Mercury Analyzer Market Report Scope & Overview:

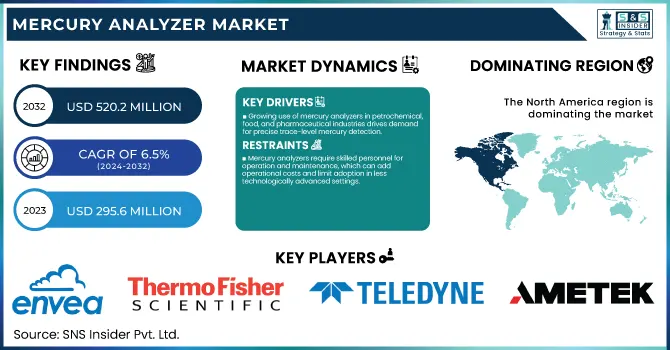

The Mercury Analyzer Market Size was valued at USD 295.6 Million in 2023 and is expected to reach USD 520.2 Million by 2032, growing at a CAGR of 6.5% over the forecast period 2024-2032.

To Get more information on Mercury Analyzer Market - Request Free Sample Report

The mercury analyzer market is driven primarily by heightened regulatory enforcement on mercury emissions and contamination. Governments worldwide have intensified their focus on controlling mercury emissions due to its severe environmental and public health implications. According to the U.S. Environmental Protection Agency (EPA), mercury emissions have been linked to numerous health risks, particularly affecting the neurological development of fetuses and young children. In response, several governments have imposed stringent regulations on mercury emissions in industries such as mining, waste management, and power generation. For instance, the Minamata Convention on Mercury, adopted by 128 countries, mandates the monitoring and control of mercury emissions. Governments in Europe and North America are particularly proactive, leading the market in mercury analyzer adoption.

In Europe, the European Environmental Agency (EEA) reports a reduction in mercury emissions by nearly 40% since 2010, highlighting the demand for mercury analyzers in industrial applications. In Asia-Pacific, countries like China and India are also introducing emission limits due to rapid industrialization. China’s National Environmental Protection Standard enforces mercury emission thresholds across various industries, requiring companies to adopt mercury analyzers for compliance. This regulatory landscape is a key driver, pushing industries to adopt advanced mercury detection and analysis tools.

The global rise in industrialization has significantly increased mercury contamination, with mercury emissions now three to ten times higher than in the pre-industrial era, according to the U.S. National Institutes of Health. Mercury analyzers provide real-time air quality monitoring, detecting mercury vapor with high accuracy and efficiency, without requiring complex sample preparation. Widely used in petrochemical, oil, and gas sectors, these advanced systems effectively measure mercury levels in air, liquids, natural gas, and solids.

Mercury Analyzer Market Dynamics

Drivers

-

Stringent global environmental regulations, especially around mercury emissions, are driving demand for mercury analyzers to help industries comply with safety standards, particularly in sectors like mining and coal power generation.

-

The increasing application of mercury analyzers in petrochemical, food, and pharmaceutical industries is boosting demand as these sectors need to ensure trace-level mercury detection for safety and quality control.

Globally, the implementation of stringent environmental regulations for the limitation of mercury emissions is one of the key drivers contributing to the growth in the mercury analyzer market. Mercury is one of the most highly toxic substances, and as such, it has a direct (negative) effect on human health and ecosystems that lead to government-enacted guidelines to monitor and mitigate its effects around the globe. Such as the Minamata Convention on Mercury, which has been signed by more than 130 countries since it was created in 2013 and requires signatories to reduce mercury emissions from sources such as coal-fired power plants, waste incineration, and mining. This convention alone has significantly increased demand for mercury analyzers, particularly in countries aiming to achieve compliance quickly.

Tight controls on mercury emissions in North America and Europe mandate that companies should have to install a mercury analyzer. As an example, the U.S. Environmental Protection Agency (EPA) has established rules such as the Mercury and Air Toxics Standards (MATS) that mandate continuous monitoring of mercury emissions from power plants. As the EPA notes, these standards have resulted in more than an 85% reduction in mercury emissions from the power sector since 2011. Likewise in Europe, coal power plants are subject to the Industrial Emissions Directive (IED), thus forcing companies towards advanced mercury analysis technology. Such regulatory frameworks increase the adoption of mercury analyzers, as companies in affected industries must ensure their emissions are within permissible limits, creating steady demand in this market.

