Memory Devices Market Report Scope & Overview:

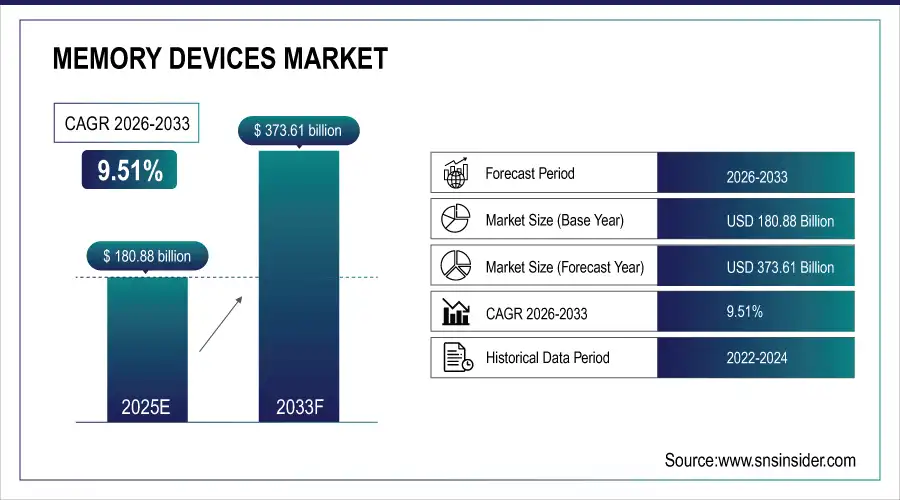

The Memory Devices Market size was valued at USD 180.88 Billion in 2025E and is projected to reach USD 373.61 Billion by 2033, growing at a CAGR of 9.51% during 2026-2033.

To Get more information On Memory Devices Market - Request Free Sample Report

The Memory Devices Market is expanding due to the growing demand for high-performance storage in data centers, cloud computing, and artificial intelligence is driving the Memory Devices Market. Fast market acceptance of the security solution for smartphones, the Internet of Things devices and the automotive electronics markets are boosting this demand. Advances in areas like 3D NAND and DRAM are increasing efficiency and capacity. Rising investment in chipmaking is easing supply chain constraints.

In 2024–25, global memory demand is projected to grow 18–22%, driven by AI servers consuming 40%+ of HBM output and data centers doubling DDR5 adoption.

Memory Devices Market Trends

-

More applications Design in 3D NAND is gaining ground, bringing greater storage density, faster performance, and lower cost per gigabyte to a variety of applications.

-

Demand is emerging for high-bandwidth, low-latency memory devices that are tailored for high-density, AI, and machine learning workloads that can deliver extremely high data processing performance.

-

Growing interest in energy-efficient memory technologies, as industry seeks to reduce power consumption and energy usage, address sustainability and green data center demands.

-

Advanced memory devices are playing an increasingly important role in the automotive industry, and not just for autonomous driving, infotainment, electric vehicles and safety-critical devices.

-

Increasing deployment of cloud applications and hyperscale data centers, the demand for memory has grown exponentially around the world for a fast and efficient storage solutions that offer extremely large capacity.

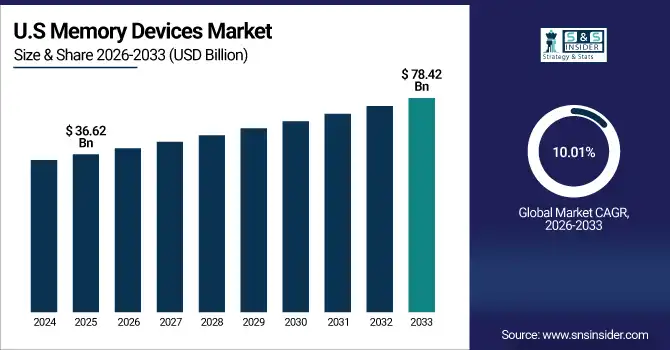

The U.S. Memory Devices Market size was valued at USD 36.62 Billion in 2025E and is projected to reach USD 78.42 Billion by 2033, growing at a CAGR of 10.01% during 2026-2033. Memory Devices Market growth is driven by growing demand for quicker storage solution from the numerous data center as well as cloud service providers is one of the factors fueling the demand of Memory Devices Market across the U.S. Growing usage of AI, machine learning, and big data analytics is further accelerating the adoption advanced memory. Growth in 5G networks and related devices are driving storage and processing requirements at a faster pace.

