Metallocene Polyethylene Market Analysis & Overview:

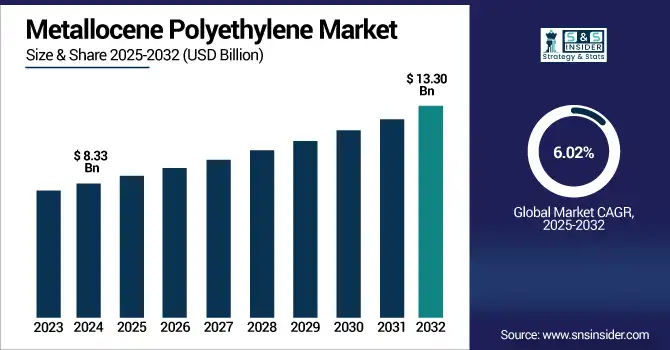

The metallocene polyethylene market size was valued at USD 8.33 billion in 2024 and is expected to reach USD 13.30 billion by 2032, growing at a CAGR of 6.02% over the forecast period of 2025-2032.

To Get more information on Metallocene-Polyethylene-Market- Request Free Sample Report

Metallocene polyethylene market analysis indicates that rising demand for flexible and lightweight packaging is a key factor propelling market growth. Packaging industries, food & beverage, personal care, and pharmaceutical industries are continuously moving to get versatile packaging that has good strength, durability, and part weight reduced for easy transportation. With exceptional clarity, puncture resistance, and heat-sealing properties, metallocene polyethylene (mPE) is suitable for shrink films, pouches, and stretch wraps. By minimizing overall material consumption without compromising strength and performance, it drives reductions in packaging costs and environmental footprints for companies. With the increasing consumer sentiment and sustainability goals, the demand for flexible packaging formats will see substantial market development for mPE due to the demand for an efficient and sustainable packaging solution, which drives the metallocene polyethylene market growth.

The U.S. Department of Energy states that 98% of plastic packaging created in the U.S. comes from virgin petroleum feedstock. The adoption of mPE helps operate with less material without sacrificing performance, which responds to the DOE’s call for efficiency resources.

Metallocene Polyethylene Market Dynamics:

Drivers

-

Advancements in Polymer Processing Technologies Drive the Market Growth

The key factor helping to drive the metallocene polyethylene market is polymer processing technologies, including blown film extrusion, injection molding, and cast film techniques. This allows manufacturers to take full advantage of the enhanced flow properties, consistency, and material properties of metallocene polyethylene resin. This makes mPE processable at higher speeds with reduced energy than conventional PE, whilst providing improved film clarity, tensile strength, and sealability. This makes it extremely desirable in industries that require high output, material uniformity, and accuracy.

In 2023, the U.S. NIST worked with manufacturing companies to create standard testing of these high-performance polymers, such as mPE, that are optimized for newer, high-speed production lines for film applications in packaging and other consumer goods.

Restrain

-

Higher Manufacturing and Licensing Costs May Hamper the Market Growth

One of the major limitations faced by the Metallocene Polyethylene (mPE) market is high manufacturing and licensing costs. Instead of conventional polyethylene production, mPE must be made from advanced catalyst systems, particularly metallocene catalysts, which are more expensive to produce and often carry stringent license restrictions. The mPE polymerization process also specifically calls for sophisticated equipment and tighter process control, and as such, will also see higher capital and operational expenditures. But such high upfront costs pose a barrier to market participation or scale-up efforts for small and mid-sized manufacturers, many of them operating in parts of the world with price-sensitive buyers. Finally, the bitumen cost escalation difference between metallocene and conventional polyethylene grades in many developing markets can make it challenging for end users to stretch their budget and pay more, despite greater performance.

Opportunities

-

Expansion in Medical and Hygiene Product Applications Creates an Opportunity in the Market

Membrane materials and process designs are viewed as areas for growth in the market. Innovations like graphene-based membranes, ceramic membranes, and polymeric blends are improving performance factors, including permeability, selectivity, chemical stability, and longevity. Moreover, polymer membranes, hybrid membrane systems, which combine different sorts of membranes, are under development to more efficiently meet complicated separation requirements. These innovations, in turn, are driving down operational costs, reducing fouling and lowering energy demand, which are making membrane solutions more cost-competitive. This trend towards sustainable and energy-saving solutions complements the global environmental agenda and extends the scope of applications of advanced membrane systems, driving the metallocene polyethylene market trends.

