Fresh Food Packaging Market Key Insights:

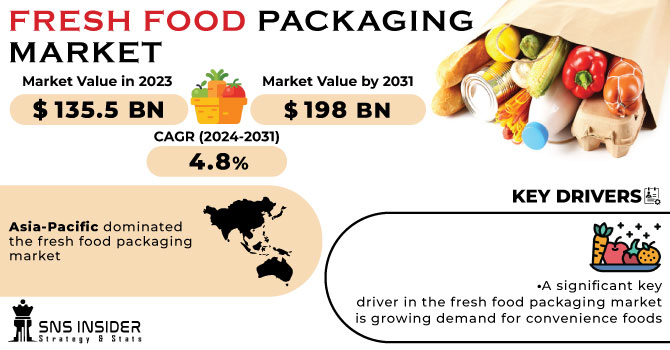

The Fresh Food Packaging Market size was valued at USD 135.5 billion in 2023 and is expected to Reach USD 198 billion by 2031 and grow at a CAGR of 4.8% over the forecast period of 2024-2031.

A positive impact in the market is anticipated over the forecast period, with increasing demand from nutrition and health conscious consumers for organically produced fruits, vegetables and dairy products. Moreover, growing food service and retail chains in the North American and European economies are expected to move away from plastic packaging to more sustainable solutions in order to attract the eco-conscious consumer base in the region. Therefore, the above factors are expected to increase the demand for environmentally friendly fresh food packaging.

Get More Information on Fresh Food Packaging Market - Request Sample Report

Plastic resins such as polypropylene (PP), polyethylene (PE), polyvinyl chloride (PVC), and polystyrene (PS), pulp, metal, and glass are mainly used for product packaging. These plastic resins are petroleum-derived. In addition, materials such as steel, aluminum and glass are energy-intensive materials. Constant fluctuations in crude oil prices, therefore, lead to uncertainties regarding the availability of raw materials at lower or economical prices, posing challenges for the packaging of perishables.

Additionally, many regulators and governments around the world have over the years set limits on the generation of predominantly plastic waste in order to curb the large amount of plastic waste generated each year. Regulators are placing greater emphasis on the reusability of packaging products and emphasizing a circular economy that encourages recycling activities, posing challenges for plastic materials and opportunities for paper and paperboard, bagasse and polylactic acid.

MARKET DYNAMICS

KEY DRIVERS:

-

A significant key driver in the fresh food packaging market is growing demand for convenience foods

Habitual lifestyles, changing eating habits and lack of time are driving an increasing preference for ready-to-eat and easy-to-prepare meals. To keep up with their fast-paced lives, consumers are looking for packaging solutions that offer portion control, on-the-go convenience and longer shelf life. Packaging plays an important role in preserving the freshness and quality of prepared foods and making them safe and convenient to consume. As the demand for ready-to-eat food continues to grow, the fresh food packaging market is expected to see more innovative and efficient packaging solutions to meet consumer needs.

-

In order to extend the shelf life of convenience foods, fresh food packaging plays an essential role

RESTRAIN:

-

Food Safety and Regulatory Compliance

Packaging plays an important role in ensuring food safety and compliance with various regulatory standards. Meeting stringent requirements for packaging materials, labeling and traceability can be complex and require additional investments in testing, certification and quality control measures.

OPPORTUNITY:

-

Innovations in smart packaging technologies

Integrating intelligent packaging technologies such as temperature sensors, time-temperature indicators and RFID tags can improve food safety and quality monitoring. These technologies provide real-time data on product health, ensure proper handling, and reduce food waste.

-

An opportunity for development of packaging solutions ensuring safe and effective delivery of food products is presented by the rapidly growing e commerce sector.

CHALLENGES:

-

The industry is facing challenges to reduce packaging waste and adopt sustainable practices

Single-use plastics and excessive packaging contribute to contamination. Finding alternatives to traditional packaging and improving recycling rates is key to meeting this challenge.

IMPACT OF RUSSIAN UKRAINE WAR

A war between Russia and Ukraine could have different effects on the food packaging market. This can lead to disruptions in the supply chain, leading to bottlenecks and higher packaging costs. Sourcing and manufacturing strategies may need to be adjusted, leading to changes in manufacturing facilities and global supply chains. Raw material prices can fluctuate, impacting the profitability and pricing strategies of packaging manufacturers. Changes in consumer behavior and regulatory actions can also affect demand and market trends. Ultimately, the effects of war on the economy and business environment can lead to market contraction or expansion.

The ongoing conflict between Russia and Ukraine has reduced plastic exports to the country, including resins, plastic machinery, plastic molds and plastic products. Plastic exports to Russia fell 61.4 %, from US $ 100 million to US $ 37.8 million, while exports to Ukraine fell 50.4 %, from US $ 20.3 million to US $ 9.4 million. So far, Russia and Ukraine will be the last to accept exports of plastic machinery and molds in 2022. This will affect the food packaging industry as plastics are a bigger contributor in this market. Polytetrafluoroethylene (PTFE) and other fluoropolymers are among the top 10 sources from Russia. A total of 950,000 kg of PTFE and other fluoropolymers were produced in Russia. This is down from 1.16 million kg for the same period in 2021.

