Metal Packaging Market Report Scope & Overview:

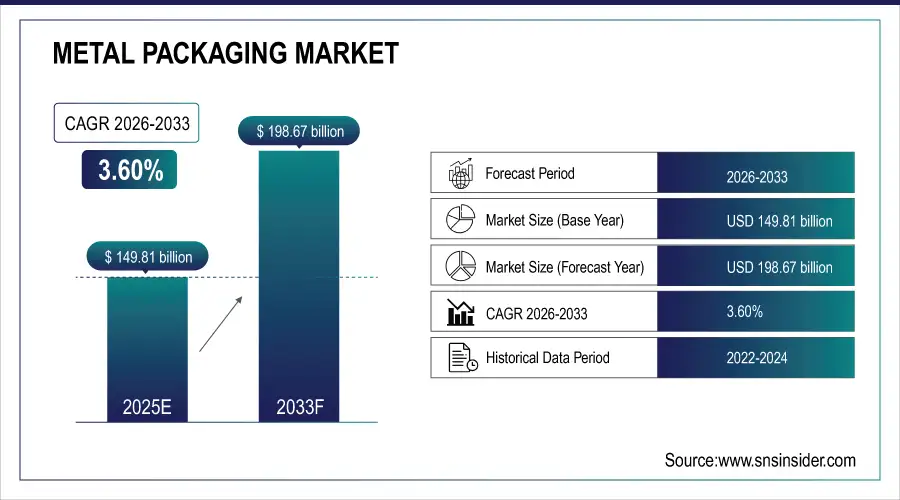

The Metal Packaging Market Size is valued at USD 149.81 Billion in 2025E and is expected to reach USD 198.67 Billion by 2033 and grow at a CAGR of 3.60% over the forecast period 2026-2033.

The Metal Packaging Market analysis, driven by increasing preference for sustainable and recyclable packaging solutions, growing consumption of canned food and beverages, and expanding application in pharmaceuticals and cosmetics. According to study, Government recycling regulations have pushed metal packaging recycling rates beyond 75% in developed regions such as Europe and North America.

Market Size and Forecast:

-

Market Size in 2025: USD 149.81 Billion

-

Market Size by 2033: USD 198.67 Billion

-

CAGR: 3.60% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Metal Packaging Market - Request Free Sample Report

Metal Packaging Market Trends:

-

Growing preference for recyclable and eco-friendly metal packaging across industries.

-

Increased adoption of lightweight aluminum and steel materials to reduce costs.

-

Rising consumption of canned food and beverages boosting packaging demand.

-

Advancements in smart packaging technologies enhancing product tracking and freshness.

-

Expansion of e-commerce driving demand for durable, tamper-proof metal packaging.

-

Government sustainability regulations encouraging circular economy and recycling initiatives globally.

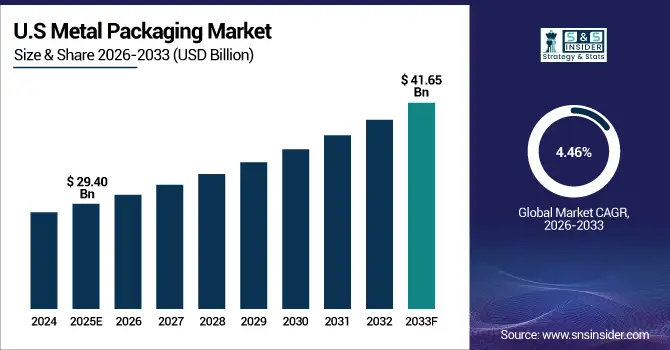

The U.S. Metal Packaging Market size is USD 29.40 Billion in 2025E and is expected to reach USD 41.65 Billion by 2033, growing at a CAGR of 4.46% over the forecast period of 2026-2033, driven by increasing demand for recyclable and durable materials. Strong adoption in food, beverage, and healthcare sectors, along with advanced manufacturing technologies, supports sustainable packaging innovation and consistent market expansion.

Metal Packaging Market Growth Drivers:

-

Sustainability Revolution Driving Global Demand for Recyclable Metal Packaging

The rising consumer consciousness regarding environmental sustainability is one of the primary factors for the metal packaging market growth. Aluminum and steel, such as the metals described above, are never lost once consumed due to their structural composition and quality. As a result, they have a significant competitive advantage over plastics, which have been the subject of attention around the world due to pollution issues. Several food, beverage, and cosmetic companies are investing in sustainable packaging to achieve their circular economy objectives and government regulations.