In 2024, the U.S. FDA approved a new category of metallocene polyethylene flexible medical packaging films demonstrating exceptional seal integrity and strength under sterilization.

Metallocene Polyethylene Market Segmentation Analysis:

By Polymer Type

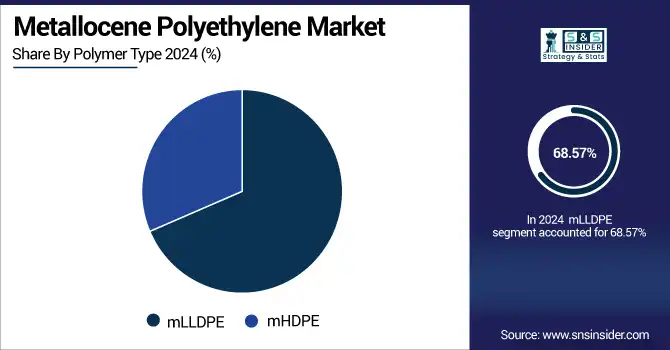

mLLDPE held the largest metallocene polyethylene market share, around 68.57%, in 2024. Such dominance is in large part due to the superior balance of flexibility, toughness, and film strength that mLLDPE offers to address many high‑performance polyethylene applications, particularly in flexible packaging, stretch and shrink films, and hygiene products. The high bean durability of is ideally suited for downgauging, where consumers are looking to both reduce material and costs, and it can be easily converted into thinner films without loss of robustness. Moreover, mLLDPE is suitable for contemporary high-throughput extraction machines, resulting in better efficiency during manufacturing and quality of output.

mHDPE held a significant metallocene polyethylene market share. It is owing to its higher stiffness, more tensile strength, and better impact strength. mHDPE will mainly be used for high structural integrity applications, including blow-molded container applications, rigid packaging, industrial drums, and household goods. Metallocene HDPE is more processable than conventional high-density polyethylene (HDPE) and has a narrower molecular weight distribution, resulting in products that are more consistent and perform better. This proves difficult in areas needing toughness and environmental stress cracking resistance, which makes it highly valuable in the transport, chemical storage, and consumer goods industries. It is also increasingly being used in various industrial and consumer-facing applications due to a combination of its recyclability and its strength at lower thickness levels.

By Application

Films segment held the largest market share, around 56%, in 2024. This predominant position is mainly attributed to the high value of film-forming capabilities of metallocene polyethylene, such as high tensile strength, improved clarity, and solid seal integrity at lower gauge. It is the above-mentioned properties of mPE films the driver behind its use as food packaging, agricultural films, stretch and shrink films, and liner for hygiene products. The global demand for lightweight, durable, and recyclable packaging materials is fuelling further penetration of mPE in the films end-use sector.

Sheets holds a significant market share in the metallocene polyethylene market. It is due to their increasing applications in protective packaging, industrial liners, medical trays, and thermoformed plastics. Metallocene polyethylene sheets provide higher toughness, better impact strength, and improved processability over standard polyethylene, making them ideal for applications requiring both rigidity and semi-flexibility. This uniform thickness and optical clarity are exactly what is desired for sectors such as food processing, medical packaging, and automotive interiors, making the materials stand out in printing, sealing, and forming efficiencies.

