Medical X-ray Market Size & Overview:

To Get More Information on Medical X-ray Market - Request Sample Report

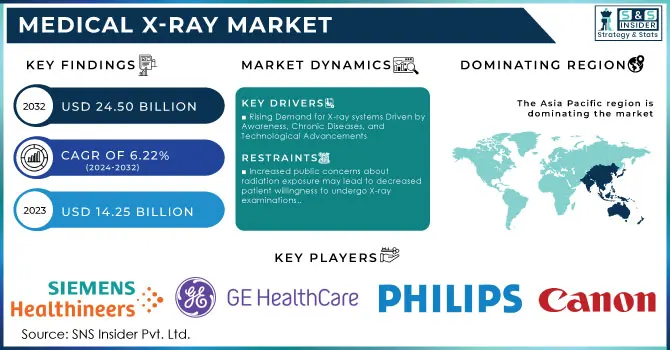

The Medical X-ray Market was estimated at USD 14.25 billion in 2023 and is poised to reach 24.50 billion in 2032 which is anticipated to expand at a compound annual growth rate of 6.22% for the forecast period of 2024-2032.

The medical X-ray market is experiencing tremendous growth rates coupled with the benefits of technological advancements, growing healthcare needs, and demographic factors. From an immense target population that requires technological innovations in diagnostic imaging, advances in X-ray technology are unlocking new growth avenues in the market. Increasing cases of cardiovascular diseases, dental conditions, and orthopedic injuries are compelling clinician demands for X-ray systems. Additionally, the investments in R&D of the high-profile giants in the field are encouraging the development of efficient and effective imaging solutions.

Emerging markets are likely to be among the biggest drivers for growth in the market for X-rays, supported by upgraded healthcare infrastructure and a growing need for accessible healthcare. Emerging X-ray systems come with developments in terms of quality images, protection against hazards of radiation exposure, and enhanced operational performance. Such needs become significant because healthcare providers want to deliver high-quality care without increasing the risks that patients expose themselves to. Furthermore, the market is being driven due to the increasing population of elders. Of course, with better life expectancy and an increased focus on preventive care, there is a high demand for regular diagnostic screenings for age-related problems before they act. Point-of-care imaging is one of the most salient market trends, featuring actual time bedside or remote diagnostic imaging. It can be very useful in an emergency setting to help the management and outcome in the shortest period possible. Portable X-ray systems that have been introduced into a variety of settings, including rural areas and disaster zones, are helping to expand and speed up the availability of medical imaging services.

However, the availability of very high-priced advanced X-ray machines hinders penetration into healthcare service organizations, particularly in developing areas. Moreover, the COVID-19 pandemic has affected the market in two ways. It curbed the routine imaging procedures and hence temporarily put down demand. However, at the same time, it increased the demand for chest X-rays meant to monitor respiratory conditions caused by COVID-19. In the medical X-ray market, this has created a complex landscape in balancing challenges with new opportunities for growth in the post-pandemic era. In totality, the medical X-ray market is expected to continue its growth as healthcare providers increasingly seek innovative solutions that meet the needs of patient care, which is constantly evolving.

Medical X-ray Market Dynamics

Drivers

-

Rising Demand for X-ray systems Driven by Awareness, Chronic Diseases, and Technological Advancements

The rise in awareness regarding early diagnosis has been one of the major factors fuelling X-rays around the world. One of the other drivers of this phenomenon is the surge in chronic diseases. Chronic diseases example includes the reports by the WHO claiming that more than 65 million people suffer from COPD in the world. Likewise, CDC statistics show that in the U.S. itself, in 2021, approximately 18.2 million adults were diagnosed with coronary artery disease. Chest X-rays will often be needed to diagnose heart diseases; hence, there is a great demand for cost-effective and efficient diagnostic tools such as X-ray systems. With the number of aged people on the rise, age-related diseases, such as osteoporosis, also rise in prevalence. According to IOF, the International Osteoporosis Foundation, more than 200 million people worldwide suffer from this disease, and elderly people over 50 come with rather severe risks of fractures. Countries like Italy, the U.K., Japan, the U.S., and Germany also come with considerable medical imaging demands with large elderly population.

