Metalized Flexible Packaging Market Report Scope & Overview:

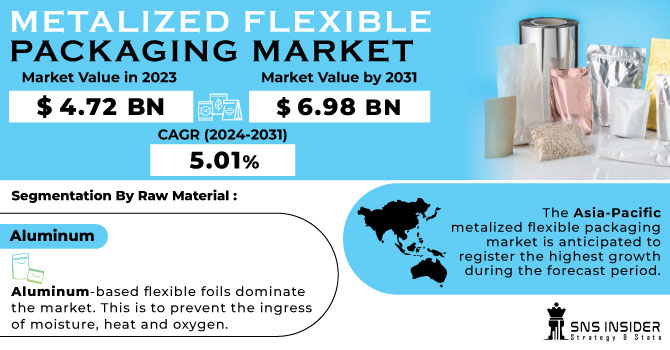

The Metalized Flexible Packaging Market size was valued at USD 4.72 billion in 2023 and is expected to Reach USD 6.98 billion by 2031 and grow at a CAGR of 5.01% over the forecast period of 2024-2031.

Customer demand for convenient food packaging and increasingly busy lifestyles are driving the metalized flexible packaging market. Metalized customizable bundles extend the lifespan of items while reducing the need for additives. The food and beverage industry are phasing out traditional packaging designs in favor of lightweight, easy-to-handle packages. Metalized flexible packages help meet this demand because they are lighter than rigid packages and do not contain glass or cans that add weight to the package.

Get More Information on Metalized Flexible Packaging Market - Request Sample Report

The texture and quality of foods, pharmaceuticals, and foodstuffs are all affected by the increase or decrease of moisture. It can also accelerate the breakdown of fatty products. Solid beverages such as espresso tend to lose flavor, while unflavoured foods retain their flavor. Metalized foils are used to prevent the lack of scent by protecting against oxygen, moisture, smoke and odors. Food waste is reduced when metalized films are used in food packaging to extend product shelf life limit.

Most of the manufacturing costs for metalized flexible packaging come from raw materials. Metalized conformal bundling polymers are petroleum-derived. Input cost pressures are expected to fluctuate due to unpredictable trends in oil prices and polymer demand for various applications.

Manufacturer productivity is impacted by fluctuations in the cost of natural materials, which can limit the development of customizable metalized bundles. Dynamic changes in the industry, including the introduction of new regulatory measures, are forcing manufacturers to develop new packaging options. In response to environmental concerns regarding the use of biodegradable metalized flexible packaging, manufacturers have developed environmentally friendly and safe packaging alternatives. Environmental concerns, changing consumer tastes, and government regulations all contribute to the current situation. Recyclable and eco-friendly products are an area that manufacturers are focusing on.

MARKET DYNAMICS

KEY DRIVERS:

-

Products with long shelf life are in high demand.

More and more consumers are seeking products that can be maintained for longer periods of time in terms of freshness, quality or safety. In order to meet this demand, metalized flexible packaging can play an important role in ensuring good barrier performance against moisture, oxygen, light and others that may adversely affect the product.

-

The metalized flexible packaging market is supported by the growth of developing economies and increasing consumer spending.

RESTRAIN:

-

Volatility in prices of raw materials causing hinder in market growth.

OPPORTUNITY:

-

There is still a growing demand for sustainable packaging solutions.

As consumers and regulators emphasize environmental responsibility, manufacturers of metalized flexible packaging have an opportunity to develop and promote more sustainable options. This includes searching for recyclable, compostable and biodegradable materials and implementing metalized film recycling programs to reduce our environmental impact.

-

Opportunities for metalized flexible packaging arise from the fast growth of e-commerce.

CHALLENGES:

-

When it comes to recycling, metalized flexible packaging is a problem.

IMPACT OF RUSSIA-UKRAINE WAR

During the war, there was a huge impact on metal imports and exports across the globe. This was majorly due to trade disruptions and increased shipping costs.

Russia accounts for about 10 % of the global output of Nickel and 5 % of aluminium exports. Due to fewer aluminium imports from Russia by other countries, the production of this packaging material was reduced which affected the food and beverage industry. The food and Beverage segment accounts for the highest market share in end-use industries that is nearly about 25 %. The cost of overall packaging went high due to which end users also increased the cost of final products produced. One of the materials used for making this packaging is a polymer that is derived from petroleum. The rise in prices of crude oil, this is affecting the production cost. Due to the war crude oil prices have reached $112/barrel.