Metallocene Polyethylene Market Regional Outlook:

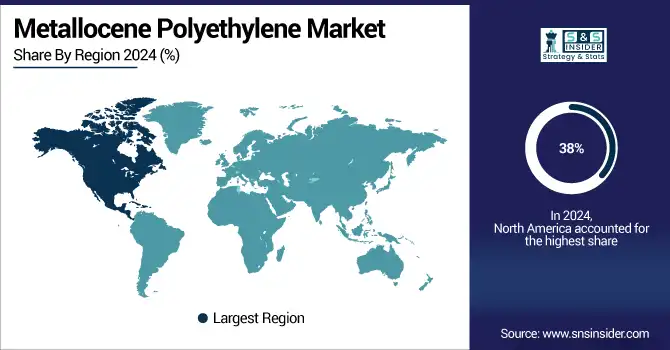

North America metallocene polyethylene market held the largest market share, around 38%, in 2024. It is due to the established plastics manufacturing infrastructure and well-developed packaging industry in this region, along with a significant presence of global polymer producers, that North America was observed to dominate in terms of market share in the metallocene polyethylene market in 2024. It is home to a large polymer chemistry innovation ecosystem, enabling the fast development and scaling of high-performance materials that include, among others, mPE. Strengthening mPE demand from food, healthcare, and e-commerce industries, along with increasing need for lightweight and recyclable packaging materials.

In 2024, A large polyolefins producer in Texas started commercial production on a new mPE film extrusion line for medical and flexible packaging in order to drive local product customization and increase supply capacity.

The U.S. metallocene polyethylene market size was USD 2.38 billion in 2024 and is expected to reach USD 3.85 billion by 2032 and grow at a CAGR of 6.21% over the forecast period of 2025-2032. It is owing to its advancements in precision production and integrated approach towards sustainable plastics, given a stringent regulatory landscape and higher demand for quality packaging products. Today, American accommodating investments by American makers in cutting-edge polymerization construction and consistent film implementations, going from snacking wellbeing to clinical cleanliness. mPE is particularly well-positioned to benefit from this downgrading trend as the U.S. packaging industry pushes toward downgauging in terms of strength and clarity where possible.

In 2024, a U.S. manufacturer of healthcare packaging received FDA approval for its metallocene polyethylene used in the manufacture of sterile barrier films for medical and pharmaceutical applications.

Asia Pacific metallocene polyethylene market held a significant market share and is the fastest-growing segment in the forecast period. It is due to a large consumer population, a growing manufacturing industry, and an increasing demand for consumer-packaged products in the region. The booming demand for low-cost, yet efficient packaging in food, retail, and agriculture, among others, in China, India, and South Asia is likely to benefit the market. The capacity of the region to ramp up production with the ability to invest in newer and energy-efficient processing technology favors better penetration of metallocene-based resins. Moreover, governments across the region are driving mPE technology ahead of traditional materials by pushing for recyclable and downgauged plastics.

In 2024, a packaging manufacturer in Vietnam installed high-speed blown film lines optimized for mLLDPE resins, enabling production of ultra-thin films for food and industrial packaging across the Asia Pacific supply chain

Europe held a significant market share in the forecast period. It is owing to stringent sustainability regulations on enterprise-level packages, rising demand for recyclable packages, and access to advanced polymer research and development facilities. These mPE qualities, allowing downgrading and recyclability among others, have been attractive to manufacturers as they move toward circular economy goals of the European Union and respond to bans on single-use plastics. Additionally, the greater focus on product quality, performance, and safety in food & healthcare packaging in Europe has driven conversion to metallocene-based materials in these sectors in the upcoming times.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major metallocene polyethylenes companies are ExxonMobil, Dow Chemical Company, LyondellBasell, SABIC, Chevron Phillips Chemical, INEOS Olefins & Polymers, Braskem, LG Chem, Borealis, and TotalEnergies Polymers.

Recent Development:

-

In February 2024, Repsol extended its ultra-clean polyethylene line with low-density metallocene grades for more recyclable, flexible films that help meet packaging sustainability objectives.

-

In December 2023, LyondellBasell announced the introduction of a new mLLDPE production line for high-durability shipping sacks, shrink wrap, and food packaging in North America into regional production capacity.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 8.33 Billion |

| Market Size by 2032 | USD 13.30 Billion |

| CAGR | CAGR of 6.02% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Polymer Type (mLLDPE and mHDPE) •By Application (Films, Sheets, Extrusion Coating, Injection Molding, Blow Molding, Wire & Cable Insulation, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ExxonMobil, Dow Chemical Company, LyondellBasell, SABIC, Chevron Phillips Chemical, INEOS Olefins & Polymers, Braskem, LG Chem, Borealis, TotalEnergies Polymers. |