Carbon Fiber Reinforced Plastics Market Key Insights:

Get More Information on Carbon Fiber Reinforced Plastics (CFRP) Market - Request Sample Report

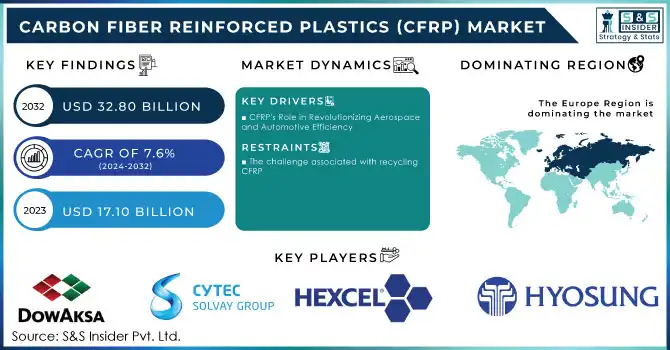

The Carbon Fiber Reinforced Plastics Market Size was valued at USD 17.10 Billion in 2023 & will reach USD 32.80 Bn by 2032 & grow at a CAGR of 7.6% over the forecast period of 2024-2032.

The Carbon Fiber Reinforced Plastics (CFRP) market has gained prominence across various industries due to its exceptional strength-to-weight ratio, durability, and resistance to corrosion. CFRP, which combines a polymer matrix with carbon reinforcements, offers superior mechanical properties compared to traditional materials like steel and aluminum. These attributes make CFRP indispensable in applications requiring weight savings without compromising strength, such as fuel-efficient automotive designs and lightweight aircraft manufacturing.

CFRP also plays a pivotal role in reducing embodied life-cycle emissions in construction, enhancing material efficiency and durability, and contributing to sustainable building practices. This aligns with the U.S. Department of Energy’s targets to cut greenhouse gas emissions from buildings by 65% by 2035 and 90% by 2050. Additionally, government initiatives, including tax incentives for electric vehicles (EVs) and renewable energy projects, are driving CFRP adoption.

The aerospace and defense sectors in the United States represent significant consumers of CFRP, leveraging its lightweight properties to improve fuel efficiency and performance. With its role in advancing green technologies and manufacturing, the CFRP market offers immense potential for innovation and growth.

Carbon Fiber Reinforced Plastics Market Dynamics

KEY DRIVERS:

-

CFRP's Role in Revolutionizing Aerospace and Automotive Efficiency

CFRP boasts lightweight yet high-strength properties, making it beneficial in sectors such as the aerospace and automotive industries. Lowering the weight enhances the fuel efficiency and makes it even perform better, thereby making CFRP one of the most in-demand materials for aircraft structures and electric vehicles. Recent reports show that the growth curve of CFRP demand has been astonishing as it is observed to be 199,000 tons globally by the end of 2022. Aviation industries, where aircraft new models, Boeing 747 Dreamliner and Airbus A350, the demand will be more than 50% coming from CFRPs.

In addition, the need for environment-friendly substitutes has fueled intense development in the recycling technologies of CFRP. For instance, it is said that recycling a kilogram of carbon fiber can take an amount of energy as low as 38 MJ in this case, which is many times less than the amount required to produce fresh carbon fiber between 5 to 15 times more. This change contributes not only to better lifecycle efficiencies for CFRPs but also to better achievement of international sustainability objectives, especially in reducing CO₂ emissions.

RESTRAIN:

-

The challenge associated with recycling CFRP

The process of separating carbon fibers from resins during recycling becomes quite complicated to recover and reuse materials. Currently, only a very small percentage of CFRP products is recycled, thus generating tonnes and tonnes of waste and its concomitant environmental concerns. As sustainability becomes a hot issue, then the necessity of creating solutions in recycling and waste management from CFRP arises. The industries are put under pressure concerning investment into all new technologies and processes, but they come up as deterring factors for companies to adopt CFRP due to the cost and complexities of the processes involved in managing waste. Recycling Carbon Fiber fiber-reinforced plastics comes up with some significant challenges that challenge sustainability initiatives within the materials sector.

For example, it is estimated that 200,000 tons of carbon fiber-reinforced polymer waste is produced annually around the globe. This is a serious environmental issue. Carbon fiber-reinforced polymer recycling is still in its infancy stage. Estimates show that only about 5-10% of carbon fiber polymer wastes are currently processed for reuse. Up to 20 times more CO₂ is consumed in the production of virgin carbon fiber compared to the recycling processes. This gap presents an urgent need for robust recycling technologies to minimize the environmental footprint CFRP generates. The development of such advanced recycling technologies would likely be costly, with facilities capable of recycling CFRP estimated to range anywhere from USD 5 million to more than USD 20 million. Such costs might discourage firms from using significant amounts of CFRP despite its current use in various markets including lightweight applications and high-strength applications.