Memory Devices Market Growth Drivers:

-

Increasing Demand for High-Performance, Energy-Efficient Memory Solutions Across Data Centers, AI, and Consumer Electronics.

Growing use of AI, IoT and big data is fueling memory needs. Fast, scalable and energy saving solutions are needed in data centers. Sales get a lift from consumer electronics such as smartphones and wearable devices. Growth in cloud computing drives storage demands even higher. Advancements in 3D NAND and DRAM also accelerate performance and market opportunity.

In 2024–25, AI-driven data centers will consume over 50% of HBM3/3E output with memory bandwidth demands surging 3x YoY, while 3D NAND shipments grow 35% and DDR5 penetration hits 60% in servers.

Memory Devices Market Restraints:

-

High Manufacturing Costs and Supply Chain Disruptions Impact Memory Device Production and Market Growth Globally

Memory devices manufacturing needs to be performed using cutting-edge fabrication technologies, which will cause high capex. Shortages and delays ensue as supply chains are disrupted. The Variation in raw material prices affects the profitability. Geopolitical tensions increase market uncertainties. There are also the abrupt technological changes, which compel manufacturers to constantly put out expensive upgrades and reduce smaller players’ ability to compete in the space.

Memory Devices Market Opportunities:

-

Growing Adoption of AI, Edge Computing, and Autonomous Vehicles Fuels Demand for Advanced Next-Generation Memory Devices Globally

AI and machine learning need faster memory architectures. the localization of demand for storage is driven by the adoption of ETC. Autonomous and electric vehicles require dependable, high-capacity answers. Smart devices /IoT growth drive new revenue opportunities. The new nonvolatile memory will create unprecedented opportunities for innovation and long-term market growth all over the world.

Global IoT connections surpass 18B in 2025, boosting embedded NOR/NAND revenue by 15% YoY, with smart sensors and edge devices demanding ultra-low-power memory.

Memory Devices Market Segment Analysis

-

By Speed Grade, High-speed memory devices, such as DDR5 and LPDDR5, led the market with a 43.67% share in 2025E, while medium-speed devices like DDR4 and LPDDR4 are projected to be the fastest growing with a CAGR of 10%.

-

By Application, smartphones and tablets dominated with 49.78% share in 2025E, whereas servers and data centers are expected to grow the fastest at a CAGR of 10.13%.

-

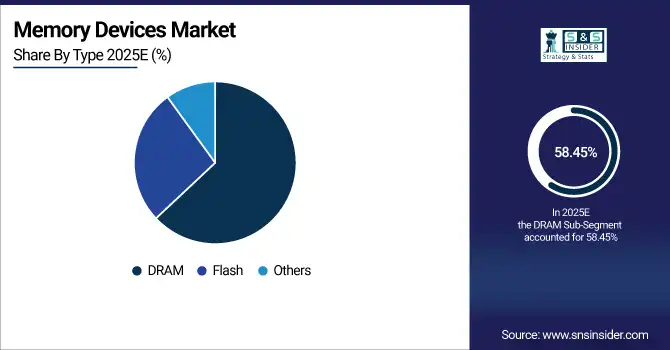

By Type, DRAM led the market with 58.45% share in 2025E, while flash memory is projected to be the fastest growing segment, with a CAGR of 9.83%.

-

By Deployment, integrated circuits (ICs) held 51.43% share in 2025E, whereas memory cards are expected to expand most rapidly with a CAGR of 10.07%.

By Speed Grade, High Speed (DDR5, LPDDR5) Leads Market While Medium Speed (DDR4, LPDDR4) Registers Fastest Growth

High-speed memories such as DDR5 and LPDDR5 are quickly becoming the norms for the foreseen demands on computing, gaming, AI workloads. Their high bandwidth, high efficiency, and relative cost effectiveness act as a catalyst for servers, data centers, and high-end consumer devices. The fastest growth for now is in size-specific mid-speed DDR4/DDR4 and LPDDR4 standards – predominantly in devices where it achieves a good balance of performance and cost, in both high end smartphones but also IoT devices and mid-range computing applications.

By Application, Smartphones and Tablets Dominate While Servers and Data Centers Shows Rapid Growth

In 2025E, the Smartphones and tablets are the major consumers of memory devices, due to growing consumer appetite for storage-hungry apps, high-resolution content and 5G technology. As they require small and energy-saving memory, the business is booming. But servers and data centers are growing most rapidly, driven by growth in cloud, artificial intelligence and big data analytics. High-capacity memory solutions that scale are essential to meet the growing demands of enterprise workloads.