The global metal recycling rate for aluminum and steel packaging averages around 68%, compared to only 14% for plastics.

Metal Packaging Market Restraints:

-

Rising Energy and Raw Material Costs Challenge Market Growth

The major drawback of the metal packaging production occupies the energy-intense and expensive process compared to plastic or paper-based industry. Most metals, including aluminum, have to be extracted, purified, and smelted with the assistance of substantial amounts of electricity. Thus, this results in the high cost and carbon dioxide emissions. Moreover, the raw material prices are very volatile, fluctuating from year to year and directly influencing the manufacturing expenditures and profits. From an economic standpoint, this makes it hard for small and medium-sized manufacturers to employ metal packaging full-scale, especially in the budget-sensitive markets of Asia and Latin America.

Metal Packaging Market Opportunities:

-

Smart and Lightweight Innovations Unlock New Growth Opportunities Globally

The Lightweight metal packaging and smart technologies Innovation is significant growth opportunity of Metal Packaging Market. The processes now allow aluminum and steel containers to be more durable and flexible while utilizing less material and saving on transportation expenses. Metal packaging has also gained traceability, authorization, and consumer engagement as QR codes, RFID tags, and temperature marks. The latter product offerings are most significant for such sectors as pharmaceuticals, drinks, and niche cosmetics, where quality verification and fascinate packaging are vital elements of brand loyalty.

Lightweight metal packaging innovations have reduced material usage by up to 25%, lowering transportation costs by nearly 15% for major manufacturers.

Metal Packaging Market Segmentation Analysis:

-

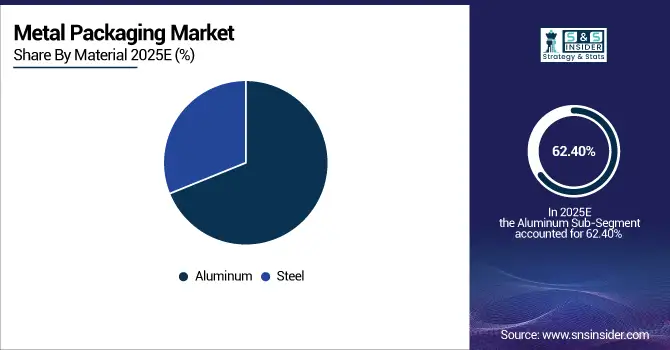

By Material: In 2025, Aluminum led the market with a share of 62.40%, while Steel is the fastest-growing segment with a CAGR of 4.90%.

-

By Product Type: In 2025, Containers & Cans led the market with a share of 46.80%, while Caps & Closures is the fastest-growing segment with a CAGR of 5.20%.

-

By Packaging Type: In 2025, Rigid Packaging led the market with a share of 71.30%, while Flexible Packaging is the fastest-growing segment with a CAGR of 5.40%.

-

By End Use: In 2025, Food & Beverages led the market with a share of 58.60%, while Pharmaceuticals is the fastest-growing segment with a CAGR of 5.50%.

By Material, Aluminum Leads Market and Steel Fastest Growth.

The Aluminum lead the market in 2025, due to its lightweight, outstanding corrosion resistance, and recyclable nature in infinite opportunities, such as beverage cans, food containers, and pharmaceutical packaging. Aluminum offers supreme barrier properties to extend product shelf life, thus attracting higher penetration by manufacturers.

In Meanwhile, steel material is portrayed as the fastest-growing segment owing to its high strength, affordability, and rising demand in industrial and household packaging applications. As demand for robust and sustainable packaging solutions keeps rising, both materials are anticipated to maintain high penetration rates.

By Product Type, Containers & Cans Lead Market and Bottles & Jars Fastest Growth.

The Containers & Cans lead the market in 2025, due to heavily consumed as the cost-effective solution for packaging a broad range of foods, cold beverages, and aerosols, offering secure space, robust protection, and excellent recycling. All are versatile, maintaining exceptional freshness and giving them more applicability.