Carbon Fiber Reinforced Plastics Market Segment Analysis

BY MATERIAL TYPE

The PAN-based segment dominate the market, holding a substantial revenue share of 52% in 2023, and is anticipated to grow at the highest CAGR of 7.6% over the forecasted year 2024-2032. This leadership can be attributed to the superior mechanical properties and versatility of Polyacrylonitrile (PAN) fibers, which are essential for high-performance applications in aerospace, automotive, and sporting goods. Recent developments include the launch of new PAN-based carbon fibers by companies like Toray Industries, which introduced innovative products designed to improve energy efficiency in electric vehicles (EVs). In August 2023, the aerodynamic performance of carbon fiber-reinforced polymer (CFRP) cables against steel cables using computational fluid dynamics. The study underscored the potential of CFRP cables for bridge applications, which could reduce overall weight by up to 80% compared to traditional steel cables. However, it also highlighted the necessity for more research on their long-term stability under aerodynamic loads.

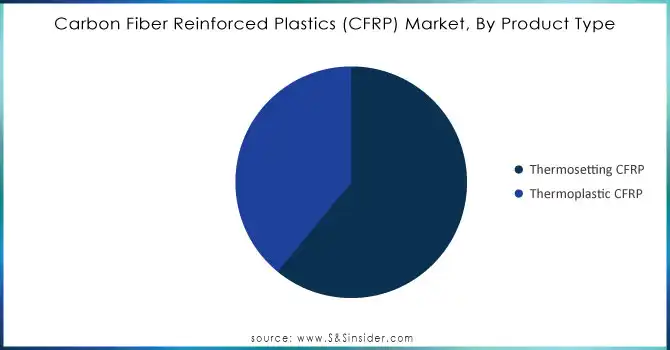

BY PRODUCT TYPE

The Thermosetting CFRP segment dominated the CFRP market, capturing a significant revenue share of 56% in 2023. This dominance mainly resulted from the material's favorable mechanical properties and thermal stability, ideal for high-performance applications in aerospace, automotive, and construction industries. The new thermosetting CFRP products especially from companies such as Hexcel and Toray Industries recently came out in the market with improved durability and even resistance to extreme environmental conditions.

The Thermoplastic CFRP segment is poised for significant growth, showcasing the fastest CAGR of 8.43% during the forecast period. Companies are investing quickly in thermoplastic resin systems for enhanced performance and shortening of the manufacturing cycle time. In the field of CFRP, for instance, Solvay has developed new kinds of thermoplastic resin systems that have driven away issues like excessive production costs, waste generation during the production process, etc.

Recently, Solvay formed a partnership with 9T Labs to develop carbon fiber-reinforced thermoplastic parts on a mass scale using a hybrid process combining 3D printing and compression molding. This technology will, therefore enable production of 100 to 10,000 parts per year thereby increasing efficiency and cost competitiveness in various applications, mainly in aerospace and automotive sectors.

Need Any Customization Research On Carbon Fiber Reinforced Plastics (CFRP) Market - Inquiry Now

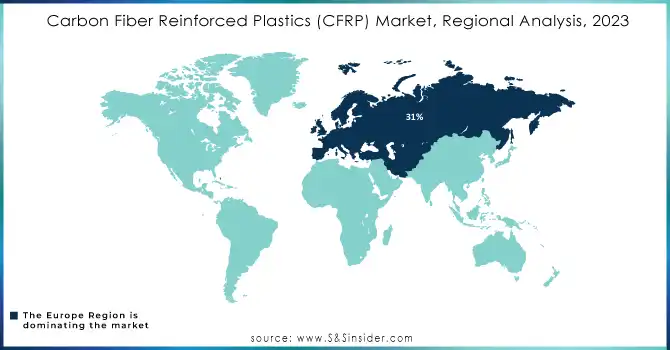

Carbon Fiber Reinforced Plastics Market Regional Analysis

In 2023, the European region dominated the Carbon Fiber Reinforced Plastics (CFRP) market, capturing approximately 31% of the global market share. This leadership can be attributed to several key factors, including the robust aerospace and automotive industries, which have increasingly adopted CFRP due to its lightweight and high-strength properties. This significant presence was supported by a projected increase in the production of electric vehicles (EVs), with estimates suggesting that over 65% of new cars sold in Europe would be fully electric by 2030. Additionally, the automotive sector's revenue was expected to expand by about USD 1.5 trillion by the same year, driven by innovations like CFRP, which enhance vehicle performance and reduce weight.