By Type, DRAM Lead While Flash Registers Fastest Growth

In 2025E, DRAM market to drive owing to its high speed, superior performance and increased demand from real time data processing in computing, smartphones and gaming systems. Positioned as Such: It is built into mean processors, so you know its adoption will be dominant. The fastest-growing, though, is flash memory, which is needed to serve the boom in non-volatile, high-capacity, portable storage. Applications of the technology in SSDs, mobile devices and enterprise storage systems are driving accelerated market penetration worldwide.

By Form Factor, Integrated Circuits (ICs) Lead While Memory Cards Grow Fastest

In 2025E, the Integrated Circuits (ICs) are the predominant memory devices for their compact design, high performance, and are integrated in consumer electronics, server, and automotive. They are the preferred form factor for all over the world. But memory cards is where the fastest growth comes from, too, with growing needs for removable, cost-effective, expandable storage in smartphones and cameras, drones, IoT products, and other applications where flexibility and portability work with data usage.

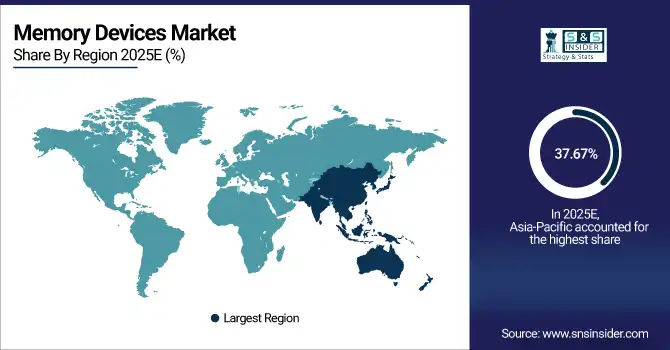

Memory Devices Market Regional Analysis:

Asia-pacific Memory Devices Market Insights

In 2025 Asia-Pacific dominated the Memory Devices Market and accounted for 37.67% of revenue share, this leadership is due to a number of strong semiconductor manufacturing regions in South Korea, Taiwan, and Japan. Rapid growth is driven by high demand from consumer electronics, 5G infrastructure and automotive sectors. And the maturing smartphone markets in China and India are adding significant fuel. Country Seeks to Maintain Regional Leadership With Support of Government and Robust R&D Spending.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Memory Devices Market Insights

China dominates memory devices market with its wide electronics manufacturing industry and growing local demand. Government’s drive for semiconductor self-reliance speeds up investments in self-owned fabrication plants and R&D. Rapid smartphone penetration and AI-powered apps to drive strong growth.

North America Memory Devices Market Insights

North America is expected to witness the fastest growth in the Memory Devices Market over 2026-2033, with a projected CAGR of 10.27% due to high acceptance of cloud, artificial intelligence and hpc as well. Continued strong U.S. data center and enterprise storage demand drives consumption. Rapid investment in semiconductor fabrication boosts supply capacity. Electric and autonomous vehicle proliferation also raises the memory stakes.

U.S. Memory Devices Market Insights

U.S. is leading North American markets, with strong demand from hyperscale data centers, cloud providers, as well as AI developers. There is strong government support for production with semiconductor programmes. The rise of the electric vehicle industry also fuels adoption.

Europe Memory Devices Market Insights

In 2025, Europe emerged as a promising region in the Memory Devices Market, due to its robust automotive industry, particularly in Germany, which is using increasingly sophisticated memory for electric and autonomous vehicles. Sustainability and energy efficiency are a priority for the region. Growing industrial automation, IoT, and edge computing solidifies the appeal. The EU’s semiconductor strategy seeks to curb reliance on imports.

Germany Memory Devices Market Insights

Germany is a key European memory market with increasing focus over the next decade being associated with the development of electric and autonomous vehicles and its strong automotive industry. High-performance memory solutions are also relevant for industrial automation and Industry 4.0 use-cases.

Latin America (LATAM) and Middle East & Africa (MEA) Memory Devices Market Insights

The Memory Devices Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to experiencing continual increments, prompted by the incidence of smartphones, digitalization and, the growth of cloud services. Consumer electronics, enterprise storage and data centers Driving demand in Brazil, Mexico and Gulf nations. The rise of e-commerce and fintech as well as smart city projects drive greater use of memory-powered gadgets. Despite small local production, the increasing number of consumers from both regions continuously propose avenues for global market extension.