In Meanwhile, bottles and jars remain the most growing segment, driven by their rising consumption patterns by personal care suppliers, cosmetic houses, and producers of the premium segment of beverage consumption. All are attractive, reusable, with the advantage of the shelves’ prominence, contributing to the trend divided between brands and end-users geared towards environmentalism.

By Packaging Type, Rigid Packaging Leads Market and Flexible Packaging Fastest Growth.

The Rigid Packaging leads the market in 2025, due to its superior strength and the high level of product protection it offers. Moreover, the segment’s popularity is due to its extensive use cases that include food, beverage and industrial applications. Specific formats include steel cans, tins, and drums which guarantee strength, resistance to tampering and prolonged shelf life.

In Meanwhile, flexible packaging is the most rapidly developing segment, growing based on the robust need for lightweight, inexpensive, and environmentally friendly solutions. Innovative solutions such as thinner metal foils and hybrid packaging designs are making their way to the overall pharmaceuticals, snacks, and RTE food sectors worldwide.

By End Use, Food & Beverages Lead Market and Personal Care & Cosmetics Fastest Growth.

The Food & Beverages leads the market in 2025, owing to the high consumption of canned foods, carbonated drinks, and ready-to-eat meals. Metal packaging keeps the products fresh, contaminant-free and much more shelf-stable than other packaging materials which boost the demand among leading food and beverages companies.

In Meanwhile, the personal care and cosmetics segment grow at the highest rate due to the trend of sustainable, premium, and aesthetically pleasing packaging. Many brands use aluminum containers and tins, which are recyclable to have a better image and to reach the sustainability goals.

Metal Packaging Market Regional Analysis:

Asia Pacific Metal Packaging Market Insights:

The Asia Pacific dominated the Metal Packaging Market in 2025E, with over 38.20% revenue share, due to strong foothold in the food and beverage, personal care, and pharmaceutical industries. Growth is attributable to the surging use of sustainable and recyclable materials by consumers, expanding urban and industrial settings. Expanded utilization of aluminum and steel packaging with lighter weights and growing gross production plant capacities have enabled manufacturing at large. Collaborations between packaging suppliers and FMCG producers have enhanced innovation in lightweight and recyclable designs.

Get Customized Report as per Your Business Requirement - Enquiry Now

China and India Metal Packaging Market Insights

China and India lead the metal packaging market due to their large consumer base, rapid industrialization, and expanding food and beverage sectors. High demand for sustainable, cost-effective packaging and increasing investment in recycling infrastructure further strengthen their dominance in regional and global markets.

North America Metal Packaging Market Insights:

The North America region is expected to have the fastest-growing CAGR 4.57%, driven by high demand for sustainable and recyclable materials in the food, beverage, and healthcare sectors. The well-developed recycling infrastructure, innovative manufacturing processes, and increasing shift toward sustainable packaging are the key factors boosting the industry in the region. The dominance of aluminum cans in the beverage sector and constant innovation in lightweight metal-packing solutions is also responsible for the robust market presence. further, the increased need for convenient and robust packaging among the consumer end-users is fueling the metal packaging market share.

U.S. and Canada Metal Packaging Market Insights

The U.S. and Canada are witnessing strong growth in the metal packaging market due to rising demand for recyclable materials, advanced packaging technologies, and sustainability initiatives. Increasing consumption of canned foods, beverages, and pharmaceuticals further drives adoption, supported by well-developed recycling infrastructure and eco-conscious consumers.

Europe Metal Packaging Market Insights

The Europe holds a significant share in the metal packaging market, due to tough environmental rules and regulations, robust recycling mechanisms, and broad implementation of the circular economy. The trio developed the use of aluminum and steel and lightweighting across food, wine, and cosmetic packing by emphasizing environmental responsibility and resource and energy. Companies have honed their product attractiveness and utility with new low-cost and lightweight configuration, laminating, and finishing goods. Furthermore, the customer’s desire for environmentally safe products and the speed at which more manufacturers are turning to reusable metal vessels are further propelling the European market.

Germany and U.K. Metal Packaging Market Insights

The U.K. and Germany are experiencing growth in the metal packaging market due to strict environmental regulations, advanced recycling systems, and strong demand for sustainable packaging. Rising consumption of premium beverages and cosmetics, along with innovation in lightweight aluminum and steel packaging, further fuels market expansion.