In 2023, the Middle East & Africa region emerged as the fastest-growing market over the forecasted period. This growth can be associated with growing investments in infrastructure and aerospace projects especially from countries such as the United Arab Emirates and Saudi Arabia that are concentrating efforts on upgrading transport networks. For example, commitment to sustainable development in Dubai and an expansion of the country's aviation industry have been strong drivers behind the increased demand for lightweight high-performance materials including CFRP.

The Middle East & Africa region is expected to emerge as the fastest-growing market for Carbon Fiber Reinforced Plastics in 2023. The region was estimated to take a nearly 12% market share. The CFRP market in the region will exhibit exponential growth due to an extraordinary investment in ambitious infrastructure and aerospace projects from countries such as the UAE and Saudi Arabia.

Key Players in Carbon Fiber Reinforced Plastics Market

Some of the major players in the Carbon Fiber Reinforced Plastics (CFRP) Market are:

-

DowAksa (DowAksa Torayca Carbon Fiber Prepreg, DowAksa ZOLAMID)

-

Cytec Solvay Group (Cytec MTM50 Carbon Fiber Prepreg, Cytec Hexcel Composites)

-

Toray Industries, Inc. (Torayca Carbon Fiber Prepreg, Toray Tenax Carbon Fiber)

-

SGL Group (SGL Carbon Fiber Prepreg, SGL Carbon Fiber Reinforced Composites)

-

Hexcel Corporation (Hexcel HexPly Carbon Fiber Prepreg, Hexcel IM7 Carbon Fiber)

-

Teijin Limited (Teijin T800 Carbon Fiber, Teijin Carbon Fiber Reinforced Composites)

-

Mitsubishi Rayon Co., Ltd. (Mitsubishi Rayon Carbon Fiber, Mitsubishi Rayon Carbon Fiber Reinforced Composites)

-

Hyosung Corporation (Hyosung Carbon Fiber, Hyosung Carbon Fiber Reinforced Composites)

-

Gurit Holding AG (Gurit GFRP Prepreg, Gurit Carbon Fiber Reinforced Composites)

-

Owens Corning (Owens Corning Carbon Fiber. Owens Corning Carbon Fiber Reinforced Composites)

-

Carbon Fiber Solutions (Carbon Fiber Solutions Prepreg, Carbon Fiber Solutions Composites)

-

Huntsman Corporation (Huntsman Carbon Fiber Prepreg, Huntsman Carbon Fiber Reinforced Composites)

-

SABIC (SABIC Carbon Fiber Reinforced Composites, SABIC Thermoplastic Composites)

-

BASF (BASF Carbon Fiber Reinforced Composites, BASF Thermoplastic Composites)

-

Airbus (Airbus Aircraft Components, Airbus Spacecraft Components)

-

Boeing (Boeing Aircraft Components, Boeing Aerospace Components)

-

General Electric (GE Aircraft Components, GE Wind Turbine Blades)

-

Toyota (Toyota Automotive Components, Toyota Electric Vehicle Components)

-

BMW (BMW Automotive Components, BMW Electric Vehicle Components)

-

Tesla (Tesla Automotive Components, Tesla Electric Vehicle Components)

RECENT TRENDS

-

In May 2024, BMW launched the 2025 M4 CS epitome of bettering automotive technology and efficiency but still proving it an utmost performance car. This is a more aggressive version of the M4 with upgraded features such as increased horsepower, aerodynamics, and lightweight parts from advanced materials such as carbon fiber. It speaks to making the car incredibly fast but maintaining every bit of BMW's reputation for performance while gaining efficiency.

-

In 2024, Toray Industries Inc. has introduced Torayca M46X carbon fiber, a new addition to the TORAYCA MX series, offering approximately 20% greater strength while preserving a high tensile modulus.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 17.10 Billion |

| Market Size by 2032 | US$ 32.80 Billion |

| CAGR | CAGR of 7.6 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Thermosetting CFRP, Thermoplastic CFRP) • By Material Type (PAN-based, Pitch-based) • By Application Type (Automotive, Aerospace, Wind Turbines, Sport Equipment, Molding & Compounding, Construction, Pressure Vessels, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | DowAksa, Cytec Solvay Group, Toray Industries, Inc., SGL Group, Hexcel Corporation, Teijin Limited, Mitsubishi Rayon Co., Ltd., Hyosung Corporation, Gurit Holding AG, Owens Corning, Carbon Fiber Solutions, Huntsman Corporation, SABIC, BASF, Airbus, Boeing, General Electric, Toyota, BMW, Tesla |

| Key Drivers | • CFRP's Role in Revolutionizing Aerospace and Automotive Efficiency • Revolutionizing CFRP Production: The Impact of Manufacturing Innovations |

| Restraints | • Challenges in Recycling CFRP: Overcoming Barriers to Sustainability |