IMPACT OF ONGOING RECESSION

Recession is not showing an impact on business. Comparing annual sales of major companies involved in metalized flexible packaging it has shown an average gain of 3.1% as compared to 2021. But businesses are having problems dealing with the rising prices of raw materials. Manufacturers’ main revenue comes from sales, due to the recession the prices of raw materials increased which affected the overall profitability. Prices of raw materials such as aluminium, and polymers depend on changing economic conditions, and the availability of resources. Aluminium cost is rising since 2022 and is arrived at $ 4100 which is a bad sign for manufacturers as it may affect their businesses.

KEY MARKET SEGMENTATION

By Raw Material

-

Aluminum

-

Chromium

-

Nickel

Based on the raw material, aluminum-based flexible foils dominate the market. This is to prevent the ingress of moisture, heat and oxygen. Aluminium foil blocks out light, oxygen, moisture and bacteria. Therefore, films are widely used in food and pharmaceutical packaging.

By Packaging Type

-

Wraps

-

Bags

-

Pouches

-

Roll Stock

-

Others

Based on Packaging Type, It is expected that the popularity of the pouch will increase further. One of his driving factors for this development is the fact that the bag takes up significantly less storage space. With so many finishes, there is a lot of branding potential.

By Structure

-

Laminated

-

Mono Extruded

-

Others

By End Use

-

Pharmaceuticals

-

Food & Beverages

-

Personal Care

-

Others

REGIONAL ANALYSIS

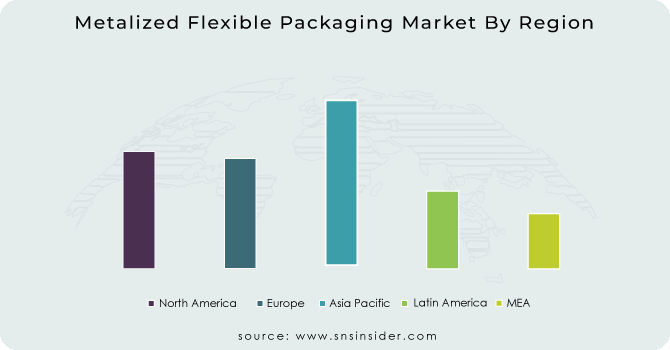

The Asia-Pacific metalized flexible packaging market is anticipated to register the highest growth during the forecast period. This growth is mainly due to the rapid expansion of end-use industries such as food and beverages, healthcare, and personal care. Factors such as increasing disposable income, changing lifestyles, and the rising middle class are driving the demand for packaging, which is expected to support the growth of the metalized flexible packaging market. Additionally, increasing demand for ready-to-eat foods and instant meals presents growth opportunities for the metalized flexible packaging market in the region.

The European metalized flexible packaging market is expected to witness steady growth during the forecast period. The main driver of growth in the European region is the demand for lightweight, user-friendly and easy-to-handle products. Growing focus on sustainability, growing need for longer shelf life, improved hygiene standards, and consumer interest in ease of use are the major factors driving the market in the region.

In the European region, Germany will account for the largest market share followed by France.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some major key players in the Metalized Flexible Packaging market are Amcor Limited, Sonoco Products Company, Mondi Group, Huhtamaki, Sealed Air Corporation, Cosmo Films Limited, Polyplex Corporation Limited, Transcontinental Inc, Constantia Flexibles, CLONDALKIN GROUP and other players.

Sonoco Products Company-Company Financial Analysis

RECENT DEVELOPMENTS

-

TUV OK Compost Home and TUV OK Compost Industrial Certifications have been awarded to SOne compostable labels and packaging ReEarth compostable flexible packaging films.

-

The British vacuum research and development specialist Idvac Ltd has developed a translucent, Non-pigmented Metalized Film without titanium dioxide which is able to be applied for applications such as barrier packaging labels and labeling.

-

Luxembourg BOPP or BROPE film specialist Jindal launched a new High Barrier EthyLyte film, which could be used in the flexible packaging market as PET Packaging Films for Recyclable Monolayers.

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.72 Bn |

| Market Size by 2031 | US$ 6.98 Bn |

| CAGR | CAGR of 5.01% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (Aluminium, Chromium, Nickel) • By Packaging Type (Wraps, Bags, Pouches, Roll Stock, Others) • By Structure (Laminated, Mono Extruded, Others) • By End Use (Pharmaceuticals, Food & Beverages, Personal Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Amcor Limited, Sonoco Products Company, Mondi Group, Huhtamaki, Sealed Air Corporation, Cosmo Films Limited, Polyplex Corporation Limited, Transcontinental Inc, Constantia Flexibles, CLONDALKIN GROUP |

| Key Drivers | • Products with long shelf life are in high demand • The metalized flexible packaging market is supported by the growth of developing economies and increasing consumer spending. |

| Market Restraints | • Volatility in prices of raw materials causing hinder in market growth. |