Latin America (LATAM) and Middle East & Africa (MEA) Metal Packaging Market Insights

Latin America (LATAM) and the Middle East & Africa (MEA) regions are experiencing gradual growth in the metal packaging market, driven by rising demand for packaged food, beverages, and personal care products. In LATAM, increasing urbanization and expanding retail networks are fueling the adoption of metal cans and containers. Meanwhile, in MEA, growing industrial activities and the rising focus on product preservation are supporting market expansion. Both regions are witnessing a steady shift toward recyclable and durable packaging solutions, encouraged by improving manufacturing capabilities and sustainability initiatives.

Metal Packaging Market Competitive Landscape:

Ball Corporation is a global leader in aluminum packaging solutions, serving beverage, personal care, and household sectors. The company emphasizes sustainability, producing high-recycled-content packaging and driving circular economy initiatives. With a strong focus on innovation and large-scale manufacturing, Ball continues to expand its global presence, delivering durable, lightweight, and eco-friendly metal packaging solutions that meet the evolving needs of brands and consumers worldwide.

-

In Jan 2025, Ball Corporation Partnered with Swedish start-up Meadow to introduce MEADOW KAPSUL reusable aluminum cans for personal care/home products, enabling refill-dispensers and advancing circular packaging solutions globally.

Crown Holdings operates an extensive global network of manufacturing plants, with a majority of its revenue generated from the beverage can business. The company offers a diverse portfolio of aluminum and steel packaging solutions across food, beverage, aerosol, and specialty segments. Its focus on lightweight designs, recycling efficiency, and premium metal packaging innovations strengthens its position as a leading player in the global metal packaging market.

-

In Nov 2024, Crown Holdings, Inc. Introduced aluminium coils produced at Constellium’s new recycling centre, qualified by Crown for beverage can production in France and Spain, advancing recycled-content usage and sustainability goals.

Silgan’s metal container business achieved strong growth, with steel food containers forming the cornerstone of its rigid packaging portfolio. The company focuses on producing infinitely recyclable packaging with high recycled content, aligning with sustainability goals. As the largest manufacturer of metal food containers in North America, Silgan serves major food and beverage brands through long-term partnerships, emphasizing innovation, quality, and environmentally responsible manufacturing practices.

-

In Oct 2025, Silgan Holdings Inc. Announced the launch of a new specialty closures plant and reported record Dispensing & Specialty Closures EBIT in Q3, driven by personal care and premium beverage packaging demand.

Metal Packaging Market Key Players:

Some of the Metal Packaging Market Companies are:

-

Ball Corporation

-

Crown Holdings, Inc.

-

Ardagh Group S.A.

-

Silgan Holdings Inc.

-

Amcor Limited

-

CAN-PACK Group

-

Toyo Seikan Group Holdings, Ltd.

-

Sonoco Products Company

-

CCL Industries

-

Mauser Packaging Solutions

-

Alcoa Corporation

-

Greif, Inc.

-

Ton Yi Industrial Corp.

-

Tubex GmbH

-

DS Containers, Inc.

-

Envases Group

-

Kian Joo Group

-

CPMC Holdings Limited

-

Hindustan Tin Works Ltd.

-

Tata Steel Limited

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 149.81 Billion |

| Market Size by 2033 | USD 198.67 Billion |

| CAGR | CAGR of 3.60% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Aluminum, Steel) • By Product Type (Containers & Cans, Bottles & Jars, Caps & Closures, Tins, Barrels & Drums, Others) • By Packaging Type (Rigid Packaging, Semi-Rigid Packaging, Flexible Packaging) • By End Use (Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals, Paints & Varnishes, Household, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Ball Corporation, Crown Holdings Inc., Ardagh Group S.A., Silgan Holdings Inc., Amcor Limited, CAN-PACK Group, Toyo Seikan Group Holdings Ltd., Sonoco Products Company, CCL Industries, Mauser Packaging Solutions, Alcoa Corporation, Greif Inc., Ton Yi Industrial Corp., Tubex GmbH, DS Containers Inc., Envases Group, Kian Joo Group, CPMC Holdings Limited, Hindustan Tin Works Ltd., Tata Steel Limited, and Others. |