Technological advancements in X-ray equipment, such as moving from analog to digital systems, allow it to change the game for better outcomes in terms of precision in imaging and patient comfort. The application of AI and machine learning in X-ray systems can automate complex diagnostic processes, often with superior results at lower costs. For instance, the latest launch of AI-enabled X-ray solutions by FUJIFILM Corporation reflects the healthy direction that the company is taking forward, toward the mass introduction of very advanced diagnostic imaging technologies.

Restraints

-

Increased public concerns about radiation exposure may lead to decreased patient willingness to undergo X-ray examinations.

-

Long-term health risks associated with X-ray radiation, including potential cancer development, may deter healthcare providers from recommending frequent use of X-ray diagnostics.

Medical X-ray Market - Key Segmentation

By Product Type

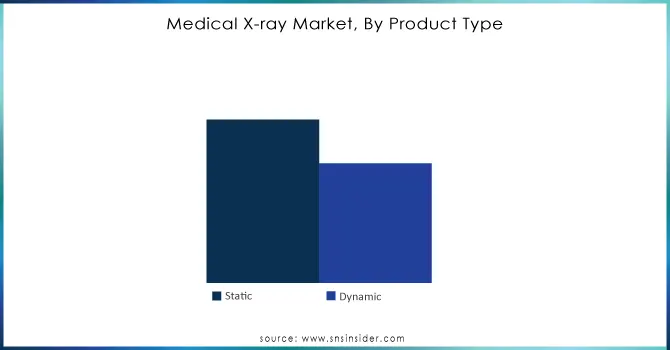

By 2023, the medical X-ray market was dominated by the static segment with a share of about 60.0%. The reason behind the dominance of the static segment is the wide use of this technology in different medical applications, starting from routine diagnostic imaging to which hospitals and clinics all over the world have resorted to static X-ray systems. Static X-rays are preferred due to their easy usage, reliability, and efficiency.

The dynamic segment is the fastest-growing segment of the medical X-ray market which is expected to grow at a rate of around 10% in the next few years. Dynamic imaging is driven by an increasing number of cases involving interventional procedures and also real-time monitoring. Dynamic X-ray systems have become significantly more efficient and precise with technological advancements, leading to increased demand.

Do You Need any Customization Research on Medical X-ray Market - Enquire Now

By Application

In 2023, the cardiovascular application segment accounted for around 35.0% of the total market share in the medical X-ray market. This can be largely attributed to increased cardiovascular diseases and high demand for efficient diagnosing tools. Medical X-rays are considered an essential diagnostic tool for various heart conditions, thus leading to a higher share among hospitals and diagnostic centers.

The oncology application segment is expected to be the highest-growing segment, with a CAGR of about 12% for the next few years. This would be mainly due to increasing incidence rates across the globe and the accurate need to imagine the cancerous condition early on and plan for optimal treatment. Advanced technologies in imaging applications are significantly improving diagnostic accuracy in oncology, and thus a significant investment area in the future.