The war also had a major impact on the import and export of metals around the world. This is mainly due to trade disruptions and increased transportation costs. Russia accounts for about 10 % of global nickel production and 5 % of aluminum exports. Declining aluminum imports from Russia by other countries have reduced production of this packaging material, impacting the food and beverage sector. The food and beverage segment has the highest market share of around 25 % in the end-use industry. The overall cost of packaging has increased, as has the cost of the final product manufactured by the end user. One of the materials in this package is a petroleum-based polymer. Rising oil prices affect production costs. As a result of the war, oil prices rose to $ 112 per barrel.

IMPACT OF ONGOING RECESSION

The recession did not affect businesses. Comparing the annual sales of major food packaging companies, it increased by an average of 3.5% compared to 2021. This is because the rise of quick-service restaurants and takeaways has created a demand for food packaging. But companies are struggling to keep up with rising commodity prices. Most of the manufacturer's revenue comes from sales. The recession pushed up commodity prices, impacting overall profitability. Prices for commodities such as aluminum and polymers depend on changing economic conditions and the availability of resources. Aluminum prices have been rising since 2022 and are now at $4,100, boding badly for manufacturers as they could affect their business.

KEY MARKET SEGMENTATION

By Raw Material

-

PE

-

PP

-

PVC

-

Aluminum

-

Paper

By Packaging Type

-

Converted Roll Stock

-

Corrugated Box

-

Gusseted Bags

By End Use

-

Dairy Products

-

Meat Products

-

Fruits

-

Vegetables

-

Others

REGIONAL ANALYSIS

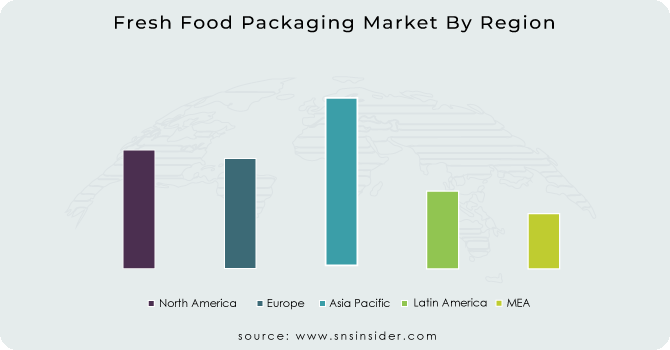

Asia-Pacific dominated the fresh food packaging market, capturing the largest revenue share. During the forecast period, this region is projected to hold a dominant position. The region is home to several fast-growing economies such as India, China, South Korea, Japan and Indonesia. Large consumer bases in countries such as India and China are responsible for the high demand for fresh food, resulting in increased demand for fresh food packaging during the forecast period.

Asia-Pacific is the largest plastic producer in the global market, accounting for more than half revenue share among all. Mass production of glass and metals such as aluminum and steel has made raw materials abundantly available and accounted for a large share of other categories in the materials segment. However, with increasing consumer awareness and stringent government regulations on plastic pollution, the plastic materials sector is expected to face several challenges.

North America has emerged as the third largest fresh food packaging market, owing to the presence of developed applied industries in the United States and Canada. The growing focus on reducing plastic use in the food and beverage industry is expected to increase demand for sustainable solutions in the region. Stringent environmental safety regulations and the growing need for easy-to-dispose solutions are expected to increase the demand for recyclable and biodegradable materials in packaging applications. Increased trade activity, driven by Europe's internal market policy allowing free trade within the region, is likely to be one of the main drivers of the growth of the European fresh food packaging market. Cartons and folding boxes are used to transport a variety of fruits, vegetables and eggs. Therefore, the demand for paper packaging products in food exports is expected to increase during the forecast period.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

The Major Players are DS Smith Plc, PPC Flexible Packaging LLC, Sonoco Products Company, Amcor plc, ProAmpac, CLONDALKIN GROUP, Transcontinental Inc, Sealed Air, Clifton Packaging Group Limited, FLAIR Flexible Packaging Corporation and other players.

Flexible Packaging Corporation-Company Financial Analysis

RECENT DEVELOPMENTS

-

Cascades introduces new, EcoFriendly Packaging for Fresh Fruit and Vegetables.

-

A new sensor has been developed by Senoptica Technologies, a deeptech packaging sensor technology company based in Ireland, using foodsafe ink that can be printed directly on the inside of the packaging, to monitor the state of packaged, perishable food products.

| Report Attributes | Details |

| Market Size in 2023 | US$ 135.5 Billion |

| Market Size by 2031 | US$ 198 Billion |

| CAGR | CAGR of 4.8% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (PE, PP, PVC, Aluminum, Paper) • By Packaging Type (Flexible Paper, Converted Roll Stock, Corrugated Box, Gusseted Bags) • By End Use (Dairy Products, Meat Products, Fruits, Vegetables, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | DS Smith Plc, PPC Flexible Packaging LLC, Sonoco Products Company, Amcor plc, ProAmpac, CLONDALKIN GROUP, Transcontinental Inc, Sealed Air, Clifton Packaging Group Limited, FLAIR Flexible Packaging Corporation |

| Key Drivers | • A significant key driver in the fresh food packaging market is growing demand for convenience foods • In order to extend the shelf life of convenience foods, fresh food packaging plays an essential role. |

| Market Restraints | • Food Safety and Regulatory Compliance |