Restraints

-

The advanced technology in mercury analyzers makes them costly, posing a barrier for small and medium-sized enterprises in adopting these solutions despite regulatory pressures.

-

Mercury analyzers require skilled personnel for operation and maintenance, which can add operational costs and limit adoption in less technologically advanced settings.

The high cost of initial investment required for mercury analyzers is one major restraint in the mercury analyzer market. Due to the advanced detection needed for trace-level mercury analysis, it is common that mercury analyzers utilize complex technology that drives high accuracy. This complexity increases their manufacturing and purchasing costs and makes these analyzers a huge investment item for companies, particularly small or medium-sized enterprises. Additionally, to work properly these analyzers often need a specific calibration and require regular periodic maintenance which adds cost. Although regulations may compel industries to reduce mercury emissions, the cost hurdle can dissuade firms, particularly those with narrow margins or limited resource inputs. Consequently, the high cost can limit adoption rates, as companies might seek alternative, albeit less precise, methods for mercury detection to reduce expenditure.

Mercury Analyzer Market Segmentation Analysis

By Type

Cold Vapor Atomic Absorption (CVAA) held the highest revenue share in the mercury analyzer market with 68% in 2023. CVAA is a universally used method with high sensitivity, low-cost performance, and reliable characteristics in wide applications to detect small concentrations of mercury. The preference for it over the years, across industries reflects its ability to deliver rapid and accurate results, essential for compliance with regulatory standards.

However, the fastest growing segment is Cold Vapor Atomic Fluorescence (CVAF) technology over the forecast period offering ultra-trace level detection for mercury and increasing demand for advanced mercury analytical methods. An increasing regulatory inclination for more accurate mercury measurement solutions is driving CVAF adoption, which offers a higher level of sensitivity and a wider range of detection. With increasing government incentives and grants targeting research in mercury detection technologies, the need for precise mercury analysis has gained momentum, benefiting market growth specifically towards its rapid expansion of CVAF.

By End Use

The environmental monitoring segment was the largest end-use segment, accounting for 28% of revenue in mercury analyzers in 2023. The adoption of newer technologies in manufacturing processes has further accelerated the growth of this segment, as governments globally focus on stringent environmental controls and monitoring provisions under the Minamata Convention on Mercury. The growing industries are investing in mercury analyzers for environmental monitoring to comply with regulatory compliance and avoid penalties.

On the other hand, the food industry segment is projected to register the highest CAGR during the forecast years. This growth is driven by rising mercury contamination issues in the food chain, especially seafood, where stringent regulation on mercury levels is applied. An increase in stringent mercury limits set forth by the U.S. Food and Drug Administration (FDA) and food safety authorities around the world is expected to propel demand for mercury analyzers in seafood, fuelling their market growth over a forecast period of time

Mercury Analyzer Market Regional Outlook

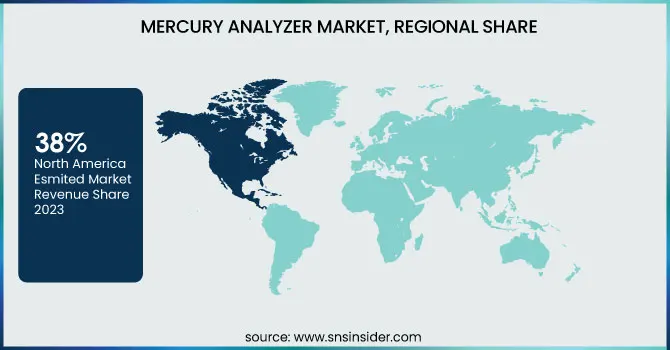

In 2023 North America dominated the mercury analyzer market and held 38% revenue share, owing to favorable regulations like the Clean Air Act operating in the United States that impose stringent regulations on mercury emissions. The strong sales in the market were from the coal-fired power plant and mining sector where regulation is heavy, thus the larger share of North America. The market in Europe was also substantial due to stringent rules on the environment and a proactive European Union.