Medical X-ray Market Regional Analysis

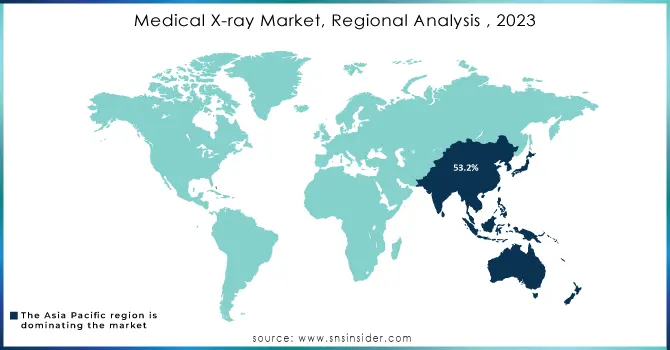

The Asia Pacific medical X-ray market dominated in 2023 with a market share of 53.2%, driven by government initiatives aimed at developing advanced digital and portable medical X-ray systems. The region also witnessed an increase in the number of mergers and acquisitions by key players, especially for AI-powered X-ray systems, due to the increasing need for early disease diagnosis. For instance, in February 2021, FUJIFILM Holdings Corporation acquired Hitachi Ltd's imaging diagnostics business. This acquisition brought additional products, including CT, MRI, X-ray, PACS, endoscopy, and ultrasound systems, under the company's portfolio. Along with this, increased healthcare spending and the intent to enhance health infrastructure in emerging economies like China and India will significantly boost the share of the Asia Pacific region in the medical X-ray market during the forecast period.

In North America, the market is likely to grow at a healthy CAGR. The main driving factors of this will be growth in emergency patient visits that require diagnostic X-rays and also a favorable reimbursement environment from government healthcare programs for digital X-ray systems. As estimated by GE Healthcare, 35.0% of U.S. emergency department visits reportedly involve diagnostic X-ray imaging.

The European X-ray market has been primarily driven by the rising incidences of chronic diseases such as cancers and cardiovascular diseases. For example, the Macmillan Cancer Report projects that the number of cancer cases in the U.K. will rise from 3.0 million in 2022 to 3.5 million by 2025.

Key Players in the Medical X-Ray Market

Imaging Equipment Manufacturers

-

Siemens Healthcare GmbH

-

CANON MEDICAL SYSTEMS CORPORATION

-

FUJIFILM Holdings Corporation

-

Koninklijke Philips N.V.

-

SAMSUNG ELECTRONICS CO., LTD.

Software and AI Solutions Providers

-

Carestream Health

-

FUJIFILM SonoSite, Inc.

-

Hologic, Inc.

-

New Medical Imaging

-

AGFA

Additional Key Players

-

Siemens Healthineers AG

-

Canon Medical Systems

-

Carestream

Recent Development

-

In July 2024: Siemens Healthineers expanded its "Make in India" initiative by launching local manufacturing of the Multix Impact E Digital Radiography X-ray System.

-

February 2024: DeepTek.ai introduced Augmento X-Ray, an AI-driven chest X-ray solution, at the Radiology Society of North America's 109th Annual Meeting.

-

January 2024: Canon Medical Systems and Olympus announced a business alliance focused on developing Endoscopic Ultrasound Systems.

-

April 2023: Shimadzu Corporation launched the EZy-Rad Pro radiography system for clinics, designed for ease of use by healthcare personnel and to reduce patient examination times.

-

August 2023: Union Minister Dr. Jitendra Singh inaugurated India’s first domestically crafted, cost-effective, lightweight, and ultrafast High Field (1.5 Tesla) Next Generation Magnetic Resonance Imaging (MRI) Scanner in New Delhi.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 14.25 Billion |

| Market Size by 2032 | USD 24.50 Billion |

| CAGR | CAGR of 6.22% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Type (Benzodiazepines, Nonbenzodiazepines, Antidepressants, Orexin Antagonists, Melatonin Antagonists, Other Drug Types) • By Application (Insomnia, Sleep Apnea, Narcolepsy, Circadian Disorders, Other Applications) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fisher & Paykel Healthcare, ResMed Inc., Philips Healthcare, Invacare Corporation, Teleflex Inc., BMC Medical Co., Ltd, Inspire Medical Systems, Natus Medical Inc., Nihon Kohden Corporation, Compumedics Limited, Advanced Brain Monitoring, SleepMed Inc., NovaSom, Inc., Medtronic plc, DeVilbiss Healthcare, Cardinal Health, Koninklijke Philips N.V., Itamar Medical Ltd., Becton, Dickinson, and Company |

| Key Drivers | • The rising prevalence of sleep disorders poses significant challenges to health and the economy. |

| Restraints | • High treatment costs for medical drugs and therapies limit accessibility for the middle-class population, potentially hindering market growth. • Technological advancements in developed regions are often accompanied by increased expenses, making treatments less affordable. • Insufficient inclusion of sleep disorder treatments in health insurance policies may restrict the number of patients seeking necessary care. |