Memory Devices Market Competitive Landscape:

Samsung is the world’s memory market leader, with lead times in DRAM and NAND flash. Its cutting-edge technologies drive smartphones, servers and AI applications. Competitiveness is guaranteed by a strong R&D and manufacturing scale. Samsung is continually pushing the envelope with state-of-the art memory solutions that support data centers, 5G, automotive, and everywhere in-between, while addressing customers’ need for high performance, efficiency, and capacity.

-

In September 2025, Samsung revived its Z-NAND technology, focusing on higher performance and lower power usage for AI-driven data centers and GPU-accelerated storage applications.

SK Hynix is a leading supplier of memory devices including DRAM and NAND flash. The company provides some of the biggest tech companies in the world, serving markets for cloud, AI and mobile. DDR5 and LPDDR5 offerings add performance upgrades DDR5 and LPDDR5 solutions continue the trend of innovative performance additions. Capacity building investments in manufacturing plants.

-

In August 2025, SK Hynix highlighted growth prospects in the AI memory market and introduced advanced QLC NAND flash technology to strengthen its position in consumer and enterprise storage.

Micron Technology is a world leader in innovative memory solutions that transform how the world uses information. Its products are designed for data-heavy applications like AI, 5G, and automotive electronics. Micron focuses on sustainability and energy-efficient technologies. Intensive investment in new technologies in GDDR6 and HBM keeps the business competitive.

-

In August 2025, Micron updated its market outlook, citing strong demand from AI infrastructure and improved DRAM market conditions, reinforcing its leadership in advanced memory solutions.

Intel Corporation has a large footprint in memory devices with emerging tech like 3D XPoint and NAND flash. It is designed for HPC, enterprise storage, and cloud workloads. Intels AI and data-centric architectures stimulates demand for new types of memory. While divesting some NAND operations, Intel is progressing development of persistent memory and advancing next-gen data-centric solutions for a world where large amounts of data need to be stored, moved and fed to the processor.

-

In September 2025, Intel officially exited China’s NAND business as its Dalian plant was rebranded under SK Hynix, following U.S. trade regulations limiting fab upgrades in China.

Memory Devices Market Key Players:

Some of the Memory Devices Market Companies are:

-

Samsung Electronics Co., Ltd.

-

SK Hynix Inc.

-

Micron Technology, Inc.

-

Intel Corporation

-

Western Digital Corporation

-

Toshiba Memory Corporation (now Kioxia Holdings Corporation)

-

Kingston Technology Company, Inc.

-

Seagate Technology Holdings PLC

-

Broadcom Inc.

-

Qualcomm Incorporated

-

Analog Devices, Inc. (ADI)

-

ON Semiconductor Corporation (onsemi)

-

Cypress Semiconductor (now part of Infineon Technologies AG)

-

Flextronics International Ltd. (Flex Ltd.)

-

Winbond Electronics Corporation

-

Infineon Technologies AG

-

Nanya Technology Corporation

-

STMicroelectronics N.V.

-

Microchip Technology Inc.

-

Renesas Electronics Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 180.88 Billion |

| Market Size by 2033 | USD 373.61 Billion |

| CAGR | CAGR of 9.51% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Speed Grade (High Speed (DDR5, LPDDR5), Medium Speed (DDR4, LPDDR4) and Low Speed (DDR3, LPDDR3) • By Application (Smartphones and Tablets, Servers and Data Centers, and Others) • By Type (DRAM, Flash, and Others) • By Form Factor (Integrated Circuits (ICs), Memory Cards and Memory Modules) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Samsung Electronics Co., Ltd., SK Hynix Inc., Micron Technology, Inc., Intel Corporation, Western Digital Corporation, Toshiba Memory Corporation (Kioxia Holdings), Kingston Technology Company, Inc., Seagate Technology Holdings PLC, Broadcom Inc., Qualcomm Incorporated, Analog Devices, Inc., ON Semiconductor Corporation (onsemi), Cypress Semiconductor (Infineon Technologies AG), Flextronics International Ltd. (Flex Ltd.), Winbond Electronics Corporation, Infineon Technologies AG, Nanya Technology Corporation, STMicroelectronics N.V., Microchip Technology Inc., Renesas Electronics Corporation |