers to electronically send prescriptions to pharmacies, reducing the risk of medication errors and improving patient safety. This segment’s rapid growth is attributed to the increasing adoption of e-prescribing systems by healthcare providers, driven by their efficiency, accuracy, and ability to reduce medication errors. Government incentives and healthcare insurance mandates have played a significant role in pushing the adoption of e-prescribing solutions. The rising demand for safer medication practices and digital workflows has accelerated the growth of this segment, making it the fastest-growing in the eHealth market.

By End-use

The Providers segment was the largest in the eHealth market in 2023, accounting for a significant market share of around 52.1%. Healthcare providers, including hospitals, clinics, and private healthcare practitioners, are the primary adopters of digital health technologies such as EHRs, telemedicine solutions, and health management systems. Providers continue to invest in these technologies to improve patient care, enhance operational efficiency, and ensure compliance with regulatory standards. The Providers segment holds the largest share due to the widespread adoption of digital health technologies in healthcare organizations, aimed at enhancing patient engagement, reducing administrative costs, and optimizing clinical workflows.

The Payers segment was the fastest-growing in the eHealth market throughout the forecast period, experiencing significant growth driven by the increasing adoption of digital health solutions by health insurance companies. The Payers segment is adopting digital tools to improve claims processing, fraud detection, and patient data management while providing more personalized healthcare plans and cost-effective solutions. As insurers seek to enhance service delivery and manage rising healthcare costs, the segment has increasingly integrated technologies such as telemedicine platforms, mHealth apps, and e-prescribing systems.

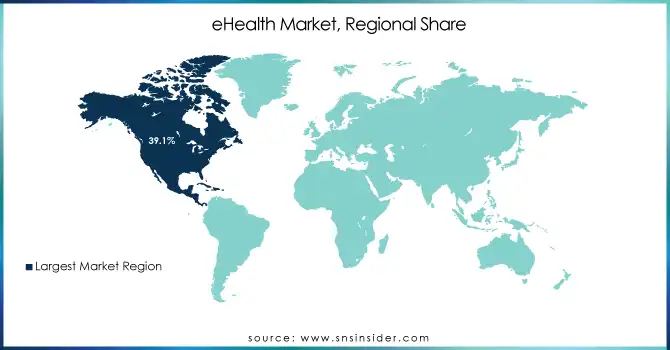

eHealth Market Regional Outlook

The North American region remained the leader in the eHealth market with a 39.1% share in 2023, driven by strong healthcare infrastructure, technological advancements, and a high adoption rate of digital health solutions. The U.S., in particular, has seen rapid growth due to significant investments in telemedicine, health information systems, and wearable technology. A 2023 report from the Consumer Technology Association revealed that 80% of U.S. consumers are open to using digital health solutions, indicating the region's strong digital health engagement. Furthermore, initiatives like the HITECH Act have incentivized the digitization of healthcare, further boosting market growth.

Europe followed closely behind, with countries such as the UK, Germany, and France leading the charge. The NHS Digital initiative in the UK and the German Digital Health Act have fostered the integration of electronic health records and telehealth services into routine care. European countries are focusing on increasing digital health literacy and inclusive healthcare, evidenced by projects like Digital Health Europe, which aims to improve cross-border healthcare delivery and patient mobility.

Asia-Pacific is the fastest-growing region for eHealth solutions, fueled by the increasing adoption of mobile health apps, AI-driven healthcare tools, and telemedicine services. Countries like China, India, and Australia are leading the charge, with India's National Health Stack initiative aiming to digitize the healthcare system. Additionally, rising smartphone penetration and the growth of the health-tech ecosystem in cities like Singapore are contributing to the rapid adoption of eHealth technologies in the region.

Need any customization research on eHealth Market - Enquiry Now

Key Players

-

CVS Health (United States)

-

Teladoc Health, Inc. (United States)

-

American Well (United States)

-

iCliniq (India)

-

Veradigm LLC (United States)

-

Koninklijke Philips N.V. (Netherlands)

-

UnitedHealth Group (United States)

-

Medtronic (Ireland)

-

Epocrates (United States)

-

Telecare Corporation (United States)

-

Medisafe (Israel)

-

Set Point Medical (United States)

-

IBM (United States)

-

Doximity, Inc. (United States)

-

LiftLabs (United States)

-

Allscripts Healthcare Solutions, Inc. (United States)

-

Siemens Healthineers (Germany)

-

General Electric Company (United States)

-

InTouch Health (United States)

-

Athenahealth, Inc. (United States)

-

Cisco Systems, Inc. (United States)

Recent Developments

In Jan 2025, eHealth, Inc. launched "Iris by eHealth," an all-inclusive Individual Coverage Health Reimbursement Account (ICHRA) solution. This offering is designed to help employers provide personalized health benefits to employees while managing the unpredictable costs associated with group health plans.

In Jan 2025, Innovaccer Inc. raised USD 275 million in Series F funding, with investments from B Capital Group, Banner Health, Danaher Ventures LLC, Generation Investment Management, Kaiser Permanente, and M12. The funding will support Innovaccer's efforts to advance healthcare AI solutions.

| Report Attributes | Details |

| Market Size in 2023 | USD 346.94 Billion |

| Market Size by 2032 | USD 1567.73 Billion |

| CAGR | CAGR of 18.26% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Telemedicine, Health Information Systems (Electronic Health Record, Electronic Medical Record, Patient Engagement Solution, Population Health Management), mHealth (Monitoring services, Diagnosis services, Healthcare Systems Strengthening Services, Others), ePharmacy, E-Prescribing, Computerized Physician Order Entry] • By End-use [Providers, Payers, Patients] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | CVS Health, Teladoc Health, Inc., American Well, iCliniq, Veradigm LLC, Koninklijke Philips N.V., UnitedHealth Group, Medtronic, Epocrates, Telecare Corporation, Medisafe, SetPoint Medical, IBM, Doximity, Inc., LiftLabs, Allscripts Healthcare Solutions, Inc., Siemens Healthineers, General Electric Company, InTouch Health, Athenahealth, Inc., Cisco Systems, Inc. |

| Key Drivers | • The eHealth market is being propelled by the widespread digitization of healthcare and strong government support. • The increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory illnesses is fueling the demand for eHealth solutions. • Advancements in AI, blockchain, 5G, and cloud computing are revolutionizing the eHealth market, enabling faster, more secure, and data-driven healthcare solutions. |

| Restraints | • The eHealth market is hindered by significant concerns regarding data security, privacy risks, and complex regulatory environments. |