On the other hand, Asia-Pacific is predicted to grow at the highest compound annual growth rate (CAGR) during the forecast period. Hence, the demand for mercury analyzers is being bolstered by rapid industrialization in economies such as China and India coupled with escalating regulatory pressure. Asia-Pacific is expected to capture a significant share of the mercury control market over the next few years due to various government programs on environmental sustainability and emission reduction, including the China National Action Plan on Mercury.

Get Customized Report as per Your Business Requirement - Enquiry Now

Recent Developments

-

In February 2024, Lumex Instruments introduced the Light 915M2 mercury analyzer, designed to provide accurate results on the measurement of atmospheric elemental mercury in ambient air and emissions monitoring or testing laboratory samples.

-

The landmark SM-5 Continuous Mercury Monitor from France's ENVEA was released worldwide in February 2023 for the highly accurate and reliable measurement of ultra-low mercury levels in flue gases with rapid response and wide dynamic range.

-

In August 2023, New mercury emission monitoring guidelines issued by the U.S. Department of Energy highlight the focus on deployable mercury analyzers for coal-fired power plants

Key Players

Key Service Providers/Manufacturers in the Mercury Analyzer Market:

-

ENVEA (France) – (SM-5 Continuous Mercury Monitor, Mercury Tracker 3000 XS)

-

Lumex Instruments (Russia) – (Light 915M2, RA-915M Mercury Analyzer)

-

Thermo Fisher Scientific (U.S.) – (Mercury Freedom System, HAAKE Viscotester IQ)

-

Teledyne Leeman Labs (U.S.) – (Hydra IIAA, QuickTrace M-7600)

-

PerkinElmer Inc. (U.S.) – (NexION ICP-MS, SMS 100 Mercury Analyzer)

-

Nippon Instruments Corporation (Japan) – (MA-3000, EMP-3)

-

Brooks Rand Instruments (U.S.) – (MERX-T, QuickTrace 7600)

-

Hitachi High-Tech Analytical Science (Japan) – (HM-3000, EA6000VX)

-

Analytik Jena AG (Germany) – (mercur DUO plus, ZEEnit 700 P)

-

AMETEK Inc. (U.S.) – (Model 919, Model 933)

Key Users of Mercury Analyzers:

-

ExxonMobil Corporation (U.S.)

-

Royal Dutch Shell plc (Netherlands)

-

BASF SE (Germany)

-

Chevron Corporation (U.S.)

-

ArcelorMittal (Luxembourg)

-

Anglo American plc (U.K.)

-

Rio Tinto Group (U.K.)

-

China National Petroleum Corporation (China)

-

Vale S.A. (Brazil)

-

Glencore plc (Switzerland)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 295.6 Million |

| Market Size by 2032 | USD 520.2 Million |

| CAGR | CAGR of 6.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Cold Vapor Atomic Absorption (CVAA), Cold Vapor Atomic Fluorescence (CVAF)) • By End Use (Environmental Monitoring {Sample Types [Air, Water, Soil]}, Food Industry, Oil & Gas, Petrochemical, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ENVEA, Lumex Instruments, Thermo Fisher Scientific, Teledyne Leeman Labs, PerkinElmer Inc., Nippon Instruments Corporation, Brooks Rand Instruments, Hitachi High-Tech Analytical Science, Analytik Jena AG, AMETEK Inc. |

| Key Drivers | • Stringent global environmental regulations, especially around mercury emissions, are driving demand for mercury analyzers to help industries comply with safety standards, particularly in sectors like mining and coal power generation. • The increasing application of mercury analyzers in petrochemical, food, and pharmaceutical industries is boosting demand as these sectors need to ensure trace-level mercury detection for safety and quality control. |

| RESTRAINTS | • The advanced technology in mercury analyzers makes them costly, posing a barrier for small and medium-sized enterprises in adopting these solutions despite regulatory pressures. |